- Home

- »

- Plastics, Polymers & Resins

- »

-

Smart Card Materials Market Size, Industry Report, 2030GVR Report cover

![Smart Card Materials Market Size, Share & Trends Report]()

Smart Card Materials Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (PVC, Polycarbonate), By Type (Contact, Contactless, Multi-component), By End- use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-435-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Card Materials Market Size & Trends

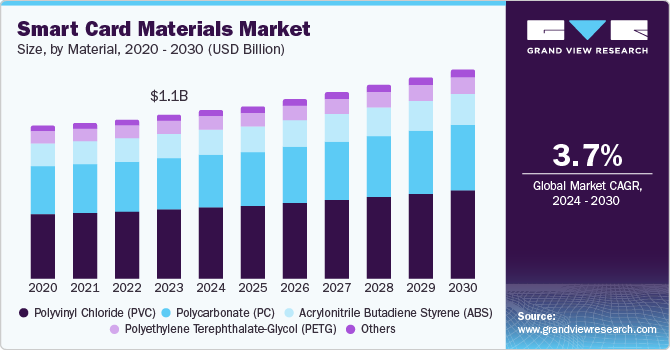

The global smart card materials market size was valued at USD 1.11 billion in 2023 and is projected to grow at a CAGR of 3.7% from 2024 to 2030. The burgeoning demand for reliable and secure payment transactions and increasing inclination towards cashless payments are expected to be the primary growth stimulants for the market. This trend is particularly evident in the banking, financial services, and insurance (BFSI) sector, where smart cards are used for credit and debit cards, and secure access to banking services. In addition, these materials are widely used to produce universal integrated circuit cards (UICC) in mobile phones and subscriber identity modules (SIM) in the telecommunication industry.

The technological advancements have been another crucial factor. Manufacturers have increasingly sought materials, including polyvinyl chloride (PVC), polycarbonate (PC), and acrylonitrile butadiene styrene (ABS), to enhance the durability and functionality of smart cards. These materials are essential for producing cards that can withstand physical wear and tear while maintaining high levels of security. Furthermore, integrating smart card technology into mobile devices, smartphones, and wearables has expanded the applications of smart cards, making them more versatile and user-friendly.

Moreover, the increasing need for secure identification and authentication solutions has driven the market. Governments and organizations worldwide have adopted smart cards for identity verification, access control, and secure data storage. For instance, e-passports, national ID cards, and driver’s licenses are increasingly embedded with smart card technology to enhance security and prevent fraud. This trend is particularly prominent in regions with stringent security regulations and a high emphasis on data protection.

Despite the widespread usage of smart card materials, the market has faced significant challenges. Uncertainty in ethylene prices has increased the cost of production and distribution, which in turn has affected the prices of vinyl chloride monomer (VCM). VCM is the immediate raw material required for the production of PVC. Fluctuating VCM prices have negatively influenced the final cost of PVC. Such volatility in ethylene prices might consequently affect the profit margins of market participants.

Material Insights

Polyvinyl Chloride (PVC) dominated the market and accounted for the largest revenue share of 42.9% in 2023 attributed to PVC's excellent chemical, mechanical, high tensile strength, and thermal properties. This thermoplastic polymer offers a unique combination of durability, flexibility, and cost-effectiveness, making it ideal for smart card production. In addition, PVC can be easily molded and shaped into various forms, allowing for the efficient production of smart cards with different designs and functionalities. This flexibility in manufacturing is essential for meeting the diverse needs of industries such as banking, telecommunications, healthcare, and transportation, where smart cards are used for various applications, including payment, identification, and access control.

Polycarbonate (PC) is expected to register the fastest CAGR of 4.3% during the forecast period owing to its exceptional properties, such as durability, high-impact resistance, and tamper-evident characteristics. These features make it suitable for high-security applications such as ID proofs and passports that require long-term use and reliability. Furthermore, PC allows for incorporating advanced security elements such as holograms, micro text, and embedded chips, which are crucial for preventing fraud and ensuring data protection.

Application Insights

Contact cards led the market and accounted for the largest revenue share of 64.2% of the market share in 2023, owing to their widespread adoption in the banking and financial services industry. These cards are extensively used for credit and debit cards, providing secure and reliable payment solutions. The need for enhanced security features, such as EMV (Europay, MasterCard, and Visa) chips, has increased the demand for contact cards in this sector. With their reliability, enhanced security aspects, compatibility with other systems, and cost-effectiveness, contact cards make them popular among users. Furthermore, the location of readers and terminals for contact cards across financial institutions and POS systems has strengthened its market position.

Multi-component cards are expected to emerge as the fastest-growing segment during the forecast period, owing to the increasing demand for secure and multifunctional solutions in the BFSI sector. These cards integrate multiple technologies, such as magnetic stripes, EMV chips, and contactless capabilities, offering enhanced security and transaction convenience. This makes them highly desirable for credit and debit cards, where robust security measures, including biometric features, are essential to prevent fraud and ensure secure payments.

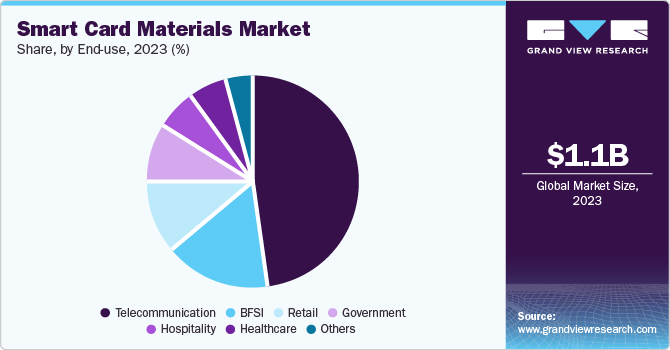

End-use Insights

Telecommunication dominated the market with a 48.3% share in 2023. The increased adoption of SIM cards in mobile devices has fueled the market growth. The global scale of telecommunications and the necessity of SIM cards for mobile connectivity have contributed to the large volume of smart cards produced. The evolution of SIM technology, including the development of embedded SIMs (eSIMs) and reprogrammable SIMs, has continued to drive innovation in smart card materials.

BFSI is projected to grow substantially during the forecast period owing to the increasing demand for secure payment solutions. With the rise of digital banking and e-commerce, there is a heightened need for smart cards that offer robust security features to protect against fraud and cyber threats. Smart cards equipped with EMV (Europay, MasterCard, and Visa) chips provide enhanced security for credit and debit transactions, making them indispensable in the BFSI sector. Furthermore, integrating contactless payment capabilities and multi-application functionalities in banking cards has fueled the need for sophisticated smart card materials.

Regional Insights

The Asia Pacific smart card materials market dominated the global market and accounted for the largest revenue share of 43.5% in 2023 due to the rapid adoption of contactless payment systems. This trend has continued, with contactless smart cards becoming the norm for everyday transactions, including public transportation, retail, and healthcare services. In addition, technological advancements with growing digital infrastructure and increasing demand for better financial transactions have boosted the market demand. Furthermore, the region’s large population and rising disposable income have driven the demand for convenient payment solutions.

The smart card materials market in China dominated the Asia Pacific market and held the largest revenue share of 63.5% in 2023. The country’s rapid urbanization and strong economic growth have fueled the market demand. In addition, government agencies and private enterprises have increasingly implemented smart card-based systems to enhance security and streamline operations.

North America Smart Card Material Market Trends

The North America smart card materials market held a substantial revenue share in 2023. This growth is attributed to the region’s cybersecurity and payment system, which increasingly demands more advanced smart card technologies. Furthermore, the evolution of digital wallets and mobile payment solutions has boosted the market growth.

U.S. Smart Card Material Market Trends

The smart card material market in the U.S. is expected to grow significantly over the forecast period, owing to the increasing preference for contactless payments and the need for advanced fraud prevention. The proliferation of smart cards in the telecommunications sector has also been a key driver. As the country continues to expand its mobile network infrastructure, the need for secure and reliable SIM cards has grown.

Europe Smart Card Material Market Trends

The Europe smart card material market is expected to growth at a CAGR of 3.8% over the forecast period driven by the growing demand for secure payment transactions and the increasing adoption of contactless payments. Europe has seen a surge in digital services and connectivity, particularly in the telecommunications sector, which is a major consumer of smart card materials. The BFSI industry's expansion and the rising popularity of debit/credit cards are also contributing to market growth. Furthermore, the region's focus on developing eco-friendly and sustainable materials is creating opportunities for smart card manufacturers to meet the demands of environmentally-conscious consumers.

The growth of the smart card material market in the UK is driven by the increasing adoption of smart cards for secure payment transactions and identification purposes. In addition, the demand for contactless payments has surged, especially following the COVID-19 pandemic, enhancing the need for efficient and set solutions. Furthermore, government initiatives to implement smart cards for various applications, such as e-passports and national IDs, are further propelling market growth. The focus on sustainability and eco-friendly materials is also positively influencing the market landscape.

Key Smart Card Material Company Insights

The global smart card materials market features key players such as Thales, IDEMIA, Infineon Technologies AG, and others. To maintain their dominant footprint, these organizations have primarily focused on R&D activities, strategic partnerships, and mergers & acquisitions.

-

Giesecke+Devrient GmbH offers secure solutions for the smart card industry. The company is known for its expertise in digital security and advanced materials. It produces high-quality smart card materials, including secure chips, card bodies, and personalization services. The company portfolio encompasses financial, governmental, and mobile application products such as EMV cards, contactless payment cards, and ID cards.

-

IDEMIA is a global identity and security solutions provider focused on smart card technologies. It offers a comprehensive range of products and services related to smart card materials, including secure chip solutions, card bodies, and personalization services. Their portfolio serves sectors such as banking, telecommunications, and government, featuring EMV payment cards, biometric identification cards, and contactless smart cards.

Key Smart Card Material Companies:

The following are the leading companies in the smart card material market. These companies collectively hold the largest market share and dictate industry trends.

- Thales

- Giesecke+Devrient GmbH

- IDEMIA

- Infineon Technologies AG

- NXP Semiconductors

- Samsung Electronics Co., Ltd.

- Texas Instruments Incorporated

- CPI Card Group Inc.

- HID Global Corporation

- Watchdata Technologies Ltd.

- CardLogix Corporation

- Eastcompeace Technology Co., Ltd.

- Wuhan Tianyu Information Industry Co., Ltd.

Recent Developments

-

In July 2024, IDEMIA launched the Starlight payment card, the first network-certified card utilizing OLED technology, enhancing the contactless payment experience. This innovative card features an illuminating effect powered solely by the NFC field, eliminating the need for a battery. Compliant with ISO standards and certified by Mastercard and Visa, the Starlight card supports multiple payment methods, including contactless transactions. As consumer demand for unique card designs grows, IDEMIA aims to redefine payment card aesthetics, helping banks and FinTechs strengthen customer connections in a digital-first landscape.

-

In May 2023, HID launched its new Seos Bamboo access security cards, made from sustainably sourced bamboo instead of traditional PVC, marking a significant step in the company's commitment to sustainability. Certified by the Forestry Stewardship Council (FSC), these eco-friendly cards are designed to meet the growing demand for renewable materials in security solutions. The Seos Bamboo cards support various green building certifications, including LEED and BREEAM, and aim to reduce environmental impact while maintaining high-security standards in physical access control systems.

Smart Card Materials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.15 billion

Revenue forecast in 2030

USD 1.42 billion

Growth rate

CAGR of 3.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Indonesia, Vietnam, Brazil, Argentina, Saudi Arabia, South Africa, UAE, Kuwait

Key companies profiled

Thales; Giesecke+Devrient GmbH; IDEMIA; Infineon Technologies AG; NXP Semiconductors; Samsung Electronics Co., Ltd.; Texas Instruments Incorporated; CPI Card Group Inc.; HID Global Corporation; Watchdata Technologies Ltd.; CardLogix Corporation; Eastcompeace Technology Co., Ltd.; Wuhan Tianyu Information Industry Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Card Materials Market Report Segmentation

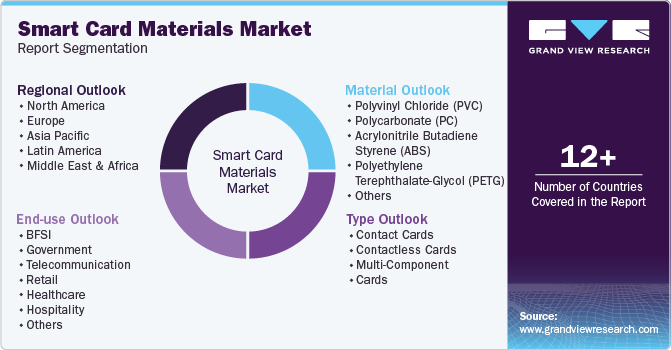

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart card materials market report based on material, type, end-use, and region.

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyvinyl Chloride (PVC)

-

Polycarbonate (PC)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polyethylene Terephthalate-Glycol (PETG)

-

Others

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Contact Cards

-

Contactless Cards

-

Multi-Component Cards

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Government

-

Telecommunication

-

Retail

-

Healthcare

-

Hospitality

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Russia

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

Saudi Arabia

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.