- Home

- »

- Medical Devices

- »

-

Skin Grafting Device Market Size, Industry Report, 2030GVR Report cover

![Skin Grafting Device Market Size, Share & Trends Report]()

Skin Grafting Device Market (2025 - 2030) Size, Share & Trends Analysis Report By Device Type, By Application (Burn Care, Chronic Wound Care), By End-use (Ambulatory Surgical Centers, Specialty Clinics Dermatology Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-493-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Skin Grafting Device Market Summary

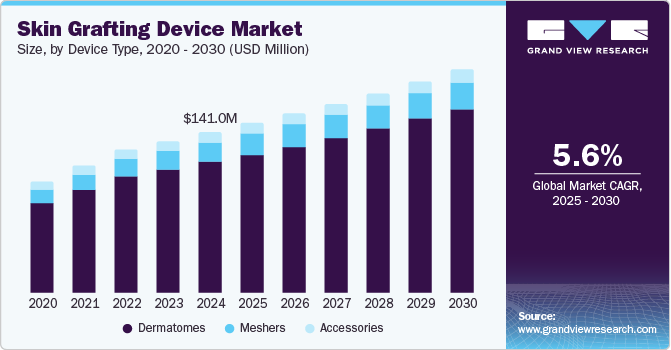

The global skin grafting device market size was valued at USD 141.0 million in 2024 and is projected to reach USD 195.8 million by 2030, growing at a CAGR of 5.63% from 2025 to 2030. The market is driven by rising awareness about aesthetic procedures, high demand for skin grafts, and increasing awareness regarding the available treatment options.

Key Market Trends & Insights

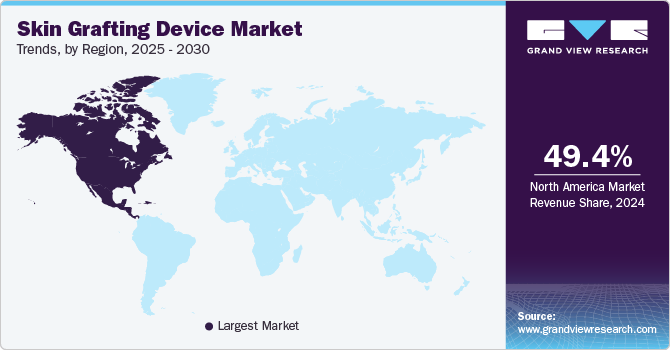

- North America skin grafting device market dominated the global industry with a share of 49.35% in 2024.

- The skin grafting device market in the U.S. held a significant share of the market in 2024.

- By device type, the dermatomes segment held the largest market share of around 82% in 2024.

- By application, the burn care segment held the largest market share of around 44.82% in 2024.

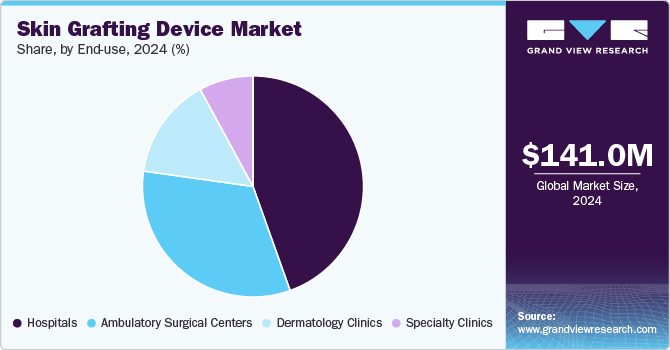

- By end-use, the hospital segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 141.0 Million

- 2030 Projected Market Size: USD 195.8 Million

- CAGR (2025-2030): 5.63%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to CUTISS, one of the pioneers in the development of the world’s first automated platform for large-scale skin tissue production, in 2023, over 20,000 burn patients were documented in the U.S., with 10% suffering from significant burns that affected more than 20% of their body area. As climate change leads to rising temperatures, the incidence of burn injuries has been on the rise. While most burns occur in private homes, they also represent a significant injury risk in combat situations and other high-risk professions.

Skin grafting is a relatively recent advancement in surgical techniques that entails replacing damaged skin with skin from the surrounding area to promote wound healing. This procedure is recommended for various conditions such as skin infections, severe burns, trauma, pressure ulcers, skin cancer, and reconstructive surgery. Skin grafting systems comprise the necessary equipment, materials, consumables, and instruments used throughout the procedure, including those for creating a mesh, collecting samples, and applying the final graft. To treat wounds involving significant tissue loss, a full-thickness skin graft is necessary. This type of graft requires the complete thickness of skin from the donor site rather than just the upper two layers. After the graft is carefully positioned over the wound and secured with a covering for optimal healing, it is harvested from the healthy area.

Supportive measures from governments, including reimbursement schemes covering approximately 70-100% of therapy expenses, encourage individuals to opt for sophisticated treatments for burns. Additionally, both government bodies and non-profit entities, such as the World Health Organization (WHO) and the American Burn Association (ABA), play significant roles in increasing awareness. The WHO actively collaborates with the International Society for Burn Injuries, among other organizations, aiming to refine burn treatment methods and implement preventive measures against burn injuries worldwide.

Moreover, strategic initiatives by major companies, including the introduction of new products and the undertaking of mergers and acquisitions, contribute to market growth. For instance, in October 2024, CUTISS AG, a life science company specializing in tissue engineering therapy and regenerative medicine, successfully performed the first-ever grafting of denovoSkin, their autologous, bio-engineered dermo-epidermal skin graft. This innovative procedure was carried out as a compassionate reconstructive measure and marks the company's inaugural case in the United States. The U.S. Food & Drug Administration (FDA) granted authorization for the procedure under a single patient Investigational New Drug (IND) application, which was executed by the skilled surgical team at Massachusetts General Hospital (MGH).

Moreover, rising cases of burn injuries are another key factor fueling the market growth. Below are some general statistics on burn injuries based on data from the World Health Organization (WHO) and the American Burn Association:

-

An estimated 180,000 deaths occur each year worldwide due to burn injuries.

-

In the U.S., there are approximately 486,000 burn injuries that require medical treatment each year, with about 40,000 of those requiring hospitalization.

-

In the U.S., fire/flame burns are the most common type of burn injury (43%), followed by scalds (34%), contact burns (9%), electrical burns (4%), chemical burns (3%), and other types of burns (7%).

-

Each year, around 1 person per 100,000 people require inpatient hospitalization at a burn center in the U.S.

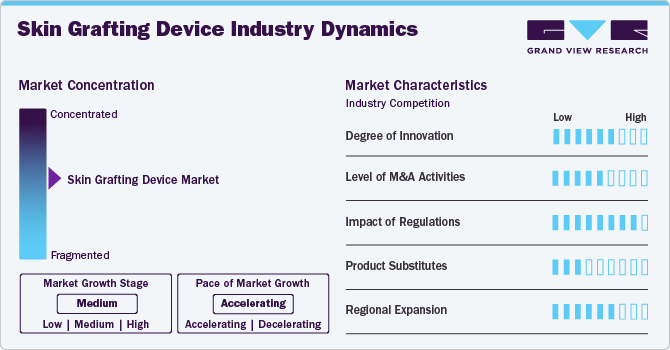

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The market is characterized by a high degree of growth due to the increasing prevalence of burn injuries, chronic wounds, and conditions requiring skin grafts, such as diabetes and ulcers, which drives demand for skin grafting devices to propel scientific advancements and encourages collaboration among researchers, medical professionals, and technology developers.

The market is witnessing a significant degree of innovation, driven by advances in technology, materials science, and surgical techniques. A notable trend is the development of automated and robotic systems that enhance precision and efficiency in grafting procedures. These advanced devices reduce surgical time and improve patient outcomes by minimizing trauma to surrounding tissues and enabling quicker recovery.

Regulatory bodies play a critical role in shaping the growth of the skin grafting device market. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), are responsible for ensuring that devices meet rigorous safety and efficacy requirements before they can be marketed. This involves comprehensive preclinical and clinical testing, which can extend the time to market but ultimately enhance patient safety. For instance, in March 2024, the FDA granted marketing authorization for the Medline Autologous Regeneration of Tissue (ART) Skin Harvesting System, a groundbreaking handheld, semi-automated device designed to harvest skin tissue from a healthy donor site on a patient’s body.

The market is poised to experience robust mergers and acquisitions (M&A) activity as companies look to expand their product portfolios and strengthen their competitive positioning.

Emerging substitutes and alternative monitoring technologies present both challenges and opportunities for the skin grafting device market. Companies must continuously innovate to retain their market share and demonstrate the unique advantages of their offerings compared to these alternatives.

The global market is expanding across various regions, driven by increasing advancements in surgical techniques. While mature markets in North America and Europe continue to dominate, emerging markets in Asia Pacific, Latin America, and the Middle East are showing considerable growth potential due to rising healthcare investments and greater awareness of skin grafting.

Device Type Insights

The dermatomes segment held the largest market share of around 82% in 2024. Dermatomes are playing a pivotal role in dominating the skin grafting device market, primarily due to their precision and efficiency in harvesting skin tissue. These specialized surgical instruments are designed to extract thin layers of skin from donor sites, making them essential for successful grafting procedures. By enabling surgeons to obtain uniform and viable skin grafts, dermatomes significantly improve graft integration and patient recovery times.

The market has seen advancements with the introduction of powered dermatomes, which offer enhanced speed, consistency, and ease of use compared to traditional hand-held models. For instance, Zimmet Biomet is one of the leading companies that offer air or electric-powered dermatomes. This technological evolution allows for quicker procedures and reduces the risk of complications associated with skin harvesting. As a result, many healthcare professionals are increasingly opting for powered versions in both clinical and surgical settings.

Application Insights

The burn care segment held the largest market share of around 44.82% in 2024, driven by increasing incidences of burn injuries and a growing demand for advanced treatment options. With the prevalence of severe burns resulting from accidents, industrial hazards, and domestic incidents, healthcare providers are seeking innovative solutions to enhance patient outcomes and expedite recovery. Skin grafting devices, particularly those designed for minimally invasive procedures, are gaining prominence. Technologies that facilitate the collection and application of skin grafts, such as the Medline Autologous Regeneration of Tissue (ART) Skin Harvesting System, are revolutionizing burn care by enabling the efficient harvesting of skin from donor sites. These devices offer significant advantages over traditional methods, including reduced trauma, faster recovery times, and improved graft take rates.

The chronic wound care segment is expected to grow at the highest CAGR of 6.44% during the forecast period, fueled by rising incidences of conditions such as diabetes, venous ulcers, and pressure sores. As the global population ages and the prevalence of chronic diseases increases, effective management of non-healing wounds has become a priority in healthcare. Traditional wound care methods often fall short, necessitating the adoption of advanced skin grafting devices that promote faster healing and improved patient outcomes. Innovative technologies, including bioengineered skin substitutes and minimally invasive graft harvesting systems, are at the forefront of this growth. These devices not only enhance the efficiency of graft application but also reduce complications associated with conventional methods. By offering enhanced healing properties, the products in this segment address the specific needs of chronic wounds, which often require more complex treatment approaches.

End-use Insights

The hospital segment dominated the market in 2024, driven by the rising prevalence of burn injuries, surgical wounds, and chronic conditions requiring reconstructive procedures. Hospitals provide a comprehensive environment equipped with advanced medical technologies and skilled healthcare professionals essential for performing complex skin grafting surgeries. This segment caters to a wide spectrum of patients, including those suffering from severe burns, diabetes-related ulcers, and traumatic injuries, making it a critical focal point for skin grafting procedures.

The ambulatory surgical centers (ASCs) segment is expected to grow at the highest CAGR during the forecast period. ASCs are increasingly becoming preferred sites for outpatient procedures due to their efficiency, cost-effectiveness, and ability to provide personalized care. This shift is driving demand for advanced skin grafting technologies as ASCs adopt minimally invasive techniques that improve patient recovery times and outcomes.

Regional Insights

North America skin grafting device market dominated the global industry with a share of 49.35% in 2024. Increasing incidence of burns and high demand for skin grafts & substitutes are expected to drive market growth. Moreover, the presence of key market players in this region, focusing on strategic initiatives such as the launch of new products and mergers & acquisitions, is expected to create lucrative growth opportunities in the region. Furthermore, rising awareness among people about burn treatment options, increasing disposable income, and the presence of well-established R&D infrastructure are some of the key factors contributing to market growth. Supportive healthcare reimbursement policies and government reforms are among the factors responsible for the largest market share held by North America.

U.S. Skin Grafting Device Market Trends

Theskin grafting device market in the U.S.held a significant share of the market in 2024. Well-developed healthcare infrastructure, increasing awareness about the usage of advanced wound care products, and the presence of several key market players are the major drivers of the market. In addition, an increase in the number of surgical procedures due to the high prevalence of sports injuries is anticipated to drive the market. In addition, the rising burden of chronic wounds is propelling the market growth. For instance, as per data published by Frontiers Media S.A. in January 2022, about 8.2 million people suffered wounds in the U.S., which cost the health system USD 28.1 to 96.8 billion.

Canada skin grafting device market held a significant share in 2024. Growing investments in healthcare and the rising adoption of skin grafting devices across hospitals and specialty clinics are supporting market expansion.

Europe Skin Grafting Device Market Trends

The skin grafting device market in Europe is expected to grow steadily over the forecast period owing to the presence of a well-established healthcare system and various nongovernment organizations such as the European Burns Association. The organization conducts educational courses for multidisciplinary teams, surgeons, and other healthcare professionals. Major players in this region are undertaking various strategies, such as mergers & acquisitions, and collaborations, contributing to market growth.

The UK skin grafting device market is expected to grow over the forecast period owing to the presence of a well-established healthcare system. Moreover, the number of nonprofit organizations, such as the British Burn Association, which aims to provide and propagate information on the best treatment and rehabilitation following a burn injury, is increasing, thereby boosting the market in the country. The key companies are adopting several strategies to increase their market share, including the launch of innovative products and expansion of R&D & manufacturing facilities. For instance, in June 2022, Smith & Nephew launched a new R&D and manufacturing facility in the UK, with an investment of more than USD 100 million. Such factors are expected to intensify competition in the UK.

The skin grafting device market in Germany is anticipated to grow significantly over the forecast period. This growth is primarily driven by several key factors, including an increasing incidence of burn injuries, technological advancements in skin grafting products, and rising healthcare expenditure.

Asia Pacific Skin Grafting Device Market Trends

The skin grafting device market in Asia Pacificis experiencing rapid growth fueled by a high rate of burn injuries and increased spending on healthcare, facilitating better access to advanced burn care products and treatments. However, emerging markets like India and China present significant growth opportunities due to their large populations and increasing industrial activities that contribute to higher burn injury rates.

China skin grafting device market is growing at a lucrative growth rate. Most of the global players have a presence in China, either through a manufacturing site, direct sales, or a distribution channel. Moreover, the number of people suffering from chronic and acute wounds in China is increasing, which is expected to encourage new players to enter the market. For instance, according to data published by the National Library of Medicine in April 2023, the prevalence of diabetes among Chinese adults aged 20 to 79 years is estimated to rise from 8.2% to 9.7% between 2020 and 2030.

Latin America Skin Grafting Device Market Trends

The skin grafting device market in Latin Americais experiencing significant growth. The growth is supported by expanding healthcare services and greater adoption of advanced medical technologies. Countries in the region are focusing on enhancing surgical outcomes, further driving demand for skin grafting devices.

Middle East and Africa Skin Grafting Device Market Trends

Theskin grafting device market in the Middle East and Africais experiencing growth owing to the rising incidence of burn injuries due to accidents, industrial mishaps, and domestic incidents. Increased awareness regarding effective burn treatment options among healthcare providers and patients further propels market growth.

Saudi Arabiaskin grafting device market is driven by the rising incidence of accidents and burns, increasing prevalence of chronic wounds, advancements in treatment technologies, and rising awareness about burn care management.

Key Skin Grafting Device Company Insights

The intensifying competition is leading to rapid technological advancements, and companies are constantly working to improve their products with a strong focus on research and development. Factors such as investments in R&D, compliance with regulatory policies, and technological advancements are constantly driving the introduction of novel techniques. In addition, market players are adopting strategies such as mergers & acquisitions, partnerships, product launches, and innovations to strengthen their foothold in the market. These advancements in the skin grafting device market are anticipated to boost the market growth over the forecast period.

Key Skin Grafting Device Companies:

The following are the leading companies in the skin grafting device market. These companies collectively hold the largest market share and dictate industry trends.

- Zimmer Biomet

- B. Braun SE

- Aygün

- De Soutter Medical

- Stryker

- Integra LifeSciences

- Rudolf Storz GmbH

- Exsurco Medical, Inc.

- NOUVAG AG

- Surtex Instruments Limited

- De Soutter Medical

- Mölnlycke Health Care AB

Recent Developments

-

In June 2024, the Army Hospital (Research & Referral) in New Delhi, India, unveiled a cutting-edge skin bank facility, marking the first of its kind within the Armed Forces Medical Services. This groundbreaking initiative is designed to transform the treatment of severe burn injuries and various skin-related ailments for servicemen, servicewomen, and their families.

-

In October 2024, CUTISS AG, one of the leading life science companies specializing in tissue engineering therapy and regenerative medicine, announced the successful grafting of denovoSkin, its autologous bio-engineered dermo-epidermal skin graft, in a compassionate reconstructive procedure. This marks the company’s first case in the U.S. The procedure received authorization from the U.S. Food & Drug Administration (FDA) under a single-patient Investigational New Drug (IND) application and was carried out by the surgical team at Massachusetts General Hospital (MGH).

-

In March 2024, the FDA approved the marketing of the Medline Autologous Regeneration of Tissue (ART) Skin Harvesting System, a groundbreaking handheld semi-automated device designed to harvest skin tissue from a healthy (donor) area of a patient's body and apply it directly to a wound where a skin graft is needed. Instead of using a blade to cut a sheet of skin, the device employs an array of thin needles to collect numerous small plugs of skin (micrografts). This innovative approach allows healthcare providers to carry out the harvesting and graft application process in a minimally invasive manner, utilizing local anesthesia and expanding the range of clinical settings suitable for this procedure beyond those typically used for conventional skin grafts.

Skin Grafting Device Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 148.8 million

Revenue forecast in 2030

USD 195.8 million

Growth rate

CAGR of 5.63% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Segment Scope

Device type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Report Coverage

Revenue, competitive landscape, growth factors, and trends

Key companies profiled

Zimmer Biomet, B. Braun SE, Aygün, De Soutter Medical, Stryker, Integra LifeSciences, Rudolf Storz GmbH, Exsurco Medical, Inc., NOUVAG AG, Surtex Instruments Limited, Mölnlycke Health Care AB, De Soutter Medical.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Skin Grafting Device Market Report Segmentation

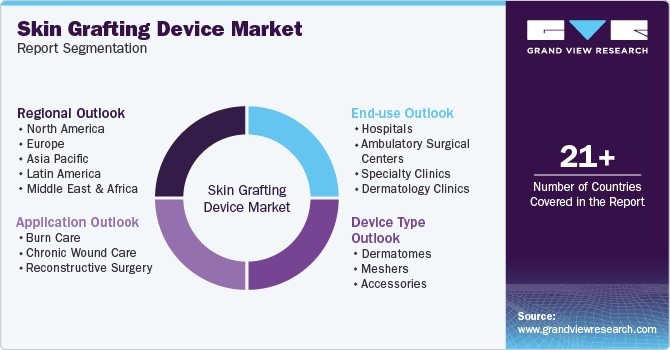

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global skin grafting device market report on the basis of device type, application, end-use, and region:

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dermatomes

-

Meshers

-

Accessories

-

-

ApplicationOutlook (Revenue, USD Million, 2018 - 2030)

-

Burn Care

-

Chronic Wound Care

-

Reconstructive Surgery

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Specialty Clinics

-

Dermatology Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global skin grafting device market size was valued at USD 141.0 million in 2024 and is expected to reach USD 148.8 million in 2025.

b. The global skin grafting device market is anticipated to grow at a CAGR of 5.63% from 2025 to 2030 to reach USD 195.8 million by 2030.

b. The dermatomes segment held the largest market share of around 81.60% in 2024 owing to increase in the prevalence of chronic wounds, burns, and other skin-related conditions.

b. Zimmer Biomet, B. Braun SE, Mölnlycke Health Care AB, Aygün, De Soutter Medical, Stryker, Integra LifeSciences, Rudolf Storz GmbH, Exsurco Medical, Inc., NOUVAG AG, Surtex Instruments Limited, and De Soutter Medical.

b. The skin grafting device market is driven by factors such as rising incidence of accidents and burns, high demand for skin grafts, and increasing awareness regarding the available treatment options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.