- Home

- »

- Advanced Interior Materials

- »

-

Small Gas Engine Market Size, Share & Growth Report, 2030GVR Report cover

![Small Gas Engine Market Size, Share & Trends Report]()

Small Gas Engine Market (2025 - 2030) Size, Share & Trends Analysis Report By Engine Displacement (20-100 CC, 101-450 CC), By Equipment (Lawnmower, Portable), By Application (Construction, Gardening), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-348-2

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Small Gas Engine Market Summary

The global small gas engine market size was estimated at USD 3,514.1 million in 2024 and is projected to reach USD 4,772.1 million by 2030, growing at a CAGR of 5.4% from 2025 to 2030. The market is experiencing robust growth driven by the rising demand for outdoor power equipment, such as lawnmowers, chainsaws, trimmers, and portable generators.

Key Market Trends & Insights

- North America accounted for the largest share of the global market and accounted for 71.37% of the market in 2023.

- The market in the U.S. is estimated to grow at a significant CAGR of 5.9% over the forecast period.

- By equipment, the lawnmower equipment segment led the market and accounted for over 35% of the global market revenue share in 2023.

- By engine displacement, the 101 cc to 400 cc engine displacement segment led the market, accounting for 43.0% of the global market revenue share in 2023.

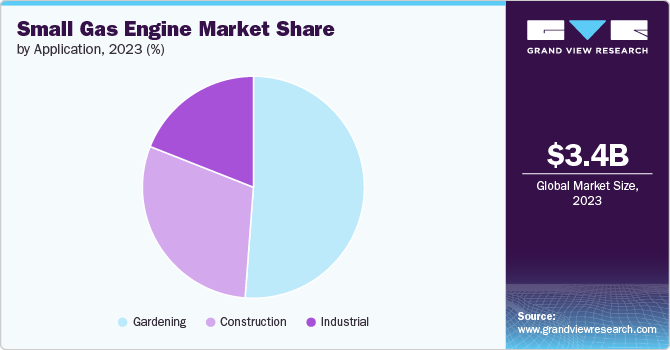

- By application, the gardening segment accounted for 48.7% of the global market revenue share in 2023.

Market Size & Forecast

- 2024 Market Size: USD 3,514.1 Million

- 2030 Projected Market Size: USD 4,772.1 Million

- CAGR (2024-2030): 5.4%

- North America: Largest market in 2023

Further, the growing construction industry, particularly in emerging markets, is fueling the demand for the market. Additionally, the increasing popularity of gardening and landscaping has boosted the demand for lawnmowers and other small gas-powered tools. Small gas engines power a variety of construction equipment, such as concrete mixers, compactors, and portable generators. The growth in construction activities, particularly in emerging markets, has fueled the demand for small, reliable, and fuel-efficient gas-powered tools and equipment.

Moreover, the increasing preference for gardening activities and the rising need for efficient and cost-effective gardening tools have been major drivers for the small gas engines market. Small gas-powered lawnmowers, trimmers, chainsaws, and leaf blowers are in high demand for residential and commercial landscaping and lawn care.

The demand for small gas engines is further fueled by technological advancements in engine design and efficiency and the increasing focus on reducing emissions and improving fuel economy. The growth of outdoor recreational activities and the expansion of the construction sector are also expected to contribute to market growth.

Drivers, Opportunities & Restraints

The small gas engine market is driven by several factors, including the increasing demand for gardening and landscaping activities, the growth of the construction industry, and the rising need for portable power solutions. The demand for high-performance and fuel-efficient small gas engines in residential, commercial, and industrial applications is also contributing to market growth. Furthermore, advancements in engine technology and the development of low-emission and high-efficiency engines present significant opportunities for market expansion.

However, the market also faces restraints such as the increasing competition from battery-powered and electric alternatives, which are gaining popularity due to their lower environmental impact and reduced operational costs. Additionally, stringent emissions regulations and the fluctuating prices of raw materials used in engine manufacturing may pose challenges to market growth.

Despite these challenges, there are numerous opportunities for growth, particularly with the increasing focus on sustainable and energy-efficient solutions and the expansion of industries such as construction and landscaping in emerging economies.

Equipment Insights

“The demand for lawnmower equipment segment is expected to grow at a significant CAGR of 5.6% from 2024 to 2030 in terms of revenue”

The lawnmower equipment segment led the market and accounted for over 35% of the global market revenue share in 2023. Lawnmowers require small, lightweight, and fuel-efficient engines, which makes small gas engines ideal for this application. Small gas engines are commonly used to power lawnmowers due to their portability, power, and environmental benefits compared to larger engines. Moreover, the surge in demand for lawnmowers is driven by the rising popularity of outdoor living, increasing environmental awareness, and the growing need to enhance the aesthetic appeal of properties through landscaping.

Portable generators are a major application for small gas engines, as they require compact, lightweight, and fuel-efficient power sources. Small gas engines are well-suited for powering portable generators used in construction, industrial, and gardening. The increasing frequency of power outages, especially in emerging markets such as China and India, has led to a surge in demand for portable generators as backup power sources. Small gas-powered generators provide a reliable and convenient solution during grid failures or natural disasters.

Engine Displacement Insights

“The demand for 20-100 CC engine displacement segment is expected to grow at a significant CAGR of 5.3% from 2024 to 2030 in terms of revenue”

The 101 cc to 400 cc engine displacement segment led the market, accounting for 43.0% of the global market revenue share in 2023. The increasing adoption of these engines is driven by their efficiency, versatility, and ability to power a wide range of equipment. These engines are widely used in lawnmowers, generators, and other equipment for residential, commercial, and industrial applications.

The 20 cc to 100 cc engine displacement segment is also expected to witness significant growth due to its use in lightweight and portable equipment such as chainsaws and trimmers. These engines are commonly used in gardening and landscaping applications.

Application Insights

“The demand for construction application segment is expected to grow at a significant CAGR of 6.5% from 2024 to 2030 in terms of revenue”

The gardening segment accounted for 48.7% of the global market revenue share in 2023. Small gas engines are extensively used in gardening equipment such as lawnmowers, chainsaws, and trimmers. The growing demand for efficient and reliable gardening tools is driving the adoption of small gas engines in this segment.

The construction industry is another significant application segment, utilizing small gas engines for various equipment such as concrete mixers, pressure washers, and portable generators. The growth of the construction sector and the increasing demand for portable power solutions are propelling the demand for small gas engines in the construction segment.

Regional Insights

“U.S. to witness fastest market growth at 5.9% CAGR”

The market in North America is driven by the presence of well-established gardening and landscaping industries and the increasing focus on home improvement and outdoor recreational activities. The growing adoption of advanced and efficient gardening tools and the rising trend of DIY gardening projects are contributing to the market growth in this region.

The U.S. Small Gas Engine Market Trends

The market in the U.S. is estimated to grow at a significant CAGR of 5.9% over the forecast period. The market is driven by the high homeownership rate and the increasing demand for outdoor power equipment. Most consumers in the U.S. often invest in lawnmowers, trimmers, and other tools powered by small gas engines to maintain their properties. The construction industry is also a major driver of small gas engine demand, as these engines are used to power a variety of equipment such as portable generators, concrete mixers, and pressure washers.

Asia Pacific Small Gas Engine Market Trends

The Asia Pacific region is witnessing substantial growth in the market, particularly in countries such as China and Japan. In China, the frequent power outages, especially in rural areas, have led to a surge in demand for portable generators powered by small gas engines to provide backup power during emergencies. Additionally, the construction industry in China, driven by infrastructure development and urbanization, is a major consumer of small gas-powered equipment. Further, in Japan, the focus on technological advancements and eco-friendly products has driven the adoption of small gas engines with improved fuel efficiency and reduced emissions.

Europe Small Gas Engine Market Trends

The market in Europe, particularly in the United Kingdom, is also on the rise. In the UK, there is a significant demand for landscaping and gardening services, which drives the need for small gas-powered equipment such as lawn mowers, trimmers, and leaf blowers. The construction industry in the UK, encompassing both residential and commercial sectors, is another key driver, as small gas engines are essential for powering tools and equipment used in construction activities. Moreover, the European Union's focus on reducing emissions and promoting energy efficiency has led to increased adoption of small, fuel-efficient gas engines that comply with environmental regulations.

Key Small Gas Engine Company Insights

Some of the key players operating in the market include Briggs & Stratton Corporation, Honda Motor Co., Ltd., and Kohler Co., among others.

-

Briggs & Stratton Corporation is a leading manufacturer of small engines, offering a wide range of high-performance and reliable engines for various applications. The company's focus on innovation and advanced technology has solidified its position in the market. Briggs & Stratton's small gas engines are known for their durability, efficiency, and ease of use.

-

Kohler Co. is a major player in the small gas engines market, offering a wide range of engines for various applications such as gardening equipment, construction tools, and portable generators. As one of the key manufacturers, Kohler provides reliable and efficient small gas engines that meet stringent emissions regulations. The company's commitment to innovation has led to the development of eco-friendly engine technologies, enabling it to stay competitive in the rapidly evolving small gas engines market.

Generac Power Systems, Inc., Lifan Power USA, Kipor Power are some of the emerging market participants in the market.

-

Generac Power Systems is a leading manufacturer of backup power generation products, including a wide range of small gas engines used in portable generators, construction equipment, and outdoor power tools. The company's small gas engines are known for their reliability, fuel efficiency, and compliance with stringent emissions regulations. Generac has expanded its product line to include modular paralleling systems, automatic transfer switches, and innovative technologies such as its PWRcell solar and battery storage solutions.

-

Kipor Power is a leading manufacturer of small gas engines and power equipment. The company offers a diverse range of small gasoline engines that are widely used in outdoor power tools, portable generators, and construction equipment. Moreover, small gas engines are known for their fuel efficiency, low emissions, and reliable performance, meeting the stringent environmental regulations in key markets. The company's product portfolio includes single-cylinder and twin-cylinder engines ranging from 3 to 25 horsepower, catering to a variety of applications.

Key Small Gas Engine Companies:

The following are the leading companies in the small gas engine market. These companies collectively hold the largest market share and dictate industry trends.

- Briggs & Stratton

- Kohler Energy

- Yamaha Motor Co., Ltd.

- Kawasaki Heavy Industries

- KUBOTA Corporation.

- Liquid Combustion Technology, LLC

- Kipor Power

- Champion Power Equipment

- SUBARU CORPORATION

- Lifan Power USA

- MARUYAMA MFg.,Co. Inc.

- American Honda Motor Co., Inc.

- Fuji Electric Co., Ltd.

- BISON Machinery

- Generac Power Systems, Inc.

Recent Developments

-

In January 2024, Northern Tool + Equipment launched NorthStar Engines, ranging from 180cc to 825cc. This new engine lineup allows the company to bring increased durability, power, and reliability to its customers by incorporating the engines into various product lines, including pressure washers, air compressors, log splitters, and NorthStar Generators.

-

In January 2023, Briggs & Stratton consolidated its engine-component production by moving operations from its Wauwatosa, Wisconsin facility to its existing plant in Auburn, Alabama. This consolidation resulted in the layoff of 160 workers at the Wauwatosa plant. Briggs & Stratton cited cost savings as the reason for this move, stating that it will minimize streamline processes, freight costs, and allow the company to build products faster.

Small Gas Engine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,675.8 million

Revenue forecast in 2030

USD 4,772.1 million

Growth Rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, engine displacement, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Briggs & Stratton; Kohler Energy; Yamaha Motor Co., Ltd.; Kawasaki Heavy Industries; KUBOTA Corporation.; Liquid Combustion Technology, LLC; Kipor Power; Champion Power Equipment; SUBARU CORPORATION; Lifan Power USA; MARUYAMA MFg., Co.Inc.; American Honda Motor Co., Inc. ; Fuji Electric Co., Ltd.; BISON Machinery; Generac Power Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Small Gas Engine Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global small gas engine market report based on equipment, engine displacement, application, and region:

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Lawnmower

-

Portable Generator

-

Leaf Blower

-

Pressure Washer

-

Chainsaw

-

Others

-

-

Engine Displacement Outlook (Revenue, USD Million, 2018 - 2030)

-

20-100 CC

-

101-450 CC

-

451- 650 CC

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Gardening

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the small gas engine market include Briggs & Stratton, Kohler Energy, Yamaha Motor Co., Ltd., Kawasaki Heavy Industries, KUBOTA Corporation., Liquid Combustion Technology, LLC, Kipor Power, Champion Power Equipment, SUBARU CORPORATION, Lifan Power USA, MARUYAMA MFg.,Co.Inc., American Honda Motor Co., Inc. , Fuji Electric Co., Ltd., BISON Machinery, Generac Power Systems, Inc.

b. The small gas engine market is experiencing robust growth driven by the rising demand for outdoor power equipment, such as lawnmowers, chainsaws, trimmers, and portable generators. Further, the growing construction industry, particularly in emerging markets, is fueling the demand for small gas engine market.

b. The global small gas engine market size was estimated at USD 3.37 billion in 2023 and is expected to reach USD3.51 billion in 2024.

b. The small gas engine market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 4.77 billion by 2030.

b. North America dominated the small gas engine market with a revenue share of 71.2% in 2023. The small gas engine market in North America is driven by the presence of well-established gardening and landscaping industries and the increasing focus on home improvement and outdoor recreational activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.