- Home

- »

- Next Generation Technologies

- »

-

Smart Cities Market Size, Share And Growth Report, 2030GVR Report cover

![Smart Cities Market Size, Share & Trends Report]()

Smart Cities Market Size, Share & Trends Analysis Report By Application, By Smart Governance, By Smart Utilities, By Smart Transportation, By Smart Healthcare, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-270-9

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Smart Cities Market Size & Trends

The global smart cities market size was valued at USD 748.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 25.8% from 2023 to 2030. The increasing urbanization, the need for efficient management of resource utilization, public safety concerns, and increasing demand for an environment with efficient energy utilization are the major driving factors for the market growth. Due to the COVID-19 pandemic, countries followed strict lockdowns and mobility constraints to avoid the spread of the virus. During the pandemic, the dependence of global economies on urban areas and the importance of public healthcare in smart city initiatives have been brought to light. However, organizations are trying to implement emerging technologies such as the Internet of Things (IoT) and Artificial Intelligence (A.I.) to overcome the challenges faced during the pandemic.

The need for sustainable structure due to the growing population and urbanization has become significant for market growth. Several regional governments are trying to handle these problems via smart city initiatives across serviceable segments, such as mobility, utility, safety, and management. The local governments have also been at the forefront of stimulating organizational and institutional changes, enabling steady investments, and creating a consortium for bringing diverse businesses together. The emergence of a new genre of public-private partnerships is also a particular development attributable to the smart city’s developments. Further, infrastructure development financing and funding models and governance systems are playing a major role in fueling the market.

The smart cities market growth can be attributed to the growing adoption of nanotechnology, Artificial Learning (A.I.), Machine Learning (ML), cloud computing, IoT, cognitive computing, big data analytics, and open data. Moreover, the increasing implementation of Build-Own-Operate (B.O.O.), Build-Operate-Transfer (B.O.T.), Original Brand Manufacturer (O.B.M.), and Bill of Material (B.O.M.) business models is also driving the successful project execution of smart cities. Asian countries have been pursuing numerous initiatives to encourage the adoption of digital technologies for smart cities while seeking to maintain consumer data privacy. Moreover, several government initiatives worldwide are anticipated to drive market growth further.

Though smart city projects need a diverse set of technologies, such as IoT, A.I., and smart sensors, to monitor city infrastructure, their application varies across projects and from city to city. The key driving factors for implementing smart city solutions are the need to improve resilient cities, reduce energy, and concern over the increase of environmental waste. Additionally, the vendors invest in Research & Development (R&D) to establish new systems and technologies for connected infrastructure across smart city projects. The key players in the market, such as Cisco Systems, Siemens AG, and IBM Corporation, are actively investing in R&D activities related to connected infrastructure in smart city development worldwide.

The smart cities concept has been gaining traction in recent years owing to numerous novel advantages smart cities can provide. However, several barriers are affecting the growth of the market. The high initial costs that are the prerequisite for the upheaval of the existing infrastructure of cities may restrain the growth of the market. The sheer number of financial commitments needed for the projects has been an important factor in slowing down market developments. However, the current scenario is expected to change in the coming years as there have been many other investment techniques that are gaining popularity, such as Build Transfer (B.T.), Build Operate Transfer (B.O.T.), Build Own Operate (B.O.O.), and public-private partnerships.

Market Concentration & Characteristics

The growth of the smart cities market is high, and the growth’s pace is accelerating. Emerging technologies such as AI, ML, cloud, data analytics, IoT and cyber security have developed rapidly. The increased adoption of these technologies in the smart city environment has enabled better connectivity, leading to growth of the smart cities market per regions such as, Asia Pacific, and Europe. For Instance, countries government across the European countries such as, U.K., and Germany are increasingly undertaking smart cities projects, such advanced projects are used to enrich the lives of citizens, and improve environmental sustainability, and privacy.

Smart cities market players are also engaging in mergers and acquisitions to expand their market positions. In addition, market players are spending huge amounts on research and development to develop advanced smart cities solutions that will enhance their market value and accelerate the growth of smart cities market.

The market is also subject to rules and regulations set by international, regional, and country-level regulatory bodies. Market participants must comply with various regulations and laws, including basic guidelines regarding the platform and data security, financial protection, and suitability checks, before they can use the site.

The significant initial investments in establishing infrastructures and solutions are projected to keep the threat of substitutes low over the projection period. The smart city market is comparatively narrowly focused, with few comparable products offers and few technology-driven alternatives. Businesses are spending a lot of money on R&D as well as the development of advanced products and technology. On the other hand, smart city solutions and products are made expressly to fill gaps and increase the effectiveness of current services. As a result, the threat of substitutes is considered low. Thus, creating smart cities business market opportunities.

End users serve a broad spectrum of industry verticals, such as public sector, healthcare, and government, and defense. Implementation of the IoT technology in end users is experiencing significant growth as a result of the growing digitization, connectivity, and innovation that is emerging in today's end use industries. Intelligent solutions help organizations manage various care bottlenecks.

Application Insights

The smart utility segment dominated the market and accounted for a market share of over 28% in 2022. The smart utility segment forms an integral part of the city infrastructure and includes multiple domains such as water treatment, consolidated data management, energy distribution, and civil distribution infrastructure management, among others. The advent of smart grids is also a significant factor driving the adoption of smart utilities. Integration of advanced data analytics and cloud technologies is also expected to drive market growth. With the rapidly increasing demand for energy, companies and governments are formulating and implementing strategies for improving renewable sources' contribution to overall energy production.

The environmental solution segment is anticipated to witness a significant CAGR of 28.8% over the forecast period. The development of the segment can be attributed to the rising government initiatives to curb pollution, optimize renewable energy usage, and establish a sustainable ecosystem for businesses. The industry players focus on improving their environmental solution portfolio to enhance their brand identity and increase their market revenues. For instance, in December 2021, IoT and A.I. solution company SENSORO launched the Environmental, Social, and Governance (E.S.G.) solution brand SENSORO Solution to provide climate monitoring, garbage classification, and ecological protection solutions.

Smart Utilities Insights

The energy management segment dominated the smart utilities segment in 2022 and accounted for more than 55% of revenue. The growing energy demand has sparked the adoption of virtual power plants, which operate on AI, machine learning, and IoT to provide security and efficiency. Key market players are focusing on establishing a strong R&D infrastructure to drive the development and overview of advanced energy management systems and design analytics solutions to integrate emerging technologies such as blockchain.

The waste management segment is expected to witness a significant CAGR of 27.0% over the forecast period. Several governments are approaching system integrators, distributors, and OEMs for smart trash bin installation across various cities. Local governments, technology solutions providers, distributors, and system integrators are the major stakeholders in implementing city-level waste management projects. Different mobile apps are also being developed to monitor the fill levels of bins and add to the users' convenience. OEMs and system integrators are particularly focusing on venues that are more crowded and can often result in generating higher volumes of waste to deploy smart garbage bins and other waste management equipment, supporting the industry growth.

Smart Transportation Insights

The Intelligent Transportation System (ITS) segment accounted for the largest revenue share in 2022. The increasing number of vehicles on the road and the need to reduce traffic congestion are key factors in deploying advanced traffic management systems. These systems reduce delays and air pollution, ensure efficient traffic management by reducing travel duration, and enable authorities and public safety agencies to rapidly and efficiently respond to accidents and emergencies. Furthermore, the government of several countries is adopting intelligent transportation systems to improve road safety and operational performance of the transport system and reduce the impact of transportation on the environment. Thus, there is high growth of the transportation segment in smart cities market.

The parking management segment is anticipated to witness a significant CAGR growth rate over the forecast period. The segment growth can be attributed to the demand for efficient parking space management, environmental protection cost reduction, solutions to improve the convenience of end users, and improved safety and security in parking lots. The rising number of vehicles in cities makes it challenging for traffic departments to manage congestion problems. As a result, the smart city projects adopted by governments worldwide are now concentrating on effectively utilizing available parking spaces to reduce pollution and traffic jams. These factors will further boost the demand for parking management systems during the forecast period.

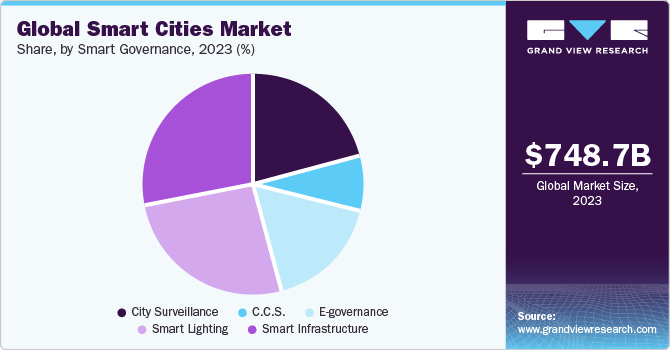

Smart Governance Insights

The smart infrastructure segment dominated the market and accounted for a market share of over 28% in 2022. Shifting various governments' focus on digitizing their business operations is anticipated to fuel the demand for smart infrastructure solutions in multiple sectors such as BFSI, healthcare, retail, manufacturing, and F&B. The majority of governments, such as the U.K., Australia, India, Canada, the U.A.E., and the U.S., are investing in smart infrastructure solutions for economic digitalization. For instance, in December 2021, the Government of Australia invested USD 135.9 million under its program to transform the economy into a digital economy by 2030. The government will also create the regulatory framework for BFSI infrastructure to support, monitor & control evolving payment systems and crypto ecosystems.

The smart lighting segment is expected to witness a significant CAGR of 25.8% over the forecast period. Increasing the energy efficiency of the city and reducing costs of energy and maintenance, smart lighting can also provide a backbone for a wide range of smart city applications, including traffic management, public safety, environmental monitoring, smart parking, and extended Wi-Fi and cellular communications, among others. Smart lighting has gained much traction in recent years due to the evolution of human-centric lighting with light-emitting diodes and organic light-emitting diodes.

Regional Insights

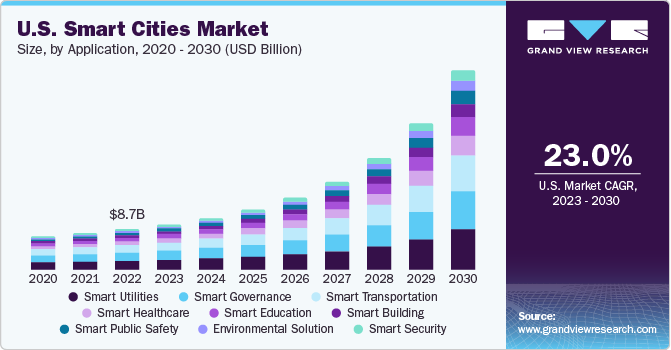

North America held the major share of over 30.4% of the global smart cities market in 2022. The regional market growth can be credited to the constant digital transformation in various industry verticals, such as government, telecom, and banking, among others. The region has a well-developed Information and Communication Technology (I.C.T.) infrastructure, the collaboration of federal and local governments with I.C.T. vendors, and the presence of prominent technology vendors. These service providers and other local authorities have widely deployed parts of the civic connectivity infrastructure which will lead to the planning for the construction of smart cities in the region. These factors will supplement the regional market's growth during the forecast period. Moreover, the rising government investments across the U.S. to boost the country’s transition toward a digital economy are creating a positive outlook for smart cities in the U.S. The U.S. government is focusing on digitizing commercial buildings to enhance citizens’ experiences and establish service transparency. Thus, driving the growth of the smart cities market in the USA.

The smart cities market in Europe was valued at USD 190.72 billion in 2022. The European government has been collaboratively working with various organizations and other regions to increase the adoption of the smart cities concept.

U.K. Smart Cities Market Trends

Smart cities market in U.K. accounted for a 23.1% revenue share of the European market in 2022. The rising popularity of smart technologies across buildings, transportation, and infrastructure in the U.K. is encouraging global industry players to set up their business operations in the region, thereby contributing to market expansion.

Germany Smart Cities Market Trends

Smart cities market in Germany is expected to grow at a CAGR of 21.3% from 2023 to 2030. Advancements in digital technologies and emerging startups in Germany are driving the growth of the smart cities market.

France Smart Cities Market Trends

Smart cities market in France is experiencing the adoption of smart cities concept by various local authorities. For instance, the France government has undertaken the New Industrial France project that enables companies to develop various equipment and solutions required for smart cities.

Asia Pacific smart cities market is witnessing significant growth. The region’s growth can be credited to the rise in disposable income, the development of digital infrastructure, globalization, and economic developments. Furthermore, developing countries across the APAC region, such as, Malaysia, Indonesia, there is high implementation of smart cities projects. Therefore, driving the growth of the smart cities market in the APAC region.

China Smart Cities Market Trends

Smart cities market in China is projected to grow at a CAGR of 27.0% from 2023 to 2030. Supportive government initiatives for smart cities and rising concerns related to energy consumption among buildings are driving the growth of the market in China.

Japan Smart Cities Market Trends

Smart cities market in Japan is experiencing a significant growth. The initiatives by key players in the market are expected to drive the demand for the smart cities market in the country.

India Smart Cities Market Trends

The key factors driving the growth of the smart cities market in India are the rising population, diminishing natural resources, and surging migration in urban areas.

Smart Cities Market in the Middle East and Africa (MEA) region is anticipated to reach USD 319.46 Billion by 2030. The increasing penetration of automated vehicles and networking technologies is expected to drive the growth of smart cities in the Middle Eastern & African regions.

Saudi Arabia Smart Cities Market

Smart cities market in Saudi Arabia is experiencing significant growth due to the rapid urbanization. The cities in the country are expected to grow considerably in the coming years compared to their neighboring countryside as the commercial activities and business clusters in urban areas continue to grow.

Key Smart Cities Company Insights

Some of the key players operating in the market include Microsoft Corporation, and Oracle Corporation.

-

Microsoft Corporation provides business software and solutions. The well-known software products from Microsoft are the Microsoft 365 series of productivity programs, Windows series of operating systems, and the Edge browser. Its flagship hardware products are Xbox video game consoles and Microsoft Surface touchscreen computers.

-

Oracle Corporation is a provider of IT software and services. The company sells database software and technology, cloud engineered systems, and enterprise software products, such as, human capital management software, enterprise resource planning software, supply chain management software, enterprise performance management software, and customer relationship management software.

-

Ericsson, and Telensa are some of the emerging market participants in the smart cities market.

-

Ericsson develops the IT products and services for the telecommunications industry and is currently leading the way in 5G. The company sells infrastructure, software and services in the field of information and communication technology for mobile service providers and enterprises, including 3G, 4G and 5G equipment, Internet Protocol (IP) and optical transport systems.

-

Telensa offers simple and effective smart lighting solutions for public and district lighting to help cities, utilities and large areas manage their lighting to save money and reduce costs.

Key Smart Cities Companies:

The following are the leading companies in the smart cities market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these smart cities companies are analyzed to map the supply network.

- ABB Limited

- AGT International

- AVEVA Group plc.

- Cisco Systems, Inc.

- Ericsson

- General Electric

- Honeywell International Inc.

- International Business Machines Corporation

- Itron Inc.

- KAPSCH Group

- Huawei Technologies Co., Ltd.

- Microsoft Corporation

- Oracle Corporation

- Osram Gmbh

- SAP SE

- Schneider Electric SE

- Siemens AG

- Telensa

- Verizon

- Vodafone Group plc

Recent Developments

-

In December 2023, Msheireb Properties (MP), Qatar based property developer, signed a Memorandum of Understanding (MoU) with Microsoft Corporation, software products developer, to develop a ‘Smart Experience’ project for visitors, retail, residents, and commercial customers in MP’s development, Msheireb Downtown Doha (MDD).The Smart Experience project is revolutionizing the way citizens interact with the urban environment by incorporating new solutions to improve the lives of MDD members.

-

In November 2023,Smart City Expo World Congress (SCEWC), the international event on cities and smart urban solutions organized by Fira de Barcelona. It is an exhibition of innovative urban solutions and projects that focus on ways to transform modern cities into more sustainable, efficient and habitable places. The congress program of SCEWC comprises eight main themes, including energy and environment, enabling technologies, mobility, housing and inclusion, management and economy, security and blue economy, and infrastructure and buildings.

-

In August 2023, NEC Corporation India, IT services provider, launched Smart City project in Tirupati, India, for Tirupati Smart City Corporation Limited.Under this project, NEC Corporation India would implement ICT solutions across the city and establish a City Operations Center (COC) in Tirupati. ICT solutions, such as, a unified command and control center, and integrated services enable real-time data collection and analysis and two-way communication, helping to provide more effective responses to environmental, and health safety.

-

In March 2023, Honeywell International announced the initiation of the first phase of the Bangalore Safe City Project. The initiative seeks to establish a secure, efficient, and empowering environment for girls and women by leveraging advanced safety and security technology. As part of the project, Honeywell plans to deploy over 7,000 video cameras at strategic locations throughout Bengaluru, equipped with cutting-edge artificial intelligence (AI) capabilities. These AI-powered video analytics systems will enable comprehensive analysis of video feeds spanning the city, contributing to enhanced safety and surveillance measures.

-

March 2023, Siemens, a smart infrastructure provider, announced the launch of a smart IoT solution called Connect Box to manage smart buildings. Connect Box offers a user-friendly approach for monitoring building performances, helps optimize energy, and substantially improves the air quality inside small to medium buildings such as retail shops, schools, apartments, and small offices in smart city projects. Therefore, The increasing implementation of IoT in smart cities market is expected to drive the market growth.

Smart Cities Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 748.7 billion

Revenue forecast in 2030

USD 3,728.3 billion

Growth Rate

CAGR of 25.8% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Application, smart governance, smart utilities, smart transportation, smart healthcare, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Germany; France; U.K.; Italy; Spain; Russia; China; India; Japan; Australia; South Korea; Brazil; Mexico; ASEAN; Nordic Region; Eastern Europe; UAE; South Africa, and Saudi Arabia

Key companies profiled

ABB Limited; AGT International; AVEVA Group plc.; Cisco Systems, Inc.; Ericsson; General Electric; Honeywell International Inc.; International Business Machines Corporation; Itron Inc.; KAPSCH Group; Huawei Technologies Co., Ltd.; Microsoft Corporation; Oracle Corporation; Osram Gmbh; SAP SE; Schneider Electric SE; Siemens AG; Telensa; Verizon; Vodafone Group plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Cities Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart cities market report based on application, smart governance, smart utilities, smart transportation, smart healthcare, and region.

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smart Governance

-

Smart Building

-

Environmental Solution

-

Smart Utilities

-

Smart Transportation

-

Smart Healthcare

-

Smart Public Safety

-

Smart Security

-

Smart Education

-

-

Smart Governance Outlook (Revenue, USD Billion, 2018 - 2030)

-

City Surveillance

-

C.C.S.

-

E-governance

-

Smart Lighting

-

Smart Infrastructure

-

-

Smart Utilities Outlook (Revenue, USD Billion, 2018 - 2030)

-

Energy Management

-

Water Management

-

Waste Management

-

Meter Data Management

-

Distribution Management System

-

Substation Automation

-

Other Smart Utilities Solutions

-

-

Smart Transportation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Intelligent Transportation System

-

Parking Management

-

Smart Ticketing & Travel Assistance

-

Traffic Management

-

Passenger Information

-

Connected Logistics

-

Other Smart Transportation Solutions

-

-

Smart Cities Smart Healthcare Outlook (Revenue, USD Billion, 2018 - 2030)

-

Medical Devices

-

Systems & Software

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Nordic Region

-

Eastern Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

ASEAN

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global smart cities market was valued at USD 656.8 billion in 2022 and is expected to reach USD 748.7 billion in 2023.

b. The global smart cities market is expected to grow at a compound annual growth rate is 25.8% from 2023 to 2030 to reach USD 3,728.3 billion by 2030.

b. Some key players operating in the smart cities market include ABB Limited; AGT International; AVEVA Group plc.; Cisco Systems, Inc.; Ericsson; General Electric; Honeywell International Inc.; International Business Machines Corporation; Itron Inc.; KAPSCH Group; Huawei Technologies Co., Ltd.; Microsoft Corporation; Oracle Corporation; Osram Gmbh; SAP SE; Schneider Electric SE; Siemens AG; Telensa; Verizon; and Vodafone Group plc.

b. North America dominated the smart cities market in 2022 and accounted for a revenue share of over 30%.

b. The growing urbanization, need for efficient management and utilization of resources, public safety concerns, and increasing demand for a healthy environment with efficient energy consumption are anticipated to be the key driving factors for the growth of the smart cities market.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Smart Cities Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Billion)

3.3. Industry Value Chain Analysis

3.4. Market Dynamics

3.4.1. Market Drivers Analysis

3.4.2. Market Restraints Analysis

3.4.3. Market Opportunity Analysis

3.5. Smart Cities Market Analysis Tools

3.5.1. Porter’s Analysis

3.5.1.1. Bargaining power of the suppliers

3.5.1.2. Bargaining power of the buyers

3.5.1.3. Threats of substitution

3.5.1.4. Threats from new entrants

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Economic and Social landscape

3.5.2.3. Technological landscape

3.5.2.4. Environmental landscape

3.5.2.5. Legal landscape

Chapter 4. Smart Cities Market: Application Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Smart Cities Market: Application Movement Analysis, USD Billion, 2023 & 2030

4.3. Smart Governance

4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4. Smart Building

4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.5. Environmental Solution

4.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.6. Smart Utilities

4.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.7. Smart Transportation

4.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.8. Smart Healthcare

4.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.9. Smart Public Safety

4.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.10. Smart Security

4.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.11. Smart Education

4.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Smart Cities Market: Smart Governance Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Smart Cities Market: Smart Governance Movement Analysis, USD Billion, 2023 & 2030

5.3. City Surveillance

5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. C.C.S.

5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.5. E-governance

5.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.6. Smart Lighting

5.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.7. Smart Infrastructure

5.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Smart Cities Market: Smart Utilities Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Smart Cities Market: Smart Utilities Movement Analysis, USD Billion, 2023 & 2030

6.3. Energy Management

6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.4. Water Management

6.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.5. Waste Management

6.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.6. Meter Data Management

6.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.7. Distribution Management System

6.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.8. Substation Automation

6.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.9. Other Smart Utilities Solutions

6.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Smart Cities Market: Smart Transportation Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Smart Cities Market: Smart Transportation Movement Analysis, USD Billion, 2023 & 2030

7.3. Intelligent Transportation System

7.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4. Parking Management

7.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5. Smart Ticketing & Travel Assistance

7.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6. Traffic Management

7.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.7. Passenger Information

7.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8. Connected Logistics

7.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.9. Other Smart Transportation Solutions

7.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 8. Smart Cities Market: Smart Healthcare Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. Smart Cities Market: Smart Healthcare Movement Analysis, USD Billion, 2023 & 2030

8.3. Medical Devices

8.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4. Systems & Software

8.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 9. Smart Cities Market: Regional Estimates & Trend Analysis

9.1. Smart Cities Market Share by Region, 2023 & 2030 (USD Billion)

9.2. North America

9.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.2.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.2.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.2.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.2.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.2.7. U.S.

9.2.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.7.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.2.7.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.2.7.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.2.7.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.2.7.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.2.8. Canada

9.2.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.8.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.2.8.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.2.8.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.2.8.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.2.8.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.3. Europe

9.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.3.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.3.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.3.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.3.7. U.K.

9.3.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.7.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.7.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.3.7.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.3.7.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.3.7.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.3.8. Germany

9.3.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.8.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.8.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.3.8.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.3.8.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.3.8.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.3.9. France

9.3.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.9.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.9.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.3.9.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.3.9.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.3.9.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.3.10. Italy

9.3.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.10.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.10.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.3.10.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.3.10.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.3.10.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.3.11. Spain

9.3.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.11.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.11.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.3.11.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.3.11.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.3.11.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.3.12. Russia

9.3.12.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.12.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.12.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.3.12.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.3.12.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.3.12.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.3.13. Nordic Region

9.3.13.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.13.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.13.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.3.13.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.3.13.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.3.13.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.3.14. Eastern Europe

9.3.14.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.14.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.14.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.3.14.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.3.14.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.3.14.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.4. Asia Pacific

9.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.4.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.4.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.4.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.4.7. China

9.4.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.7.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.7.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.4.7.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.4.7.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.4.7.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.4.8. India

9.4.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.8.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.8.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.4.8.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.4.8.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.4.8.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.4.9. Japan

9.4.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.9.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.9.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.4.9.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.4.9.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.4.9.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.4.10. South Korea

9.4.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.10.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.10.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.4.10.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.4.10.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.4.10.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.4.11. Australia

9.4.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.11.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.11.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.4.11.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.4.11.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.4.11.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.4.12. ASEAN

9.4.12.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.12.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.12.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.4.12.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.4.12.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.4.12.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.5. Latin America

9.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.5.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.5.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.5.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.5.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.5.7. Brazil

9.5.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.7.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.5.7.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.5.7.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.5.7.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.5.7.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.5.8. Mexico

9.5.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.8.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.5.8.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.5.8.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.5.8.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.5.8.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.6. MEA

9.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.6.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.6.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.6.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.6.7. UAE

9.6.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.7.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6.7.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.6.7.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.6.7.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.6.7.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.6.8. South Africa

9.6.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.8.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6.8.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.6.8.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.6.8.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.6.8.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

9.6.9. Saudi Arabia

9.6.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.9.2. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6.9.3. Market Size Estimates and Forecasts by Smart Governance, 2018 - 2030 (USD Billion)

9.6.9.4. Market Size Estimates and Forecasts by Smart Utilities, 2018 - 2030 (USD Billion)

9.6.9.5. Market Size Estimates and Forecasts by Smart Transportation, 2018 - 2030 (USD Billion)

9.6.9.6. Market Size Estimates and Forecasts by Smart Healthcare, 2018 - 2030 (USD Billion)

Chapter 10. Competitive Landscape

10.1. Recent Developments & Impact Analysis by Key Market Participants

10.2. Company Categorization

10.3. Company Market Positioning

10.4. Company Market Share Analysis

10.5. Company Heat Map Analysis

10.6. Strategy Mapping

10.6.1. Expansion

10.6.2. Mergers & Acquisition

10.6.3. Partnerships & Collaborations

10.6.4. New Product Launches

10.6.5. Research And Development

10.7. Company Profiles

10.7.1. ABB Limited

10.7.1.1. Participant’s Overview

10.7.1.2. Financial Performance

10.7.1.3. Product Benchmarking

10.7.1.4. Recent Developments

10.7.2. AGT International

10.7.2.1. Participant’s Overview

10.7.2.2. Financial Performance

10.7.2.3. Product Benchmarking

10.7.2.4. Recent Developments

10.7.3. AVEVA Group plc.

10.7.3.1. Participant’s Overview

10.7.3.2. Financial Performance

10.7.3.3. Product Benchmarking

10.7.3.4. Recent Developments

10.7.4. Cisco Systems, Inc.

10.7.4.1. Participant’s Overview

10.7.4.2. Financial Performance

10.7.4.3. Product Benchmarking

10.7.4.4. Recent Developments

10.7.5. Ericsson

10.7.5.1. Participant’s Overview

10.7.5.2. Financial Performance

10.7.5.3. Product Benchmarking

10.7.5.4. Recent Developments

10.7.6. General Electric

10.7.6.1. Participant’s Overview

10.7.6.2. Financial Performance

10.7.6.3. Product Benchmarking

10.7.6.4. Recent Developments

10.7.7. Honeywell International Inc.

10.7.7.1. Participant’s Overview

10.7.7.2. Financial Performance

10.7.7.3. Product Benchmarking

10.7.7.4. Recent Developments

10.7.8. International Business Machines Corporation

10.7.8.1. Participant’s Overview

10.7.8.2. Financial Performance

10.7.8.3. Product Benchmarking

10.7.8.4. Recent Developments

10.7.9. Itron Inc.

10.7.9.1. Participant’s Overview

10.7.9.2. Financial Performance

10.7.9.3. Product Benchmarking

10.7.9.4. Recent Developments

10.7.10. KAPSCH Group

10.7.10.1. Participant’s Overview

10.7.10.2. Financial Performance

10.7.10.3. Product Benchmarking

10.7.10.4. Recent Developments

10.7.11. Huawei Technologies Co., Ltd.

10.7.11.1. Participant’s Overview

10.7.11.2. Financial Performance

10.7.11.3. Product Benchmarking

10.7.11.4. Recent Developments

10.7.12. Microsoft Corporation

10.7.12.1. Participant’s Overview

10.7.12.2. Financial Performance

10.7.12.3. Product Benchmarking

10.7.12.4. Recent Developments

10.7.13. Oracle Corporation

10.7.13.1. Participant’s Overview

10.7.13.2. Financial Performance

10.7.13.3. Product Benchmarking

10.7.13.4. Recent Developments

10.7.14. Osram Gmbh

10.7.14.1. Participant’s Overview

10.7.14.2. Financial Performance

10.7.14.3. Product Benchmarking

10.7.14.4. Recent Developments

10.7.15. SAP SE

10.7.15.1. Participant’s Overview

10.7.15.2. Financial Performance

10.7.15.3. Product Benchmarking

10.7.15.4. Recent Developments

10.7.16. Schneider Electric SE

10.7.16.1. Participant’s Overview

10.7.16.2. Financial Performance

10.7.16.3. Product Benchmarking

10.7.16.4. Recent Developments

10.7.17. Siemens AG

10.7.17.1. Participant’s Overview

10.7.17.2. Financial Performance

10.7.17.3. Product Benchmarking

10.7.17.4. Recent Developments

10.7.18. Telensa

10.7.18.1. Participant’s Overview

10.7.18.2. Financial Performance

10.7.18.3. Product Benchmarking

10.7.18.4. Recent Developments

10.7.19. Verizon

10.7.19.1. Participant’s Overview

10.7.19.2. Financial Performance

10.7.19.3. Product Benchmarking

10.7.19.4. Recent Developments

10.7.20. Vodafone Group plc

10.7.20.1. Participant’s Overview

10.7.20.2. Financial Performance

10.7.20.3. Product Benchmarking

10.7.20.4. Recent Developments

List of Tables

Table 1 Smart Cities Market 2018 - 2030 (USD Billion)

Table 2 Global smart cities market estimates and forecasts by region, 2018 - 2030 (USD Billion)

Table 3 Global smart cities market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 4 Global smart cities market estimates and forecasts by smart governance, 2018 - 2030 (USD Billion)

Table 5 Global smart cities market estimates and forecasts by smart utilities, 2018 - 2030 (USD Billion)

Table 6 Global smart cities market estimates and forecasts by smart transportation , 2018 - 2030 (USD Billion)

Table 7 Global smart cities market estimates and forecasts by smart healthcare, 2018 - 2030 (USD Billion)

Table 8 Application market by region, 2018 - 2030 (USD Billion)

Table 9 Smart Governance by region, 2018 - 2030 (USD Billion)

Table 10 Smart Building by region, 2018 - 2030 (USD Billion)

Table 11 Environmental Solution by region, 2018 - 2030 (USD Billion)

Table 12 Smart Utilities by region, 2018 - 2030 (USD Billion)

Table 13 Smart Transportation by region, 2018 - 2030 (USD Billion)

Table 14 Smart Healthcare by region, 2018 - 2030 (USD Billion)

Table 15 Smart Public Safety by region, 2018 - 2030 (USD Billion)

Table 16 Smart Security by region, 2018 - 2030 (USD Billion)

Table 17 Smart Education by region, 2018 - 2030 (USD Billion)

Table 18 Smart Governance by region, 2018 - 2030 (USD Billion)

Table 19 City Surveillance by region, 2018 - 2030 (USD Billion)

Table 20 C.C.S. by region, 2018 - 2030 (USD Billion)

Table 21 E-governance by region, 2018 - 2030 (USD Billion)

Table 22 Smart Lighting by region, 2018 - 2030 (USD Billion)

Table 23 Smart Infrastructure by region, 2018 - 2030 (USD Billion)

Table 24 Smart Utilities by region, 2018 - 2030 (USD Billion)

Table 25 Energy Management by region, 2018 - 2030 (USD Billion)

Table 26 Water Management by region, 2018 - 2030 (USD Billion)

Table 27 Waste Management by region, 2018 - 2030 (USD Billion)

Table 28 Meter Data Management by region, 2018 - 2030 (USD Billion)

Table 29 Distribution Management System by region, 2018 - 2030 (USD Billion)

Table 30 Substation Automation by region, 2018 - 2030 (USD Billion)

Table 31 Other Smart Utilities Solutions by region, 2018 - 2030 (USD Billion)

Table 32 Smart Transportation by region, 2018 - 2030 (USD Billion)

Table 33 Intelligent Transportation System by region, 2018 - 2030 (USD Billion)

Table 34 Parking Management by region, 2018 - 2030 (USD Billion)

Table 35 Smart Ticketing & Travel Assistance by region, 2018 - 2030 (USD Billion)

Table 36 Traffic Management by region, 2018 - 2030 (USD Billion)

Table 37 Passenger Information by region, 2018 - 2030 (USD Billion)

Table 38 Connected Logistics by region, 2018 - 2030 (USD Billion)

Table 39 Other Smart Transportation Solutions by region, 2018 - 2030 (USD Billion)

Table 40 Smart Healthcare by region, 2018 - 2030 (USD Billion)

Table 41 Medical Devices by region, 2018 - 2030 (USD Billion)

Table 42 Systems & Software by region, 2018 - 2030 (USD Billion)

Table 43 North America smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 44 North America smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 45 North America smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 46 North America smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 47 North America smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 48 U.S. smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 49 U.S. smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 50 U.S. smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 51 U.S. smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 52 U.S. smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 53 Canada smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 54 Canada smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 55 Canada smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 56 Canada smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 57 Canada smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 58 Europe smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 59 Europe smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 60 Europe smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 61 Europe smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 62 Europe smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 63 U.K. smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 64 U.K. smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 65 U.K. smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 66 U.K. smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 67 U.K. smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 68 Germany smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 69 Germany smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 70 Germany smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 71 Germany smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 72 Germany smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 73 France smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 74 France smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 75 France smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 76 France smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 77 France smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 78 Italy smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 79 Italy smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 80 Italy smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 81 Italy smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 82 Italy smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 83 Spain smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 84 Spain smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 85 Spain smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 86 Spain smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 87 Spain smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 88 Russia smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 89 Russia smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 90 Russia smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 91 Russia smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 92 Russia smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 93 Nordic Region smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 94 Nordic Region smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 95 Nordic Region smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 96 Nordic Region smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 97 Nordic Region smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 98 Eastern Europe smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 99 Eastern Europe smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 100 Eastern Europe smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 101 Eastern Europe smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 102 Eastern Europe smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 103 Asia Pacific smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 104 Asia Pacific smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 105 Asia Pacific smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 106 Asia Pacific smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 107 Asia Pacific smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 108 China smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 109 China smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 110 China smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 111 China smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 112 China smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 113 India smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 114 India smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 115 India smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 116 India smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 117 India smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 118 Japan smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 119 Japan smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 120 Japan smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 121 Japan smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 122 Japan smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 123 Australia smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 124 Australia smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 125 Australia smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 126 Australia smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 127 Australia smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 128 South Korea smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 129 South Korea smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 130 South Korea smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 131 South Korea smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 132 South Korea smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 133 ASEAN smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 134 ASEAN smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 135 ASEAN smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 136 ASEAN smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 137 ASEAN smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 138 Latin America smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 139 Latin America smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 140 Latin America smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 141 Latin America smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 142 Latin America smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 143 Brazil smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 144 Brazil smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 145 Brazil smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 146 Brazil smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 147 Brazil smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 148 Mexico smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 149 Mexico smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 150 Mexico smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 151 Mexico smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 152 Mexico smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 153 MEA smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 154 MEA smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 155 MEA smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 156 MEA smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 157 MEA smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 158 UAE smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 159 UAE smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 160 UAE smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 161 UAE smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 162 UAE smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 163 South Africa smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 164 South Africa smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 165 South Africa smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 166 South Africa smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 167 South Africa smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 168 Saudi Arabia smart cities market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 169 Saudi Arabia smart cities market, by smart governance, 2018 - 2030 (Revenue, USD Billion)

Table 170 Saudi Arabia smart cities market, by smart utilities, 2018 - 2030 (Revenue, USD Billion)

Table 171 Saudi Arabia smart cities market, by smart transportation , 2018 - 2030 (Revenue, USD Billion)

Table 172 Saudi Arabia smart cities market, by smart healthcare, 2018 - 2030 (Revenue, USD Billion)

List of Figures

Fig. 1 Smart Cities Market Segmentation

Fig. 2 Market landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot (1/3)

Fig. 9 Segment Snapshot (2/3)

Fig. 10 Segment Snapshot (3/3)

Fig. 11 Competitive Landscape Snapshot

Fig. 12 Smart Cities Market: Industry Value Chain Analysis

Fig. 13 Smart Cities Market: Market Dynamics

Fig. 14 Smart Cities Market: PORTER’s Analysis

Fig. 15 Smart Cities Market: PESTEL Analysis

Fig. 16 Smart Cities Market Share by Application, 2023 & 2030 (USD Billion)

Fig. 17 Smart Governance Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 18 Smart Building Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 19 Environmental Solution Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 20 Smart Utilities Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 21 Smart Transportation Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 22 Smart Healthcare Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 23 Smart Public Safety Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 24 Smart Security Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 25 Smart Education Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 26 Smart Cities Market Share by Smart Governance, 2023 & 2030 (USD Billion)

Fig. 27 City Surveillance Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 28 C.C.S. Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 29 E-governance Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 30 Smart Lighting Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 31 Smart Infrastructure Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 32 Smart Cities Market, by Smart Utilities: Market Share, 2023 & 2030

Fig. 33 Energy Management Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 34 Water Management Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 35 Waste Management Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 36 Meter Data Management Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 37 Distribution Management System Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 38 Substation Automation Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 39 Other Smart Utilities Solutions Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 40 Smart Cities Market Share by Smart Transportation, 2023 & 2030 (USD Billion)

Fig. 41 Intelligent Transportation System Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 42 Parking Management Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 43 Smart Ticketing & Travel Assistance Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 44 Traffic Management Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 45 Passenger Information Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 46 Connected Logistics Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 47 Other Smart Transportation Solutions Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 48 Smart Cities Market, by Smart Healthcare: Market Share, 2023 & 2030

Fig. 49 Medical Devices Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 50 Systems & Software Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 51 Regional Marketplace: Key Takeaways

Fig. 52 North America Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 53 U.S. Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 54 Canada Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 55 Europe Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 56 U.K. Smart Cities Market Estimates and Forecasts, 2018 - 2030) (USD Billion)

Fig. 57 Germany Smart Cities Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 58 France Smart Cities Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 59 Italy Smart Cities Market Estimates and Forecasts, 2018 - 2030) (USD Billion)

Fig. 60 Spain Smart Cities Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 61 Russia Smart Cities Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 62 Nordic Region Smart Cities Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 63 Eastern Europe Smart Cities Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 64 Asia Pacific Smart Cities Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Fig. 65 China Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 66 Japan Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 67 India Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 68 South Korea Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 69 Australia Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 70 ASEAN Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 71 Latin America Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 72 Brazil Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 73 Mexico Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 74 MEA Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 75 Saudi Arabia Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 76 UAE Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 77 South Africa Smart Cities Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 78 Key Company Categorization

Fig. 79 Company Market Positioning

Fig. 80 Key Company Market Share Analysis, 2023

Fig. 81 Strategic FrameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Smart Cities Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Smart Governance

- Smart Building

- Environmental Solution

- Smart Utilities

- Smart Transportation

- Smart Healthcare

- Smart Public Safety

- Smart Security

- Smart Education

- Smart Cities Smart Governance Outlook (Revenue, USD Billion, 2018 - 2030)

- City Surveillance

- C.C.S.

- E-governance

- Smart Lighting

- Smart Infrastructure

- Smart Cities Smart Utilities Outlook (Revenue, USD Billion, 2018 - 2030)

- Energy Management

- Water Management

- Waste Management

- Meter Data Management

- Distribution Management System

- Substation Automation

- Other Smart Utilities Solutions

- Smart Cities Smart Transportation Outlook (Revenue, USD Billion, 2018 - 2030)

- Intelligent Transportation System

- Parking Management

- Smart Ticketing & Travel Assistance

- Traffic Management

- Passenger Information

- Connected Logistics

- Other Smart Transportation Solutions

- Smart Cities Smart Healthcare Outlook (Revenue, USD Billion, 2018 - 2030)

- Medical Devices

- Systems & Software

- Application Security Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America Smart Cities Market Application Outlook

- Smart Governance

- Smart Building

- Environmental Solution

- Smart Utilities

- Smart Transportation

- Smart Healthcare

- Smart Public Safety

- Smart Security

- Smart Education

- North America Smart Cities Market Smart Governance Outlook

- City Surveillance

- C.C.S.

- E-governance

- Smart Lighting

- Smart Infrastructure

- North America Smart Cities Market Smart Utilities Outlook

- Energy Management

- Water Management

- Waste Management

- Meter Data Management

- Distribution Management System

- Substation Automation

- Other Smart Utilities Solutions

- North America Smart Cities Market Smart Transportation Outlook

- Intelligent Transportation System

- Parking Management

- Smart Ticketing & Travel Assistance

- Traffic Management

- Passenger Information

- Connected Logistics

- Other Smart Transportation Solutions

- North America Smart Cities Market Smart Healthcare Outlook

- Medical Devices

- Systems & Software

- U.S.

- U.S. Smart Cities Market Application Outlook

- Smart Governance

- Smart Building

- Environmental Solution

- Smart Utilities

- Smart Transportation

- Smart Healthcare

- Smart Public Safety

- Smart Security

- Smart Education

- U.S. Smart Cities Market Smart Governance Outlook

- City Surveillance

- C.C.S.

- E-governance

- Smart Lighting

- Smart Infrastructure

- U.S. Smart Cities Market Smart Utilities Outlook

- Energy Management

- Water Management

- Waste Management

- Meter Data Management

- Distribution Management System

- Substation Automation

- Other Smart Utilities Solutions

- U.S. Smart Cities Market Smart Transportation Outlook

- Intelligent Transportation System

- Parking Management

- Smart Ticketing & Travel Assistance

- Traffic Management

- Passenger Information

- Connected Logistics

- Other Smart Transportation Solutions

- U.S. Smart Cities Market Smart Healthcare Outlook

- Medical Devices

- Systems & Software