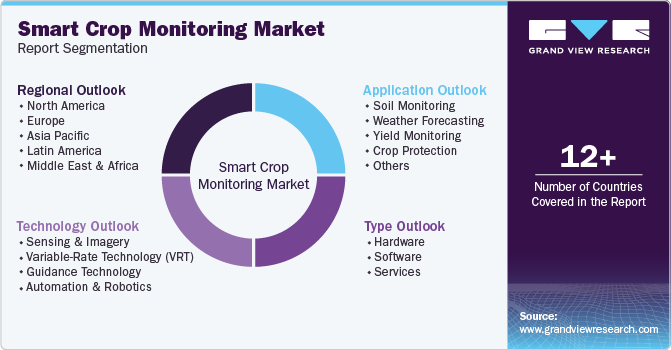

Smart Crop Monitoring Market Size, Share & Trends Analysis Report By Type (Hardware, Software, Services), By Technology (Sensing & Imagery, VRT, Automation & Robotics), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-428-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Smart Crop Monitoring Market Size & Trends

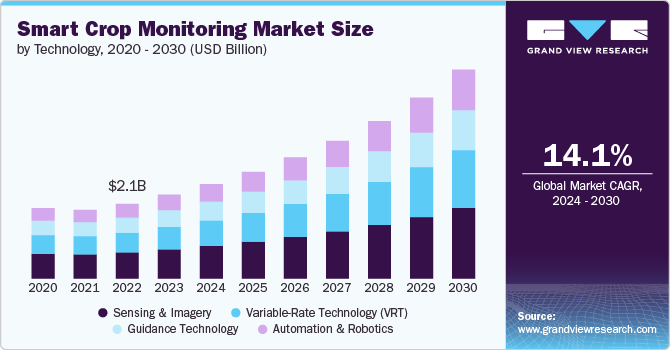

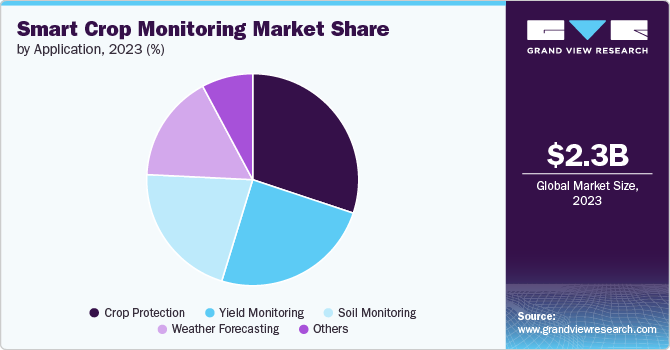

The global smart crop monitoring market size was estimated at USD 2.31 billion in 2023 and is projected to grow at a CAGR of 14.1% from 2024 to 2030. The agriculture sector is undergoing a significant transformation with the advent of smart technologies, particularly in the domain of crop monitoring. Smart crop monitoring is gaining traction in the market driven by the need for increased efficiency, productivity, and sustainability in farming practices.

According to an article published by the United Nations Department of Economic and Social Affairs, the global population is projected to reach 9.8 billion by 2050, resulting in the demand for food expected to rise significantly. This necessitates the adoption of advanced technologies that can optimize crop yields, reduce waste, and ensure food security.

The market has evolved significantly over the past decade, driven by advancements in IoT, AI, and machine learning. These technologies have enabled the development of sophisticated monitoring systems that can provide real-time data on a wide range of parameters, including soil moisture, temperature, humidity, and pest activity. As result, farmers can now monitor their crops more effectively and respond quickly to potential issues, minimizing crop loss and improving overall productivity. The market is poised for significant growth, with an increasing number of farmers adopting these technologies to meet the challenges posed by climate change, resource scarcity, and the need for sustainable farming practices.

Precision farming is a key trend in modern agriculture, driven by the need to optimize resource use and increase productivity. Smart crop monitoring systems enable precision farming by providing real-time data on crop health, allowing farmers to apply fertilizers, pesticides, and water only where needed. This not only reduces costs but also minimizes the environmental impact of farming practices. Furthermore, governments across the globe are recognizing the importance of smart farming technologies in ensuring food security and sustainable agriculture. Government in the countries such as U.S., Canada, Australia, China, and India among others are offering subsidies and incentives to farmers who adopt smart farming technologies, driving the market growth.

Growing awareness of the need of sustainable farming practices to mitigate the impact of agriculture on the environment. Smart crop monitoring technologies enable farmers to reduce their use of water, fertilizers, and pesticides, leading to more sustainable farming practices. Such factors are driving the adoption of smart farming technologies, particularly in regions where water scarcity and environmental degradation are major concerns.

Climate change is having a profound impact on agriculture, with changing weather patterns and extreme weather events posing significant challenges for farmers. Smart crop monitoring system helps farmers adapt to these changes by providing real-time data on environmental conditions and enabling them to make informed decisions on crop management.

Type Insights

Based on type, the market is classified into hardware, software, and services. The hardware segment led the market with the largest revenue share of 57.7% in 2023. One of the most significant trends in this segment is the integration of IoT devices with other technologies such as drones and satellite imagery. According to a report by the U.S. Department of Agriculture (USDA), there has been a notable increase in the use of drones equipped with multispectral and hyperspectral cameras in monitoring crop health and detecting pest infestations. Furthermore, development of low-cost sensors has made it easier for small and medium-sized farms to adopt smart monitoring systems.

The service segment is projected to witness at the fastest CAGR of 15.4% from 2024 to 2030. The segment’s growth can be attributed to the growing focus on training and education services. As smart crop monitoring technologies become more complex, there is growing need for training programs that help farmers understand how to use these tools effectively. This trend is supported by government initiatives aimed at promoting the adoption of precision agriculture. For instance, National Agricultural Statistics Services (NASS) has been conducting surveys and training sessions to educate farmers about the benefits of precision farming technologies.

Technology Insights

Based on technology, the market is classified into sensing & imagery, variable-rate technology (VRT), guidance technology, and automation & robotics. The sensing & imagery segment led the market with the largest revenue share of 34.78% in 2023. The segment's growth is attributed to the growing need for sustainable farming practices, coupled with the rising global population and the subsequent demand for food, has pushed farmers to seek more efficient ways to monitor and manage their crops.

The automation & robotics segment is projected to grow at the fastest CAGR of 15.1% from 2024 to 2030. One of the most notable trends in this segment is the development of autonomous farm machinery. Companies are increasingly investing in the development of autonomous drones, tractors, and harvesters that can operate with minimal human interventions. Furthermore, the integration of IoT with automation & robotics is also gaining traction in the market, as it allows for the creation of smart farms where various systems communicate and operate cohesively. Such factors are driving the demand for the automation & robotics segment over the forecast period.

Application Insights

Based on application, the market is classified into soil monitoring, weather forecasting, yield monitoring, crop protection, and others. The crop protection segment led the market with the largest revenue share of 30.11% in 2023. The increasing prevalence of pests and diseases, exacerbated by climate change, has made crop protection a top priority for farmers globally. Growing shift towards integrated pest management (IPM) is a major trend observed in the market. IPM strategies combine cultural, mechanical, and chemical methods to control pests in an environmentally sustainable manner. Furthermore, tools such as remote sensing, drones, and AI-based pest detection systems, are increasingly being integrated into IPM frameworks to enhance their effectiveness.

The soil monitoring segment is anticipated to register at a significant CAGR from 2024 to 2030. The trend towards precision agriculture has significantly boosted the demand for soil monitoring solutions. Farmers are increasingly adopting soil sensors and data analytics tools to gain real-time insights into soil conditions, including moisture levels, pH, nutrient content, and temperature. Governments and international organizations are encouraging practices that minimize environmental impact, and soil monitoring technology plays a key role in achieving this goal. The ability to monitor soil conditions in real-time helps farmers optimize input usage, thus promoting sustainable farming practices.

Regional Insights

North Americadominated the smart crop monitoring market with the largest revenue share of 31.31% in 2023. The market’s growth in the region is attributed to the combination of advanced technological infrastructure, large-scale farming operations, and government support. The adoption of precision agriculture is widespread, with farmers increasingly relying on smart technologies to enhance crop yield and efficiency.

U.S. Smart Crop Monitoring Market Trends

The smart crop monitoring market in the U.S. is expected to grow at the fastest CAGR of 12.7% from 2024 to 2030. The country’s vast and diverse agricultural landscape makes it an ideal testing ground for new technologies. The U.S. market is witnessing rapid advancements in sensor technology, with a growing emphasis on developing low-cost, high precision sensors. In addition, the integration of blockchain technology in smart crop monitoring is gaining traction is further anticipated to drive the demand for the market in the U.S.

Asia Pacific Smart Crop Monitoring Market Trends

The smart crop monitoring market in Asia Pacific is expected to grow at the fastest CAGR of 15.4% from 2024 to 2030. This growth can be attributed to the increasing adoption of precision agriculture technologies in countries such as China, India, and Japan. The region’s large agricultural base, coupled with the need to improve food security, is fueling the demand for smart farming solutions. Furthermore, government initiatives play a crucial role in driving the adoption of smart crop monitoring in Asia Pacific. For instance, the “Digital Agriculture Mission” aims to integrate technology into farming practices to increase productivity and sustainability. Similarly, China’s “Smart Agriculture” initiative focuses on the development and deployment of advanced technologies in agriculture, including smart crop monitoring.

Europe Smart Crop Monitoring Market Trends

The smart crop monitoring market in Europe is expected to grow at a notable CAGR of 13.7% from 2024 to 2030. The market's growth in the region can be attributed to the stringent environmental regulations and strong emphasis on sustainability. These factors are driving the adoption of smart crop monitoring technologies that reduce the environmental impact of farming practices.

Key Smart Crop Monitoring Company Insights

Some of the key companies operating in the global market include AGCO Corporation, CLAAS Group, Climate LLC, Deere & Company, Microsoft Corporation, Prospera Technologies, Raven Industries Inc., Robert Bosch GmbH, Small Robot Co., and Trimble Inc., among others.

-

Deere & Company, engaged in the manufacturing of agricultural equipment. The company has invested heavily in precision agriculture, leveraging IoT, AI, and data analytics to develop smart crop monitoring tools. Furthermore, the company has formed strategic partnerships and made acquisitions to strengthen its position in the market

Small Robot Co. and Raven Industries Inc. are some of the emerging companies in the target market.

-

Small Robot Co. is a U.K.-based company offering agricultural services. The company has developed a suite of agricultural robots designed to monitor, map, and manage crops on a pre-plant basis. The company’s products use advanced AI and machine learning to provide precision monitoring and treatment, which significantly reduces the need for pesticides and fertilizers

Key Smart Crop Monitoring Companies:

The following are the leading companies in the smart crop monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- AGCO Corporation

- CLAAS Group

- Climate LLC

- Deere & Company

- Microsoft Corporation

- Prospera Technologies

- Raven Industries Inc.

- Robert Bosch GmbH

- Small Robot Co.

- Trimble Inc.

Recent Developments

-

In July 2024, Cropin Technology Solutions Private Limited, a cloud-based agricultural solution provider launched a real-time agri-intelligence solution named Sage. The solution is powered by Google Gemini and converts agricultural landscape into a grid-based-map with options of 5x5 km, 3x3 meters, and 10x10 meters

-

In April 2023, Bosch BASF Smart Farming GmbH and AGCO Corporation announced a joint venture to integrate smart spraying technology with Fendt Rogator sprayers. The new spraying solution integrated with weed identification technology develop by Bosch BASF, automated sensitivity thresholds, and targeted spraying

Smart Crop Monitoring Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.61 billion |

|

Revenue forecast in 2030 |

USD 5.77 billion |

|

Growth rate |

CAGR of 14.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, Technology, Application, and Region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; and South Africa |

|

Key companies profiled |

AGCO Corporation; CLAAS Group; Climate LLC; Deere & Company; Microsoft Corporation; Prospera Technologies; Raven Industries Inc.; Robert Bosch GmbH; Small Robot Co.; and Trimble Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Smart Crop Monitoring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart crop monitoring market report based on type, technology, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Sensing & Imagery

-

Variable-Rate Technology (VRT)

-

Guidance Technology

-

Automation & Robotics

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Soil Monitoring

-

Weather Forecasting

-

Yield Monitoring

-

Crop Protection

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart crop monitoring market size was estimated at USD 2.31 billion in 2023 and is expected to reach USD 2.61 billion in 2024.

b. The global smart crop monitoring market is expected to grow at a compound annual growth rate of 14.1% from 2024 to 2030, reaching USD 5.77 billion by 2030.

b. The hardware segment dominated the market in 2023 and accounted for more than 57.0% share of global revenue. One of the most significant trends in this segment is the integration of IoT devices with other technologies such as drones and satellite imagery.

b. Some of the players operating in the smart crop monitoring market include AGCO Corporation, CLAAS Group, Climate LLC, Deere & Company, Microsoft Corporation, Prospera Technologies, Raven Industries Inc., Robert Bosch GmbH, Small Robot Co., and Trimble Inc.

b. Smart crop monitoring is gaining traction in the market driven by the need for increased efficiency, productivity, and sustainability in farming practices. According to an article published by the United Nations Department of Economic and Social Affairs, global population is projected to reach 9.8 billion by 2050, resulting in the demand for food expected to rise significantly. This necessitates the adoption of advanced technologies that can optimize crop yields, reduce waste, and ensure food security.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."