Smart Blood Pressure Monitoring Devices Market Size, Share & Trends Analysis Report, By Type, By Technology (Wi-Fi Based/4G, Bluetooth Based), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-934-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

The global smart blood pressure monitoring devices market size was valued at USD 998.0 million in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 11.1% during the forecast period. The global market has witnessed growth in 2020 during the COVID-19 pandemic due to the increase in the demand for remote monitoring devices. Increasing incidences of hypertension due to eating habits, stress, and changing lifestyles are contributing to the growth of the market over the forecast period. According to the estimates published by the World Health Organization (WHO) in 2021, around 1.28 billion adults aged 30-79 years have hypertension globally.

The COVID-19 pandemic had positively impacted the health monitoring devices market. Initially, the lockdown has impacted the supply chain and logistics of every market globally. As the need for these devices increases, the restriction on transportation and logistics also lifted off to fulfilling the demand for the product in the market. The lockdown and restrictions have changed the purchase and usage behavior across the globe, which has increased the usage of health monitoring devices. The rising awareness and benefits of the devices among consumers have contributed to the growth of the market for smart blood pressure monitoring devices.

The demand for smart blood pressure monitoring devices is very high on account of the prevalence of chronic disease, rising geriatric population, and increasing risk of lifestyle associated disorders among a wide population due to the rising incidences of obesity and sedentary lifestyle. The smart blood pressure monitoring device works one step ahead towards accuracy and reliable blood pressure measurement at home and ensures that the patient gets trustworthy results due to its advanced working mechanism. These smart devices can also show the record of its previous measurements done at home and the physician can interpret the blood pressure trends on the basis of previous records also and prescribes medicines on the basis of the analysis.

Technological advancements such as mobile-based blood pressure monitoring systems and digital monitoring devices are anticipated to drive the demand. Improvement and ease of use in devices for measuring blood pressure is positively impacting the market for smart blood pressure monitoring devices. Wearable and portable devices and mobiles such as wristwatches are gaining popularity owing to the associated benefits such as the wireless transmission of patient information and easy handling. New technologies such as mHealth, which supports treatment and medication compliances for patients in chronic disease management, are expected to fuel the growth of the market for smart blood pressure monitoring devices. It helps in tracking the patient’s health information, medication schedule, and follow up for the treatment. These associated advantages are expected to propel market growth.

Type Insights

The upper arm blood pressure monitor segment dominated the market for smart blood pressure monitoring devices and accounted for the largest revenue share of more than 60.6% in 2021 as it is the most accurate form of device used to monitor blood pressure. This device can be easily operated by consumers at home with a reliable result. The wrist blood pressure monitor segment generated the second-highest revenue in 2021 and is expected to witness the highest growth rate over the forecast period due to the rising awareness about health and fitness among the people.

The wrist blood pressure monitoring devices is the most convient and easy to use device. The accuracy of the device vary in different product as per the technology used in the device. A person can carry the device and can check the blood pressure from any remote place without any assistance. However, the American Heart Association recommends using a home blood pressure monitor that measures blood pressure in upper arm and not using wrist or finger blood pressure monitors.

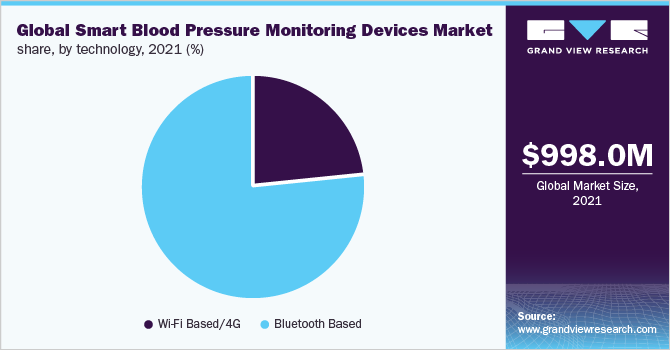

Technology Insights

The Bluetooth based segment dominated the market for smart blood pressure monitoring devices and accounted for the maximum revenue share of more than 76.6% in 2021 as most of the blood pressure monitor devices are based on blueooth connectivity and people are still not aware of Wi-Fi based devices. These devices are easy to use and compact, and gives the option of transferring results via Bluetooth to a smartphone, or laptop to ensure more thorough follow-up care for the patient.

The wi-fi based/4G segment is expected to witness the growth rate of 15.9% over the forecast period as Wi-Fi based blood pressure monitor provides medically accurate and reliable blood pressure and heart rate measurements with immediate feedback on the device and full history in the app which can also be linked with various health programs.

Regional Insights

North America dominated the smart blood pressure monitoring devices market and accounted for the maximum revenue share of more than 41.2% in 2021. as it has a highly regulated and developed healthcare infrastructure. Increasing investments in the development of accurate and effective blood pressure monitoring devices are expected to contribute to the regional market growth in the coming years. Moreover, new product launches, along with technological advancements, are expected to fuel the growth of the market for smart blood pressure monitoring devices.

In Asia Pacific, the market for smart blood pressure monitoring devicesis expected to register the fastest growth rate over the forecast period. The presence of untapped opportunities, increasing investments by manufacturers, growing awareness levels, and rising incidences of hypertension. Rapidly improving healthcare facilities and the rising number of undiagnosed and untreated cases of high blood pressure are the key factors contributing to the regional market growth.

Key Companies & Market Share Insights

The market for smart blood pressure monitoring devices is witnessing intense competition as it is price sensitive. The market players are continuously launching advanced products in a low price range to capture a big share of the market. The companies are adopting competitive strategies, such as mergers and acquisitions, strategic alliances, collaborative agreements, and partnerships, to withstand the competition. The industry growth is directly associated with the rising investments by manufacturers in the development of cost-effective, innovative, and easy-to-use products. For instance, in January 2021, Omron Healthcare introduced its first remote patient monitoring service at CES 2021 with new digital health tools to boost patient-to-physician communication and empower more active management of hypertension. Some of the prominent players in the smart blood pressure monitoring devices market include:

-

Omron Healthcare, Inc.

-

Koninklijke Philips N.V.

-

Qardio, Inc

-

iHealth Labs Inc.

-

ForaCare Suisse AG

-

Welch Allyn

-

A&D Medical Inc.

-

Beurer GmbH

-

Microlife AG

-

Withings

-

Kaz Inc.

-

SunTech Medical, Inc.

Smart Blood Pressure Monitoring Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2022 |

USD 1.1 billion |

|

Revenue forecast in 2030 |

USD 2.5 billion |

|

Growth rate |

CAGR of 11.1% from 2022 to 2030 |

|

Base year for estimation |

2021 |

|

Historic data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, technology, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; India; China; Indonesia; Malaysia; Philippines; Singapore; Thailand; Brazil; Mexico; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Omron Healthcare, Inc; Koninklijke Philips N.V.; Qardio, Inc.; iHealth Labs Inc.; ForaCare Suisse AG; Welch Allyn; A&D Medical Inc.; Beurer GmbH; Microlife AG; Withings; Kaz Inc.; SunTech Medical, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global smart blood pressure monitoring devices market report on the basis of type, technology, and region:

- Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Upper Arm Blood Pressure Monitor

-

Wrist Blood Pressure Monitor

-

Finger Blood Pressure Monitor

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Wi-Fi Based/4G

-

Bluetooth Based

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Indonesia

-

Malaysia

-

Philippines

-

Singapore

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global smart blood pressure monitoring devices market size was estimated at USD 998.0 million in 2021 and is expected to reach USD 1.1 billion in 2022.

b. The global smart blood pressure monitoring devices market is expected to grow at a compound annual growth rate of 11.1% from 2022 to 2030 to reach USD 2.5 billion by 2030.

b. North America dominated the smart blood pressure monitoring devices market with a share of 41.2% in 2021. This is attributable to the highly regulated and developed healthcare infrastructure.

b. Some key players operating in the smart blood pressure monitoring devices market include Omron Healthcare, Inc, Koninklijke Philips N.V., Qardio, Inc., iHealth Labs Inc., ForaCare Suisse AG, Welch Allyn, A&D Medical Inc., Beurer GmbH, Microlife AG, Withings, Kaz Inc., SunTech Medical, Inc.

b. Key factors that are driving the smart blood pressure monitoring devices market growth include the increasing incidences of hypertension due to eating habits, stress, and changing lifestyles.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."