Small Modular Reactor Market Size, Share & Trends Analysis Report By Product Type (Heavy Water Reactors, Light Water Reactors, High-Temperature Reactors), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-389-3

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Small Modular Reactor Market Size & Trends

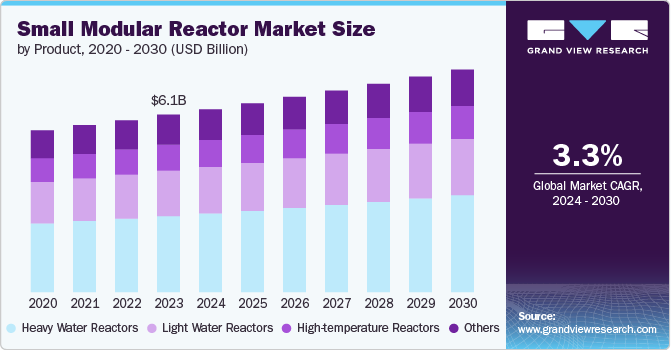

The global small modular reactor market size was estimated at USD 6.14 billion in 2023 and is expected to grow at a CAGR of 3.3% from 2024 to 2030. This growth is attributed to their potential to provide a more flexible and cost-effective solution for nuclear power generation. These are designed to be factory-built and shipped to sites, reducing construction time and costs compared to traditional large reactors. Small modular reactor (SMRs) also provides improved safety features, including passive safety systems and the ability to be deployed in remote or smaller grid locations where larger plants are not feasible.

Moreover, SMRs can support grid stability, complement renewable energy sources, and provide a reliable, low-carbon energy source, supporting global efforts to reduce greenhouse gas emissions and transition to cleaner energy systems.

The demand is expected to be hampered by its high upfront costs, and regulatory barriers. The higher initial investment needed for developing and deploying, making it difficult for investors to justify the expense compared to alternative energy sources. Moreover, the complex and stringent regulatory landscape for nuclear technology can also cause delays and increase costs, which is further expected to affect the potential developers. Public concerns about nuclear safety and waste management also persist, impacting the acceptance and support for SMRs. These factors collectively are likely to affect its widespread adoption.

Key market players are opting for various strategies to gain market share in which they are employing strategies including strategic partnerships and collaborations with governments, utilities, and private investors to secure funding and support. They are also focusing on modularity and scalability, which allows for easier and more cost-effective deployment compared to traditional large reactors. These players are emphasizing the safety and reliability of SMRs, leveraging their advanced design features that enhance safety margins and reduce risks.

Product Type Insights

Based on product, the market is segmented into heavy water reactors, light water reactors, high-temperature reactors, and others. Among these, heavy water reactors dominated the market with a revenue share of 42.9% in 2023 and is further expected to grow at a significant rate over forecast period. This growth is attributed to their ability to efficiently use natural uranium, which reduces the requirements for expensive uranium enrichment processes. This feature makes heavy water SMRs specifically attractive in regions with abundant natural uranium resources but limited enrichment capabilities. Moreover, heavy water reactors have superior neutron economy, allowing them to achieve high fuel burn-up and longer operational cycles, that improves overall fuel efficiency and reduces waste. These factors are likely to boost demand for the product over the coming years.

Demand for light water small modular reactors is expected to grow at a fastest rate over the period of 2024-2030. Light water small modular reactors penetration is driven by their compatibility with existing nuclear infrastructure and fuel supply chains, making its integration into current energy systems more convenient. These are the most commonly used nuclear reactors worldwide, which means the technology, operational experience, and regulatory frameworks are well-established, reducing the risks associated with deployment.

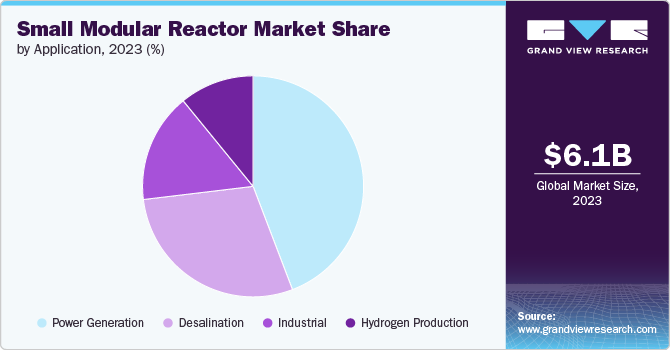

Application Insights

On the basis of application, small modular reactor market is segmented into power generation, desalination, industrial, and hydrogen production. Power generation applications accounted for the largest revenue share of 44.2% in 2023. This growth is attributed to their ability to provide reliable, low-carbon energy with a smaller footprint compared to traditional reactors. SMRs offer flexibility in deployment, allowing for incremental capacity additions which can fulfill the growing energy needs. The modular design of the SMRs enables easier integration into existing energy infrastructure and makes them suitable for remote or off-grid locations.

Desalination application is anticipated to grow at a fastest rate over the forecast period. The demand for is driven by the capacity of SMRs to provide a stable and continuous supply of high-quality thermal energy needed for desalination processes. It can efficiently generate the large amounts of heat required for thermal desalination methods, such as multi-stage flash desalination and multi-effect distillation. Their compact size and modularity make them well-preferred for deployment in coastal regions where fresh water is scarce. It can benefit he regions facing water scarcity from a reliable and sustainable source of fresh water while minimizing environmental impact and reducing dependence on fossil fuels.

Regional Insights

North America dominated the small modular reactor market with a revenue share of 25.4% in 2023. The demand is driven by the region's focus on transitioning to cleaner energy sources and achieving carbon reduction goals. Small modular reactor offers a practical solution for replacing aging fossil fuel infrastructure with low-carbon technology. The support by the region’s government and a significant investment in nuclear research and development is further likely to bolster the products demand over the forecast period.

U.S. Small Modular Reactor Market Trends

The small modular reactor market in the U.S. is growing at a CAGR of 3.5% over the forecast period. The market growth is attributed to the supportive federal and state-level policies targeted at reducing greenhouse gas emissions and achieving net-zero targets. The government has been actively supporting SMR development through funding and research initiatives, recognizing their potential to enhance grid stability and support renewable energy integration.

Europe Small Modular Reactor Market Trends

Europe small modular reactor market is growing at a CAGR of 3.1% from 2024-2030. Europe is witnessing an increasing demand for small modular reactors as part of its broader strategy to decarbonize its energy system and ensure energy security. Many European countries are pursuing reliable, low-emission power sources to complement intermittent renewable energy and phase out coal and other high-emission fuels. SMRs provide a solution to address these needs while meeting stringent safety and environmental standards. Moreover, the region’s focus on technological innovation and international collaboration supports the deployment of advanced nuclear technologies, including SMRs, as part of a diverse and sustainable energy mix.

Asia Pacific Small Modular Reactor Market Trends

The small modular reactor market in Asia Pacific is expected to grow at the highest CAGR over the forecast period. The demand for small modular reactors is rising owing to the increasing energy needs, rapid economic growth, and significant investments in nuclear technology. Furthermore, developing economies such as China and India are also exploring SMRs to enhance their energy security, reduce air pollution, and meet rising electricity demands in a sustainable manner. The region's diverse geographical and demographic landscape makes it a preferable option for providing reliable power to remote or densely populated areas.

Key Small Modular Reactor Company Insights

Some of the key players operating in the market include Fluor Corporation and Rolls-Royce plc.

-

Fluor Corporation is a U.S.-based company offering products and services related to construction, procurement, and engineering. Its services and expertise section includes engineering & design, procurement, fabrication, construction, maintenance, and innovation & expertise. This company mainly operates through three business segments, energy solutions, urban solutions, and mission solutions. Furthermore, with its products, it serves various industries including chemicals, energy transition, fuels, life science, infrastructure, manufacturing, and technology.

-

Rolls-Royce plc is involved in the manufacturing of propulsion and power solutions. Its products and services are categorized into civil aerospace, defense, power systems, and electrical aviation. The company employs around 41,400 people.

General Atomics and X Energy LLC are some of the emerging participants in market.

-

General Atomics is involved is a defense and diversified technology company. It was a division of General Dynamic and then was acquired by Blue family in the year 1986. This company provides products and services under 5 segments including energy, defense, unmanned aircraft systems, and commercial products. Furthermore, company operates around 8.3 million square feet of manufacturing and laboratory facility with over 12,500 employe strength.

-

X Energy LLC is involved in the manufacturing and engineering of fuel designs and nuclear reactors. The nuclear reactors segment of the company offers Xe-Mobile and Xe-100. Xe-100 is a small modular reactor with a modular design and the technology is based on Gen-IV High-Temperature Gas-cooled Reactors (HTGR). Furthermore, this small modular reactor is designed to offer around 60 years of operational life.

Key Small Modular Reactor Companies:

The following are the leading companies in the small modular reactor market. These companies collectively hold the largest market share and dictate industry trends.

- Brookfield Asset Management

- Moltex Energy

- General Electric Company

- ULTRA SAFE NUCLEAR

- X Energy LLC

- Fluor Corporation

- Rolls-Royce plc

- Westinghouse Electric Company LLC

- Terrestrial Energy Inc.

- General Atomics

Recent Developments

- In May 2023, Westinghouse announced the launch of AP300 which is a small modular nuclear reactor, and it will be available in the market by 2027. It is a smaller version of its AP1000 nuclear reactor. This product will generate around 300 megawatts of energy which will help in proving power to 3,00,000 houses. Furthermore, the aim for introducing a new product is to expand access of people to nuclear power as there is increasing demand for clean energy.

Small Modular Reactor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.33 billion |

|

Revenue forecast in 2030 |

USD 7.69 billion |

|

Growth rate |

CAGR of 3.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina |

|

Key companies profiled |

Brookfield Asset Management; Moltex Energy; General Electric Company; ULTRA SAFE NUCLEAR; X Energy LLC; Fluor Corporation; Rolls-Royce plc; Westinghouse Electric Company LLC; Terrestrial Energy Inc.; General Atomics |

|

Customization scope |

Free report customization (equivalent up to 8 analysts orking days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Small Modular Reactor Market Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the small modular reactor market on the basis of product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Heavy Water Reactors

-

Light Water Reactors

-

High-temperature Reactors

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Generation

-

Desalination

-

Industrial

-

Hydrogen Production

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global small modular reactor market size was estimated at USD 6.14 billion in 2023 and is expected to reach USD 6.33 billion in 2024.

b. The global small modular reactor market is expected to grow at a compound annual growth rate (CAGR) of 3.3% from 2024 to 2030 to reach USD 7.69 billion by 2030.

b. Heavy water reactors accounted for the largest revenue share of over 42.9% in 2023. This growth is attributed to their ability to provide reliable, low-carbon energy with a smaller footprint compared to traditional reactors. Small modular reactor offer flexibility in deployment, allowing for incremental capacity additions which can fulfill the growing energy needs.

b. Some key players operating in the small modular reactor market include Brookfield Asset Management, Moltex Energy, General Electric Company, ULTRA SAFE NUCLEAR, X Energy LLC, Fluor Corporation, Rolls-Royce plc, Westinghouse Electric Company LLC, Terrestrial Energy Inc., General Atomics.

b. The key factors that are driving the market growth are their ability to provide grid stability, complement renewable energy sources, and offer a reliable, low-carbon energy source, supporting global efforts to reduce greenhouse gas emissions and transition to cleaner energy systems.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."