- Home

- »

- Next Generation Technologies

- »

-

Smart Factory Market Size & Share, Industry Report, 2030GVR Report cover

![Smart Factory Market Size, Share & Trends Report]()

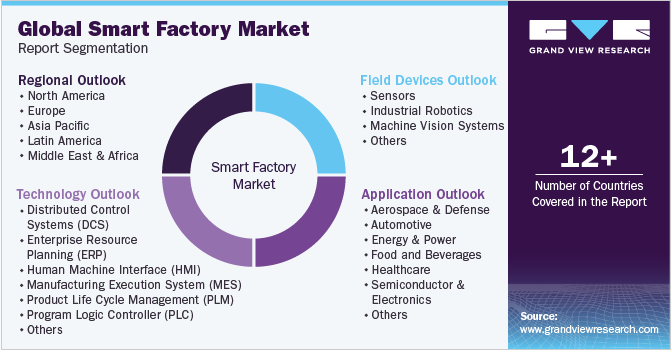

Smart Factory Market (2025 - 2030) Size, Share & Trends Analysis Report By Field Devices (Sensors, Industrial Robots, Machine Vision Systems), By Technology (Distributed Control Systems, ERP, Human Machine Interface), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-124-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Factory Market Summary

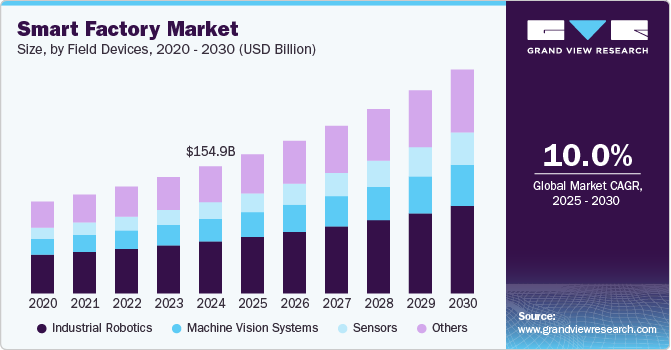

The global smart factory market size was estimated at USD 154.89 billion in 2024 and is projected to reach USD 272.64 billion by 2030, growing at a CAGR of 10.0% from 2025 to 2030. The market is primarily driven by the increasing demand for automation and digital transformation, which enhances operational efficiency and reduces costs for manufacturers.

Key Market Trends & Insights

- The Asia Pacific regional market accounted for the largest revenue share in 2024.

- The China smart factory market held a substantial market share in 2024.

- By technology, the distributed control systems (DCS) segment recorded the largest revenue share of over 16% in 2024.

- By field devices, the sensors segment is anticipated to record the highest CAGR from 2025 to 2030.

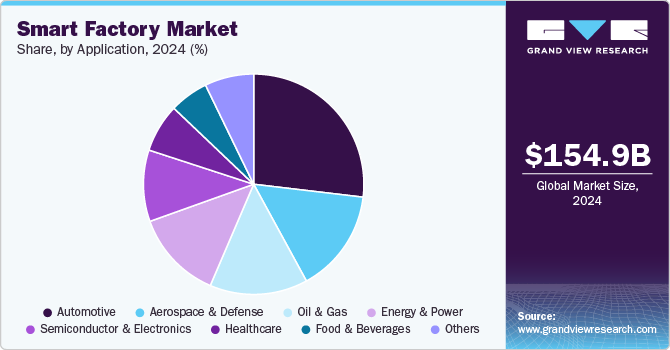

- By application, the automotive segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 154.89 Billion

- 2030 Projected Market Size: USD 272.64 Billion

- CAGR (2025-2030): 10.0%

- Asia Pacific: Largest market in 2024

In addition, the growing emphasis on energy efficiency and sustainability, coupled with advancements in technologies such as IoT, AI, and robotics, is propelling the adoption of smart factory solutions across various industries. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) technologies is also facilitating smarter decision-making and predictive maintenance, which is expected to present lucrative opportunities for the smart factory industry in the coming years.The increasing demand for automation and digital transformation across various industries, as companies seek to enhance operational efficiency and reduce costs. Governments worldwide are promoting initiatives that support the adoption of Industry 4.0 technologies, which include advanced manufacturing systems, robotics, and IoT solutions. In addition, the rise in energy costs and environmental regulations is pushing manufacturers to adopt sustainable practices, leading to a greater emphasis on energy efficiency and resource optimization in production processes and driving the smart factory industry.

In addition, the proliferation of Industry 4.0 is a significant trend in the market as it encourages the implementation of interconnected manufacturing systems that leverage real-time data for improved decision-making and efficiency. The adoption of industrial Internet of Things (IIoT) technologies is on the rise, enabling manufacturers to collect and analyze vast amounts of data to optimize operations. Furthermore, advancements in 5G technology are enhancing connectivity within factories, allowing for faster data transmission and more reliable communication between devices. Another notable trend is the growing use of collaborative robots (cobots), which work alongside human operators to increase productivity while ensuring safety in the workplace.

Furthermore, the integration of AI and machine learning into manufacturing processes enables predictive analytics that can significantly reduce downtime and improve maintenance schedules. In addition, the rise of cloud computing allows manufacturers to access data remotely and implement scalable solutions that can adapt to changing production demands. The development of advanced robotics is also transforming factories, with industrial robots becoming more versatile and capable of performing complex tasks alongside human workers. These technological innovations are enhancing productivity and driving down operational costs, making smart factories an attractive option for manufacturers seeking competitive advantages, thereby driving smart factory industry expansion.

Moreover, the rise of sustainability concerns is influencing both operational practices and investment decisions. Manufacturers are increasingly adopting green technologies that minimize energy consumption and reduce waste throughout production processes. Smart factory solutions often incorporate energy-efficient systems that optimize resource use based on real-time data analysis. This shift towards sustainability is driven by regulatory pressures and consumer demand for environmentally friendly products. As companies strive to enhance their corporate social responsibility profiles, investments in sustainable manufacturing practices are expected to grow significantly, further supporting the expansion of the smart factory industry in the coming years.

Technology Insights

The distributed control systems (DCS) segment recorded the largest revenue share of over 16% in 2024, owing to its critical role in enhancing process control and operational efficiency across various industries. The segmental growth is further driven by the increasing adoption of automation technologies and the need for sophisticated control mechanisms in complex manufacturing environments. In addition, the growing emphasis on sustainability and energy efficiency further propels the demand for DCS, as these systems support the transition towards cleaner energy sources and improved resource management in industrial settings.

The human-machine interface (HMI) segment is projected to register the highest CAGR of 12.7% from 2025 to 2030, owing to the increasing demand for automation and the need for efficient control and monitoring of complex processes across various industries. As industries embrace Industry 4.0, there is a growing emphasis on user-friendly, touch-screen interfaces that facilitate seamless interaction between operators and machines, enhancing productivity and operational efficiency. The integration of advanced technologies such as IoT and data analytics further drives this growth as companies seek to leverage real-time data for improved decision-making and process optimization.

Field Devices Insights

The industrial robots segment accounted for the largest revenue share 2024, driven by the increasing demand for automation across various industries. With a projected market value of approximately USD 16.89 billion, the industrial robotics market is benefiting from advancements in artificial intelligence and digital automation technologies, which enhance operational efficiency and productivity. The growing adoption of robots in sectors such as automotive, electronics, and healthcare further contributes to this revenue growth, as companies seek to optimize their manufacturing processes and reduce labor costs.

The sensors segment is anticipated to record the highest CAGR from 2025 to 2030. This growth is largely driven by the increasingly adoption of automation and IoT technologies, the demand for advanced sensor solutions that enable real-time monitoring and data collection. These sensors are essential for ensuring precise control and operation of machinery, enhancing safety protocols, and improving overall operational efficiency. The integration of sensors with AI and machine learning technologies is expected to drive innovation and growth in this segment, making it a key area of focus for manufacturers looking to enhance their smart factory capabilities.

Application Insights

The automotive segment accounted for the largest revenue share in 2024, primarily due to the industry's rapid adoption of automation and advanced manufacturing technologies. As automakers increasingly integrate smart factory solutions to enhance production efficiency, reduce costs, and improve product quality, investments in robotics, IoT, and data analytics are becoming essential. The growing emphasis on electric vehicles (EVs) and sustainable manufacturing practices is also driving demand for innovative production techniques that smart factories can provide.

The food & beverages segment is anticipated to record a significant CAGR from 2025 to 2030, reflecting the increasing consumer demand for automation and efficiency in food production processes. As manufacturers seek to enhance safety, quality, and traceability in their operations, the integration of smart factory technologies such as IoT sensors and AI-driven analytics is becoming crucial. In addition, the rising focus on sustainability and health-conscious products is prompting food and beverage companies to invest in advanced manufacturing solutions that optimize resource use and minimize waste. With these trends driving innovation and operational improvements, the food and beverages segment is well-positioned for robust growth in the coming years.

Regional Insights

North America smart factory market held a significant revenue share of 26% in 2024. This growth is driven by the rapid adoption of Industry 4.0 technologies, which emphasize automation, data exchange, and advanced manufacturing processes. In addition, the focus on sustainability and the integration of IoT and AI technologies are further propelling the demand for smart factories in this region

U.S. Smart Factory Market Trends

The U.S. smart factory market held a dominant position in 2024, fueled by increased investments in smart manufacturing solutions, which are further fueled by the need for operational efficiency, cost reduction, and improved product quality, thereby driving market growth in U.S.

Europe Smart Factory Market Trends

Europe smart factory is expected to grow at a considerable CAGR of over 8% from 2025 to 2030, driven by the rise of 5G technology is facilitating faster and more reliable connectivity within factories, enabling seamless integration of smart devices and systems. In addition, the integration of advanced technologies such as IoT, AI, and robotics is transforming traditional manufacturing processes into interconnected systems that enable real-time data analysis and predictive maintenance, thereby improving overall operational performance.

The UK smart factory market is expected to grow rapidly in the coming years, primarily driven by the increasing demand for automation and digital transformation across various industries. Government initiatives promoting Industry 4.0 technologies are encouraging manufacturers to adopt smart factory solutions to enhance productivity and efficiency. The emphasis on resource optimization, energy efficiency, and cost reduction in industrial operations further fuels this growth.

The Germany smart factory market held a substantial market share in 2024, driven by a strong industrial base and a commitment to innovation. The adoption of Industry 4.0 principles is prevalent, with many manufacturers investing in digital twins, advanced robotics, and AI-driven analytics to optimize production processes. The German government supports this transition through initiatives aimed at enhancing digital infrastructure and promoting sustainable manufacturing practices.

Asia Pacific Smart Factory Market Trends

The smart factory market in the Asia Pacific region is expected to grow at the highest CAGR of over 11% from 2025 to 2030, primarily driven by rapid industrialization and significant government support for smart manufacturing initiatives across the region. The increasing demand for efficient production processes and high-quality products is fueling investments in smart factories across APAC, positioning it as a leader in the global smart manufacturing landscape.

The Japan smart factory market is expected to grow rapidly in the coming years. The market is driven by the increasing focus of the country on automation and innovation to maintain its competitive edge in global manufacturing.

The China smart factory market held a substantial market share in 2024. In China, the "Made in China 2025" strategy aims to upgrade its manufacturing capabilities through advanced technologies such as IoT, robotics, and AI. Japan is also focusing on automation and innovation to maintain its competitive edge in global manufacturing.

Key Smart Factory Company Insights

Some of the key players operating in the market include Rockwell Automation, Inc. and General Electric Company, among others.

-

Rockwell Automation, Inc. is a prominent American company specializing in industrial automation and digital transformation technologies and operates globally, serving diverse sectors such as aerospace, automotive, food and beverage, and life sciences. The company offers a comprehensive range of products and services, including connected components, control systems, and advanced software solutions like FactoryTalk. Rockwell is recognized for its leadership in manufacturing execution systems (MES) and has been acknowledged for its innovative approaches to integrating AI and IIoT technologies into smart manufacturing processes.

-

General Electric Company (GE) is a multinational conglomerate with a strong focus on industrial automation through its Digital Industries division. The company leverages its expertise in data analytics and connectivity to provide solutions that enhance operational efficiency across various industries, including aviation, healthcare, and renewable energy. The company emphasizes the integration of advanced technologies such as artificial intelligence and machine learning to optimize manufacturing processes.

Some of the emerging market players in the smart factory market include Danfoss and Fanuc Corporation, among others

-

Danfoss provides energy-efficient and climate-friendly solutions, focusing on integrating smart manufacturing technologies to enhance operational efficiency while minimizing environmental impact. The company invests significantly in research and development to explore innovative technologies that incorporate automation and data-driven decision-making.

-

Fanuc Corporation specializes in robotics and factory automation. The company has a high focus on continuous innovation in smart manufacturing technologies, including advanced robotics and AI integration, which allows it to maintain a competitive edge. Fanuc's focus on enhancing production efficiency through automation and its commitment to developing cutting-edge solutions make it an emerging player in the evolving landscape of smart factories.

Key Smart Factory Companies:

The following are the leading companies in the smart factory market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens AG

- GE Vernova (General Electric Company)

- Rockwell Automation, Inc.

- Schiender Electric

- Honeywell International, Inc.

- ABB Ltd.

- Mitsubishi Electric Corporation

- Fanuc Corporation

- Danfoss

Recent Developments

-

In November 2024, Schneider Electric announced the opening of its new smart factory in Dunavecse, Hungary, which spans 28,000 m² and will employ up to 500 workers. This facility aims to enhance production capacity for engineering-to-order (ETO) solutions tailored to customer specifications, with 90% of its output designated for export across Europe.

-

In October 2024, ABB Ltd. announced a new brand positioning and tagline, "Engineered to Outrun," emphasizing its commitment to electrification and automation in the industrial sector. This strategic move aims to reinforce ABB's leadership in digital transformation by highlighting its innovative solutions that enhance operational efficiency and sustainability.

-

In October 2024, Mitsubishi Electric Corporation announced a significant investment of approximately USD 86 billion in advanced switchgear production and power electronics at its U.S. subsidiary, Mitsubishi Electric Power Products, located in Pittsburgh, Pennsylvania. This investment aims to enhance production capabilities in response to the growing demand for transmission and distribution grid products as the U.S. pursues renewable energy and decarbonization goals.

Smart Factory Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 169.61 billion

Revenue forecast in 2030

USD 272.64 billion

Growth rate

CAGR of 10.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, field devices, application regional

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; U.A.E.

Key companies profiled

Siemens AG; GE Vernova (General Electric Company); Rockwell Automation, Inc.; Schneider Electric; Honeywell International, Inc.; ABB Ltd.; Mitsubishi Electric Corporation; Fanuc Corporation; Danfoss

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Factory Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart factory market report based on technology, field devices, application, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Distributed Control Systems (DCS)

-

Enterprise Resource Planning (ERP)

-

Human Machine Interface (HMI)

-

Manufacturing Execution System (MES)

-

Product Life Cycle Management (PLM)

-

Program Logic Controller (PLC)

-

Supervisory Controller and Data Acquisition (SCADA)

-

Others

-

-

Field Devices Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sensors

-

Industrial Robotics

-

Machine Vision Systems

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Energy & Power

-

Food and Beverages

-

Healthcare

-

Semiconductor & Electronics

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global smart factory market size was estimated at USD 154.89 billion in 2024 and is expected to reach USD 169.61 billion in 2025.

b. The global smart factory market is expected to witness a compound annual growth rate of 10.0% from 2025 to 2030 to reach USD 272.64 billion by 2030.

b. The industrial robotics segment accounted for the largest market share of over 41% in 2024. Manufacturers increasingly prefer industrial robots due to their ability to enhance production efficiency, reduce human labor costs, and improve product quality.

b. Some key players operating in the smart factory market include ABB, Ltd., Dassault Systemes S.E., FANUC Corporation, General Electric Company, Honeywell International, Inc., Johnson Controls, Inc., KUKA AG, Mitsubishi Electric Corporation, Rockwell Automation, Inc., Schneider Electric SE, Canon Inc., Cisco System Inc., Emerson Electric Co.

b. The smart factory market is expected to grow substantially due to several key factors, including increasing emphasis on energy efficiency, improved manufacturing productivity, and the establishment of advanced manufacturing infrastructures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.