- Home

- »

- Electronic & Electrical

- »

-

Smart Air Purifier Market Size, Share & Trends Report, 2030GVR Report cover

![Smart Air Purifier Market Size, Share & Trends Report]()

Smart Air Purifier Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Commercial, Residential), By Technology (HEPA Filter, Activated Carbon, Others), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-357-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Air Purifier Market Size & Trends

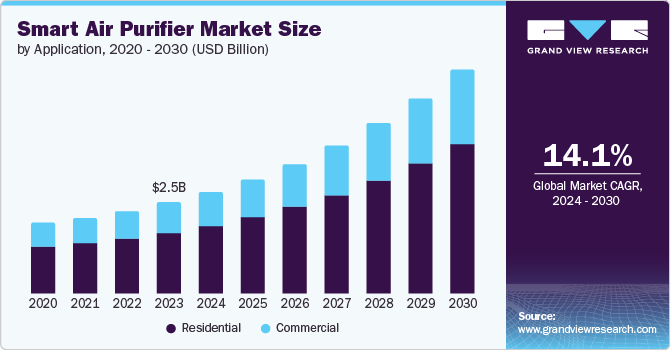

The global smart air purifier market size was valued at USD 2.53 billion in 2023 and is projected to grow at a CAGR of 14.1% from 2024 to 2030. The global smart air purifier market is driven by increasing pollution levels, growing prevalence of respiratory diseases, and rising urbanization. Smart air purifiers advanced sensors and connectivity features enable users to track and manage air quality remotely. The increasing innovation and technological development is further expected to add to the market growth.

Integrating AI and machine learning algorithms in these products is a significant trend in the smart air purifier market. Advanced technologies enable smart air purifiers to provide personalized air quality control solutions. These devices can store user preferences and air quality levels and offer personalized purification settings accordingly. For instance, in April 2024, Qubo, a brand by Hero Electronix, introduced a new line of Smart Air Purifiers in India, which has integrated smart features that a mobile application and QSensAI can control. This AI technology can learn individual performances over time.

According to an article published by the World Health Organization (WHO) in December 2023, the combined effects of household air pollution and ambient air pollution are estimated to cause 6.7 million premature deaths each year. Growth in the realized information about the impacts of indoor and outdoor aerosols led to an increased demand for smart air purifiers as this helps offer more efficient and easier ways of improving air quality indoors. Smart air purifiers work based on the internet, where users receive current information on the air quality in their homes.

Application Insights

Residential accounted for the largest market revenue share of 66.8% in 2023. The increasing use of air purifiers at home due to their ability to provide clean air and ease of use are driving the growth of this segment. According to the survey conducted by the Centers for Disease Control and Prevention in August 2023, about 88.8% of users of air cleaners and air purifiers use them for removing dust, mold, pollen, or other allergens from the air. This increasing use of air purifiers, coupled with rising innovations, has fostered growth in the residential segment.

The commercial segment is projected to grow at the fastest CAGR during the forecast period. The increasing applications of air purifiers in commercial spaces such as offices and educational centers and the launch of new and advanced products will likely drive market growth. For instance, in June 2021, the Smith System introduced Cascade Air, a commercial air purifier for learning environments.

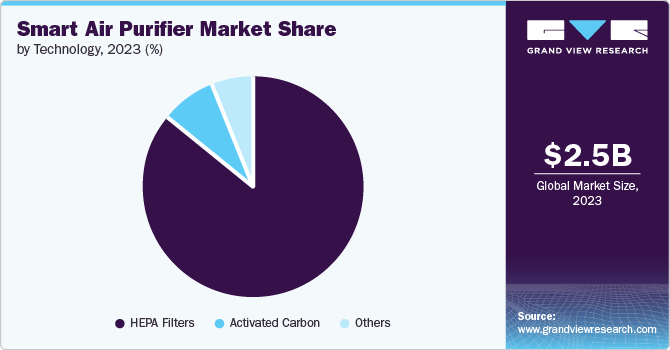

Technology Insights

HEPA filters segment dominated the market with a revenue share of 85.7% in 2023 due to the increasing use of high-efficiency particulate air (HEPA) filter technology in smart air purifiers. According to the U.S. Environmental Protection Agency, HEPA filters can remove about 99.97% of dust, mold, pollen, bacteria, and other airborne particles of the size of 0.3 microns (µm). These benefits of the HEPA technology are driving the development demand for air purifiers with this technology, further boosting the segment growth. For instance, in October 2021, Dyson introduced two air purifiers with HEPA filtration.

The activated carbon segment is projected to grow at the fastest CAGR over the forecast period. The use of charcoal in the filtration technique of activated carbon helps absorb particles that are present in the air and eliminate bad odors, tobacco smell, or any toxic gases. These are the benefits of the activated carbon technology are expected to drive the segment growth over the forecast period.

Regional Insights

North America smart air purifier market was identified as a lucrative region in 2023. There is an increasing prevalence of diseases, such as asthma, allergies, and even heart disease, in the region. For instance, according to the National Heart, Lung, and Blood Institute, asthma affects approximately 25 million people in the U.S. This increasing prevalence of diseases and rising awareness among people about the health impact of low air quality is expected to drive the market growth in the region. The presence of local and global players and the launch of new products in the region are also expected to drive market growth. For instance, in June 2024, IQAir, a Switzerland-based company, introduced XE air purifiers with smart features and advanced particle sensor technology in North America

U.S. Smart Air Purifier Market Trends

The U.S. smart air purifier market is expected to grow significantly due to the country's rising health concerns and technological advancement. For instance, the U.S. Centers for Disease Control and Prevention (CD) recognizes the risks of poor air quality, including respiratory illness, allergies, and even heart disease. This has created a market for air purifiers that can easily remove allergens, promoting healthier indoor living environments.

Europe Smart Air Purifier Market Trends

Europe smart air purifier market is anticipated to witness significant market growth over the forecast period. The growth is due to rising air pollution, exceeding World Health Organization recommended limits, in some European countries. According to an article published by the European Environment Agency in June 2024, exposure to nitrogen dioxide levels and fine particulate matter above the recommendations of the WHO led to approximately 52,000 and 253,000 premature deaths, respectively, in 2021. This highlights the need for solutions such as air purifiers offering real-time monitoring and adjustments to target specific pollutants.

The UK smart air purifier market is expected to grow rapidly due to air quality challenges, particularly in urban areas. In addition, increasing awareness regarding the benefits of smart air purifiers and developing and launching new products in the country are further expected to drive market growth. For instance, in July 2024, Molekule introduced its first product in the UK market by launching Molekule Air Pro, a professional air purifier built with photoelectrochemical oxidation (PECO) technology. Such developments are likely to boost market growth in the country.

Asia Pacific Smart Air Purifier Market Trends

Asia Pacific smart air purifier market dominated the market with a revenue share of 41.4% in 2023. Increasing pollution levels, the presence of developing economies such as China and increasing investments by key market players in the region are anticipated to fuel Market growth. For instance, in November 2023, ECOVACS Group, a global company operating in the service robotics and smart household appliances sector, opened its first office in Singapore. Such developments are likely to drive the region's demand and market growth.

India smart air purifiers market is expected to grow significantly over the forecast period owing to the country's increasing technological advancements, rising standard of living, and new product launches. For instance, in April 2023, the Xiaomi Smart Air Purifier 4 was launched in India at its Smarter Living 2023 event. Such developments are likely to boost the awareness and demand for smart air purifiers in the country.

Key Smart Air Purifier Company Insights

Some of the companies in the smart air purifier market include Honeywell International Inc. Koninklijke Philips N.V.; Blueair, Xiaomi, and Americair. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Blueair is a global company that produces and markets air purification devices, such as purifiers, filters, and monitors, to manage indoor air pollution. Classic Pro CP7i, Blue Pure 311i Max, and DustMagnet 5410i are some of the key products launched by the company.

-

Americair produces and sells high-quality HEPA air purification devices. The company offers air purification systems, industrial solutions, replacement filters, and legacy products for residential and commercial industries. It also provides portable, installed, and commercial HEPA air filtration products to meet different client needs and air quality solutions.

Key Smart Air Purifier Companies:

The following are the leading companies in the smart air purifier market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International Inc.

- Koninklijke Philips N.V.

- Sunbeam Products, Inc.

- Xiaomi

- Blueair

- Frootle India (COWAYCO., LTD)

- Whirlpool

- Americair

- Sharp Corporation

- Dyson

Recent Developments

-

In July 2024, Blueair introduced a new and advanced air purifier, the Classic Pro CP7i, for spaces of about 589 square feet or more with advanced technology to deactivate germs.

-

In July 2024, Xiaomi introduced the MIJIA All-Effect Air Purifier Ultra Enhanced Edition, which can remove 95 air pollutants in China.

-

In May 2024, AAF International opened its ISO Class 4, 6, and 7 cleanrooms in Missouri to manufacture HEPA filters.

-

Dyson has launched its latest air purifier, the Dyson Purifier Big+Quiet, with Cone Aerodynamics technology.

Smart Air Purifier Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.82 billion

Revenue forecast in 2030

USD 6.23 billion

Growth rate

CAGR of 14.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; UAE

Key companies profiled

Honeywell International Inc., Koninklijke Philips N.V.; Sunbeam Products, Inc.; Xiaomi; Blueair; Frootle India (COWAYCO.,LTD); Whirlpool; Americair ; Sharp Corporation; Dyson

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Air Purifier Market Report Segmentation

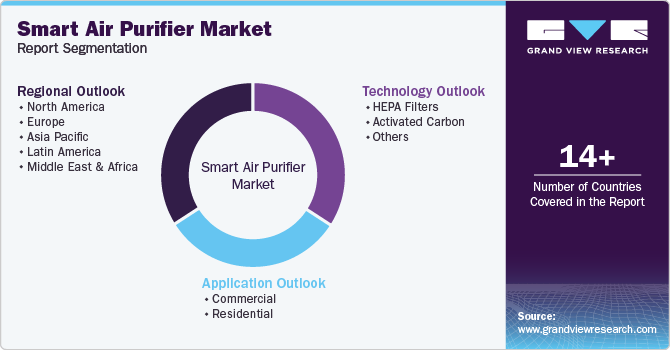

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart air purifier market report based on application, technology, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

HEPA Filters

-

Activated carbon

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.