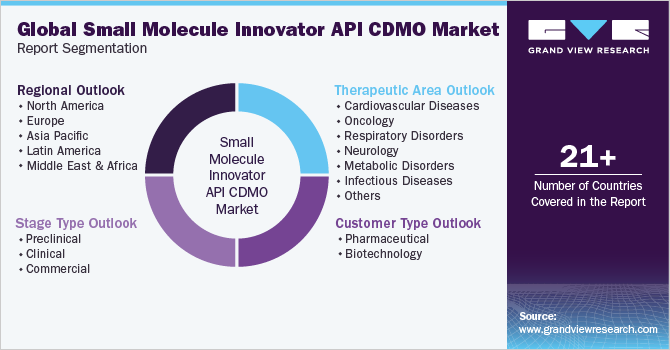

Small Molecule Innovator API CDMO Market Size, Share & Trends Analysis Report By Stage Type (Preclinical, Clinical, Commercial), By Customer Type (Pharmaceutical, Biotechnology), By Therapeutic Area, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-250-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

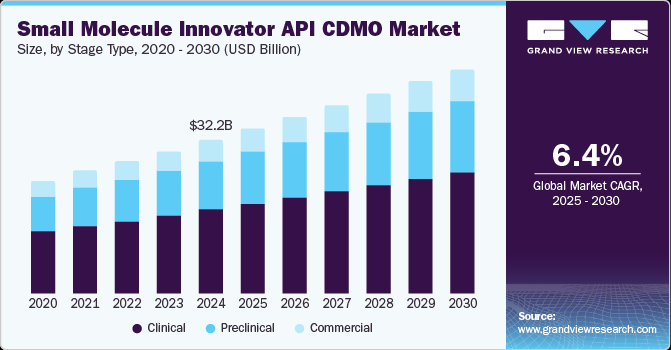

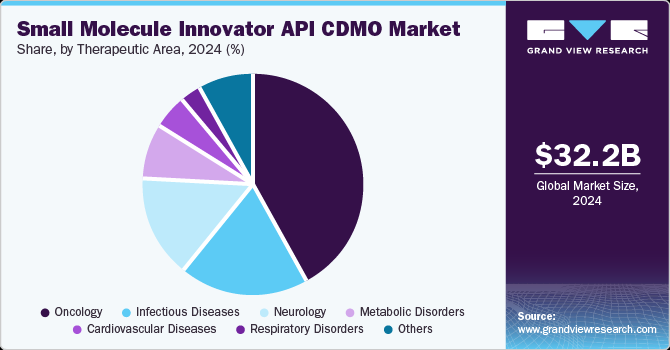

The global small molecule innovator API CDMO market size was estimated at USD 32.25 billion in 2024 and is projected to grow at a CAGR of 6.38% from 2025 to 2030. Growth of the small molecule innovator API CDMO industry can be attributed to the increasing demand for small-molecule drugs, rising outsourcing by pharmaceutical companies, and growing number of clinical trials. In addition, rising pharmaceutical investment in R&D to expand the development of new small molecule innovator APIs, increasing demand for novel therapies, and growing prevalence of cancer & age-related disorders are among the key factors driving market growth.

Small molecules continue to play an important role in developing new treatments globally. For instance, according to an article published by the American Chemical Society in January 2024, the U.S. FDA approved 50 new drugs in 2024, marking a notable increase from the 37 approvals in 2022. Moreover, The U.S. FDA approved 55 new drugs. Among these, 31 were small molecule therapies, accounting for 56% of the total approvals, a significant increase from 46% in the previous year. Thus, growing approval of new drugs is expected to drive the market over the estimated time period.

Besides, the trend of outsourcing activities in the pharmaceutical domain is rising as companies find value in acquiring additional competencies essential for successful drug development and commercialization. In addition to providing extended expertise and assisting in improved cash flow management, outsourcing brings significant manufacturing advantages, including reducing investment risks. In the context of early-stage technologies and products, establishing expensive in-house capabilities entails substantial risks across the product development phases. At the same time, outsourcing serves as a risk-averse alternative. A limited understanding of the required scale for current and future product offerings or market penetration poses significant hurdles in designing and scaling manufacturing for in-house production. Consequently, the preference for outsourcing has grown as an effective strategy until market demand for products becomes well established and understood.

The enhanced efficiency serves as another pivotal driver for pharmaceutical outsourcing. With mounting pressure on pharmaceutical companies to expedite the introduction of new drugs to the market, outsourcing emerges as a solution to accelerate the drug development process. Leveraging their expertise, experience, and cutting-edge equipment, CDMOs facilitate the swift & efficient production of high-quality drugs, enabling pharmaceutical firms to adhere to their development schedules. Likewise, key initiatives undertaken by the companies in this sector are also expected to boost market growth. For instance, in March 2023, Catalent, Inc. collaborated with Grünenthal for an orally dosed small molecule in Grünenthal’s pipeline. This collaboration broadened the company’s operational capabilities in the market.

Likewise, the global distribution of clinical trials is expected to boost the market in the coming years. Clinical trials are executed globally, and their geographical distribution is shaped by diverse factors such as disease prevalence, regulatory conditions, population demographics, healthcare infrastructure, and cost considerations. As of February 2024, there is a discernible trend toward a more globalized approach to clinical trials. Over half of all registered studies are conducted outside the U.S. Meanwhile, over 35% of trials are exclusively conducted within the U.S. This emphasizes the increasing international collaboration in the collective pursuit of medical advancement.

Opportunity Analysis

The market presents significant opportunities driven by the growing pharmaceutical industry's increasing reliance on CDMOs, with cost-effectiveness as the prominent factor. Besides, factors such as growing demand for a range of novel therapies and increasing outsourcing trends among pharmaceutical and biopharmaceutical companies present new opportunities for the market players. Currently, outsourcing is referred to as an efficient strategy for pharmaceutical firms to minimize the expenses for costly infrastructure and equipment investments. These CDMOs are expected to witness demand due to the increased need for expertise, regulatory compliance, and advanced manufacturing capabilities among pharmaceutical and biopharmaceutical companies to deliver drug development and manufacturing services in a financially prudent manner. Furthermore, stringent global regulations and the complexity of innovative APIs serve as another growth opportunity factor for market growth.

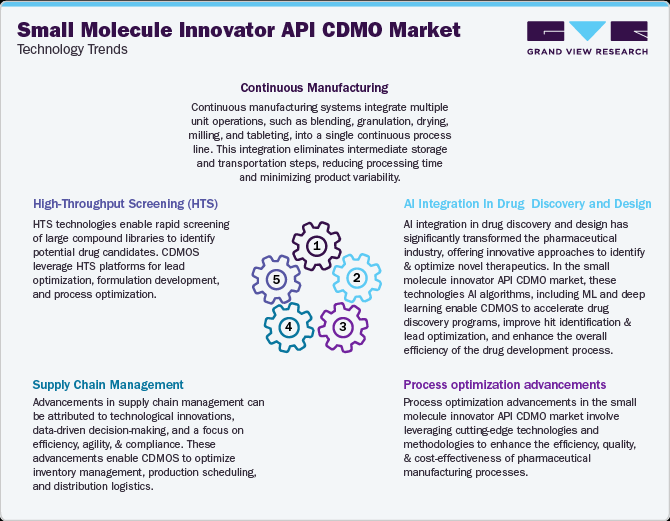

Technological Advancements

The technological landscape of the small molecule innovator API CDMO market is continuously evolving to meet the industry’s demands for innovation, efficiency, and regulatory compliance. Several advancements have shaped the market, enhancing drug development, manufacturing processes, and productivity. A few significant technological advancements in the market for small molecule innovator API CDMO are continuous manufacturing, high-throughput screening (HTS), supply chain management, AI integration in drug discovery and design, and process optimization advancements. These technological advancements are streamlining numerous aspects of the clinical trial process, including patient recruitment, study design, site selection, data management, and regulatory compliance, allowing pharmaceutical/biopharmaceutical manufacturers to meet the growing demand for medications while adhering to regulatory standards. In addition, these advancements enable small molecule innovator API CDMOs to accelerate the development of new therapies, reduce costs, and improve the efficiency of clinical research, further fueling the market.

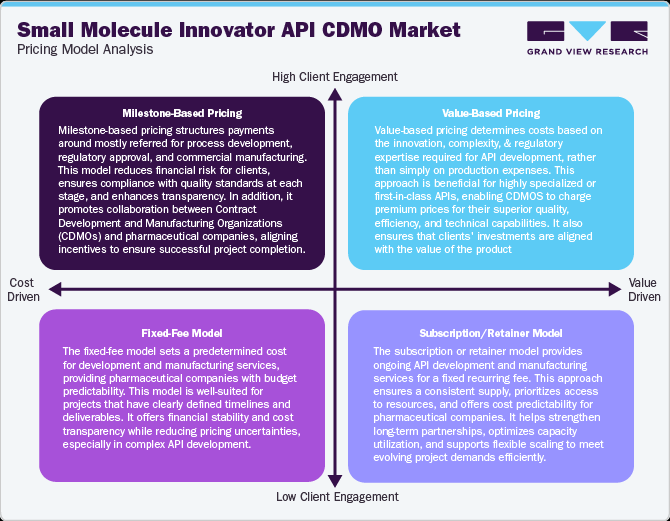

Pricing Model Analysis

The pricing models in small molecule innovator API CDMO operate under various pricing models to balance cost efficiency, innovation, and regulatory compliance while ensuring profitability. Fixed-fee model pricing is one of the standard approaches, covering production expenses plus a fixed margin for transparency. Milestone-based pricing links payments to development stages like formulation, regulatory approval, and production, reducing financial risk. In addition, value-based pricing is gaining attention for highly complex or differentiated APIs, which reflects innovation and technical expertise. Volume-based pricing benefits long-term partnerships, offering tiered discounts for bulk production. Additionally, subscription or retainer models provide stability for clients requiring continuous supply and dedicated capacity. Hence, most CDMOs are increasingly adopting flexible pricing strategies to remain competitive, aligning cost structure requirements, regulatory needs, and technological advancements, ensuring new growth in the global market.

Market Concentration & Characteristics

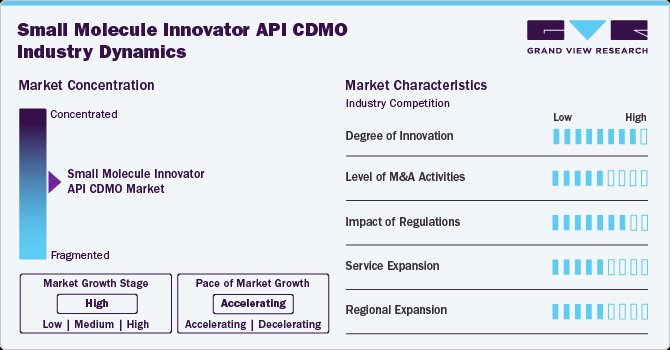

The market growth stage is stable and is expected to accelerate over the estimated period. The small molecule innovator API CDMO market is characterized by technologies, regulatory considerations, and globalization & outsourcing of product processes to influence advantages and specialized capabilities.

The small molecule innovator API products innovations is continuously evolving to meet the industry’s demands for innovation, efficiency, and regulatory compliance. Several advancements have shaped the market, enhancing drug development, manufacturing processes, and productivity.

Compliance with stringent regulatory requirements, particularly in the pharmaceutical industry, is a critical component. CDMOs in this market are emphasizing robust quality assurance practices and adherence to regulatory standards thereby witnessing lucrative growth opportunities.

Small molecule innovator API CDMO players in the market leverage strategies such as collaborations, partnerships, and acquisitions to promote the reach of their offerings and increase their product capabilities globally. For instance, in October 2023, Cambrex Corporation concluded a USD 38 million-capacity expansion of its small molecule API manufacturing facility in North Carolina. This enhancement resulted in a twofold increase in the facility’s manufacturing capacity. The expansion included innovative analytical & chemical development laboratories, two additional clinical manufacturing suites, and the establishment of a small-scale commercial manufacturing operation featuring three work centers and 2,000 L reactors.

Increasing R&D activities, rising number of mergers & acquisitions, & growing disease burden can influence market dynamics positively.

The local presence of several established pharmaceutical, rising number of ongoing clinical studies, technologically advanced formulation development, and demand for small molecule innovator API products fuels market growth.

Stage Type Insights

The clinical stage type segment led the small molecule innovator API CDMO industry and accounted for 54.56% of global revenue in 2024. The clinical segment is further sub-segmented to Phase I, Phase II, and Phase III. The segment growth is driven by improving access to medicine, robust small molecule development pipeline, and launch of new drugs. Besides, these clinical small molecule innovator API CDMOs provide support, expertise, and services for appropriate drug formulation, clinical trials (phase I-IV), scale-up, validation & large-scale commercial manufacturing, among others. Clinical CDMOs ensure that appropriate drug products are developed & tested for clinical trials, offer expertise, and save time for APIs at the clinical stage, fueling the market demand.

The preclinical segment is anticipated to grow at a lucrative CAGR over the forecast period. Small molecule drugs are designed to enhance and mimic the behavior of natural substances or products within the body. These molecules have simple structures and are customizable to meet specific therapeutic goals. During the early clinical development phase, raw materials, intermediates, and API specifications are used with appropriate testing methods. As the preclinical stage progresses, these test methods/details are studied, and tolerance may be improved with gained knowledge.

Customer Type Insights

The pharmaceutical segment dominated the market in 2024, accounting for a revenue share of 91.07%. Small-molecule drugs have been the backbone of the pharmaceutical industry for nearly a century. In addition, several pharmaceutical companies are shifting their focus on CDMOs to develop novel small molecule innovator API drugs for the treatment of various indications in areas such as oncology, immunology, and infectious diseases. This has enabled medical breakthroughs and helped address unmet medical needs, saving several lives using the small molecule innovator API.

The biotechnology segment's expansion is driven by rising demand for biotechnology and enhanced molecular efficiency. Furthermore, high investments in the biotechnology industry and constant improvements in molecular biology have resulted in the advent of new scientific disciplines such as metabolomics, proteomics, and genomics. The growing use of biotech solutions has aided in the innovation of therapeutic proteins and other medications. Furthermore, the growing R&D pipeline is expected to positively impact the market. In addition, the burden of chronic and infectious diseases is growing worldwide, which is expected to increase the interest of biotechnology companies in developing new drugs, fueling the need for CDMOs.

Therapeutic Area Insights

The oncology segment dominated the small molecule innovator API CDMO market in 2024 and is expected to grow at the fastest CAGR of 6.80% during the forecast period. The segment is expected to grow due to the increasing number of cancer cases worldwide. For instance, the Cancer Atlas predicts that there will be 29 million cancer cases globally by 2040. Recent trends in pharmaceutical products have shifted with growing R&D for cancer treatments. The pharmaceutical sector has witnessed significant growth due to rising demand for oncology drugs & therapies fueled by innovative-targeted treatments and personalized medicine approaches, which has led to a rise in demand for the small molecule innovator API CDMOs.

The infectious diseases market has witnessed dynamic trends and scenarios across various disease segments. The infectious diseases small molecule innovator API CDMO market, which deals with infectious diseases caused by bacterial and viral pathogens, has witnessed dynamic trends and scenarios across various disease segments. Such diseases are a major cause of death worldwide and establish an ever-growing medical need. Growing prevalence of severe diseases caused by harmful bacteria, fungi, viruses, and parasites, such as Severe Acute Respiratory Syndrome (SARS), has resulted in growth of the infectious diseases market and need for new drugs.

Regional Insights

North America small molecule innovator API CDMO market is expected to grow at a CAGR of 5.91% over the forecast period. This can be attributed to increasing investments by pharmaceutical companies and growing R&D of small molecule drugs. This has led to a surge in demand for contract development and manufacturing services. The local presence of several established pharmaceutical, biotechnology, & CDMO entities and the increasing number of clinical trials are key factors expected to contribute to market growth. These regional entities are focused on small molecule innovator API transactions with geographic expansion & capacity deals in novel therapeutics, which mostly include acquiring new capabilities.

U.S. Small Molecule Innovator API CDMO Market Trends

The small molecule innovator API CDMO industry in the U.S. held the largest share in 2024. Pharmaceutical companies are increasingly outsourcing their development & manufacturing activities to CDMOs to reduce costs, accelerate time to market, and access specialized expertise. This trend is fueling the U.S. market growth as CDMOs expand to meet the growing demand for outsourcing services. This expansion involves investments in new facilities, equipment upgrades, & process improvements. Furthermore, the growing number of companies expanding their manufacturing facilities to cater to the rising pharmaceutical demand is likely to propel market growth.

Europe Small Molecule Innovator API CDMO Market Trends

The small molecule Innovator API CDMO industry in Europe is expected to grow significantly due to robust pharmaceutical sector with numerous drug discoveries, development, and manufacturing companies. The growing number of pharmaceutical activities is likely to improve the demand for CDMOs. Moreover, the rising trend of outsourcing services to European countries is anticipated to contribute to the increasing demand for small molecule innovator API CDMOs.

The small molecule innovator API CDMO market in Germany held the largest share in 2024, owing to the advancements in therapy and increasing clinical trial activities. In addition, increasing complexity of products and stringent regulatory norms are some key factors anticipated to propel market growth during the forecast period.

The UK small molecule innovator API CDMO market is anticipated to grow over the forecast period. The UK is considered a lucrative market for pharmaceutical companies due to its extensive R&D initiatives, excellent early innovation medicine platforms, and pharmaceutical clinical trials being undertaken to address the challenges posed by various diseases. Moreover, the presence of various multinational CDMOs in the country is anticipated to contribute to market growth.

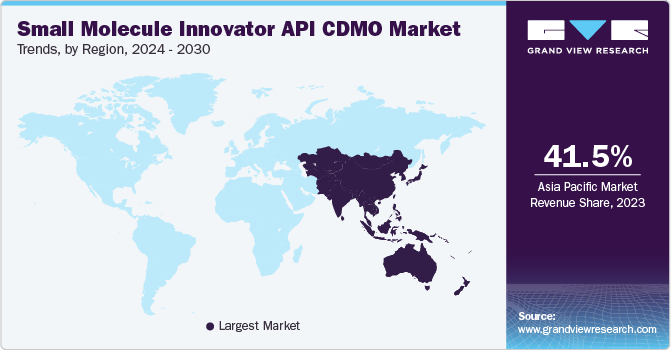

Asia Pacific Small Molecule Innovator API CDMO Market Trends

Asia Pacific held the largest market share of 41.74% in 2024. In the past decade, the manufacturing of pharmaceutical products has been outsourced to Asian countries, such as India and China. Asia Pacific is expected to witness rapid growth in its pharmaceutical industry due to rising healthcare expenditure, increasing prevalence of chronic diseases, and improving healthcare infrastructure. This is expected to drive the demand for small molecule APIs and CDMO services to support drug development and manufacturing.

The small molecule innovator API CDMO market in China held the largest share in 2024 due to rising geriatric population and the presence of a large middle-income group are likely to boost the demand for APIs. Moreover, the availability of low-cost labor is one of the major factors for pharmaceutical firms across the globe to outsource API development and manufacturing to China.

The Japan small molecule innovator API CDMO market is expected to grow over the forecast period due Regulatory compliance, technological advancements, strong R&D capabilities, skilled workforce, strategic location, and favorable government initiatives.

The small molecule innovator API CDMO market in India is anticipated to grow at the fastest CAGR over the forecast period owing to low labor costs, improvements in healthcare infrastructure, and easy availability of technical expertise.

Key Small Molecule Innovator API CDMO Company Insights

The major players operating across the small molecule innovator API CDMO industry focus on adopting in-organic strategic initiatives such as mergers, partnerships, acquisitions, etc. The prominent strategies companies adopt are service launches, mergers & acquisitions/joint ventures, mergers, partnership & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge driving market growth. Hence, increasing adoption of in-organic strategic initiatives is highly anticipated to boost the market share of prominent players. For instance, in August 2024,Lonza's small molecules facility in Bend, Oregon, added clinical bottling and labeling capabilities. This enhancement will improve support for customers working on early-stage development.

Key Small Molecule Innovator API CDMO Companies:

The following are the leading companies in the small molecule innovator API CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- Lonza Group Ltd.

- Novo Holdings (Catalent, Inc.)

- Thermo Fisher Scientific, Inc.

- Siegfried Holding AG

- Recipharm AB

- CordenPharma International

- Samsung Biologics

- Labcorp

- Ajinomoto Bio-Pharma Services

- Piramal Pharma Solutions

- Jubilant Life Sciences (Jubilant Biosys Limited)

- WuXi AppTec Co., Ltd.

Recent Developments

-

In February 2024, BioVaxys announced the acquisition of IMV portfolio of discovery, preclinical & clinical development-stage from IMV Inc., Immunovaccine Technologies, & IMV USA. These were developed in infectious disease, oncology, antigen desensitization, & other immunological fields based on IMV’s DPX immune educating platform technology.

-

In July 2024, Siegfried Holdings announced plans to enhance its drug substances services by acquiring an early-phase contract development and manufacturing organization (CDMO) site in Grafton, Wisconsin, from Curia Global

-

In August 2023, Catalent, Inc. announced the acquisition of Metrics Contract Services (Metrics), a CDMO from Mayne Pharma Group Limited, for USD 475 million. The acquisition was expected to enhance the company’s oral solid formulation capabilities in development, manufacturing, and packaging, expanding its capacity to handle potent compounds.

-

In February 2023, Piramal Pharma Solutions announced producing the first few batches of APIs at its Michigan facility in Riverview, U.S.

Small Molecule Innovator API CDMO Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 34.61 billion |

|

Revenue forecast in 2030 |

USD 47.14 billion |

|

Growth rate |

CAGR of 6.38% from 2025 to 2030 |

|

Historical year |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Stage type, customer type, therapeutic area, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Taiwan; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Israel |

|

Key companies profiled |

Lonza Group Ltd., Novo Holdings (Catalent, Inc.); Thermo Fisher Scientific, Inc.; Siegfried Holding AG; Recipharm AB; CordenPharma International; Samsung Biologics; Labcorp; Ajinomoto Bio-Pharma Services; Piramal Pharma Solutions; Jubilant Life Sciences (Jubilant Biosys Limited); WuXi AppTec Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Small Molecule Innovator API CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global small molecule innovator API CDMO market report based on stage type, customer type, therapeutic area, and region:

-

Stage Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical

-

Clinical

-

Phase I

-

Phase II

-

Phase III

-

-

Commercial

-

-

Customer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Small

-

Medium

-

Large

-

-

Biotechnology

-

Small

-

Medium

-

Large

-

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Diseases

-

Oncology

-

Respiratory Disorders

-

Neurology

-

Metabolic Disorders

-

Infectious Diseases

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

Taiwan

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global small molecule innovator API CDMO market size was estimated at USD 32.25 billion in 2024 and is expected to reach USD 34.61 billion in 2025.

b. The global small molecule innovator API CDMO market is expected to grow at a compound annual growth rate of 6.38% from 2025 to 2030 to reach USD 47.14 billion by 2030.

b. Asia Pacific dominated the small molecule innovator API CDMO market with a share of 41.74% in 2024. This is attributable to the high development and manufacturing capacity in Asian countries such as China and India, which establishes the Asia Pacific region as a global leader in producing small molecule innovator APIs.

b. Some key players operating in the small molecule innovator API CDMO market include Lonza Group Ltd., Novo Holdings (Catalent, Inc.), Thermo Fisher Scientific, Inc., Siegfried Holding AG, Recipharm AB, CordenPharma International, Samsung Biologics, Labcorp, Ajinomoto Bio-Pharma Services, Piramal Pharma Solutions, Jubilant Life Sciences (Jubilant Biosys Limited), and WuXi AppTec Co., Ltd.

b. Key factors driving the market growth include increasing demand for small-molecule drugs, increasing outsourcing trends among pharmaceutical companies, and a surge in the number of clinical trials.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."