- Home

- »

- Next Generation Technologies

- »

-

Smart Clothing Market Size, Share And Trends Report, 2030GVR Report cover

![Smart Clothing Market Size, Share & Trends Report]()

Smart Clothing Market (2025 - 2030) Size, Share & Trends Analysis Report By Textile Type (Active, Passive, Ultra Smart), By Product Type (Apparel, Footwear, Wearable Patches), By Distribution Channel (Offline, Online), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-166-5

- Number of Report Pages: 99

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Clothing Market Summary

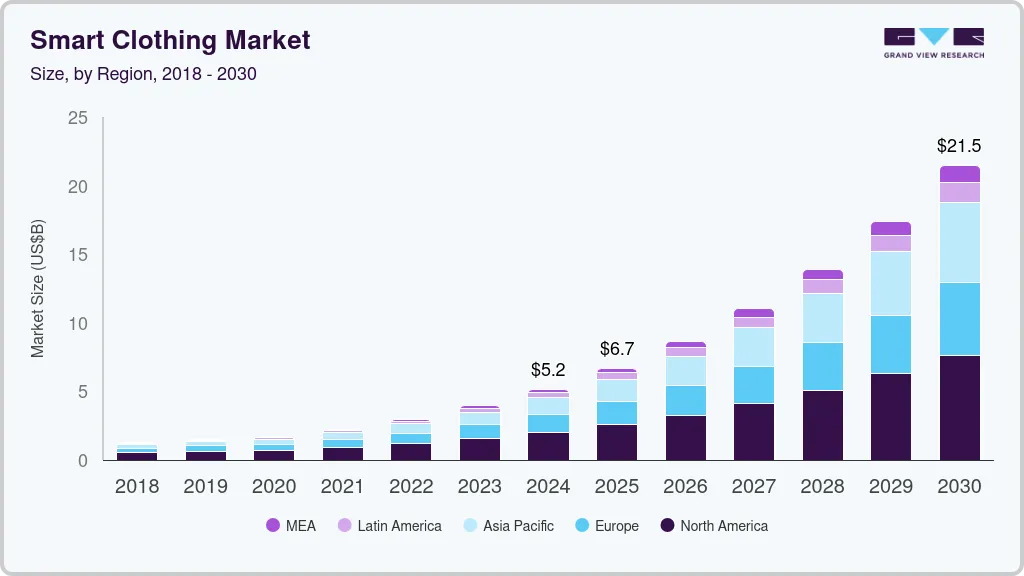

The global smart clothing market size was estimated at USD 5.16 billion in 2024 and is projected to reach USD 21.48 billion by 2030, growing at a CAGR of 26.2% from 2025 to 2030. Smart clothing, also known as high-tech clothing, smart wear, electronic textiles, or smart fabrics, is designed to monitor the wearer's health by providing biometric information such as heart rate, body temperature, muscle tension, and pulse rate.

Key Market Trends & Insights

- North America dominated the smart clothing market with the largest revenue share of 38.9% in 2024

- The smart clothing market in the U.S. held a dominant position in North America in 2024.

- By textile type, the passive smart segment led the market with the largest revenue share of 42.6% in 2024.

- By product type, the apparel segment led the market with the largest revenue share of 57.6% in 2024.

- By distribution channel, the offline segment led the market with the largest revenue share of 63.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.16 Billion

- 2030 Projected Market Size: USD 21.48 Billion

- CAGR (2025-2030): 26.2%

- North America: Largest market in 2024

The global market is experiencing significant growth, particularly in the sports and healthcare sectors, owing to the increasing awareness of health and fitness in daily life. Smart clothing offers a range of features, including biometric monitoring, activity tracking, and performance enhancement, enabling individuals to monitor health metrics, optimize workout routines, and enhance overall well-being. A societal focus on a healthy lifestyle and a growing preference for real-time health monitoring are further propelling the adoption of smart clothing.The advancement of wearable sensors, textile technology, and data analytics has propelled the evolution of smart clothing. This change is marked by the seamless integration of microcontrollers, sensors, and connectivity technologies directly into garments, enabling the real-time monitoring of body movements, vital signs, and other crucial biometric data. With ongoing technological advancements, smart clothing is gaining greater comfort, sophistication, and user-friendliness, contributing to its increased adoption across various applications.

In the sports and fitness industry, smart clothing presents significant potential. Athletes and fitness enthusiasts can gain from the instantaneous monitoring of biometric data, including oxygen saturation, heart rate, muscle activity, and movement patterns. This data serves as a valuable resource for refining training regimens, mitigating injury risks, and elevating overall performance. In addition, smart clothing can offer feedback on posture, technique, and form, empowering users to make necessary adjustments and enhance their exercise routines. The integration of smart clothing with wearable devices and mobile apps contributes to the development of a comprehensive fitness ecosystem, delivering personalized insights and guidance for individuals seeking to optimize their health goals.

Textile Type Insights

Based on textile type, the passive smart segment led the market with the largest revenue share of 42.6% in 2024. Various factors such as health and fitness awareness, advancements in technology, sports performance optimization, and integration with IoT ecosystems are driving the market growth. The growing adoption of Internet of Things (IoT) ecosystems, where smart clothing integrates with smartphones, fitness apps, and other devices, enhances their appeal by providing actionable insights to users. Furthermore, passive smart clothing that incorporates energy-harvesting features, such as solar-powered sensors or fabric that generates electricity from body movement, is gaining interest in line with sustainable and eco-friendly fashion trends.

The ultra smart segment is predicted to foresee at the fastest CAGR during the forecast period. Ultra-smart textiles, also known as very smart textiles, are third-generation smart textiles distinguished by their ability to sense, respond, and adjust to environmental conditions. Functioning like a cognitive and reasoning "brain," these textiles comprise a unit with activation capabilities. For instance, when the wearer reaches a specific heart rate level, the garment goes a step further by emitting audible beeps and producing vibrations. This dynamic responsiveness showcases the advanced capabilities of ultra-smart textiles, as they are designed to adapt their functions based on the wearer's specific needs. This level of sophistication in monitoring, real-time reaction to data, and adaptive functionality underscores the innovative nature of ultra-smart textiles, marking a significant advancement in the integration of intelligence and practicality in wearable technology.

Product Type Insights

The apparel segment led the market with the largest revenue share of 57.6% in 2024. The rising preference for apparel like smart shirts, jackets, and vests is generating favorable prospects for market growth. Smart apparel offers essential biometric data, including heart rate, breathing rate, and muscle activity, enabling professional optimization of performance and workout plans. This real-time data is seamlessly transmitted to partner apps, providing valuable insights into diverse sport-related metrics such as calories burned, intensity and recovery, fatigue levels, and sleep quality. The growing adoption of upper wear across various end-user applications is anticipated to create significant opportunities for smart clothing providers throughout the forecast period.

The footwear segment is predicted to foresee at a significant CAGR during the forecast period. The increasing integration of technology into footwear has transformed traditional shoes into intelligent, data-capturing devices. Smart footwear includes sensors and connectivity features that monitor various aspects, such as step count gait analysis, and even offer features like GPS tracking. Moreover, the popularity of smart footwear is driven by the rising awareness of health and fitness, as these shoes provide users with valuable insights into their physical activities and help optimize workout routines. In addition, the incorporation of smart technologies in footwear enhances the overall user experience, making them not only functional but also fashionable.

Distribution Channel Insights

Based on distribution channel, the offline segment led the market with the largest revenue share of 63.3% in 2024. Traditional retail channels, such as brick-and-mortar stores and physical outlets, continue to play a crucial role in consumer purchasing behavior. Many consumers still prefer the in-person shopping experience, where they can physically interact with and try on smart clothing items before making a purchase. In addition, offline distribution channels often provide a more immediate and accessible way for consumers to explore and purchase smart clothing. This is particularly important in the global market, where consumers may have questions about the technology, features, and compatibility of these innovative products.

The online segment is anticipated to witness at a significant CAGR during the forecast period. The increasing prevalence of e-commerce platforms and the growing trend of online shopping have significantly contributed to the dominance of this segment. The vast array of choices available on online platforms, coupled with user reviews and ratings, enhances the decision-making process for consumers seeking smart clothing. Moreover, online channels often offer competitive pricing, discounts, and promotions, attracting a large and diverse customer base.

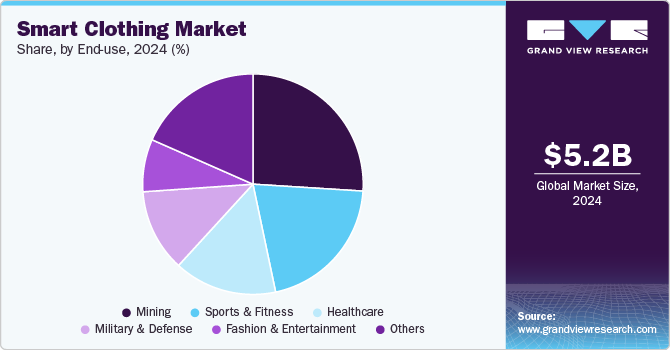

End Use Insights

Based on end use, the mining segment led the market with the largest revenue share of 15.1% in 2024. Numerous factors, such as hazardous environment detection, accident prevention and risk mitigation, remote monitoring, and real-time data, are driving the growth of the segment. Mining companies face significant insurance and liability costs due to the high-risk nature of the work. Smart clothing can help lower these costs by providing measurable data on safety improvements, reducing the likelihood of accidents, and improving overall risk management. Moreover, smart clothing is increasingly being integrated with IoT platforms used in the mining industry. This allows for better data analysis, predictive maintenance of equipment, and enhanced communication between workers and control centers, contributing to smoother operations.

The sports & fitness segment is anticipated to exhibit at a significant CAGR over the forecast period. Sensors have already found application in clothing lines and undergarments, including sports bras with heart rate monitoring capabilities and heated underwear. The sports and fitness industry is experiencing a surge in demand for smart innerwear, driven by the widespread adoption of sports bras equipped with sensors capable of recording metrics such as running distance, breathing rates, and heart rates. The integration of sensor technology into innerwear not only meets the evolving needs of athletes and fitness enthusiasts but also positions this market segment for considerable expansion over the forecast period.

Regional Insights

North America dominated the smart clothing market with the largest revenue share of 38.9% in 2024, attributed to the region's advancements in smart clothing technologies and the presence of key market players like Sensoria Inc., Ralph Lauren Media LLC, and Under Armour, Inc. The remarkable growth is further fueled by the increasing demand for smart clothing, especially from the military sector. The military is actively adopting and adapting smart clothing technologies to create battle-ready uniforms, providing a distinct advantage in the field. These uniforms, equipped with in-built sensors, measure crucial metrics such as muscle data, temperature, and heart and respiration rates and can even identify wounds to assess a soldier's health.

U.S. Smart Clothing Market Trends

The smart clothing market in the U.S. held a dominant position in North America in 2024. Consumers in the U.S. are becoming increasingly health-conscious, driving demand for wearable fitness trackers integrated into clothing. Smart clothing with built-in sensors can monitor vital signs, activity levels, and overall health, which has become a popular trend for fitness enthusiasts.

Europe Smart Clothing Market Trends

The smart clothing market in the Europe is expected to witness at a significant CAGR over the forecast period. European countries are increasingly leveraging smart clothing in healthcare for remote patient monitoring and elderly care. With an aging population in Europe, there is a growing need for smart garments that monitor health parameters like heart rate, blood pressure, and respiratory rates to provide better care for elderly patients.

Asia Pacific Smart Clothing Market Trends

The smart clothing market in the Asia Pacific region is anticipated to register at a significant CAGR over the forecast period. Many leading technology and textile manufacturing companies in countries like China, Japan, and South Korea have been actively involved in producing smart clothing. This includes the integration of advanced sensors, fabrics, and electronic components into garments. Moreover, the region has a large and tech-savvy consumer base. The growing urban population, coupled with an increasing awareness of health and fitness, has driven the demand for smart clothing. In addition, the region is known for its rapid adoption of new technologies, creating a conducive environment for the market growth.

Key Smart Clothing Company Insights

Some key players in the global market, such as DuPont, AiQ Smart Clothing, and Sensoria.These companies are at the forefront of sensor technology, conductive textiles, and durability, ensuring their smart clothing solutions remain competitive and innovative. These companies are integrating highly advanced sensors into their wearables, offering more precise and actionable data. Thus, focus on data accuracy has significantly increased the demand for its products within the fitness and sports industry.

-

DuPont is a key player in developing high-performance textiles and conductive fabrics, which are essential for smart clothing applications. DuPont has pioneered materials like Intexar, a smart clothing technology platform. Intexar is a stretchable, washable, and durable electronic ink-based technology that can be integrated into garments to monitor biometrics such as heart rate, breathing, and activity levels. This material is used by apparel manufacturers to develop smart textiles

-

AiQ Smart Clothing integrates electronics into fabrics by embedding conductive fibers directly into the material. This approach enables the production of washable, flexible, and durable smart clothing that retains the appearance and comfort of traditional garments while incorporating advanced technological functionalities. AiQ Smart Clothing targets various industries with tailored smart clothing solutions, including healthcare, sports and fitness, military, and industrial safety. For instance, the BioMan product line is designed to monitor biometrics such as heart rate, breathing rate, and muscle activity, making it valuable for medical and athletic purposes

Key Smart Clothing Companies:

The following are the leading companies in the smart clothing market. These companies collectively hold the largest market share and dictate industry trends.

- AiQ Smart Clothing

- DuPont

- Myontec

- Myzone

- Owlet UK

- Sensoria

- Siren

- TORAY INDUSTRIES, INC.

- Vulpes Electronics GmbH

- Wearable X

Recent Developments

-

In September 2024, Lole, athletic wear and outerwear producer, acquired Louis Garneau Sports in the field of cycling and sports equipment with three brands such as Garneau, Sugoi and Sombrio. The acquisition will allow Lole to broaden its product range and strengthen its focus on innovation and quality, resulting in a more varied selection of sports apparel and equipment for customers

-

In August 2024, a research group of the University of Waterloo developed a smart fabric. The fabric has the potential to harvest energy, monitor track and health movement. Developed by the research team, this fabric can convert solar energy and body heat into electricity, allowing for continuous operation without the need for an external power source. In addition, the material can be embedded with sensors to monitor variables like temperature, stress, and other parameters

-

In April 2024, Shepherd Center, a non-profit hospital, partnered with Sensoria Health Inc., a developer of IoT wearables to innovate and implement advanced technologies to enhance the accuracy of care for individuals with Multiple Sclerosis. Through this partnership with Sensoria Health, the focus is on harnessing cutting-edge sensor technologies, such as smart socks, to integrate clinical assessments into patients' everyday activities

Smart Clothing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.70 billion

Revenue forecast in 2030

USD 21.48 billion

Growth rate

CAGR of 26.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Textile type, product type, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

AiQ Smart Clothing; DuPont; Myontec; Myzone; Owlet UK; Sensoria; Siren; TORAY INDUSTRIES, INC.; Vulpes Electronics GmbH; Wearable X

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Clothing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart clothing market report based on textile type, product type, distribution channel, end use, and region:

-

Textile Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Active Smart

-

Passive Smart

-

Ultra Smart

-

-

Product Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Apparel

-

Footwear

-

Wearable Patches

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Offline

-

Online

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Military & Defence

-

Sports & Fitness

-

Fashion & Entertainment

-

Healthcare

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global smart clothing market size was estimated at USD 5.16 billion in 2024 and is expected to reach USD 6.70 billion in 2025.

b. The global smart clothing market is expected to grow at a compound annual growth rate of 26.2% from 2025 to 2030 to reach USD 21.48 billion by 2030.

b. North America dominated the smart clothing market with a share of 38.9% in 2024. This growth is attributed to the region's advancements in smart clothing technologies and the presence of key market players like Sensoria Inc., Ralph Lauren Media LLC, and Under Armour, Inc. The remarkable growth is further fueled by the increasing demand for smart clothing, especially from the military sector.

b. Some key players operating in the smart clothing market include AiQ Smart Clothing; DuPont; Myontec; Myzone; Owlet UK; Sensoria; Siren; TORAY INDUSTRIES, INC.; Vulpes Electronics GmbH; and Wearable X.

b. Key factors that are driving the smart clothing market growth include growing awareness of health and fitness among individuals, and advances in textile technology, wearable sensors, and data analytics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.