- Home

- »

- Medical Imaging

- »

-

Small Animal Imaging Market Size And Share Report, 2030GVR Report cover

![Small Animal Imaging (In-vivo) Market Size, Share & Trends Report]()

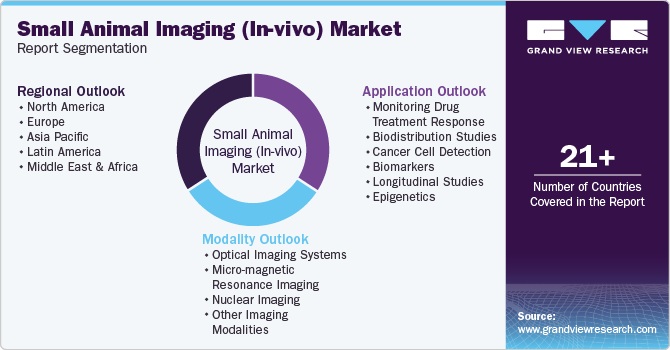

Small Animal Imaging (In-vivo) Market Size, Share & Trends Analysis Report By Modality (Optical Imaging Systems, Micro-magnetic Resonance Imaging, Nuclear Imaging), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-645-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Small Animal Imaging (In-vivo) Market Trends

The global small animal imaging (in-vivo) market size was valued at USD 1.12 billion in 2023 and is projected to grow at a CAGR of 7.7% from 2024 to 2030. The market growth is attributed to the growing need for small animal imaging, which is used to monitor treatment response, determine drug delivery, detect cancer cells, and more. The market growth is also due to increased investments by organizations in preclinical research and technological advancement, such as high-resolution MRI and other imaging methods. Furthermore, a rise in the number of research-based organizations and pharmaceutical institutes has also resulted in the growth of this market.

There is a growing demand for preclinical research using small animals to develop new drugs. Research on small animals allows efficient and safer testing to proceed to human trials. There is an increased demand for noninvasive research procedures to minimize animal harm. Furthermore, small animal imaging allows researchers to develop new treatment methods for early disease diagnosis. Hence, these factors are responsible for the increase in the growth of the small animal imaging (in-vivo) market.

Furthermore, the growth in the pharmaceutical and clinical research sector has increased the demand for high-end equipment required for clinical research. This has increased demand for high-resolution modalities, in-vivo imaging devices, and real-time data storage options. There has been an increase in regulatory body approvals for treatments and preclinical research. Furthermore, increased investment by the government and major market players has resulted in the growth of this market.

Modality Insights

The optical imaging systems segment dominated the market in 2023, with a share of 38.5%. This growth was attributed to the increased demand for accurate and noninvasive optical imaging methods required for preclinical research. Optical imaging systems allow for repeated imaging studies to track disease progression and treatment response, as the technique used in these systems is typically noninvasive or minimally invasive. This assures minimal stress on the animal bodies. Hence, these reasons have contributed to the positive market growth of this segment.

The micro-magnetic resonance imaging (micro-MRI) segment is expected to witness a CAGR of 8.1% during the forecast period. This market growth is attributed to the system functionality, noninvasiveness, and high-resolution properties. Micro-MRI provides images with a high resolution, allowing researchers to visualize details in small animals on a cellular level. Furthermore, micro-MRI provides noninvasive imaging, allowing researchers to repeat imaging studies without harming animals. Therefore, these factors are responsible for the market growth of this segment.

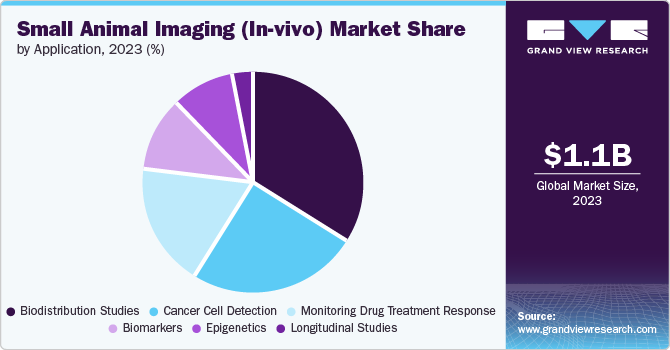

Application Insights

The biodistribution studies segment dominated the market in 2023, with a share of 33.8%. Biodistribution studies with small animal imaging give necessary inputs into drug interactions with the body. Drug movement, along with its absorption, distribution, and excretion, is studied with the help of biodistribution. Advancements in small animal imaging techniques with higher specificity are aiding in increasing accuracy in biodistribution studies. These factors are responsible for the market growth of this segment.

The cancer cell detection segment is expected to grow at a CAGR of 8.3% during the forecast period. The market growth was due to the rise in the prevalence of cancer diseases and the increase in the number of targeted cancer therapies. Demand for the development of new diagnoses and therapies has increased the use of small animal imaging in cancer research. This allows researchers to study the development of cancer tissues and their response to treatment. Therefore, these factors are responsible for the market growth of the segment.

Regional Insights

North America dominated the small animal imaging (in-vivo) market, with a market share of 35.9% in 2023. This growth was attributed to the pharmaceutical and medical research sector developed in this region. Heavy investments by the key market players in the research and development of new drugs and therapies have increased the demand for small animal imaging techniques. Government funding and a favorable regulatory environment have increased the demand for small animal imaging devices for preclinical research purposes.

U.S. Small Animal Imaging (In-vivo) Market Trends

The U.S. dominated the North American market in 2023 with a market share of 79.9%. The factors responsible for the market growth in the country are the presence of leading research institutes, colleges, and medical companies. Heavy investments by major private companies in developing new drugs and therapies have increased demand for small animal imaging devices. Moreover, Increased funding by the government for medical research has also increased the demand for small animal imaging devices.

Europe Small Animal Imaging (In-vivo) Market Trends

Europe small animal imaging (in-vivo) market was identified as a lucrative region in this industry in 2023. This growth increased the demand for preclinical research to develop new drugs and therapies. Government investment in research and development has increased the demand for technologically advanced imaging devices to observe and study animals and their treatment responses. Furthermore, biotechnological and pharmaceutical institutes have increased the rate of research programs to develop new drugs with better efficiency and fewer side effects.

The UK Small animal imaging (in-vivo) market is expected to increase due to the presence of developed pharmaceutical and medical infrastructure and the rise in preclinical research regarding cancer treatment and other diseases. Furthermore, increased government funding for studying drugs and therapies has increased demand for small animal imaging devices.

Asia Pacific Small Animal Imaging (In-vivo) Market Trends

Asia Pacific had a market share of 22.6% in 2023 owing to the development in the healthcare sector and the region's overall economic growth. There is also growth in the research sector due to heavy investments from government and private investors. Furthermore, the rising prevalence of cancer and other diseases has increased the demand for research facilities. These reasons have contributed to the growth of the small animal imaging market.

Due to significant manufacturing facilities and growing demand for preclinical cancer research facilities, China held a substantial market share in the small animal imaging (in-vivo) market. This has resulted in increased expenditures by the government and other companies to develop new drugs, which has contributed to the market growth in this country.

Key Small Animal Imaging (In-vivo) Company Insights

Some of the major companies in the small animal imaging (in-vivo) market are Aspect Imaging Ltd, PerkinElmer, Inc., FUJIFILM Holdings Corporation, and Miltenyi Biotec, among others. Companies are focusing on developing products that can aid in the research and diagnostics through technological advancements, mergers and acquisitions.

-

PerkinElmer, Inc. is a company specializing in precision optics. The company deals with sectors such as computer systems, diagnostics, life science research, food, environmental and industrial testing. Furthermore, the company manufactures analytical instruments, genetic testing, medical imaging, software, and instruments.

-

Miltenyi Biotec is a biotechnology company that provides products and services for clinical researchers, scientists to use in research, translational research, and clinical applications. The services include spatial biology, sample separation, clinical applications, and small animal imaging.

Key Small Animal Imaging (In-vivo) Companies:

The following are the leading companies in the small animal imaging (in-vivo) market. These companies collectively hold the largest market share and dictate industry trends.

- Aspect Imaging Ltd.

- PerkinElmer, Inc.

- FUJIFILM Holdings Corporation

- Miltenyi Biotec

- Thermo Fisher Scientific Inc.

- Bruker

- Siemens AG

- Promega Corporation

- Mediso

Recent Developments

-

In February 2024, Bruker a company manufacturing scientific instruments announced the acquisition of Special Instruments Imaging LLC, a preclinical in-vivo optical imaging systems company. The acquisition filled the gap in technology and product portfolio of Bruker BioSpin Preclinical Imaging division.

Small Animal Imaging (In-vivo) Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.20 billion

Revenue forecast in 2030

USD 1.87 billion

Growth Rate

CAGR of 7.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 – 2022

Forecast period

2024 – 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Aspect Imaging Ltd., PerkinElmer, Inc., FUJIFILM Holdings Corporation, Miltenyi Biotec, Thermo Fisher Scientific Inc., Bruker, Siemens AG, Promega Corporation, Mediso

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Small Animal Imaging (In-vivo) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global small animal imaging (in-vivo) market report based on modality, application, and region.

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Optical Imaging Systems

-

Bioluminescence Imaging

-

Cerenkov Luminescence Imaging

-

Fluorescence Imaging

-

-

Micro-magnetic Resonance Imaging

-

Nuclear Imaging

-

Micro Positron Emission Tomography (Micro PET)

-

Micro Single Photon Emission Computerized Tomography (Micro SPECT)

-

-

Other Imaging Modalities

-

Micro Computerized Tomography Imaging

-

Micro Ultrasound Imaging

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Monitoring Drug Treatment Response

-

Biodistribution Studies

-

Cancer

-

Cell Detection

-

Biomarkers

-

Longitudinal Studies

-

Epigenetics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."