- Home

- »

- Medical Devices

- »

-

Sinus Tissue Resection Market Size & Share Report, 2030GVR Report cover

![Sinus Tissue Resection Market Size, Share & Trends Report]()

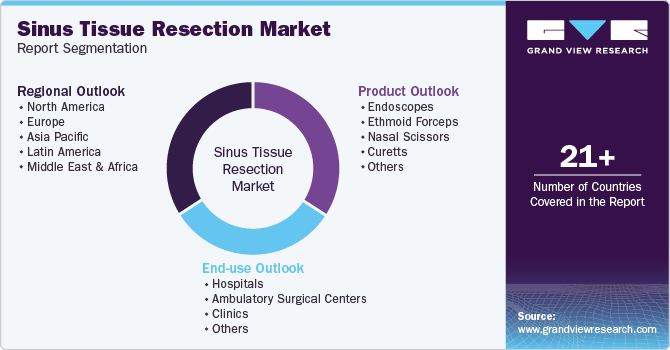

Sinus Tissue Resection Market Size, Share & Trends Analysis Report By Product (Endoscopes, Ethmoid Forceps, Nasal Scissors, Curettes), By End-use (Hospitals, Clinics), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-289-7

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Sinus Tissue Resection Market Size & Trends

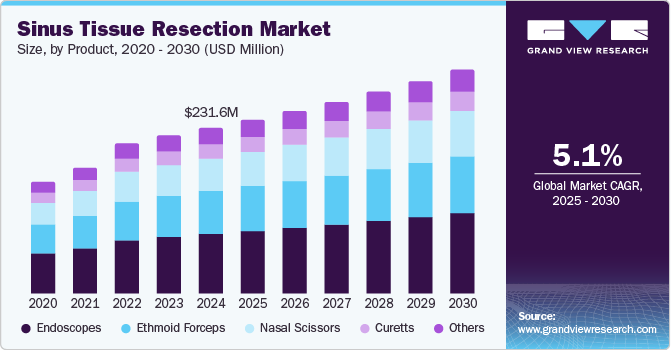

The global sinus tissue resection market size was estimated at USD 231.6 million in 2024 and is anticipated to grow at a CAGR of 5.08% from 2025 to 2030. The market growth can be attributed to factors such as increasing preference for minimally invasive surgeries and the growing prevalence of chronic sinusitis. Furthermore, the numerous benefits, such as no incisions, low discernable change to a patient's face, and shorter recovery time associated with minimally invasive sinus surgeries, are anticipated to boost the adoption of sinus tissue resection procedures.

In addition, the rising prevalence of chronic sinusitis is expected to support market growth in the coming years. Sinusitis is a common health problem, affecting many individuals yearly. For instance, according to the article published by the American College of Allergy, Asthma & Immunology in November 2022, sinusitis affects 31 million individuals in the U.S., and individuals living in America spend more than USD 1 billion on over-the-counter medications for treating sinusitis every year. Moreover, as per the statistics published by the CDC/National Center for Health Statistics in January 2022, around 28.9 million adults in the U.S. were diagnosed with sinusitis in the U.S. Thus, the availability of a large patient pool suffering from sinus infection is expected to drive the market over the forecast period.

Furthermore, the increasing adoption of technologically advanced solutions such as artificial intelligence (AI) and machine learning algorithms for treating sinusitis can fuel market growth. Manufacturers and companies are introducing technologically advanced solutions to help surgeons and healthcare professionals in sinus surgeries. For instance, in September 2021, Acclarent, Inc., a part of Johnson & Johnson, introduced AI-powered ENT technology to provide efficient and reliable image-guided preoperative planning and navigation for ENT procedures like endoscopic sinus surgery. Such advanced developments are anticipated to propel the market growth in the coming years.

Market Concentration & Characteristics

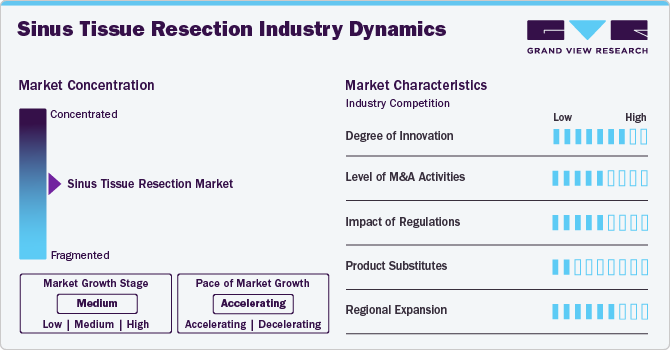

The industry growth stage is medium, and the pace of industry growth is accelerating due to major players offering various types of instruments for sinus resection, technological advancements, and multiple initiatives undertaken by industry participants.

The degree of innovation is high due to the rising technological advancements and the development of advanced products. Major and emerging players continuously innovate to deliver better products and focus on acquiring approvals from regulatory bodies for their innovative products. For instance, in February 2022, Olympus received clearance from the FDA for its CELERIS single-use sinus debrider system. It is a compact and portable system for coagulating, cutting, debriding, and removing thin bone and soft tissue sinus/rhinology procedures. Thus, such novel developments and approvals for innovative products are anticipated to drive market growth in the coming years.

The industry is characterized by medium merger and acquisition (M&A) activity. This is owing to several aspects, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing industry. Prominent players are buying smaller firms operating across the industry. For instance, in May 2022, Medtronic plc, a key industry player, acquired Intersect ENT, a manufacturer of products and devices used in sinus surgery. This acquisition was expected to positively impact patients suffering from chronic rhinosinusitis (CRS).

Regulations are supervised by regulatory bodies such as the Food and Drug Administration (FDA) in the U.S. and identical authorities globally. The agencies have issued a regulatory framework to assure product security, effectiveness, and quality standards. Moreover, the authorities are also involved in approval procedures for the instruments used during sinus surgeries. For instance, in August 2021, the FDA cleared a specialized Peregrine endoscope from 3NT Medical. This endoscope provides clinicians an up-close viewpoint of the hard-to-reach spots within the sinuses to assist diagnose and treat diseases such as rhinosinusitis infections.

Some of the alternatives for sinus tissue resection market products include nasal decongestants, sprays, and corticosteroids.

Several major players represent the sinus tissue resection market. Some major players operating in the market include Medtronic, Stryker (Entellus Medical, Inc.), and INTEGRA LIFESCIENCES among others. Major and minor players are undertaking various strategies, such as partnerships, acquisitions, product launches, expansions, and mergers, to expand their presence in the market.

The industry is witnessing robust global expansion due to the increasing emphasis of industry participants on improving the accessibility of products in various countries. Companies are forming distribution partnerships to distribute ENT products. For instance, in May 2020, Fiagon, a manufacturer of surgical technologies, collaborated with Smith+Nephew to provide its ENT surgical navigation products in the Asia Pacific region. This agreement covers the Indian subcontinent, New Zealand, China, Australia, and other ASEAN markets. Fiagon's ENT portfolio also comprises many navigated tools and adaptors that enable surgeons to track distinct instruments throughout endoscopic sinus surgery.

Product Insights

The endoscopes segment dominated the market in 2024 and accounted for a revenue share of 35.9%. Endoscopes enhance airflow through the nose and relieve symptoms associated with sinuses. They also lower the severity of sinus infections. Growing approvals and launches of endoscopes that can be used in sinus surgeries are anticipated to boost segment growth over the forecast period. Moreover, endoscopic sinus surgery is a minimally invasive surgery. Thus, the increasing adoption of minimally invasive procedures is anticipated to support the segment growth over the forecast period.

The nasal scissors segment is anticipated to grow with the highest CAGR over the forecast period. These scissors are widely used for blunt dissection and cutting of soft tissues within the nasal cavity. The rising prevalence of chronic sinusitis and the wide utility of scissors in sinus surgical procedures is expected to support the segment growth in the coming years. In addition, the availability of nasal scissors from the major market participants, such as Integra LifeSciences Corporation, Xelpov Surgical, Surtex Instruments, and Millennium Surgical, can boost segment growth.

End-use Insights

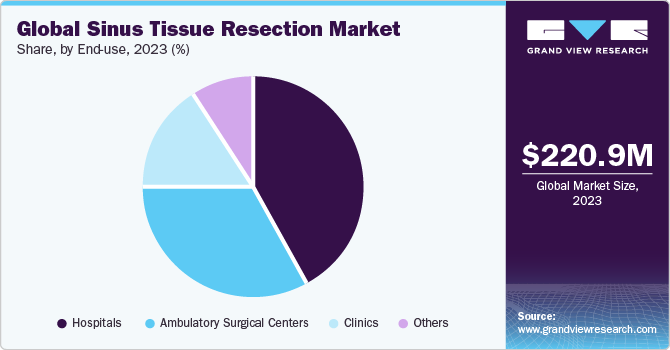

The hospital segment accounted for the largest market share of 41.80% in 2024. This high revenue share of the segment is due to the availability of a large number of hospitals conducting sinus surgeries. Some of the hospitals performing sinus surgical procedures include Boston Children’s Hospital, Wockhardt Hospitals, and NYU Langone Hospitals.

The clinics segment is anticipated to grow at the fastest CAGR during the forecast period. Several advantages include lower costs and better interaction with staff due to fewer patients than hospitals. Moreover, the presence of a large number of clinics is anticipated to boost the segment growth in the coming years. For instance, according to the article published by Healthline in March 2023, the Centers for Medicare and Medicaid Services (CMS) estimates that approximately 4,500 rural health clinics are available in the U.S . Thus, the availability of many clinics is expected to support the segment growth in the coming years.

Regional Insights

The North America sinus tissue resection market held the largest revenue share of 44.70% in 2024. The rising approvals from the FDA for instruments used in sinus tissue resection procedures and the growing efforts of key participants to enhance their product portfolios are anticipated to boost the market growth in the region.

U.S. Sinus Tissue Resection Market Trends

The U.S. sinus tissue resection market accounted for the largest share of the North American market in 2024 due to the presence of key players and the increasing preference for minimally invasive surgeries. Furthermore, the growing efforts from industry stakeholders to improve awareness about the sinus is anticipated to boost the country's market. For instance, in September 2021, the American Rhinologic Society (ARS) and the American Academy of Otolaryngology sponsored an event designed to inform and educate patients about the causes of their nasal and sinus symptoms; such awareness initiatives are anticipated to support the U.S. market growth over the forecast period.

Europe Sinus Tissue Resection Market Trends

Europe's sinus tissue resection market is anticipated to show lucrative growth due to a significant rise in the incidence of chronic diseases such as asthma, rhinitis, and allergies across the European region and the growing focus of industry participants on continuous research and developmental activities to introduce minimally invasive procedures.

The sinus tissue resection market in the UK is anticipated to grow over the forecast period due to the rising number of sinus surgeries nationwide. For instance, according to the study published by the National Library Of Medicine in July 2021, there was a significant increase in sinus surgical procedures from 2010 to 2019 in England. Endoscopic surgeries increased by 21.1%. Thus, the increasing adoption of endoscopic surgeries is anticipated to boost the market growth,

France's sinus tissue resection market is expected to grow in the coming years due to growing efforts to increase awareness about sinus surgical procedures and sinusitis. For instance, in June 2022, the 8th Functional & Radical Endoscopic Sinus Surgery Dissection Course was conducted in Laboratoire d'Anatomie, France. Such courses can improve knowledge about endoscopic surgeries and help boost their adoption across the country.

The sinus tissue resection market in Germany is anticipated to witness significant growth from 2024 to 2030 due to the country's well-established healthcare infrastructure and system, the easy availability of the products, and the rising prevalence of allergic rhinitis.

Asia Pacific Sinus Tissue Resection Market Trends

The Asia Pacific region is anticipated to witness the fastest growth during the forecast period. This growth is driven by the growing prevalence of chronic conditions and sinusitis across the region and the presence of well-developed healthcare infrastructure in countries such as Japan.

Japan's sinus tissue resection market is expected to grow significantly in the coming years. Rising technological advancements, product launches, and the increasing adoption of minimally invasive procedures are anticipated to support the country's market growth.

The sinus tissue resection market in China is expected to grow over the forecast period due to the growing focus of industry participants on adapting minimally invasive sinus surgical procedures. Several studies are being published focusing on endoscopic sinus surgeries. For instance, the study published by Springer Nature Limited in January 2023 reviewed the clinical and economic benefits of image-guided systems in functional endoscopic sinus surgery in China. Such studies can help drive the country's market in the coming years.

India's sinus tissue resection market is expected to grow over the forecast period due to developing healthcare infrastructure, improved R&D activities, and the availability of numerous hospitals and healthcare facilities performing sinus tissue resection surgeries.

Middle East & Africa Sinus Tissue Resection Market Trends

The sinus tissue resection market in the Middle East & Africa is anticipated to witness lucrative growth in the coming years due to the increasing number of patients suffering from sinusitis and chronic disorders such as Asthma. For instance, the study published by Elsevier B.V. in October 2021 found the prevalence of Asthma and allergic rhinitis in the UAE compared to that in adjacent nations. As per this study, around 7.4% of the UAE people have Asthma, compared with 6.4% in Kuwait and 3.6% in Saudi Arabia. Thus, the several patients suffering from chronic disorders are expected to drive the regional market over the period.

The sinus tissue resection market in Saudi Arabia is anticipated to grow over the forecast period due to the growing prevalence of sinusitis across the country. According to a study published by the Springer Nature Group in June 2023, the prevalence of Chronic rhinosinusitis (CRS) in Saudi Arabia increased due to the rise in exposure to allergens. This study was conducted in Saudi Arabia from November 2022 to January 2023.

Kuwait's sinus tissue resection market is expected to grow in the coming years due to increased healthcare expenditure, rising preference for minimally invasive surgeries, and technological advancements.

Key Sinus Tissue Resection Company Insights

The competitive landscape of the market is influenced by both emerging and established companies. These players emphasize the introduction of innovative products, developing partnerships, and engaging in mergers and acquisitions. In addition, increased investments in research and development are expected to intensify competition within the market.

Key Sinus Tissue Resection Companies:

The following are the leading companies in the sinus tissue resection market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Stryker (Entellus Medical, Inc.)

- INTEGRA LIFESCIENCES

- B. Braun Melsungen AG

- Stille[AP20]

- KARL STORZ

- CARDIMED INTERNATIONAL

- Novo[AP21] Surgical Inc.

- Surtex Instruments

- Xelpov Surgical

View a comprehensive list of companies in the Sinus Tissue Resection Market

Recent Developments

-

In April 2024, Integra LifeSciences Holdings Corporation, a major market player, acquired Acclarent, Inc., a provider of sinus tissue resection products. This acquisition can strengthen Integra Lifesciences's ear, nose, and throat (ENT) products portfolio.

-

In March 2024, Olympus Canada Inc. expanded its ENT product line by launching a CELERIS single-use sinus debrider system to facilitate functional endoscopic sinus surgery in outpatient settings.

-

In December 2023, NHS Fife, Scotland, adopted Medtronic StealthStation ENT to improve accuracy for multiple ENT surgeries, including sinus surgeries. This system uses electromagnetic technology and AI to deliver image-guided surgery.

Sinus Tissue Resection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 243.0 million

Revenue forecast in 2030

USD 311.4 million

Growth rate

CAGR of 5.08% from 2025 to 2030

Actual Data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Medtronic; Stryker (Entellus Medical, Inc.); INTEGRA LIFESCIENCES; B. Braun Melsungen AG; Stille; KARL STORZ; CARDIMED INTERNATIONAL; Novo Surgical Inc; Surtex Instruments; Xelpov Surgical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Sinus Tissue Resection Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global sinus tissue resection marketreport on the basis of product, end-use, and region:

-

Product Outlook (Revenue in USD Million) 2018-2030

-

Endoscopes

-

Ethmoid Forceps

-

Nasal Scissors

-

Curetts

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sinus tissue resection market is expected to grow at a compound annual growth rate of 5.08% from 2025 to 2030 to reach USD 311.4 million by 2030.

b. The global sinus tissue resection market growth was estimated at USD 231.6 million in 2024 and is expected to reach USD 243.0 million in 2025.

b. North America dominated the sinus tissue resection market with a share of 44.7% in 2024. This is attributable to factors such as favorable reimbursement scenarios, technological advancements, and new product launches.

b. Some key players operating in the sinus tissue resection market include Medtronic, Stryker (Entellus Medical, Inc.), INTEGRA LIFESCIENCES, B. Braun Melsungen AG, Stille, KARL STORZ, CARDIMED INTERNATIONAL, Novo Surgical Inc., Surtex Instruments, and Xelpov Surgical.

b. Key factors that are driving the sinus tissue resection market growth include the increasing preference for minimally invasive surgeries and the growing prevalence of chronic sinusitis.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."