- Home

- »

- Renewable Energy

- »

-

Small Hydropower Market Share Analysis, Industry Report, 2025 - 2030GVR Report cover

![Small Hydropower Market Size, Share & Trends Report]()

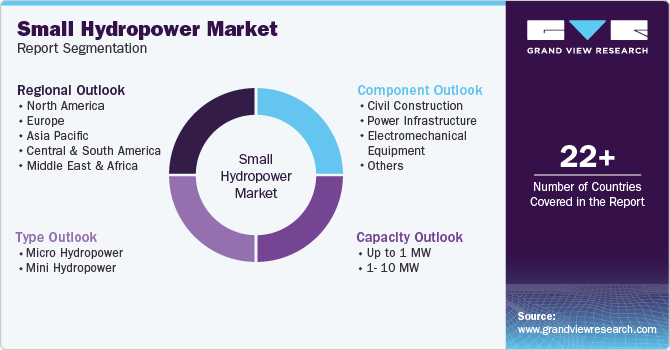

Small Hydropower Market (2025 - 2030) Size, Share & Trends Analysis Report By Capacity (Up to 1 MW, 1- 10 MW), By Type (Micro Hydropower, Mini Hydropower), By Component, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-891-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Small Hydropower Market Summary

The global small hydropower market size was valued at USD 2.18 billion in 2024 and is projected to reach USD 2.56 billion by 2030, growing at a CAGR of 2.8% from 2025 to 2030. The industry is primarily driven by the increasing global demand for renewable energy and rural electrification initiatives.

Key Market Trends & Insights

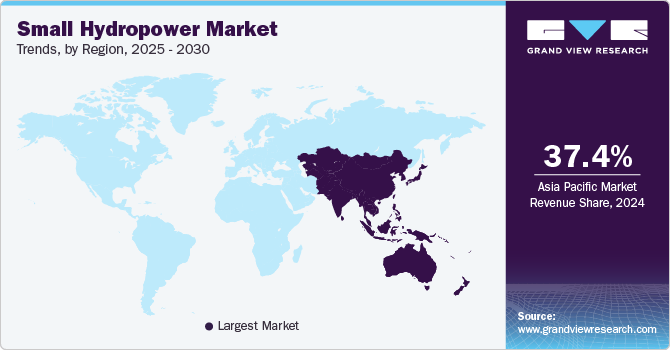

- The small hydropower market in Asia Pacific accounted for the largest revenue share of over 37.38% in 2024.

- China small hydropower market has been steadily expanding its small hydropower capacity as part of its strategy to diversify renewable energy sources and meet sustainability goals.

- Based on the type, the micro hydropower segment held the largest revenue share of 55.71% in 2024.

- Based on capacity, the up to 1 MW segment accounted for the highest revenue market share of over 55.0% in 2024.

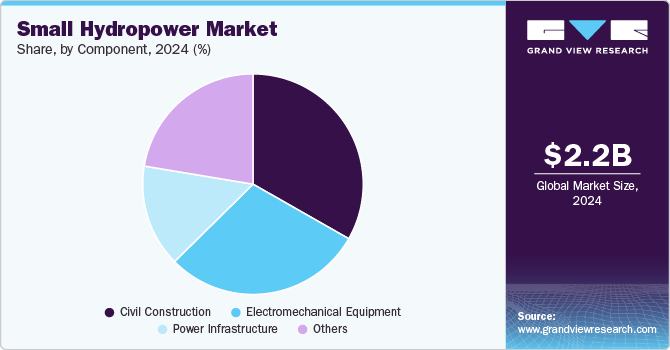

- Based on components, the civil construction segment accounted for the highest revenue share of 33.24% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.18 Billion

- 2030 Projected Market Size: USD 2.56 Billion

- CAGR (2025-2030): 2.8%

- Asia Pacific: Largest Market in 2024

Many governments are promoting small hydropower projects due to their low environmental impact, cost-effectiveness, and ability to provide a stable energy supply in remote areas. Additionally, supportive policies, tax incentives, and financial aid from organizations such as the World Bank and the International Renewable Energy Agency (IRENA) are encouraging investments in small-scale hydropower solutions. Technological advancements, including more efficient turbines and digital monitoring systems, are also enhancing the feasibility and attractiveness of small hydropower projects.

Governments worldwide are implementing supportive policies, including feed-in tariffs, subsidies, and tax incentives, to encourage investment in SHP projects. The rising need for rural electrification, particularly in developing regions, has further accelerated market growth. Small hydropower systems offer a reliable and cost-effective alternative to fossil fuel-based power generation, aligning with international sustainability goals and carbon reduction commitments.

Technological advancements have also played a crucial role in the expansion of the SHP market. Innovations in turbine efficiency, automation, and grid integration have improved the viability of small-scale hydropower projects. Additionally, modern SHP installations require lower capital investments and have shorter payback periods compared to large hydropower plants, making them attractive to investors and utilities. The ability of SHP projects to operate with minimal environmental impact further enhances their appeal in an era of heightened environmental consciousness and stricter regulatory frameworks.

Type Insights

Based on the type, the micro hydropower segment held the largest revenue share of 55.71% in 2024 and is expected to grow at the fastest CAGR of 3.8% during the forecast period. Governments and private entities are investing in micro hydropower projects to enhance rural electrification, particularly in remote areas where grid connectivity is limited. Advancements in turbine technology, coupled with favorable regulatory policies and financial incentives, are further accelerating market growth. Additionally, micro hydropower systems offer a cost-effective and sustainable alternative to fossil fuels, aligning with global decarbonization goals.

The mini hydropower segment is driven by increasing demand for decentralized renewable energy solutions and rural electrification initiatives. Governments and private investors are prioritizing mini hydropower projects due to their cost-effectiveness, lower environmental impact, and ability to provide stable, off-grid electricity in remote areas. Advancements in turbine technology and regulatory incentives further enhance the segment's growth, making mini hydropower a viable alternative to fossil fuel-based power generation. Additionally, the rising emphasis on energy security and sustainability goals continues to propel investment in this segment, strengthening its role in the global renewable energy landscape.

Capacity Insights

Based on capacity, the up to 1 MW segment accounted for the highest revenue market share of over 55.0% in 2024. This segment benefits from lower capital investment requirements, streamlined regulatory approvals, and shorter project development timelines compared to larger installations. Additionally, advancements in turbine efficiency and modular hydropower technologies enhance feasibility, while government incentives and policies supporting renewable energy adoption further accelerate growth. As industries and communities seek reliable, sustainable power sources, the sub-1 MW segment remains a key enabler of energy access and rural electrification initiatives.

The 1 MW to 10 MW capacity segment is driven by the increasing demand for decentralized renewable energy solutions, particularly in remote and off-grid areas. Governments and private investors are prioritizing this segment due to its ability to provide stable and sustainable electricity with minimal environmental impact.

Component Insights

Based on components, the civil construction segment accounted for the highest revenue share of 33.24% in 2024. This segment encompasses critical components such as dams, weirs, intake structures, penstocks, and powerhouses, all of which are essential for the efficient harnessing of hydropower potential. Advancements in engineering design, material innovation, and sustainable construction practices have significantly enhanced the durability and cost-effectiveness of these structures.

The electromechanical equipment segment is expected to expand at a CAGR of 3.9% over the forecast period. Major small hydropower plants have a trash rack cleaning machine, which removes material from water in order to avoid it entering plant waterways and damaging the electromechanical equipment or reducing hydraulic performance. In small hydropower, the electromechanical equipment costs vary from country to country depending upon the requirements affecting the investment costs that differ not only from country to country but also from region to region. In addition, the cost of various components of electro-mechanical equipment has been worked out as per prevailing rates based on runner diameter and capacity of the plant for different types of turbines and generators.

Regional Insights

North America small hydropower market is experiencing a resurgence as a clean, renewable energy source, particularly in regions with abundant water resources. Trends include an increased focus on environmental sustainability, with efforts to minimize ecological impacts through fish-friendly turbines and improved water management practices. There is also a push for the modernization of aging infrastructure, with many small hydropower projects being retrofitted or upgraded to enhance efficiency and performance. Additionally, government incentives and policies promoting clean energy are boosting the growth of small hydropower, especially in remote and off-grid areas, as part of broader efforts to transition to renewable energy sources.

U.S. Small Hydropower Market Trends

The small hydropower market in the U.S. is experiencing a resurgence as part of the broader push for renewable energy. Trends indicate an increased focus on modernizing existing infrastructure, such as retrofitting old dams with new technology to enhance efficiency and minimize environmental impact. Advances in turbine design, energy storage integration, and improved regulatory frameworks are enabling more small-scale projects to emerge, particularly in underserved rural and remote areas. Despite challenges related to permitting, environmental concerns, and fluctuating energy prices, the sector is poised for growth as part of the nation's transition to a cleaner energy grid.

Asia Pacific Small Hydropower Market Trends

The small hydropower market in Asia Pacific accounted for the largest revenue share of over 37.38% in 2024. The region benefits from increasing demand for renewable energy, rural electrification initiatives, and government support. Countries like China, India, and Vietnam are leading in SHP installations due to favorable policies, abundant water resources, and investment in sustainable infrastructure. Technological advancements, declining costs, and the need for energy security further propel market growth. However, challenges such as environmental concerns, regulatory hurdles, and high initial costs persist. The region continues to witness significant developments, with emerging markets contributing to the expansion of decentralized and off-grid small hydropower solutions.

China small hydropower market has been steadily expanding its small hydropower capacity as part of its strategy to diversify renewable energy sources and meet sustainability goals. In recent years, China has focused on improving the efficiency and environmental impact of these plants, while also addressing the challenges posed by the aging infrastructure of existing projects. The government's support for these technologies is evident in policy incentives, including subsidies and green bonds, and small hydropower plays a crucial role in the country's efforts to transition to a low-carbon energy system. However, concerns about the ecological impact and the displacement of local communities continue to be areas of focus

Europe Small Hydropower Market Trends

The small hydropower market in Europe is experiencing notable growth, particularly in the 1-10 MW capacity segment, which is projected to dominate the market due to increasing investments in decentralized energy projects. Countries like Norway, France, and Italy are leading this trend, driven by rural electrification initiatives and governmental support. For instance, the European Investment Bank has funded multiple small hydropower projects, including a significant investment for the construction of run-of-river plants in Italy.

Germany small hydropower market is expected to grow over the forecast period. In 2023, hydropower accounted for 4% of the country's total installed power generation capacity and 3% of total power generation. The sector is expected to see gradual growth, with projections indicating that by 2035, hydropower will account for 2% of total installed generation capacity. This trend is expected to continue to play a pivotal role in Germany's renewable energy landscape.

Central & South America Small Hydropower Market Trends

The small hydropower market in Central and South America is driven by increasing energy demands and supportive government policies. Brazil, as the largest hydropower producer in the region, leads the market with significant installed capacity and a reported 20% increase in small hydropower installations in 2024. The country's extensive water resources and favorable regulatory frameworks are key factors propelling this growth. Additionally, Chile is making strides with small and micro hydropower projects, which added 228 MW to its capacity recently, alongside larger initiatives like the Espejo de Tarapacá pumped storage facility that integrates solar energy.

Middle East & Africa Small Hydropower Market Trends

The small hydropower market in the Middle East & Africa is growing as the region has significant untapped hydropower potential, particularly in sub-Saharan Africa, where many countries are beginning to recognize the benefits of small-scale hydropower for rural electrification and energy security. For instance, projects initiated in countries like Kenya and Nigeria are aimed at enhancing local energy supply through small hydropower installations, contributing to both economic development and sustainability goals.

Challenges such as inadequate infrastructure and financing constraints have historically hindered the growth of small hydropower in the MEA region. However, recent initiatives by governments and international organizations are focusing on addressing these barriers. Investments are increasingly directed towards off-grid small hydropower solutions that cater to remote communities lacking access to centralized electricity networks. This trend is expected to drive the adoption of innovative technologies that enhance efficiency and reduce costs, making small hydropower a viable option for meeting local energy needs while supporting broader renewable energy targets.

Key Small Hydropower Company Insights

The global small hydropower market is characterized by intense competition. Key players such as ANDRITZ, Bharat Heavy Electricals Limited, FLOVEL Energy Private Limited, General Electric, Gilkes, Natel Energy, and Siemens Energy, among others, dominate the market with advanced components and robust supply chain networks. The competitive environment is further intensified by the entry of new players, partnerships, and collaborations. Regional players are leveraging government incentives to gain market share, while established companies focus on R&D, vertical integration, and scaling production to maintain their competitive edge.

-

In March 2024, the United Nations Industrial Organization (UNIDO) executed two small hydropower projects in Nigeria as part of over USD 10 million over a contract of over three years. The project aims to enhance energy accessibility and promote circular economy practices to address pollution and climate change in Nigeria.

Key Small Hydropower Companies:

The following are the leading companies in the small hydropower market. These companies collectively hold the largest market share and dictate industry trends.

- ANDRITZ

- Bharat Heavy Electricals Limited

- FLOVEL Energy Private Limited

- General Electric

- Gilkes

- Natel Energy

- Siemens Energy

- SNC Lavalin Group

- TOSHIBA CORPORATION

- Voith GmbH & Co.

Small Hydropower Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.22 billion

Revenue forecast in 2030

USD 2.56 billion

Growth rate

CAGR of 2.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, capacity, component, region

Regional scope

North America; Europe; Asia Pacific; Central & South America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; China; India; Japan; South Korea; Australia; Brazil; Colombia; Paraguay; Saudi Arabia, UAE; South Africa; Egypt

Key companies profiled

Siemens Energy; General Electric; Voith GmbH & Co. KGaA; TOSHIBA CORPORATION; FLOVEL Energy Private Limited; ANDRITZ; Natel Energy; Gilkes; Bharat Heavy Electricals Limited; SNC Lavalin Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Small Hydropower Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global small hydropower market report on the basis of type, capacity, component, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Micro hydropower

-

Mini hydropower

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 1 MW

-

1- 10 MW

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Civil Construction

-

Power Infrastructure

-

Electromechanical Equipment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Colombia

-

Paraguay

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global small hydropower market size was estimated at USD 2.18 billion in 2024 and is expected to reach USD 2.22 billion in 2025.

b. The global small hydropower market is expected to grow at a compounded annual growth rate of 2.8% from 2025 to 2030 to reach USD 2.56 billion by 2030.

b. The Asia Pacific dominated the small hydropower market with the highest share of 37.38% in 2024. Factors such as versatility, low investment costs, and a large supply of water resources in the region support the growth of the market during the forecast period.

b. Some key players operating in the small hydropower market include Siemens Energy, General Electric, Voith GmbH & Co. KGaA, TOSHIBA CORPORATION , FLOVEL Energy Private Limited, ANDRITZ, Natel Energy, Gilkes

b. Key factors driving the small hydropower market growth include financial investments, rural electrification, & policy initiatives in small hydropower projects in response to climate change that will drive the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.