Small Molecule API Market Size, Share & Trends Analysis Report By Type (Synthetic, Biotech), By Manufacturer, By Application (Oncology, Pulmonology, CNS, Endocrinology), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-952-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Small Molecule API Market Size & Trends

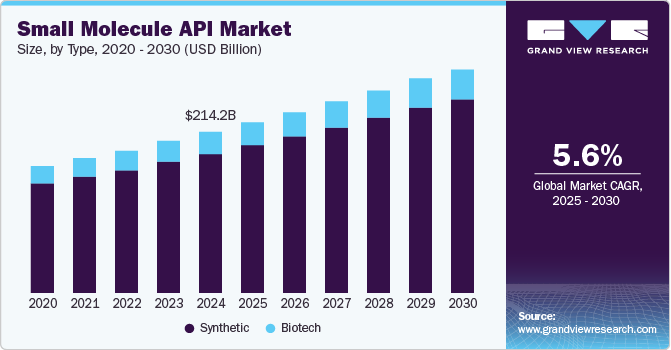

The global small molecule API market size was valued at USD 214.2 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2030. The rising prevalence of chronic diseases worldwide, increasing demand for small molecule drugs, and increasing emphasis on outsourcing and contract manufacturing, which has led to increased production capacity, are major factors driving the market growth.

The rising prevalence of chronic diseases such as cancer, cardiovascular diseases, diabetes, and neurological disorders is a significant driver of the small molecule active pharmaceutical ingredient (API) market. For instance, according to the statistics released by the World Health Organization (WHO) in September 2023, noncommunicable diseases (NCDs) cause the death of approximately 41 million people every year, which is about 74% of all deaths worldwide. Therefore, there is an increasing demand for effective therapeutic agents. Small molecule APIs can penetrate cells and modulate intracellular targets, which can help develop drugs for chronic disease management and drive industry demand.

The increasing number of patent expirations has further created opportunities for drug manufacturers to introduce affordable alternatives to high-demand medications. This has further led to new drug approvals and development. For instance, according to the research study published by Elsevier B.V. (ScienceDirect) in October 2024, the Food and Drug Administration (FDA) approved 55 new drugs in 2023, which included 38 new molecular entities and 17 biologics. This trend is further expected to add to the pipeline of affordable alternatives alongside treatments to enhance therapeutic options for patients.

The adoption of advanced technologies and the rise of specialty medicines are expected to drive a shift within the pharmaceutical industry. This evolution is likely to increase demand for small-volume production, as the industry adapts to the complexity of specialized treatments.

Type Insights

The synthetic segment accounted for the largest share of 86.5% in 2024 and is expected to grow at the fastest CAGR of 5.6% over the forecast period owing to its cost-effectiveness and scalability. Synthetic APIs enable precise control over molecular structure and purity, which makes them suitable for a wide range of therapeutic applications. In addition, increasing demand for effective therapeutic solutions for treating various cardiovascular diseases, cancer, and other chronic conditions is expected to further add to the demand in the market.

The biotech segment is expected to grow significantly over the forecast period from 2025 to 2030 owing to the increasing advancements in biotechnology that have expanded the production capabilities for complex small molecules and the growing demand for precision medicines. In addition, biotech processes, such as biocatalysis and fermentation, facilitate sustainable production routes, further driving demand for green chemistry. In addition, the growing demand for precision medicine has led to a focus on highly targeted therapies, which biotech methods can support by efficiently producing complex APIs. The rising investment in R&D for biotech-based drug development, coupled with supportive regulatory frameworks, is further expected to add to the growth of this segment.

Manufacturer Insights

In-house accounted for the largest market share of 59.7% in 2024, owing to the need for cost control, quality assurance, and strategic flexibility. In-house API production allows companies to reduce outsourcing costs, protect intellectual property, and ensure regulatory compliance while maintaining higher profit margins. The companies are also engaged in the expansion of their production facilities to meet increasing demand in the market. For instance, in July 2024, Eurofins CDMO Alphora Inc. completed a new API manufacturing facility at its Mississauga, Canada, site, adding 15,000 sq ft of GMP processing and warehousing space to enhance its production capacity and capabilities.

The outsourced segment is expected to grow at the fastest CAGR of 5.7% over the forecast period from 2025 to 2030. The benefits offered by outsourcing such as reduced operational costs are likely to drive the segment growth. Outsourcing allows pharmaceutical companies to utilize advanced technologies, and large-scale capacities of contract development and manufacturing organizations (CDMOs), leading to improved production and efficiency.

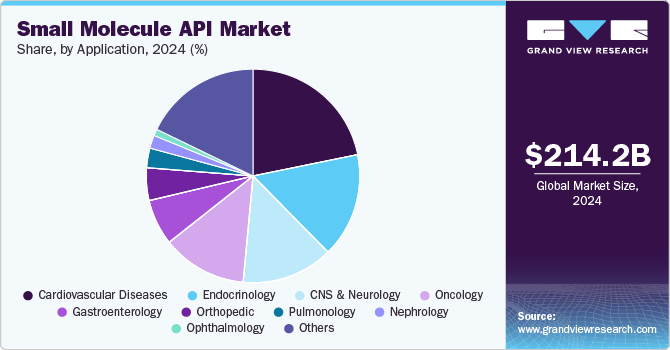

Application Insights

Cardiovascular diseases accounted for the largest market share of 21.7% in 2024, owing to the increasing prevalence of the disease. According to the information published by the Centers for Disease Control and Prevention (CDC), heart disease led to the death of 702,880 people in the U.S. in 2022. The growing prevalence of the disease has led to the increased efforts and demand for developing advanced solutions, which is likely to drive the segment growth in the market.

The oncology segment is projected to grow at the fastest CAGR of 7.2% over the forecast period from 2025 to 2030. The increasing number of cancer cases and investments by private and public players to develop effective solutions is likely to drive the demand. For instance, in July 2024, Pfizer announced an investment of approximately USD 743 million in ingredient plant expansion, enabling the production of small-molecule active pharmaceutical ingredients for oncology, pain, and antibiotic medicines.

Regional Insights

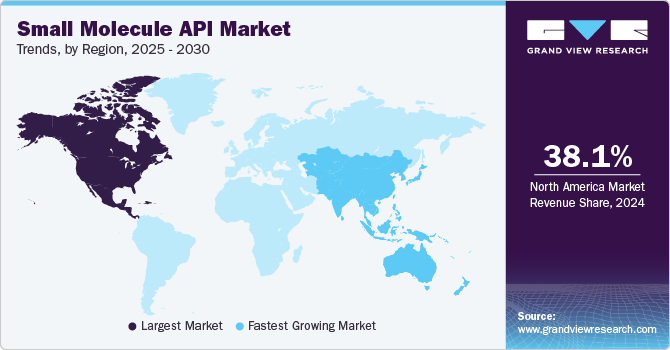

North American small molecule API market accounted for the largest market revenue share of 38.1% in 2024. The large market share can be attributed to the presence of a well-established healthcare sector and increasing investments in advanced R&D infrastructure and technological advancements. For instance, in March 2023, the Canadian Critical Drug Initiative (CCDI) received a green light with an investment of USD 80.5 million to create an integrated research, development, and manufacturing cluster in Edmonton. The initiative is likely to help meet the demand for manufacturing small-molecule therapeutics in the country and drive regional growth.

U.S. Small Molecule API Market Trends

The U.S. market accounted for the largest share of the North America Small Molecule API market in 2024. The increasing investment in the pharmaceutical industry, the presence of the key players in the market, and their development activities are likely to help drive market demand in the country. For instance, in September 2024, The API Innovation Center announced it had received about USD 14 million in strategic funding for the development of critical APIs and to boost the pharmaceutical industry in the U.S.

Europe Small Molecule API Market Trends

The Europe small molecule API market is expected to grow significantly over the forecast period owing to well-established pharmaceutical industry, advanced manufacturing infrastructure, and stringent regulatory standards. The growing demand for high-quality and sustainable APIs, coupled with increasing investments in R&D, is further likely to boost the market growth. In August 2024, Asymchem launched a new small molecule development and API pilot plant manufacturing facility in the UK, marking its expansion into the European market. The expansion is likely to help boost the small molecule API market in Europe.

The small molecule API market in Germany held the largest share in the European market. The increasing emphasis on innovation and advancing the pharmaceutical industry is likely to drive market growth in the country. For instance, in June 2023, Boehringer Ingelheim International GmbH announced its plans to establish a Chemical Innovation Plant (CIP) in Ingelheim, Germany. The plant is likely to focus on developing manufacturing techniques for active pharmaceutical ingredients (APIs) and producing drugs for various stages of clinical trials. Such development activities by the key players are further expected to add to market growth.

The UK small molecule API market is expected to grow significantly over the forecast period owing to the increasing prevalence of various diseases and the need to develop advanced treatment solutions. The investment activities by the public and private players in the country are further likely to drive market growth.

Asia Pacific Small Molecule API Market Trends

The Asia Pacific small molecule API market is anticipated to grow at the fastest CAGR of 6.6% over the forecast period. The increasing investment in the development of healthcare infrastructure and pharmaceutical industry in emerging economies of the region is likely to drive the market growth in the region.

The Japan small molecule API market accounted for a significant market share in 2024 due to high-quality manufacturing standards and adherence to stringent regulatory guidelines. The growing focus on biotechnology, precision medicine, and the aging population has led to increased demand for APIs, which is likely to foster innovation in the market and drive market growth.

The India small molecule API market is expected to grow significantly owing to the growing efforts to develop the pharmaceutical industry, low cost of manufacturing and cost-efficient research and development facilities in the country. According to the information published by the India Brand Equity Foundation, the country has over 2,000 WHO-GMP-approved facilities and more than 10,500 manufacturing facilities supplying to over 150 countries. These capabilities in the country are likely to drive market growth over the forecast period.

Key Small Molecule API Company Insights

Some of the key companies operating in the small molecule API market are Merck & Co., Inc., AbbVie, Inc., Bristol-Myers Squibb Company, and Albemarle Corporation. These companies are engaged in various strategies, such as mergers and acquisitions and expansion activities to gain a competitive edge in the market.

-

Albemarle Corporation is a global developer and manufacturer of specialty chemicals. The company develops catalysts, bromine, and various fine chemicals, including those used in pharmaceuticals. It specializes in providing organometallic compounds that enable high selectivity and can increase product yields in the synthesis of small-molecule drugs.

-

Merck & Co., Inc. is a global healthcare company that develops and manufactures various medicines, vaccines, and biological therapies. The company also conducts pharmaceutical research and contributes to several therapeutic areas, such as oncology, cardiology, infectious diseases, and vaccines. The company also manufactures a wide range of APIs in-house to support its extensive portfolio of proprietary drugs for varied critical health issues.

Key Small Molecule API Companies:

The following are the leading companies in the small molecule API market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- AbbVie, Inc.

- Bristol-Myers Squibb Company

- Albemarle Corporation

- Boehringer Ingelheim International GmbH

- Cipla, Inc.

- Dr. Reddy’s Laboratories Ltd.

- Aurobindo Pharma

- Sun Pharmaceutical Industries Ltd.

Recent Developments

-

In October 2024, SK Pharmteco announced its plans to strengthen its small molecule and peptide capacity with an investment of approximately USD 260 million investment in South Korea.

-

In July 2024, Ventus Therapeutics announced the opening of its office facility and laboratory in Montreal, Canada, marking the expansion of its R&D capacity.

-

In June 2024, Matrix Pharma announced the acquisition of the API business of Viatris Inc. for funded by KSSF II. The acquisition is expected to significantly improve the company’s position in the Indian API market.

Small Molecule API Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 226.6 billion |

|

Revenue forecast in 2030 |

USD 297.0 billion |

|

Growth rate |

CAGR of 5.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, manufacturer, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Merck & Co., Inc., AbbVie, Inc., Bristol-Myers Squibb Company, Albemarle Corporation, Boehringer Ingelheim International GmbH, Cipla, Inc., Dr. Reddy’s Laboratories Ltd., Aurobindo Pharma, Sun Pharmaceutical Industries Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

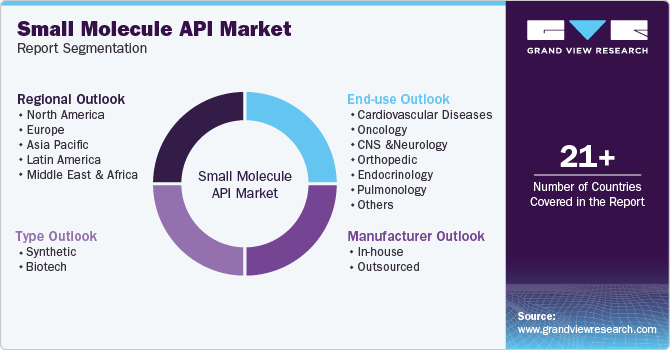

Global Small Molecule API Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global small molecule API market report based on type, manufacturer, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Synthetic

-

Biotech

-

-

Manufacturer Outlook (Revenue, USD Billion, 2018 - 2030)

-

In-house

-

Outsourced

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiovascular Diseases

-

Oncology

-

CNS & Neurology

-

Orthopedic

-

Endocrinology

-

Pulmonology

-

Gastroenterology

-

Nephrology

-

Ophthalmology

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."