- Home

- »

- Next Generation Technologies

- »

-

Smart Airports Market Size And Share, Industry Report, 2030GVR Report cover

![Smart Airports Market Size, Share & Trends Report]()

Smart Airports Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology, By Application, By Location (Landside, Airside, Terminal Side), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-530-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Airports Market Summary

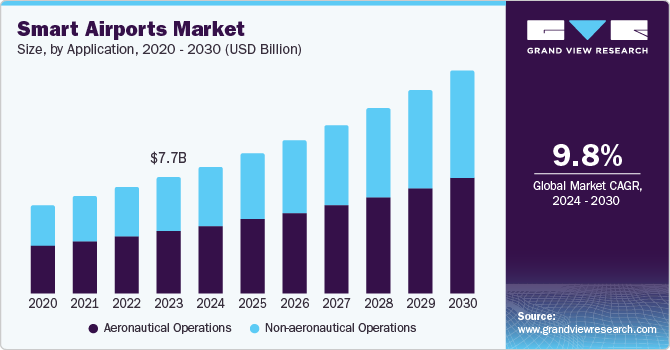

The global smart airports market size was valued at USD 7.69 billion in 2023 and is projected to grow at a CAGR of 9.8% from 2024 to 2030. The market growth is primarily driven by the rising adoption of digital technologies across all domains, the trend of digital transformation, rising number of passengers traveling by air.

Key Market Trends & Insights

- North America smart airports market dominated with the highest 45.18% share in 2023.

- By technology, the passenger, cargo, & baggage ground handling control dominated the market with a revenue share of 31.0% in 2023.

- By application, the aeronautical operations dominated the market in 2023.

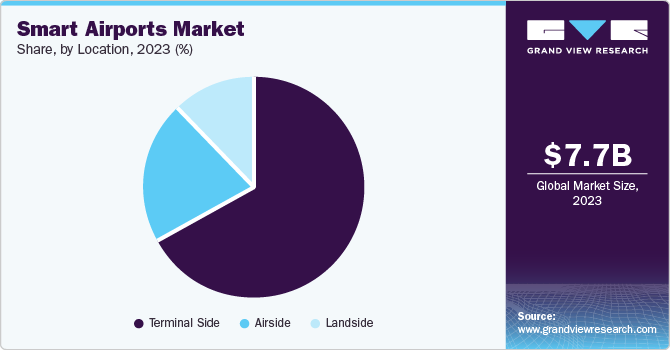

- By location, the terminal side segment held the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 7.69 Billion

- 2030 Projected Market Size: USD 38.52 Billion

- CAGR (2024-2030): 9.8%

- North America: Largest market in 2023

Furthermore, cost optimization in daily operations has led to airports adopting smart technologies in their operations.

A significant lowering of operational costs can be achieved by adopting smart airport solutions. For instance, the use of smart ventilation and lighting solutions by switching to green building architecture can help in significantly reducing energy costs. Issues concerning delayed flights, longer waiting time for passengers, operational inefficiency, as well as in-flight & ground services can be efficiently addressed by a smart airport. Moreover, security is a vital aspect in airport operations, which can be addressed by implementing smarter surveillance solutions such as connected CCTV cameras, computerized gates, AI-based screening systems, and biometric monitoring systems.

Sustainability has become a crucial parameter in operations globally and utilizing energy-efficient alternatives such as LED lighting, optimized water & air systems, and low-consumption electronics helps achieve this goal efficiently and quickly. The modernization and digitization of old airports coupled with the establishment of new ones, rising focus on passenger safety, growth in commercial aviation services, rising demand from developing and emerging economies, and the rising adoption of green initiatives by governments and industry stakeholders are key drivers expected to boost market expansion during the forecast period.

Technology Insights

The passenger, cargo, & baggage ground handling control dominated the market with a revenue share of 31.0% attributed to rapid growth in the number of passengers travelling by air worldwide. For instance, the Federal Aviation Administration (FAA) offers service to over 45,000 flights as well as 2.9 million passengers on a daily basis. Moreover, as per European Union estimates, more than 800 million European citizens travelled by air in 2022. This large footfall of travelers makes it vital for airport operators to optimize their passenger handling capacity, regulate ground as well as in-flight operations, and utilize digital solutions to control passenger flow, cargo, and baggage handling capabilities at airports.

The security systems technology is projected to witness a CAGR of 10.8% during the forecast period owing to the increasing need and importance of ensuring a safe travel environment. Air travel is considered safer over other forms of transportation due to the utmost care that is taken across the whole process. From the entry of a passenger in the airport premises to their exit, advanced security systems ensure that there is no threat to the whole ecosystem and stakeholders. Innovations in screening technologies, the rising presence of tracking & detection machines, and automation in security systems are expected to further contribute to market expansion.

Application Insights

Aeronautical operations dominated the market in 2023 attributed to the vast scope of operations possess. Starting with the booking process, IT systems are employed at the back end for better flow and optimization. Airport infrastructure, security systems, air-traffic control systems, and baggage handling equipment all require significant human as well as capital resources for their smooth operation. In-flight operations require skilled professionals to ensure a safe and satisfactory passenger experience. These factors have helped augment and create a comprehensive ecosystem at airports, which is responsible for smoothly conducting aeronautical operations across all stages.

The non-aeronautical operations segment is expected to expand at a growth rate of 10.5% over the forecast period. This segment includes a wide range of commercial activities that take place in the airport premises. Parking areas, taxi services, food and beverage outlets, lounges, lodging facilities, and duty-free shops all add significantly to the overall revenue. By identifying the precise habits and needs of passengers, service providers can utilize historical datasets and digital smart computer systems to create a highly personalized user experience. Non-aeronautical sources not only provide additional revenue but also serve to alleviate the impact of lower revenues during economic downturns and offer better profit margins as compared to aeronautical operations.

Location Insights

The terminal side segment held the largest market share in 2023 attributed to a wide range of terminal side activities and a continuous endeavor to achieve best-in-class practices for optimized performance and higher profit margins. Advanced biometric authentication systems at the entrance, integration of world-class infrastructure, availability of latest security infrastructure, and a demand for enhanced service quality across all areas of airport services promise lucrative growth prospects. For instance, technologies such as self-service kiosks and check-in counters enable passengers to navigate check-in, boarding pass retrieval, and even luggage tagging independently. This streamlines the whole process, reduces congestion, and shortens passenger wait times, leading to a more positive travel experience.

The airside segment is anticipated to experience a CAGR of 10.8% during the forecast period. This location plays a critical role across the whole airport ecosystem. Seamless integration with landside and terminal side operations through technologies such as digital passenger flow management systems improves airport efficiency and enhances passenger experience. Smart technologies such as digital twin simulations and autonomous runway incursion detection systems are revolutionizing airside safety. These advancements mitigate potential risks and contribute to a safer operating environment for both passengers and the crew.

Regional Insights

North America smart airports market dominated with the highest 45.18% share in 2023. The high regional share is owing to the presence of a significant number of air travelers and numerous international airports across the U.S. and Canada, the well-established air travel ecosystem, economic affluence, high level of awareness, and increased adoption of smart technologies. Growing investments in critical airport infrastructure projects, increasing focus on enhancing the overall passenger experience, and presence of key industry players are additional factors adding to the regional growth prospects.

U.S. Smart Airports Market Trends

The U.S. smart airports market dominated with the highest share in 2023. This is attributed to the presence of a large number of international airports that also experience a high passenger traffic. For instance, Hartsfield-Jackson Atlanta International Airport andDallas Fort Worth International Airport are consistently ranked among the busiest airports worldwide. This high volume requires efficient operations and passenger management, making smart airport solutions highly attractive to stakeholders. The Transportation Security Administration (TSA) actively promotes and invests in modernizing airport infrastructure. This creates a supportive environment for the development and implementation of smart airport technologies.

Europe Smart Airports Market Trends

Europe smart airports market has been identified as a region with high growth prospects. This is owing to a major modernization push through the replacement of aging infrastructure with advanced technological solutions, which is creating a strong demand for smart airport technologies. The European region experiences high volume of air traffic, which pushes airports to opt for smart solutions to efficiently handle the traffic load and streamline operations. Additionally, environmental concerns have become a major priority in Europe, leading smart airport solutions that optimize energy usage and promote sustainable practices to find a receptive market.

The UK smart airports market is at the forefront when it comes to the utilization of digital technologies. Presence of some of the busiest airports such as Heathrow Airport compels authorities to opt for advanced solutions. For instance, in April 2024, the Manchester Airports Group (MAG), operator of the Manchester airport in the UK, decided to adopt the Veovo platform, which uses real-time data and Artificial Intelligence (AI) to enable airport authorities in providing enhanced operations. The platform analyzes past trends and real-time information to boost resource planning and allocation, predict off-block times, improve aircraft turns, and increase revenue.

The Germany smart airports market is known for prioritizing operational efficiency and environmental sustainability. Smart airport solutions cater to both these aspects by optimizing processes, reducing energy consumption, and improving resource management. For instance, in October 2023, the Munich Airport introduced smart trolleys with interactive tablets to provide a smoother airport experience to passengers. This will allow flyers to experience a smoother check-in process by entering their flight details either manually or scanning their boarding passes. Passengers can receive real-time updates about their flight status and departure details through the tablet.

Asia Pacific Smart Airports Market Trends

The Asia Pacific region is anticipated to witness highest growth in the smart airports market at 13.1% CAGR by 2030. This is owing to a significant rise in air passenger traffic in the region, particularly in countries such as China, India, and Singapore. This surge in demand has necessitated airport modernization to ensure efficient passenger flow, security, and operational effectiveness. Airports in Asia Pacific utilize smart technologies to enable streamlined resource management, improved energy consumption, and minimal maintenance downtime.

The India smart airports market is expected to advance at a promising pace. With a significant surge in the volume of passengers opting for domestic as well as international air travel, authorities in India are implementing various digital technology solutions to make air travel a pleasant experience for travelers. For instance, through Digi Yatra, passengers can be automatically allowed entry, on the basis of a facial recognition system present at checkpoints such as entry point check, entry for security check, and boarding. Additionally, the feature also allows self-bag drop as well as check-in via facial recognition. Digi Yatra facilitates paperless travel and helps passengers avoid identity checks at multiple points.

Key Smart Airport Company Insights

Some of the key companies in the smart airports market include SITA, Thales S.A., and Siemens AG, among others.

-

SITA provides IT and telecommunication services to the airline industry. It offers solutions based on industry (airline, airport, ground handlers, government) and portfolio (digital travel, border management, baggage management, communication and exchange, passenger processing, and operations at the airport).SITA helps airlines and airports operate more efficiently and securely by providing the technological backbone for many critical functions.

-

Siemens provides vertiport integration solutions, physical security information management systems, fire and life safety systems, and sustainable energy solutions such as AI and analytics to help predict maintenance needs, optimize resource use, and reduce energy consumption for airports. The company provides technology for baggage handling systems, data management platforms, and building automation systems, all aimed at streamlining operations and improving resource utilization.

Key Smart Airports Companies:

The following are the leading companies in the smart airports market. These companies collectively hold the largest market share and dictate industry trends.

- SITA

- Thales S.A.

- Siemens AG

- Amadeus IT Group

- IBM Corporation

- Cisco Systems, Inc.

- Indra Sistemas, S.A.

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Huawei Technologies Co., Ltd.

Recent Developments

-

In April 2024, Honeywell announced the development of Surface Alert (SURF-A), a software technology that is expected to assist in runway incursion avoidance. The technology will aid pilots by providing audio and visual data in terms of safety precautions on the runway.

-

In March 2024, Amadeus announced the acquisition of Voxel, a B2B payment and an electronic invoice solution provider for hotels, travel sellers, and other stakeholders in the travel business. This deal is expected to benefit the entire air travel ecosystem by streamlining payment operations.

-

In November 2023, Honolulu airport announced that it would be using SITA Smart Path for biometric-enabled exit from the U.S. for fast and efficient service delivery. The technology will offer passengers a touchless process that will further secure and streamline international departures.

Smart Airports Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.40 billion

Revenue forecast in 2030

USD 14.72 billion

Growth rate

CAGR of 9.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, location, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; Japan; Australia; South Korea; India; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

SITA; Thales S.A.; Siemens AG; Amadeus IT Group; IBM Corporation; Cisco Systems, Inc; Indra Sistemas, S.A.; Honeywell International Inc.; L3Harris Technologies, Inc.; Huawei Technologies Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

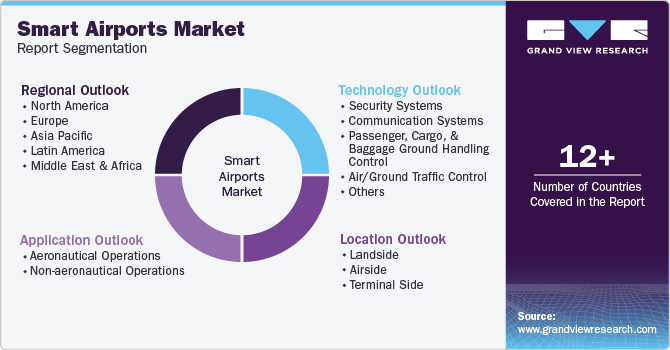

Global Smart Airports Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart airports market report based on technology, application, location, and region.

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Security Systems

-

Communication Systems

-

Passenger, Cargo, & Baggage Ground Handling Control

-

Air/Ground Traffic Control

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aeronautical operations

-

Non-aeronautical operations

-

-

Location Outlook (Revenue, USD Billion, 2018 - 2030)

-

Landside

-

Airside

-

Terminal side

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.