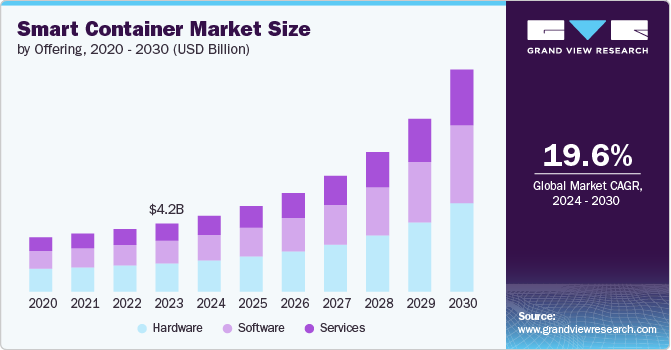

Smart Container Market Size, Share & Trends Analysis Report By Offering (Hardware, Software, Services), By Technology, By Application (Asset Tracking & Management, Supply Chain Optimization), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-348-6

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Smart Container Market Size & Trends

The global smart container market size was estimated at USD 4.20 billion in 2023 and is expected to register a CAGR of 19.6% from 2024 to 2030. A smart container is a shipping container equipped with advanced technologies such as IoT sensors, GPS, and real-time tracking systems to monitor and manage its contents and conditions during transit. These containers are used for ensuring the safety, security, and integrity of goods, optimizing supply chain efficiency, and providing real-time data on location, temperature, humidity, and other environmental factors. The market growth is attributable to factors such as increased focus on end-to-end (E2E) supply chain visibility, increasing demand for monitoring and controlling internal container conditions, and rapid adoption of IoT devices by logistics and shipping companies.

The growing complexity of global supply chains has heightened the need for end-to-end (E2E) visibility to enhance efficiency and responsiveness. Smart containers equipped with advanced tracking and monitoring technologies provide real-time data on the location and status of goods, enabling better decision-making. Companies are investing in these technologies to gain a competitive edge by optimizing inventory management and reducing delays. Enhanced E2E visibility helps in identifying potential disruptions and allows for proactive measures to mitigate risks. Additionally, it improves customer satisfaction by providing accurate delivery timelines and transparency. Overall, the increased focus on E2E visibility is driving the adoption of smart containers in the logistics industry.

The demand for monitoring and controlling internal container conditions is rising due to the need to maintain the quality and integrity of goods during transit. Smart containers are equipped with sensors that monitor temperature, humidity, and other environmental factors, ensuring that sensitive products like pharmaceuticals and perishable goods are transported under optimal conditions. This capability is crucial for industries that require strict compliance with regulatory standards. Real-time monitoring allows immediate corrective actions if conditions deviate from the set parameters, reducing the risk of spoilage and loss. The ability to control internal conditions also supports the growing demand for sustainable and efficient supply chain practices. As a result, the market for smart containers is expanding rapidly.

The increased adoption of IoT devices by shipping companies is transforming the logistics landscape, enhancing the functionality of smart containers. IoT-enabled containers provide continuous data streams on their status and condition, improving the accuracy and reliability of shipment tracking. Shipping companies are leveraging this technology to optimize routes, reduce fuel consumption, and enhance overall operational efficiency. The integration of IoT devices facilitates better coordination across the supply chain, leading to improved delivery performance and cost savings. Furthermore, the data collected from these devices can be analyzed to gain insights into operational bottlenecks and identify areas for improvement. The trend towards IoT adoption is a significant market growth driver.

Offering Insights

The hardware segment held the largest market share of 41.6% in 2023, due to the essential role of physical components such as sensors, GPS devices, and RFID tags in enabling real-time tracking and monitoring. These hardware elements are crucial for providing accurate data on location, temperature, humidity, and other conditions within the container, ensuring the integrity and safety of transported goods. Additionally, the ongoing advancements in sensor technology and the increasing integration of IoT devices have further boosted the adoption of smart container hardware. The reliability and effectiveness of these hardware components make them indispensable for enhancing supply chain visibility and operational efficiency.

The software segment is expected register the fastest CAGR of 20.5% over the forecast period, due to the increasing need for sophisticated data analytics, real-time monitoring, and predictive maintenance capabilities. Advanced software solutions enable seamless integration of IoT devices, providing users with actionable insights and enhanced decision-making capabilities. The growing emphasis on supply chain optimization and the need for customized software applications to manage diverse logistics operations have further driven this growth. Additionally, the shift towards cloud-based platforms and AI-driven analytics has made software solutions more scalable and accessible, contributing to their rapid adoption and market expansion.

Technology Insights

The GPS segment held the largest market share of 36.2% in 2023, primarily due to its essential role in providing accurate location tracking capabilities. GPS technology allows real-time monitoring of container movements across global supply chains, enabling precise asset management and operational efficiency. Its widespread adoption is driven by the need for enhanced security, reduced transit times, and improved route optimization. Additionally, GPS systems integrate seamlessly with other IoT sensors to provide comprehensive data on container conditions, further bolstering their market dominance in smart container solutions.

The LoRa WAN segment registered the fastest CAGR of 20.2% over the forecast period, due to its ability to offer long-range, low-power connectivity ideal for IoT applications in logistics. This technology enables cost-effective deployment and operation of large-scale sensor networks, covering vast areas with minimal infrastructure. LoRaWAN's capability to penetrate deep indoor and urban environments while maintaining connectivity contributes to its popularity in urban logistics and smart city initiatives. Moreover, its compatibility with diverse sensors for monitoring temperature, humidity, and other conditions makes it a versatile choice for enhancing visibility and efficiency across supply chains.

Application Insights

The asset tracking & management segment dominated the smart container market and held a 36.9% market share because it addresses critical needs in supply chain logistics. By providing real-time visibility and monitoring of container locations and conditions, this segment helps companies optimize asset utilization, reduce operational costs, and ensure timely delivery of goods. This capability is crucial for enhancing overall supply chain efficiency and meeting customer demands for transparency and reliability. Additionally, asset tracking solutions often integrate with other IoT technologies, such as GPS and sensors, offering comprehensive insights that further drive their adoption and market dominance.

The supply chain optimization segment registered the fastest CAGR of 20.3% over the forecast period, due to its critical role in enhancing efficiency and reducing costs across logistics operations. By leveraging real-time data from smart containers, companies can optimize routes, inventory levels, and asset utilization, leading to significant improvements in overall supply chain performance. This capability addresses the growing demand for precise and reliable delivery schedules, minimizing delays and disruptions. Additionally, advanced analytics and predictive insights from these solutions help businesses make informed decisions, further driving their adoption and market leadership.

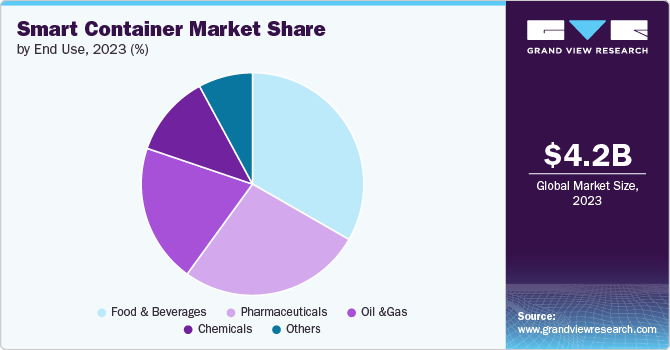

End Use Insights

The food and beverages segment dominated the market with a revenue share of 33.3% and is also expected to register the fastest CAGR, due to the critical need for maintaining the freshness and safety of perishable goods during transit. Smart containers equipped with real-time monitoring sensors ensure optimal conditions by tracking temperature, humidity, and other environmental factors, which are vital for preventing spoilage and contamination. The increasing consumer demand for high-quality, fresh products has driven the adoption of these technologies to enhance supply chain transparency and efficiency. Additionally, regulatory requirements for food safety and quality standards have accelerated the integration of smart containers in this sector. The ability to promptly address and mitigate potential issues during transportation provides significant value, contributing to the rapid growth and dominance of the food and beverages segment in the market.

The pharmaceuticals segment is expected to grow at the second-fastest CAGR over the forecast period, due to the stringent requirements for monitoring and maintaining the integrity of medical products during transit. Smart containers equipped with advanced sensors provide real-time data on temperature, humidity, and other environmental conditions, ensuring compliance with regulatory standards. This capability is crucial for preventing spoilage and maintaining the efficacy of pharmaceuticals, which are highly sensitive to environmental changes. Additionally, the growing demand for biologics and specialty drugs, which require precise handling and tracking, further drives the adoption of smart container solutions in the pharmaceutical industry.

Regional Insights

North America held the largest market share of 35.6% in 2023, primarily due to its advanced logistics infrastructure and high adoption rate of IoT technologies. The region's strong focus on enhancing supply chain efficiency and transparency has driven the demand for smart container solutions across various industries, including pharmaceuticals, food and beverages, and automotive. Additionally, the presence of major technology providers and a supportive regulatory environment have further contributed to the region's leadership.

U.S. Smart Container Market Trends

The U.S. held the largest revenue share in the North America market in 2023, due to its robust technological infrastructure and high investment in IoT and supply chain optimization solutions. Additionally, the country's strong presence of major logistics companies and extensive trade activities have driven the adoption of smart container technologies.

Asia Pacific Smart Container Market Trends

The smart container market in Asia Pacific is expected to grow at the fastest CAGR of 20.6% over the forecast period, driven by rapid industrialization and expansion of the logistics sector. The region's increasing trade activities and the adoption of advanced technologies for supply chain management have significantly contributed to this growth. Additionally, government initiatives to improve infrastructure and enhance trade efficiency have further accelerated the adoption of smart container solutions in Asia Pacific.

Europe Smart Container Market Trends

Europe held a significant market share of the smart container market in 2023 due to its strong emphasis on regulatory compliance and sustainability in logistics operations. The region's well-established transportation networks and adoption of advanced technologies, including IoT and smart container solutions, have further bolstered its position in the market.

Key Smart Container Company Insights

Some of the key companies operating in the Smart Container Market include ORBCOMM, and Traxens, among others.

- ORBCOMM is a leading market player, offering IoT solutions that enhance visibility and efficiency in supply chain operations. Their advanced monitoring technologies provide real-time data on container location, condition, and security, catering to industries like shipping, logistics, and transportation. ORBCOMM's solutions optimize asset utilization, improve inventory management, and ensure compliance with regulatory requirements, positioning them as a key enabler of smart logistics solutions globally.

Roambee Corporation, and Nexxiotare some of the emerging market companies in the target market.

- Roambee Corporation specializes in supply chain visibility and intelligence, facilitating precise on-time, in-full, and in-condition delivery of shipments and assets globally. Their AI-powered platform and innovative monitoring solutions leverage IoT sensor data to enhance customer experience, service levels, and operational efficiencies across sectors including Pharma, Food, Electronics, and Automotive. Roambee Corporation's technology significantly improves in multimodal ETAs, delivery performance, and cold chain compliance, delivering a substantial return on investment for supply chain asset management.

Key Smart Container Companies:

The following are the leading companies in the smart container market. These companies collectively hold the largest market share and dictate industry trends.

- ORBCOMM

- Traxens

- Globe Tracker ApS

- Phillips Connect Technologies

- Emerson Electric Co.

- Hapag-Lloyd AG

- Seaco

- Savvy Telematics

- Sensitech Inc.

- Robert Bosch GmbH

- A.P. Moller - Maersk

- Roambee Corporation

- Nexxiot

Recent Developments

-

In May 2024, Roambee Corporation introduced the world's first true 5G GPS smart label, designed for single-journey logistics applications. This innovative peel-and-ship label integrates advanced sensors and 5G connectivity to provide real-time visibility and quality assurance across supply chains, catering to global enterprises and 3PLs alike.

-

In June 2023, Traxens introduced the TRAXENS-BOX 3 tracker, the first to achieve ATEX certification for use in potentially explosive environments aboard LNG vessels. This advancement positioned Traxens as a leader in providing secure and compliant smart container solutions, meeting increasing demand from maritime companies for enhanced tracking capabilities and regulatory readiness.

Smart Container Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.67 billion |

|

Revenue forecast in 2030 |

USD 13.69 billion |

|

Growth rate |

CAGR of 19.6% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, technology, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

ORBCOMM; Traxens; Globe Tracker ApS; Phillips Connect Technologies; Emerson Electric Co.; Hapag-Lloyd AG; Seaco; Savvy Telematics; Sensitech Inc.; Robert Bosch GmbH; A.P. Moller - Maersk; Roambee Corporation; Nexxiot. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Smart Container Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart container market report based on offering, technology, application, end use, and region:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Domestic Intermodal

-

International Intermodal

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Asset Tracking & Management

-

Supply Chain Optimization

-

Safety and Security

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Food and Beverages

-

Pharmaceuticals

-

Oil and Gas

-

Chemicals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart container market size was valued at USD 4.20 billion in 2023 and is expected to reach USD 4.67 billion in 2024.

b. The global smart container market is expected to witness a compound annual growth rate of 19.6% from 2024 to 2030 to reach USD 13.69 billion by 2030.

b. The GPS segment held the largest market share of 36.2% in the smart container market primarily due to its essential role in providing accurate location-tracking capabilities

b. Key players in the smart container market include ORBCOMM, Traxens, Globe Tracker ApS, Phillips Connect Technologies, Emerson Electric Co., Hapag-Lloyd AG, Seaco, Savvy Telematics, Sensitech Inc., Robert Bosch GmbH, A.P. Moller - Maersk, Roambee Corporation, and Nexxiot.

b. The growth of the market is attributable to factors such as increased focus on end-to-end (E2E) supply chain visibility, increasing demand for monitoring and controlling internal container conditions, and rapid adoption of IoT devices by logistics and shipping companies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."