- Home

- »

- Biotechnology

- »

-

Single-use Pump Market Size & Share, Industry Report, 2030GVR Report cover

![Single-use Pump Market Size, Share & Trends Report]()

Single-use Pump Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Equipment, Accessories), By Material (Polypropylene (PP) Pumps, Polyethylene (PE) Pumps), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-091-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Single-use Pump Market Size & Trends

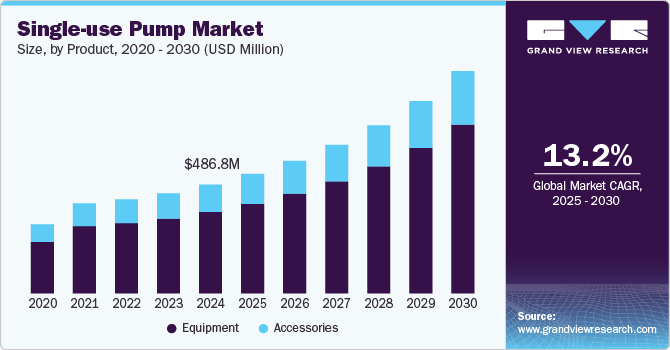

The global single-use pump market size was estimated at USD 486.8 million in 2024 and is projected to grow at a CAGR of 13.23% from 2025 to 2030. The increasing need for single-use pumps across numerous applications, as well as the expanding number of biopharmaceutical businesses, are driving the expansion of this market. Furthermore, rising demand for sterile disposable products is projected to fuel the expansion of the single-use pump industry.

The COVID-19 pandemic prompted the pharmaceutical sector to ramp up manufacturing rapidly. Increased FDA approvals for biologics have increased biopharmaceutical development, especially within North America & Asia. With a surge in biopharmaceuticals demand expected over the next 5 to 7 years, demand for single-use solutions such as bioreactors, pumps, mixers, connectors, tubing, consumables, and other types of instruments is likely to grow.

The rise in the geriatric population and the number of ailments has resulted in an upsurge in pharmaceutical demand. Since the pharmaceutical sector makes substantial use of single-use technology, the requirement for single-use pumps is predicted to rise. Furthermore, increased disposable income has encouraged the rise of the food and beverage as well as cosmetics industries. With the increasing usage of single-use pumps in the food & beverage and cosmetic and chemical industries, the single-use pump industry is expected to flourish during the forecast period.

Recent statistics highlight the growing burden of chronic diseases. According to the Centers for Disease Control and Prevention (CDC), six in ten adults in the United States live with at least one chronic disease, and four in ten are reported to have two or more chronic diseases. These conditions are the leading causes of death and disability in the country, accounting for 90% of the nation's $4.5 trillion in annual healthcare expenditures. Globally, the World Health Organization (WHO) 2023 reports that noncommunicable diseases (NCDs) are responsible for 74% of all deaths, with 77% of these deaths occurring in low- and middle-income countries.

The escalating incidence of chronic diseases necessitates efficient and reliable drug delivery systems, thereby propelling the demand for single-use pumps. Manufacturers are responding by developing innovative, user-friendly devices tailored to the needs of chronic disease management. For instance, wearable single-use pumps for insulin delivery are becoming increasingly popular among diabetic patients, offering improved mobility and quality of life. As the global healthcare landscape continues to grapple with the challenges posed by chronic diseases, the adoption of single-use technologies is expected to rise, further driving market growth.

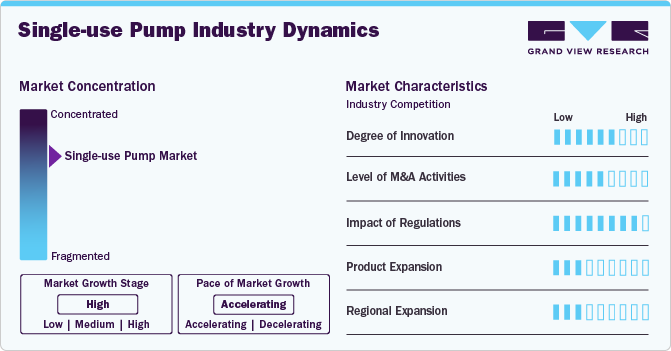

Market Concentration & Characteristics

The single-use pump market is characterized by a high degree of innovation, with companies focusing on developing advanced materials, improved flow control mechanisms, and automation features. Innovation is driven by the demand for sterile and efficient fluid handling in biopharmaceutical and biotechnology applications. Continuous R&D efforts are also directed toward enhancing pump compatibility with a wide range of chemicals, reducing the risk of contamination, and improving scalability for diverse applications.

M&A activities in the single-use pump market are robust as companies seek to expand their product portfolios, gain access to new technologies, and strengthen their market positions. Strategic acquisitions of smaller, innovative firms by larger corporations are common, allowing established players to diversify their offerings and enter new regional markets. These activities also foster collaboration between industry players, accelerating the development of advanced single-use technologies.

The market operates under stringent regulatory frameworks due to its critical role in the pharmaceutical and bioprocessing industries. Regulatory agencies like the FDA and EMA enforce guidelines to ensure product safety, sterility, and compliance with Good Manufacturing Practices (GMP). These regulations drive companies to invest in validation processes and quality assurance systems, thereby influencing product design and innovation.

Companies in the single-use pump industry are expanding their product lines to cater to diverse applications, including upstream and downstream bioprocessing, cell and gene therapy, and personalized medicine manufacturing. This expansion is propelled by the growing adoption of single-use technologies in research and manufacturing settings, with firms introducing pumps that cater to higher flow rates, enhanced precision, and broader chemical compatibility.

Regional expansion is a significant focus area, with companies targeting emerging markets in Asia-Pacific, Latin America, and the Middle East & Africa. The growing biopharmaceutical manufacturing capabilities in these regions, coupled with government incentives and rising demand for cost-effective and scalable solutions, are encouraging global players to establish local facilities and distribution networks. This trend ensures the widespread availability of single-use pump technologies across geographies.

Product Insights

The equipmentsegment held the largest market share of 74.89% in 2024. The segment is also projected to exhibit the fastest CAGR of 13.49% during 2025-2030. This is primarily attributed to factors such as the increasing adoption of single-use systems and technologies in pharmaceutical & biotech companies due to benefits such as lower initial investment and R&D costs, low costs for labor and supplies, growing demand for biologics, and rising demand for single-use pumps among end users.

Furthermore, the government has invested heavily in the development of COVID-19 vaccines, treatments, and diagnostic tests, which is projected to fuel the demand for single-use pumps, hence driving total market growth. For example, in March 2020, the Canadian government funded CAD 275 million (USD 205.92 million) for COVID-19 research and development initiatives such as diagnostics, antivirals, vaccines, & clinical trials.

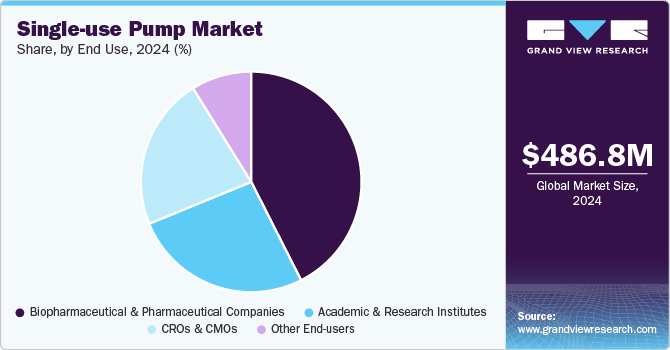

End Use Insights

The biopharmaceutical & pharmaceutical companies segment held 42.53% of the global market share in 2024, accounting for the largest share of the market. The majority of popular biopharmaceutical manufacturing techniques necessitate the handling, transporting, processing, and purifying of large-molecule pharmaceuticals produced by living cells. These operations, which are carried out with materials in a liquid phase, necessitate the use of pumping technologies capable of providing volumetric consistency along with accuracy, adequate pressures & flow rates, and material compatibility. Thus, it will increase the adoption of single-use pumps in biopharmaceutical & pharmaceutical companies and further boost the single-use pump industry growth.

In addition, products offered by major companies are also boosting market growth. For instance, in May 2019, Quattroflow announced the addition of the innovative QF30SU Single-Use Diaphragm Pump to its portfolio of single-use pumps. In November 2022, the company also launched an advanced QF5kSU Quaternary Diaphragm Pumps. The continuous development of novel products by manufacturers and their increasing adoption are likely to propel the single-use pump industry's growth.

Material Insights

The Polypropylene (PP) pump segment held a 52.33% share in 2024, accounting for the largest proportion of the market. A PP Pump is composed of polypropylene, a thermoplastic polymer. Due to its resistance to heat, chemicals, and corrosion, this type of pump is frequently used in the medical & biopharmaceutical industries. Thus, high demand and usage of the pp pump will contribute to the segment's continued expansion.

The Polyethylene (PE) pump segment is expected to grow at the fastest CAGR of 13.87% during 2025-2030. PE Pump, built from polyethylene, has a high corrosion resistance to hostile liquids and chemicals. It is frequently utilized in biopharmaceutical, medical, manufacturing sectors, and consumer goods industries. Furthermore, while there are numerous material alternatives on the market, polyethylene is among the most extensively used. Thus, the growing need for polyethylene in the single-use pump sector is expected to boost market expansion in the coming years.

Regional Insights

North America single-use pump market held the largest market share of 42.73% in 2024. This large share can be attributed to several factors, including the availability of various major manufacturers, cost-effectiveness of single-use pumps, increased process efficiency, increased sterility, and risk mitigation, stringent regulatory requirements, and regulatory compliance in North America.

U.S. Single-use Pump Market Trends

The single-use pump market in the U.S. holds a significant share of the regional market that can be attributed to the presence of large-scale manufacturing facilities for biopharmaceuticals. The biopharmaceutical sector is considered the most R&D-intensive in the U.S., and its development is recognized as a high-impact factor in the industry. Hence, it is expected to drive the adoption of single-use pump in the coming decade for a flexible and fast approach, leading to significant revenue generation in the U.S.

Europe Single-use Pump Market Trends

The single-use pump market in Europe is poised for significant growth, driven by increasing demand in the biopharmaceutical sector. Key factors contributing to this growth include the rising adoption of single-use technologies in manufacturing processes and the need for enhanced flexibility and efficiency in production.

The UK single-use pump market growth is driven by the rising demand for advanced medical technologies that address the growing prevalence of diseases in the country. In addition, local manufacturing initiatives supported by government incentives play a significant role in the UK market’s expansion as manufacturers have focused on strengthening domestic production to reduce dependency on imports and counter supply chain disruptions.

The single-use pump market in France has experienced significant growth due to the country's strong focus on sustainable and cost-effective fluid management solutions across various industries, including pharmaceuticals, biopharmaceuticals, and chemicals.

The single-use pump market in Germany is driven by the country's increasing focus on biotechnology and pharmaceutical manufacturing. Germany has a large number of bioprocessing facilities requiring advanced fluid handling solutions. Single-use pumps offer the flexibility and sterility needed in these environments, particularly for small-scale, personalized medicine production. The emphasis on minimizing cross-contamination and improving operational efficiency has further encouraged German manufacturers to adopt single-use technology.

Asia Pacific Single-use Pump Market Trends

The market growth in the region is mainly driven by factors such as increasing industrialization in sectors such as pharmaceuticals, food processing, and biotechnology. There has been a rapid growth of the pharma and biotech industries in this region. As these industries require high-quality standards and strict regulations, single-use pumps offer the benefits of sterility assurance, rapid changeovers, and ease of use nature of these single-use pumps. Moreover, many companies in the Asia-Pacific region focus on cost optimization in their manufacturing processes. Single-use pumps offer a perfect solution to reduce the cost while still maintaining the highest quality of standard. Considering these factors, many companies are encouraged to switch to single-use pumps thus pushing the single-use pump industry growth in the region.

The single-use pump market in China is expected to grow over the forecast period, driven by increasing investments in healthcare and biomedical research. China's expanding focus on advancing cancer research, genomics, and personalized medicine is fueling the demand for proteomics technologies. The expansion of the biopharmaceuticals sector in the country is driving the growth of the market in China. International companies are expanding their manufacturing facilities in this region through partnerships and collaborations with China-based companies. For instance, in April 2022, Merck entered into a partnership with the Administrative Management Committee of Wuxi National for the development of the first single-use manufacturing center by Merck in Asia Pacific.

The single-use pump market in India is expected to witness growth due to the increasing presence of a substantial number of contract and in-house manufacturers in the country. For instance, in February 2022, Cytiva signed an MoU with Bangalore Bioinnovation Centre (BBC), India, to offer a platform for skill development in the bioprocessing field. Such initiatives undertaken by various entities are expected to enhance the Indian market on the global platform.

Middle East & Africa Single-use Pump Market Trends

The Middle East & Africa (MEA) market for single-use bioprocessing is experiencing significant growth due to the increasing demand for biopharmaceuticals, the need for more efficient & cost-effective bioprocessing methods, and the expansion of the biopharmaceutical industry in the region.

The Saudi Arabia single-use pump market is experiencing significant growth, driven by increasing adoption of single-use technologies across the pharmaceutical, biotechnology, and chemical industries. Key trends include a rising focus on biopharmaceutical production, where single-use pumps are favored for their efficiency, reduced risk of cross-contamination, and lower operational costs.

The Kuwait single-use pump market is witnessing a growing demand for biopharmaceuticals, driven by an aging population, rising chronic disease prevalence, and the need for more advanced treatment options. Single-use technologies are crucial in the production of biopharmaceuticals, including vaccines, mAbs, and other therapeutic proteins.

Key Single-use Pump Company Insights

The market players operating in the single-use pump industry are adopting product approval as a strategy to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Single-Use Pump Companies:

The following are the leading companies in the single-use pump market. These companies collectively hold the largest market share and dictate industry trends.

- Dover Corporation

- Spirax Group plc

- Xylem

- Levitronix

- Stobbe Group

- Getinge (High Purity New England)

- Ace Sanitary

- Verder Group (Verder Liquids)

- Sartorius AG

- Avantor Inc.

Recent Developments

In October 2024, Avantor expanded its partnership with the National Institute for Bioprocessing Research and Training (NIBRT) to enhance biopharma manufacturing. This collaboration focuses on downstream optimization of monoclonal antibodies (mAbs) and includes the provision of Masterflex pump systems and single-use technologies to improve training and operational efficiency in biopharmaceutical workflows.

-

In June 2024, AdvantaPure, a unit of NewAge Industries, partnered with High Purity New England (HPNE) to distribute fluid transfer solutions in the Northeast U.S. This collaboration aims to enhance service quality in the biopharmaceutical sector.

-

In April 2024, Xylem launched the Jabsco PureFlo 21 Single Use diaphragm pump, featuring an integrated, adjustable pressure relief valve-the first of its kind in single-use pumping technology. This innovation enhances operator safety and reduces fluid contamination risks.

Single-use Pump Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 534.8 million

Revenue forecast in 2030

USD 995.2 million

Growth rate

CAGR of 13.23% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Report updated

January 2025

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Dover Corporation, Spirax Group plc, Xylem, Levitronix, Stobbe Group, Getinge (High Purity New England), Ace Sanitary, Verder Group (Verder Liquids), Sartorius AG, Avantor Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Single-use Pump Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research Inc. has segmented the global single-use pump market report based on product, material, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Peristaltic pumps

-

Quaternary diaphragm pump

-

Centrifugal pumps

-

Others

-

-

Accessories

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP) Pumps

-

Polyethylene (PE) Pumps

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical & Pharmaceutical Companies

-

CROs & CMOs

-

Academic & Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global single-use pump market size was estimated at USD 486.8 million in 2024 and is expected to reach USD 534.78 million in 2025.

b. The global single-use pump market is expected to grow at a compound annual growth rate of 13.23% from 2025 to 2030 to reach USD 995.2 million by 2030.

b. North America dominated the single-use pump market with a share of 42.7% in 2024. This is attributable to the availability of various major manufacturers, the launch of new & technologically advanced devices, and favorable reimbursement regulations.

b. Some key players operating in the single-use pump market include Dover Corporation, Spirax Group plc, Xylem, Levitronix, Stobbe Group, Getinge (High Purity New England), Ace Sanitary, Verder Group (Verder Liquids), Sartorius AG, and Avantor Inc.

b. The increasing need for single-use pumps across numerous applications, as well as the expanding number of biopharmaceutical businesses, are driving the expansion of this market. Furthermore, rising demand for sterile along with disposable products is projected to fuel the expansion of this market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.