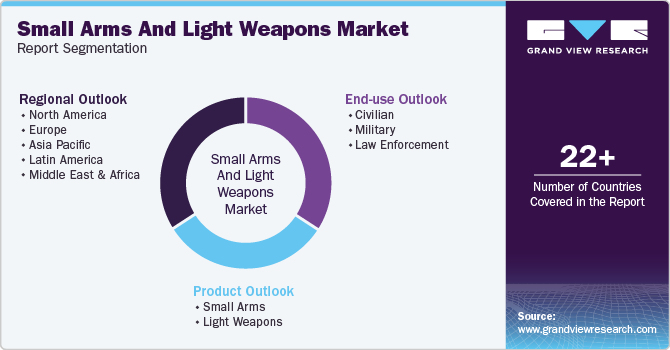

Small Arms And Light Weapons Market Size, Share & Trends Analysis Report By Product (Small Arms, Light Weapons), By End-use (Civilian, Military, Law Enforcement), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-276-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

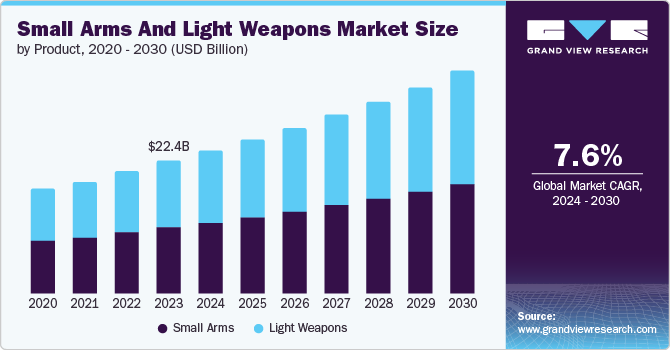

The global small arms and light weapons market size was valued at USD 22.39 billion in 2023 and is projected to grow at a CAGR of 7.6% from 2024 to 2030. The global market for small arms and light weapons (SALW) market is driven by the rising threats of terror attacks leading to increased adoption of arms by civilians, particularly in developed countries such as the U.S. In addition, increasing investment by the government in developing countries for the development of military and police forces to provide them extra protection is significantly driving the market growth.

Geopolitical tensions and conflicts around the world continue to drive the demand for these weapons. In regions experiencing instability, such as parts of the Middle East, Africa, and Eastern Europe, both state and non-state actors seek to acquire small arms for self-defense, law enforcement, and military operations. The proliferation of conflicts and the presence of armed groups necessitate the acquisition of these weapons to maintain security and stability, further fueling the market. The increasing crime rates and concerns about personal security in various parts of the world contribute significantly to the growing demand for SALW. In some countries, the perception of insufficient law enforcement and a rising threat of violence have led civilians to purchase firearms for self-defense. This trend is particularly noticeable in regions with high crime rates or where there is a lack of trust in local security forces. The desire for personal protection and the right to bear arms in certain countries have also increased civilian ownership of small arms.

The rising threats of terrorism globally are also one of the key driving factors for the market expansion. Netizens and military personals are preferring SALW due to its convenience of carrying and ease of using is driving the market growth. Lastly, advancements in manufacturing technologies, including 3D printing and modular weapon systems, have made small arms more accessible and customizable. This technological evolution allows for easier production and distribution, allowing smaller manufacturers and individuals to enter the market. This ease of access can lead to increased proliferation and diversification of available weapon types, catering to a broader range of consumers and further driving demand.

Product Insights

The light weapons segment is held the largest market revenue share of 50.0% in 2023. The rising need for self-defense and security, particularly in regions experiencing political instability or high crime rates, is contributing to this demand. Additionally, military modernization programs and defense spending are contributing to this demand as armed forces seek to upgrade their equipment with more advanced, lightweight, and versatile weapons. The increasing popularity of shooting sports and recreational activities also plays a role, as enthusiasts seek high-quality and reliable firearms.

The small arms segment is expected to grow significantly over the forecast period. Rising concerns over personal safety and security have led individuals to seek firearms for self-defense purposes. Additionally, the growing interest in shooting sports and hunting activities has spurred demand for small arms among enthusiasts. Military and law enforcement agencies are also significant consumers, driven by modernization programs and the need to equip personnel with advanced firearms.

End-use Insights

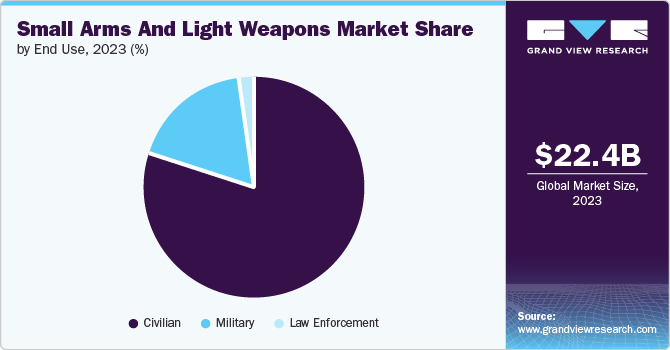

The civilian segment held the largest market revenue share in 2023. The rising interest in personal safety and self-defense prompts more individuals to purchase firearms for protection. Additionally, recreational activities such as sport shooting and hunting have gained popularity, further fueling demand. Changes in legislation in various regions have also influenced the market, either by easing restrictions on firearm ownership or by creating uncertainties that prompt consumers to buy weapons in anticipation of future restrictions.

The law enforcement segment is projected to grow with the fastest CAGR over the forecast period. The growing need for enhanced security measures in response to increasing crime rates and terrorism threats. Law enforcement agencies are investing in advanced weaponry to equip officers with more effective tools for crime prevention and public safety. Additionally, the modernization and expansion of police forces in various regions and government initiatives to support law enforcement contribute to this growing demand.

Regional Insights

North America dominated the market in 2023 accounting for a market revenue share of 43.3%. The growing popularity of shooting sports and outdoor activities has led to a rise in gun ownership as enthusiasts seek firearms for recreational purposes. Additionally, concerns over civil unrest and social instability have heightened interest in personal security, prompting more individuals to purchase firearms for protection. The rise in home defense awareness, partly fueled by marketing from firearms manufacturers, has also contributed to the trend.

U.S. Small Arms And Light Weapons Market Insights

The U.S. held a significant market revenue share in 2023. Heightened concerns over personal safety, especially in urban areas, have led many Americans to purchase firearms for self-defense. The growth of shooting sports and hunting as popular recreational activities in the U.S. continues to sustain and increase demand for a wide range of firearms and related equipment.

Europe Small Arms And Light Weapons Market Insights

The European market is projected to grow rapidly in the coming years. The growing interest in recreational shooting sports and hunting is expanding the civilian market for firearms. Another significant driver is the modernization of military and law enforcement equipment, as many European nations are investing in more advanced, lightweight, and versatile weaponry. Finally, the influence of international arms trade agreements and the availability of surplus military equipment have made these weapons more accessible, thereby boosting demand across the continent.

The UK market is projected to increase over the forecast period. The UK has experienced heightened concerns around rural crime, leading farmers and landowners to seek firearms for protection against theft and poaching. Moreover, changes in UK legislation, such as adjustments to the licensing process, have made it more accessible for individuals to acquire firearms legally.

Asia Pacific Small Arms And Light Weapons Market Insights

Asia Pacific is projected to grow at the fastest CAGR over the forecast period. The ongoing security concerns and regional conflicts in certain areas heighten the need for defense and law enforcement agencies to upgrade and expand their arsenals. Additionally, the growing economies in countries such as India and China are increasing their defense budgets, which includes investments in modernizing their military and police forces. Moreover, the rise in private security services and civilian ownership for personal protection contributes to this demand.

China held a significant market revenue share in 2023. China's increasing investment in defense and security, driven by its growing concerns over regional security threats and internal stability, plays a crucial role. The Chinese government's modernization efforts for its armed forces and law enforcement agencies also contribute significantly to this demand. Additionally, China's expansive international arms trade activities, particularly with developing countries, have boosted the production and development of these weapons.

Japan is projected to grow at the fastest CAGR over the forecast period. Japan's strategic focus on enhancing its self-defense capabilities amidst regional security challenges has led to a modernization of its self-defense forces, including the acquisition of advanced weaponry. Another factor is the growth of shooting sports and recreational activities, which has spurred interest in legally permissible firearms and replicas for training and hobby purposes.

Key Small Arms And Light Weapons Company Insights

Some of the key companies in the global small arms and light weapons (SALW) market include Heckler & Koch; Colt; Beretta USA Corp.; FN HERSTAL; Glock, Inc.; and others.

-

Kalashnikov Concern JSC Kalashnikov Concern JSC, is a Russian defense manufacturer, that offers a diverse range of small arms and light weapons (SALW) products. These include civilian firearms such as rifles, shotguns, and handguns, designed for legal civilian use in self-defense, hunting, and sport shooting.

-

Beretta USA Corp. provides a wide range of firearms, including shotguns such as the A400 Xtreme PLUS and A300 Ultima. They also manufacture pistols such as the 92XI and 3032 Tomcat. And their rifles category includes the BRX1. Their classic 92FS Brigadier and modern M9A4 Centurion pistols are widely famous in the world.

Key Small Arms And Light Weapons Companies:

The following are the leading companies in the small arms and light weapons market. These companies collectively hold the largest market share and dictate industry trends.

- Heckler & Koch

- Colt

- Beretta USA Corp.

- FN HERSTAL

- Glock, Inc.

- Kalashnikov Concern JSC

- RemArms LLC.

- KNDS France

- SIG SAUER

- General Dynamics Corporation

- Smith & Wesson

- DASAN MACHINERIES CO., LTD.

Recent Developments

- In November 2022, Colt announced a partnership with Jordan Armament and Weapon Systems (JAWS) to co-produce handguns and rifles in Jordan. This collaboration aims to support Jordan's defense industry by localizing manufacturing. The agreement, signed during the SOFEX conference in Aqaba, also involves Colt's expertise in making small arms lighter and marketing them in the Middle East.

Small Arms And Light Weapons Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 24.14 billion |

|

Revenue forecast in 2030 |

USD 37.50 billion |

|

Growth Rate |

CAGR of 7.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Vietnam, Philippines, Thailand, Indonesia, Brazil, Argentina, Saudi Arabia, UAE, Qatar, Israel. |

|

Key companies profiled |

Heckler & Koch; Colt; Beretta USA Corp.; FN HERSTAL; Glock, Inc.; Kalashnikov Concern JSC; RemArms LLC.; KNDS France; SIG SAUER; General Dynamics Corporation; Smith & Wesson; DASAN MACHINERIES CO., LTD. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Small Arms And Light Weapons Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the small arms and light weapons market report based on product, end-use, and region.

-

Product Outlook (Revenue, USD Million, Volume in Units, 2018 - 2030)

-

Small Arms

-

Pistols & Revolvers

-

Bolt-action Rifles & Carbines

-

Submachine Guns

-

Assault Rifles

-

Light Machine Guns

-

-

Light Weapons

-

Heavy Machine Guns

-

Under-barrel & Mounted Grenade Launchers

-

Portable Anti-tank Guns

-

Recoilless Guns

-

Portable Launchers & Rocket Systems

-

-

-

End-use Outlook (Revenue, USD Million, Volume in Units, 2018 - 2030)

-

Civilian

-

Military

-

Law Enforcement

-

-

Regional Outlook (Revenue, USD Million, Volume in Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Philippines

-

Thailand

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Qatar

-

Israel

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."