- Home

- »

- Plastics, Polymers & Resins

- »

-

Slip Additives Market Size, Share & Growth Report, 2030GVR Report cover

![Slip Additives Market Size, Share & Trends Report]()

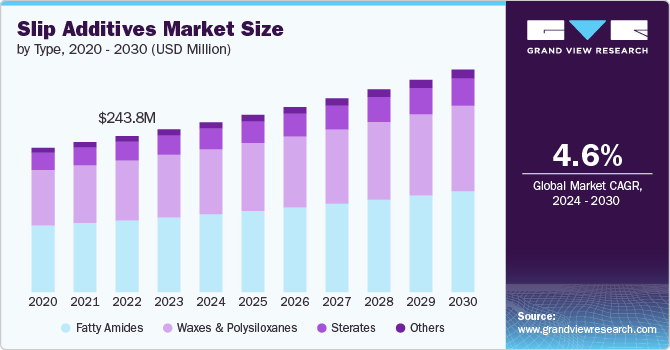

Slip Additives Market Size, Share & Trends Analysis Report By Type (Fatty Amides, Waxes & Polysiloxanes, Sterates), By Carrier Resin (LDPE, LLDPE, HDPE), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-355-2

- Number of Report Pages: 119

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Slip Additives Market Size & Trends

The global slip additives market size was estimated at USD 254.27 million in 2023 and is estimated to grow at a CAGR of 4.6% from 2024 to 2030. Increasing demand for high-quality packaging materials and the need for enhanced operational efficiency in the packaging processes are some of the market drivers.The market’s growth is primarily fueled by the booming packaging industry, especially in sectors like food & beverages, consumer goods, and pharmaceuticals.

The consumer goods industry requires packaging materials that not only preserve the quality and integrity of products but also facilitate smoother processing and transportation. Slip additives improve the anti-friction properties of packaging films, making them easier to handle, fill, and pack. As operational efficiency and product safety become paramount, the demand for effective slip additives in packaging materials is witnessing a significant surge. This trend is further supported by materials science advancements that enhance slip additives' performance and environmental sustainability.

Drivers, Opportunities & Restraints

The primary market driver is the rapidly expanding packaging industry. With rising e-commerce sales expansion, demand for durable and efficient packaging solutions is expected to increase soon. This will also ensure product safety during transit. Slip additives play a crucial role in enhancing the performance of plastic films used in packaging, improving their handling, and reducing friction.

The stringent regulatory landscape regarding the use of chemicals in packaging materials is expected to hinder the market's growth. Environmental concerns and health hazards associated with certain additives have led to increased scrutiny by regulatory bodies worldwide. Compliance with these regulations requires significant investment in research and development to formulate environmentally friendly and safe slip additives.

The shift towards sustainable and biodegradable packaging materials presents a substantial opportunity for the market. Consumers and regulators increasingly favor eco-friendly packaging options, so the industry is pressured to innovate and adopt green practices. This is expected to provide a push for developing new, environmentally friendly slip additives that can be incorporated into biodegradable films.

Type Insights

Fatty amides held the largest revenue share of over 46.0% in 2023. Fatty amides are expected to observe growing demand in the packaging industry, particularly in the manufacturing of polyolefin films. Derived from natural sources, fatty amides, such as erucamide and oleamide, are preferred for their biocompatibility and effectiveness in reducing friction between film layers. They migrate to the surface of the plastic film over time, creating a lubricating layer that facilitates better handling and processing of the packaging material.

Demand for waxes, including polyethylene and montan ester, is expected to increase on account of their ability to provide a smooth finish and enhance the film's resistance to abrasion and sticking. Polysiloxanes, or silicone-based additives, offer exceptional lubricity and thermal stability, making them ideal for high-temperature applications. Waxes and polysiloxanes can be engineered to provide immediate and long-lasting slip properties.

End Use Insights

Packaging end use held the largest revenue share of 79.90% in 2023. Packaging end use is expected to observe growing demand on account of the diverse properties of slip additives, such as enhanced product appeal, longevity, and functional efficiency. Slip additives are used in plastic films and packaging materials to reduce friction between layers, thus enabling smoother handling and processing. In the food packaging industry, slip additives ensure that films do not stick together during production and storage, preserving the quality and ease of access to the products.

Non-packaging is expected to grow at the fastest CAGR during the forecast period. The non-packaging end uses include automotive, construction, and electronics, among others. In the automotive sector, additives are used to improve resistance to wear and tear in interior parts. In the construction industry, slip additives are integrated into materials to enhance the durability and ease of maintenance of flooring and wall coverings. In electronics, additives are used in cable manufacturing, where they improve the insulation properties and flexibility of cables.

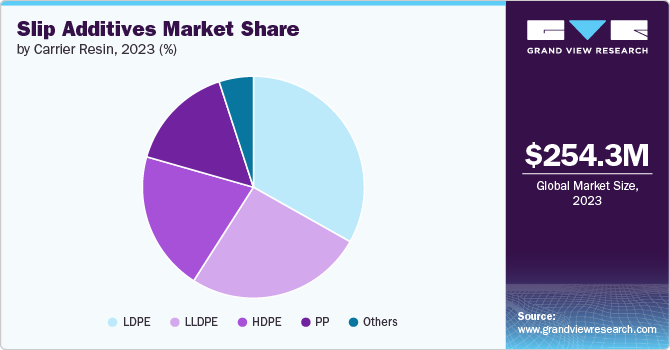

Carrier Resin Insights

LDPE held the largest revenue share of over 33% in 2023. LDPE's characteristics, such as flexibility, transparency, and resistance to moisture, make it suitable for producing films used in food packaging, consumer goods, and agricultural products. Slip additives are crucial in enhancing LDPE's processing and End Use performance, particularly by minimizing friction and blocking issues that can arise during film production and use.

HDPE's superior properties, including its strength, durability, and chemical resistance, make it suitable for packaging products that require robust protection. Incorporating slip additives into HDPE enhances its performance by reducing surface friction and facilitating easier processing and handling of HDPE-based packaging materials. Moreover, slip additives contribute to the overall quality of HDPE films, allowing for smoother surfaces and improved resistance to scratching and scuffing.

Regional Insights

Asia Pacific held a revenue share of 49.90% of the overall slip additives market. Asia Pacific is expected to remain the fastest-growing region in the market over the forecast period, driven by the booming packaging industry in countries such as China, India, and Japan. The market growth is likely to be fueled by rapidly expanding End Use industries, including food and beverage, pharmaceuticals, and consumer goods. Competitive manufacturing costs and a growing focus on sustainable practices are expected to provide new opportunities for market participants.

North America Slip Additives Market Trends

The slip additives market in North America is characterized by technological innovation and stringent regulatory standards, particularly in the food packaging sector. The push for environmentally friendly packaging materials is anticipated to increase research and development activities in the slip additives industry.

U.S. Slip Additives Market Trends

The slip additives market in the U.S. is expected to grow significantly during the forecast period. U.S. manufacturers are expected to invest in products that enhance the performance of packaging films while adhering to environmental and safety standards. The U.S. market is also characterized by its high demand for convenience foods and online retail, further accelerating the need for advanced packaging solutions and, by extension, slip additives.

Europe Slip Additives Market Trends

The slip additives market in Europe is characterized by a strong emphasis on sustainability and the circular economy. The region is at the forefront of implementing stringent environmental regulations, which significantly influence the development and adoption of slip additives. European companies are leaders in adopting green manufacturing practices and investing in biodegradable and renewable slip additives.

Key Slip Additives Company Insights

Some of the key players operating in the market include Croda International Inc., Fine Organics, Honeywell International Inc., and BASF SE

-

BASF SE is a leading chemical company headquartered in Germany. The company has a broad product portfolio that includes chemicals, plastics, performance products, and crop protection products.

-

Fine Organics is an India-based manufacturer and exporter of specialty chemicals, serving a diverse range of industries such as plastics, food, cosmetics, and pharmaceuticals. The company is mainly focused on oleochemicals and has plans to expand its footprint in Asian markets.

Key Slip Additives Companies:

The following are the leading companies in the slip additives market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Cargill

- Croda International Inc.

- Emery Oleochemicals

- Evonik Industries AG

- Fine Organics

- Honeywell International Inc.

- Lonza Group

- Lubrizol Corporation

- PMC Biogenix

Recent Developments

-

In September 2023, Ampacet introduced a new slip solution that can be used in flexible packaging applications. The product comes with low and consistent slip performance and has a coefficient of friction between 0.20 to 0.25.

-

In December 2020, MicroMB announced a new slip additive product to reduce friction and facilitate polymer processing and handling. The product is suitable for different ink types, base resins, diffusion rates, and temperatures.

Slip Additives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 265.33 million

Revenue forecast in 2030

USD 347.85 million

Growth rate

CAGR of 4.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, carrier resin, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Russia; China; India; Japan; South Korea; Brazil; GCC; South Africa

Key companies profiled

BASF SE; Cargill; Croda International Inc.; Emery Oleochemicals; Evonik Industries AG; Fine Organics; Honeywell International Inc.; Lonza Group; Lubrizol Corporation; PMC Biogenix

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Slip Additives Market Report Segmentation

This report forecasts volume and revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global slip additives market report based on type, carrier resin, end use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fatty Amides

-

Waxes and Polysiloxanes

-

Sterates

-

Others

-

-

Carrier Resin Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

LDPE

-

LLDPE

-

HDPE

-

PP

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Non-Packaging

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global slip additives market size was estimated at USD 254.27 million in 2023 and is expected to reach USD 265.33 million in 2024.

b. The global slip additives market is expected to grow at a compound annual growth rate of 4.6% from 2024 to 2030 to reach USD 347.85 million by 2030.

b. By end use, packaging dominated the market with a revenue share of over 79.0% in 2023.

b. Some of the key vendors of the global slip additives market are BASF SE, Cargill, Croda International Inc., Emery Oleochemicals, Evonik Industries AG, Fine Organics, Honeywell International Inc., Lonza Group, Lubrizol Corporation, and PMC Biogenix

b. The key factor driving the growth of the global slip additives market is the rising demand for packaging products in industries such as consumer goods, food & beverage, and e-commerce.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."