- Home

- »

- Electronic Security

- »

-

Smart Card Market Size And Share, Industry Report, 2030GVR Report cover

![Smart Card Market Size, Share & Trends Report]()

Smart Card Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Memory, MPU Microprocessor), By Interface (Contact, Contactless, Dual Interface), By Functionality, By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-464-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Card Market Summary

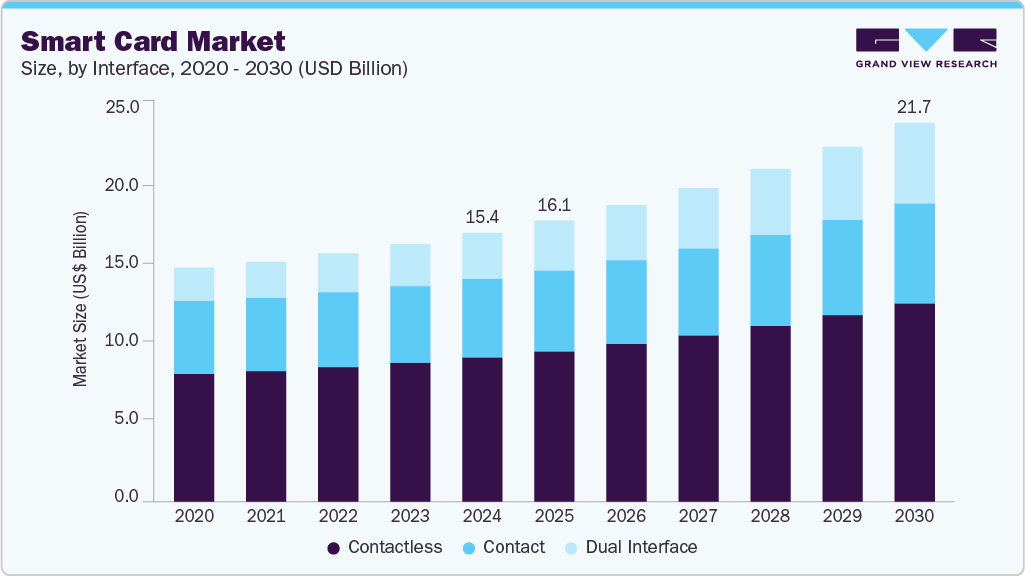

The global smart card market size was estimated at USD 15.40 billion in 2024 and is projected to reach USD 21.73 billion by 2030, growing at a CAGR of 6.1% from 2025 to 2030. A smart card is a tangible card that houses embedded memory or a microcontroller within a contact pad.

Market Size & Trends:

- The smart card industry in the Asia Pacific region dominated the market in 2024, accounting for over 38% share of the global revenue.

- The U.S. smart card industry is expected to grow significantly in 2024.

- By type, the MPU microprocessor segment led the market in 2024, accounting for over 60% share of the global revenue.

- By interface, the contactless segment accounted for the largest market revenue share in 2024.

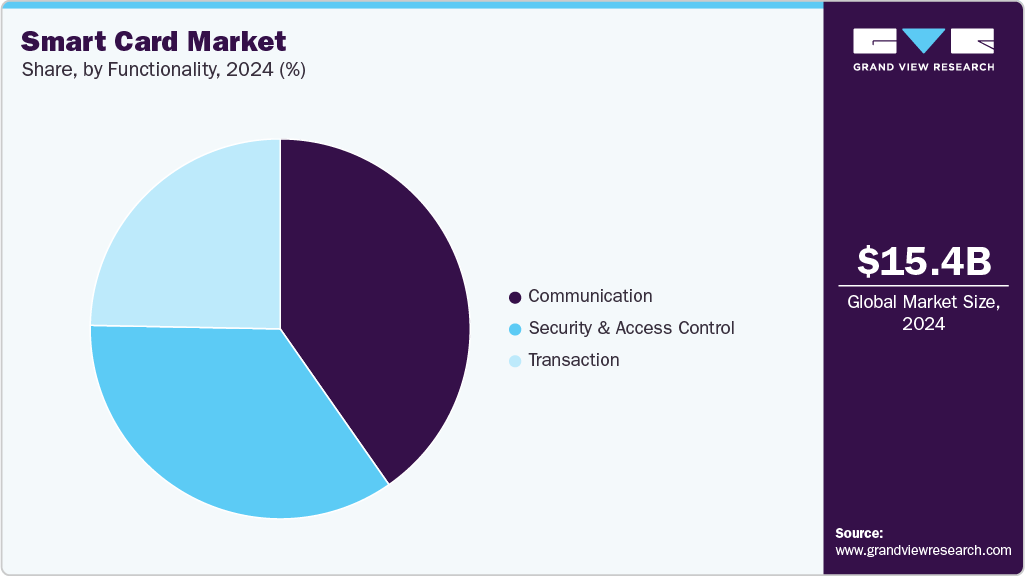

- By Functionality, the communication segment accounted for the largest market revenue share in 2024.

Key Market Statistics:

- 2024 Market Size: $15.40 Billion

- 2030 Estimated Market Size: $21.73 Billion

- CAGR: 6.1% (2025-2030)

- Asia Pacific: Largest market in 2024

- North America: Fastest growing region

It establishes a connection with a reader via short-range wireless technologies or direct physical contact methods like radio-frequency identification (RFID) or near-field communication (NFC). Smart cards use encryption to provide safety for in-memory information and are generally developed to be tamper-resistant. Those equipped with a microcontroller chip can perform on-card processing tasks and manage data stored in the chip's memory.

The market is anticipated to grow significantly over the forecast period. The expansion is fueled by multiple factors, including an upsurge in cashless transactions, rapid digitalization, and increased demand across diverse industry verticals, all of which collectively propel the advancement of the smart card industry. Moreover, the emergence of a novel information security paradigm for users, made possible by blockchain technology, is poised to unlock new avenues for the market. Smart cards' adept handling of cryptographic keys facilitates secure and seamless transactions within blockchain applications.

The major factors influencing the growth of the smart card industry are the increasing demand for payment systems that offer both security and convenience, coupled with the rising necessity for robust identification and authentication methods. Smart cards play a key role in serving as effective tools for access control, secure login procedures, and digital signatures, all of which are extensively utilized for identification and authentication. As various industries increasingly require stringent identity verification measures, the demand for smart cards is projected to grow significantly.

Type Insights

The MPU microprocessor segment led the market in 2024, accounting for over 60% share of the global revenue. The MPU microprocessor provides higher processing power, allowing the smart card to execute more sophisticated applications and perform complex computations. Smart cards with MPU microprocessors enhance their functionality, security, and versatility, enabling them to handle more complex tasks and applications than traditional smart cards with simpler microcontrollers. Furthermore, as contactless payments gain popularity, smart cards must support near-field communication (NFC) technology. MPUs can integrate NFC capabilities to facilitate secure and convenient contactless transactions.

The memory segment is estimated to grow significantly over the forecast period. This high growth is attributed to the increasing demand for secure data storage, the proliferation of contactless payment systems, and the widespread adoption of smart cards for various identification and authentication applications. Memory-based smart cards offer efficient and secure storage solutions for sensitive information, making them a preferred choice for enterprises and sectors requiring reliable data management and protection. These cards are often used in high-volume applications where the primary requirement is data storage and retrieval, such as transportation cards, loyalty cards, and basic access control cards.

Interface Insights

The contactless segment accounted for the largest market revenue share in 2024. This growth is driven by the increasing adoption of smart cards equipped with technologies such as NFC, which offer convenience and speed. These features enable users to make secure payments, access data, and interact with various devices without physical contact. The expansion of the Internet of Things (IoT) and smart devices has also driven the demand for communication-enabled smart cards. These cards can authenticate users, transfer data, and establish secure connections between devices, contributing to the segment's growth.

The dual interface segment is expected to grow at the highest CAGR over the forecast period, driven by the increasing use of smart cards across various transactions. These cards serve as payment cards (credit, debit, prepaid), offering enhanced security and expanded data storage compared to magnetic stripe cards. They're also vital for access control, ensuring security in buildings, offices, and transportation. Additionally, smart cards play a role in loyalty programs, enabling businesses to monitor spending and reward loyal patrons while serving as efficient and secure transport tickets for buses, trains, and metros.

Functionality Insights

The communication segment accounted for the largest market revenue share in 2024. Smart cards with communication functionalities, such as near-field communication (NFC) and contactless payment capabilities, have gained significant popularity due to the growing need for seamless and convenient connectivity. These features enable users to make secure payments, access data, and interact with various devices without physical contact. The expansion of the Internet of Things (IoT) and smart devices has also driven the demand for communication-enabled smart cards. These cards can authenticate users, transfer data, and establish secure connections between devices, contributing to the segment's growth.

The transaction segment is expected to grow at the highest CAGR over the forecast period, driven by the increasing use of smart cards across various transactions. These cards serve as payment cards (credit, debit, prepaid), offering enhanced security and expanded data storage compared to magnetic stripe cards. They're also vital for access control, ensuring security in buildings, offices, and transportation. Additionally, smart cards play a role in loyalty programs, enabling businesses to monitor spending and reward loyal patrons while serving as efficient and secure transport tickets for buses, trains, and metros.

Application Insights

The telecommunication segment accounted for the largest market revenue share in 2024. Smart cards have extensive use in the telecommunications industry, particularly in the form of SIM (Subscriber Identity Module) cards for mobile phones. These cards are critical for enabling secure communication, authenticating subscribers, managing mobile network access, and providing a platform for value-added services. As mobile networks evolve to support advanced technologies like 5G, the role of smart cards in ensuring secure and efficient communication is likely to become even more crucial. Additionally, integrating mobile services beyond traditional communication, such as mobile payments and digital identity, further reinforces the positive trajectory of smart card applications in the telecom industry.

The BFSI segment is anticipated to grow at the highest CAGR during the forecast period. The adoption of smart cards within the banking, financial services, and insurance (BFSI) sector offers numerous benefits, notably ensuring the safety of data transfers and protecting confidential information. Smart cards are also used as access control cards, payment authentication cards, and debit or credit cards in the BFSI industry. These versatile cards also serve as electronic wallets when funds are loaded onto them, enabling secure money transfers through cryptographic protocols to vending machines or accounts.

Regional Insights

North America dominated the smart card industry is expected to grow significantly in 2024. With the rise of digitalization and the integration of smart card technology across industries, the North American market is witnessing expansion across sectors like finance, healthcare, government, and more. Government policymakers in the region are closely examining strategies to enhance the efficiency of information systems within the healthcare industry. A significant focus has been placed on the widespread adoption of electronic health records for all citizens and the establishment of seamless record exchange mechanisms at all operational levels.

U.S. Smart Card Market Trends

The U.S. smart card industry is expected to grow significantly in 2024 due to increasing demand for secure, contactless payment solutions and identity verification systems across financial services, healthcare, and government sectors. Innovations such as biometric authentication, multi-factor verification, and NFC-enabled contactless cards enhance security and convenience, driving adoption among consumers and enterprises. Government initiatives, including the Department of Defense’s Common Access Card (CAC) program and smart ID implementations for employees and contractors, stimulate market growth by standardizing secure access and digital identity solutions.

Europe Smart Card Market Trends

The smart card market in Europe is expected to grow significantly over the forecast period. This can be attributed to widespread adoption of contactless payment methods and government-backed e-ID programs, emphasizing secure identity verification and digital services. Countries like Germany and Estonia lead with national ID cards integrating biometric data, enhancing security, and reducing fraud. The growing preference for cashless transactions, accelerated by hygiene concerns during the pandemic, has increased contactless card usage in retail and public transport. Furthermore, interoperability standards such as EMV ensure seamless cross-border transactions, while government initiatives support smart card deployment in healthcare and transportation, reinforcing the region’s digital transformation and market expansion.

Asia Pacific Smart Card Market Trends

The smart card industry in the Asia Pacific region dominated the market in 2024, accounting for over 38% share of the global revenue. Governments and businesses in the Asia Pacific are increasingly recognizing the advantages of smart cards in enhancing data security, streamlining processes, and improving customer experiences. Additionally, the rise of mobile technology and the Internet of Things (IoT) is driving the integration of smart card capabilities into various devices, further boosting the market's growth.

For instance, in January 2023, Delhi Metro Rail Corporation Limited partnered with Airtel Payments Bank Limited, an Indian payments bank, to offer commuters a smart card top-up service. This collaboration aims to bring digital transaction services to a wider audience and enhance the convenience of public transportation in Delhi.

Key Smart Card Company Insights

Some key companies in the smart card industry are IDMEA, Thales Group, Samsung, and HID Global Corporation.

-

IDEMIA provides secure identity and payment solutions, specializing in developing and producing smart cards for various applications, including payments, digital identity, and safe access. With a strong focus on biometric integration and cryptographic technologies, IDEMIA supports governments and enterprises worldwide by delivering contactless and dual-interface smart cards that enhance security and user convenience.

-

HID Global Corporation is a prominent provider of trusted identity solutions, offering smart card technologies that enable secure physical and logical access, contactless payments, and identity verification. Known for its government-grade smart cards and advanced authentication platforms, HID Global integrates mobile-enabled and IoT-compatible features to meet evolving security demands. The company’s products are widely adopted across government, healthcare, and enterprise security sectors, supporting secure credential issuance and management.

Key Smart Card Companies:

The following are the leading companies in the smart card market. These companies collectively hold the largest market share and dictate industry trends.

- Block, Inc.

- CardLogix Corporation

- CPI Card Group Inc.

- Giesecke+Devrient GmbH

- HID Global Corporation

- IDEMIA

- INTELIGENSA

- Samsung

- Sony Corporation

- Thales Group

Recent Developments

-

In April 2025, the MENA Fintech Association (MFTA), a Dubai-based non-profit registered with the Abu Dhabi Global Market (ADGM), announced a partnership with International Smart Card (ISC), also known as Qi, Iraq’s leading provider of digital payments, fintech solutions, and digital identity services. This collaboration aims to foster innovation, accelerate the adoption of digital payments, and promote inclusive financial transformation throughout the MENA region.

-

In November 2024, international smart card company QiCard acquired Miswag, Iraq’s e-commerce platform, in a confidential transaction valued in the seven-figure range. The acquisition, finalized earlier in the year but disclosed recently, followed the completion of key integrations across services, organizational structures, and operational processes. This strategic move aims to strengthen QiCard’s position in Iraq’s digital economy by combining its expertise in digital payments and identity solutions with Miswag’s extensive e-commerce infrastructure, thereby enhancing the country’s fintech and online retail ecosystems.

-

In November 2024, GlobalFoundries announced a collaboration with IDEMIA Secure Transactions (IST), a division of IDEMIA Group, to manufacture IST’s smart card integrated circuit using GlobalFoundries’ 28ESF3 process technology. This two-year partnership aims to establish a fully European value chain and provide an efficient, integrated solution for the next generation of IST’s smart card technology, enhancing supply chain security and technological innovation within the region.

Smart Card Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.13 billion

Revenue forecast in 2030

USD 21.73 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Actual data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, functionality, type, interface, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; ; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Block, Inc.; CardLogix Corporation; CPI Card Group Inc.; Giesecke+Devrient GmbH; HID Global Corporation; IDEMIA; INTELIGENSA; Samsung; Sony Corporation; Thales Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Card Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart card market report based on type, interface, functionality, application, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Memory

-

MPU Microprocessor

-

-

Interface Outlook (Revenue, USD Million, 2017 - 2030)

-

Contact

-

Contactless

-

Dual Interface

-

-

Functionality Outlook (Revenue, USD Million, 2017 - 2030)

-

Transaction

-

Communication

-

Security & Access Control

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Telecommunication

-

Government & Healthcare

-

Retail & Ecommerce

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart card market size was estimated at USD 15.40 billion in 2024 and is expected to reach USD 16.13 billion in 2024.

b. Key factors that are driving the smart card market growth include upsurge in cashless transactions and increasing demand for payment systems.

b. The global smart card market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030 to reach USD 21.73 billion by 2030.

b. The MPU microprocessor segment led the market in 2024, accounting for over 60% share of the global revenue. Smart cards with MPU microprocessors enhance their functionality, security, and versatility, enabling them to handle more complex tasks and applications than traditional smart cards with simpler microcontrollers.

b. Some key players operating in the smart card market include Block, Inc.; CardLogix Corporation; CPI Card Group Inc.; Giesecke+Devrient GmbH; HID Global Corporation; IDEMIA; INTELIGENSA; Samsung Electronics Co., Ltd.; Sony Corporation; Thales.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.