Skin Care Products Market Size, Share & Trends Analysis Report By Product (Face Creams & Moisturizers, Sunscreen), By Gender (Male, Female), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-902-9

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global skin care products market size was estimated at USD 135.83 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. Escalating demand for face creams, sunscreens, and body lotions across the globe is expected to positively impact the growth. Moreover, the flourishing e-commerce sector is anticipated to boost market growth further. The COVID-19 pandemic had a devastating impact on the beauty and cosmetics industry. Store closures due to strict lockdown measures resulted in disastrous consequences, with sales decreasing by 60-70% from March to April 2020 globally. The companies responded positively to the crisis by addressing and increasing their production capacities offering hand sanitizers and cleaning agents, as consumers spent less on beauty and grooming products.

The market for skin care products has experienced substantial growth driven by the influence of viral content creators and emerging trends of organic skin care. This surge began with the launch of Kylie Jenner's pink-branded product line in May 2019, which complemented her existing brand, Kylie Cosmetics. Subsequently, popular singer Rihanna introduced Fenty Skin in the summer of 2020. The increasing popularity of these brands has served as an inspiration for other celebrities. Pharrell introduced his brand, Humanrace, Carmen Electra unveiled GOGO Skincare, and Jennifer Lopez launched JLo Beauty, all of which were announced in 2020. This trend continued well into 2022, with Scarlett Johansson launching her skin-care line, The Outset.

Due to the influence of well-known personalities and the rising demand for high-quality skin care products, the rise of these celebrity-led brands is increasing the demand for skin care products globally. Personalized products have been gaining traction among consumers in the U.S. With the growing consumer inclination toward natural beauty products, the concept of creams, serums, and moisturizers infused with natural ingredients is expected to witness significant demand over the forecast period. Such products are considered more effective and have few or no side effects, which, in turn, is expected to increase their application among consumers.

Many consumers have expressed a keen interest in Korean skincare and are willing to test Korean products because of the rising popularity of K-beauty. The core of K-beauty focuses only on resolving skincare issues and it emphasizes the use of nourishing products to improve skin health, prevent or minimize skin issues, and preserve a young complexion. Hydration is considered a key to achieving healthy skin, which is why Korean skincare offers an extensive range of moisturizing and nourishing products such as sheet masks, essences, sleeping masks, and pressed serums. Recognizing the growing demand for Korean beauty products, numerous brands have introduced skincare products that are either made in Korea or inspired by Korean beauty practices.

Increasing investments in the research & development of products, coupled with the rising trend of natural ingredient-based skincare products, have encouraged manufacturers to launch new products. For instance, in June 2021, Hale Cosmeceuticals, a well-established product manufacturer in the U.S., launched two natural ingredient products−Natural AZA Cleanser and Date Palm Deep Moisturizer−for the U.S. market. In addition, in October 2022, the skincare line Naturium made its debut in the UK market through Space NK. There were 14 products in the collection that were specially designed for the UK market, with prices ranging from £18 to £27. The widely recognized Niacinamide Serum 12% Plus Zinc 2%, and Purple Ginseng Cleansing Balm by Naturium were among the products highlighted.

Face creams and moisturizers are gaining increasing popularity globally, as people are becoming more conscious of their physical appearance along with being more concerned about skin disorders and malignancies. Furthermore, with a rising number of consumers opting for cruelty-free products due to their increased consciousness regarding animal welfare and the environment, the demand for vegan or blends of plant-based ingredients in these products has increased.

Gender Insights

The female segment held the largest revenue share of 61.66% in 2022 and is expected to maintain its lead over the forecast period. Women are increasingly adding personal grooming products to their daily routines to enhance their confidence and appearance, which is significantly contributing to the segment growth. Furthermore, the importance of self-care in recent years has encouraged women to proactively create relaxing self-care experiences through complex skincare routines at home. This trend is driving the demand for skincare products with active ingredients that have healing and nourishing properties, including creams, lotions, repair creams, peels, masks, serums, powders, and scrubs.

The male segment is projected to register the fastest CAGR of 5.0% from 2023 to 2030. The growing awareness among males regarding personal hygiene and regular grooming, increased product launches, celebrity endorsements, and rising disposable income are the major factors fueling the expansion of the men's skincare market. The appetite of men for skin care products is evolving beyond traditional grooming products such as deodorants, razors, and face wash to more specific skincare products like anti-aging and sun protection creams. The demand for anti-aging creams and sunscreens among men is expected to witness substantial growth in the near future.

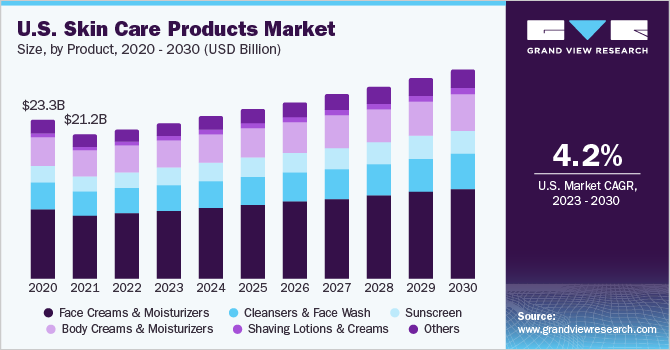

Product Insights

Face creams and moisturizers held the largest revenue share of 42.11% in 2022 and are expected to maintain their lead over the forecast period. Face creams and moisturizers are among the most used items as these are frequently applied. Apart from benefits such as instant hydration, reduced breakouts, and refreshed skin, moisturizers are an easy-to-use, hassle-free, and quick solution for combating dry skin. Furthermore, with a growing number of consumers opting for cruelty-free skincare products due to their increased consciousness about animal welfare and the environment, the demand for vegan or blends of plant-based ingredients in skin care products has increased. Thus, the face creams and moisturizers segment is noted to have significant growth options in the future.

The shaving lotions and creams segment is projected to register the fastest CAGR of 5.5% from 2023 to 2030. The growth is mainly owing to an increasing number of people becoming a part of corporate culture and giving importance to personal grooming. The market is anticipated to be driven by increased spending. Consumers generally practice shaving for the removal of their facial hair. Growing awareness regarding self-grooming, coupled with the rising disposable income, is expected to positively impact the market growth. Increasing awareness through advertisements, social media blogs, YouTube channels, and influencers is likely to augment the demand further.

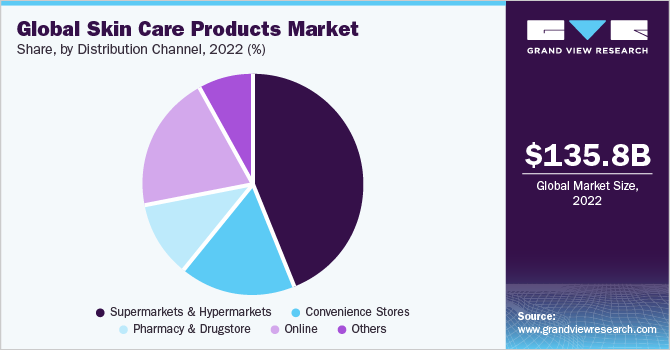

Distribution Channel Insights

The supermarkets and hypermarkets segment held the largest revenue share of 43.72% in 2022. Supermarkets and hypermarkets offer significant advantages to consumers, such as freedom of selection, lower prices, and high visibility of international brands, which makes them a suitable platform for all customers. According to an Entrepreneur Handbook article published in July 2021, Tesco, Sainsbury’s, Asda, and Morrisons supermarkets accounted for 63% of the retail sale in the UK As supermarkets/hypermarkets offer significant advantages to consumers, such as freedom of selection, lower prices, and high visibility of international brands, it makes them a suitable platform for customers of all types of skincare products.

The convenience stores channel is projected to register a CAGR of 5.0% from 2023 to 2030. Some customers buy these products from such stores because of the ease of purchase, their extensive network, and the ability to purchase the same products on a regular basis. Such stores accommodate more cosmetic and skin-oriented products owing to the growing consumer preference for the same. These stores offer a moderate range of product choices and help consumers make quick purchase decisions. Some of the popular convenience stores are 7-Eleven, Inc.; Alimentation Couche-Tard Inc.; Sainsbury’s Local; Londis; Krystals Express; and Casey’s General Stores.

Regional Insights

Asia Pacific held the largest revenue share of 39.65% in 2022. The expansion of the chemical industry in India and China, both of which are backed by regulatory support, is expected to ensure continuous raw material access to skincare product manufacturers, and thus, be a positive factor for the market in Asia Pacific over the forecast period. China is among the major countries contributing to the growth of the global cosmetics and market of skin care products, in terms of consumption as well as production. Various government policies are also promoting the demand for skin care products in the country.

North America is expected to register a CAGR of 4.4% from 2023 to 2030. Consumers in North American countries such as the U.S. and Canada are willing to pay a high price for a more youthful appearance, along with brighter and glowing skin. The rising consumer demand for specific skin care solutions and increasing consciousness regarding specific ingredients are expected to boost the demand for personalized beauty products. The presence of well-established product manufacturers in North America, such as Procter & Gamble and Unilever, along with the growing infrastructure facilities for retailers, is expected to support the demand for skin care products.

Key Companies & Market Share Insights

The market is characterized by the presence of a few established players and new entrants. Companies have been expanding their product portfolios by incorporating new and innovative skin care products to widen their consumer base. For instance, in July 2021, Shiseido Co. Ltd. announced the launch of ULTIMUNE Power Infusing Concentrate III in Japan, which is a renewal of the iconic serum ULTIMUNE Power Infusing Concentrate N. The product will be available in approximately 380 stores nationwide and on its beauty website watashi+.

In addition, in June 2021, Beiersdorf AG’s NX NIVEA Accelerator expanded into China and selected the top five startups for a new program in Shanghai. The brand signed a partnership agreement with China’s leading e-commerce platform Tmall and is focusing on collaborating with beauty startups from the areas of indie brands, beauty technology, personalization, and platform business models with a high degree of digitalization. In June 2021, P&G’s GoodSkin MD was launched in CVS Pharmacy’s offline and online stores. The brand will be offering six products: sunscreen, vitamin C and vitamin B serums, a night cream, a rescue cream, and a cleanser. Some prominent players in the global skin care products market include:

-

L’Oréal S.A.

-

Beiersdorf AG

-

Shiseido Co., Ltd.

-

Procter & Gamble (P&G)

-

Unilever

-

Johnson & Johnson, Inc.

-

Avon Products, Inc.

-

Coty Inc.

-

Colgate-Palmolive Company

-

Revlon

Skin Care Products Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 142.14 billion |

|

Revenue forecast in 2030 |

USD 196.20 billion |

|

Growth Rate |

CAGR of 4.7% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

July 2023 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Gender, product, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Brazil; Saudi Arabia |

|

Key companies profiled |

L’Oréal S.A.; Beiersdorf AG; Shiseido Co. Ltd.; Procter & Gamble (P&G); Unilever; Johnson & Johnson Services, Inc.; Avon Products, Inc.; Coty Inc.; Colgate-Palmolive Company; Revlon |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Skin Care Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global skin care products market report based on gender, product, distribution channel, and region.

-

Gender Outlook (Revenue, USD Billion, 2017 - 2030)

-

Male

-

Female

-

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Face Creams & Moisturizers

-

Cleansers & Face Wash

-

Sunscreen

-

Body Creams & Moisturizers

-

Shaving Lotions & Creams

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Pharmacy & drugstore

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global skin care products market size was estimated at USD 135.83 billion in 2022 and is expected to reach USD 142.14 billion in 2023.

b. The global skin care products market is expected to grow at a compound annual growth rate of 4.7% from 2022 to 2030 to reach USD 196.20 billion by 2030.

b. The Asia Pacific dominated the skin care products regional market with a share of 40% in 2022. The rapidly growing popularity of skin care products among middle- and high-income individuals in their daily routine is supporting the market growth in the region.

b. Some key players operating in the skin care products market include L’Oréal S.A., Beiersdorf AG, Shiseido Co., Ltd., Procter & Gamble (P&G), Unilever, and Johnson & Johnson, Inc.

b. Escalating demand for face creams, sunscreens, and body lotions across the globe is expected to have a positive impact on the market over the forecast period. Moreover, the flourishing e-commerce sector is anticipated to boost skin care products market growth further.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."