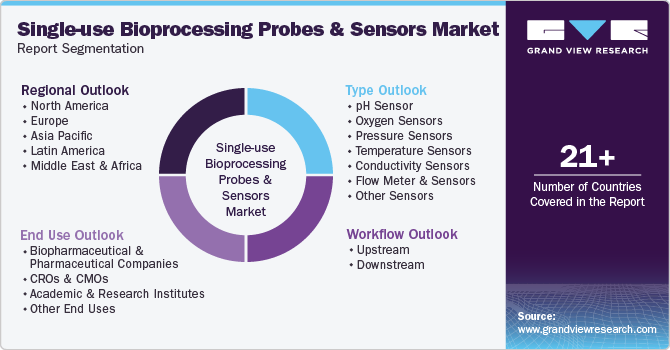

Single-use Bioprocessing Probes & Sensors Market Size, Share & Trends Analysis Report By Type (pH Sensors), By Workflow (Upstream, Downstream), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-250-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

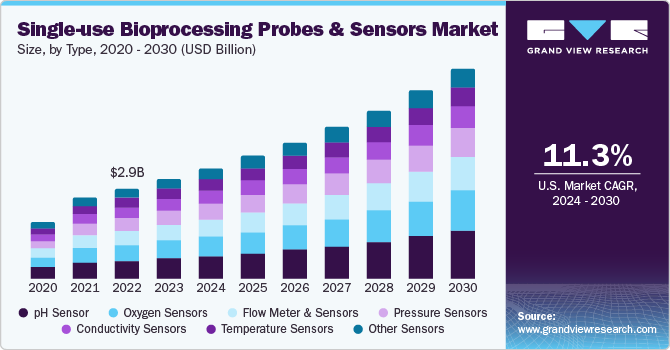

The global single-use bioprocessing probes & sensors market size was estimated at USD 2.99 billion in 2023 and is projected to grow at a CAGR of 11.32% from 2024 to 2030. Increasing implementation of single-use technology (SUT) for bioproduction, commercial advantages over conventional products, and rising demand for improved bioprocess monitoring are some of the factors that drive the market growth. The implementation of SUT in biomanufacturing processes offers several advantages that resonate throughout the biopharmaceutical industry.

Single-use systems significantly reduce the risk of cross-contamination, ensuring product purity and integrity. By eliminating the need for cleaning and sterilization between batches, these systems enhance operational efficiency, leading to shorter turnaround times and increased productivity. Moreover, single-use technology offers greater flexibility in scaling production, allowing manufacturers to adapt quickly to changing market demand. This agility is particularly valuable in upstream bioprocessing, where the ability to rapidly adjust production volumes can optimize resource utilization and minimize costs. As biomanufacturers attempt to rationalize the processes and accelerate the growth of bioprocessing, the advantages associated with single-use products, such as sensors and probes, position them as a foundation of modern bioprocessing strategies, driving innovation and efficiency across the industry.

Furthermore, the commercial advantages of single-use sensors lie in their ability to streamline operations, reduce costs, enhance flexibility, and improve regulatory compliance & product quality. These benefits make them an attractive option for companies aiming to optimize their processes and stay competitive in their respective fields. Reduced cleaning and sterilization costs, low capital expenditure, reduced risk of product cross-contamination, Increased process flexibility, etc. are some of the benefits offered by single-use sensors and probes over stainless steel.

Moreover, the use of disposable sensors in single-use bioreactors provides a noninvasive measurement of critical parameters. The additional advantage of single-use sensors is that it does not require electrolytes, thereby reducing the equilibration time. Hence, disposable sensors & probes have gained widespread acceptance by offering various commercial advantages over conventional products. These advantages serve as major contributing factors for driving the single-use probes and sensors market.

The single-use bioprocessing probes & sensors market experienced a positive impact from the COVID-19 pandemic, particularly in the increased demand for single-use products driven by the heightened need for vaccines, treatments, and assays. These products played an important role in facilitating the rapid scaling up of production by biopharmaceutical companies to meet the unprecedented global demand for vaccines. The pandemic underscored the importance of maintaining sterility and minimizing contamination risks in pharmaceutical and biologics production, highlighting the significance of single-use products in such scenarios.

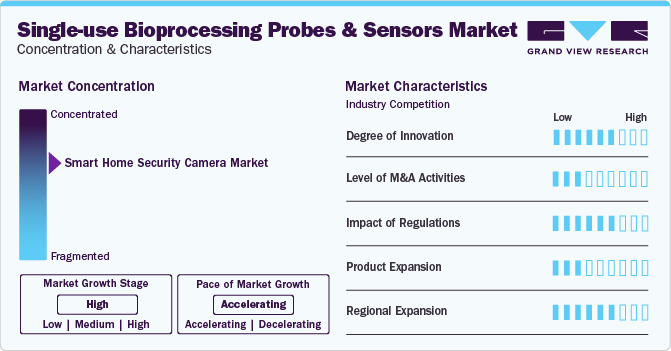

Industry Concentration & Characteristics

The presence of Original Equipment Manufacturers (OEMs) has increased the demand for single-use probes and sensors. Such OEMs are at the forefront of innovations in single-use equipment. The innovation includes disposable bioreactors, chromatography columns, and entire single-use processes and biomanufacturing facilities.

The market is also characterized by a moderate level of merger and acquisition activities undertaken by several industry players. This is due to several factors, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market. For instance, in March 2021, Mettler-Toledo International acquired PendoTECH, a manufacturer of single-use sensors, transmitters, control systems, and software.

Regulatory bodies are increasingly supporting single-use technologies due to their ability to maintain stringent quality control standards. Compliance with regulatory standards such as Good Manufacturing Practices (GMP) is essential to meet the quality requirements set by regulatory authorities like the Food and Drug Administration (FDA) and the European Medicines Agency (EMA). Single-use technologies must adhere to these regulations to guarantee product integrity and patient safety throughout the manufacturing process.

The single use bioprocessing probes and sensors industry is growing due to expanding applications and advancements in biotechnology and production processes that require compliance with regulatory guidelines. Numerous industry players are focusing on expanding their product and services portfolio. For instance, in October 2023, Hamilton Company introduced VisiFerm SU, a single-use redesign of trusted dissolved oxygen sensors.

Market players adopt this strategy to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas. However, the expansion of biopharmaceutical and biologic industries expedites the growth of the single use bioprocessing probes & sensors market. For instance, in October 2023, Thermo Fisher Scientific, Inc. expanded its biologics manufacturing plant in St. Louis, Missouri. The expansion doubled the company's biologics manufacturing capacity in St. Louis, increasing production from 2,000l to 5,000l to produce complicated biologic medicines for various diseases, such as cancer, autoimmune problems, and rare disorders.

Type Insights

The pH sensors segment held the largest market share of 20.10% in 2023. This segment is also anticipated to observe growth at the fastest CAGR over the forecast period. The market for single use bioprocessing pH sensors is driven by several factors, such as the increasing demand for biopharmaceuticals, including monoclonal antibodies, vaccines, & cell and gene therapies, which necessitates precise & reliable pH monitoring to ensure product quality and process efficiency. pH sensors can be deployed in nearly all biological processes, from initial inoculation to bioreactors to final downstream harvesting and purification of the product. Single-use pH sensors offer significant advantages, such as reduced contamination risks, lower costs associated with cleaning & sterilization, and ease of integration into disposable bioprocessing systems. The shift toward more flexible and scalable manufacturing processes, primarily in personalized medicine and small-batch production, further fuels the adoption of single-use pH sensors.

Furthermore, the oxygen sensors segment is witnessed to grow at a significant CAGR over the forecast period. In biomanufacturing steps, oxygen and carbon dioxide are the most important gases to be monitored. Changes in oxygen concentration may hamper metabolism, cell growth, and productivity. Optical oxygen sensors are the standard equipment for single-use bioreactors, as these sensors allow the noninvasive operation of chemosensors.

Workflow Insights

The upstream segment dominated the market in terms of revenue in 2023 with a market share of 73.46% and is expected to grow at the fastest CAGR from 2024 to 2030. In upstream bioprocessing, single-use sensors are used in media preparation, cell culture, and cell separation for the measurement of pH, pressure, conductivity, temperature, turbidity, and flow. The sensors utilized in upstream bioprocessing can be categorized as either on-line or off-line. On-line sensors are further divided into in-line and at-line sensors. These sensors offer advantages such as minimizing the risk of cross-contamination and providing precise monitoring of parameters, enhancing productivity.

The downstream segment is anticipated to grow significantly at a CAGR of 11.18% over the forecast period. Downstream processing involves the separation, isolation, and purification of the final product from the cell culture. The harvested yield from upstream undergoes multiple unit operations to remove impurities and isolate the desired product. The most common in-line single-use sensors in downstream bioprocessing are used to monitor pH, pressure, conductivity, temperature, turbidity, and flow. The gap in the market for downstream-specific single-use sensors presents an opportunity for manufacturers to innovate and develop products tailored to these processes. As the market moves toward more integrated and continuous processing, the demand for single-use sensors in downstream applications is expected to grow during the forecast period.

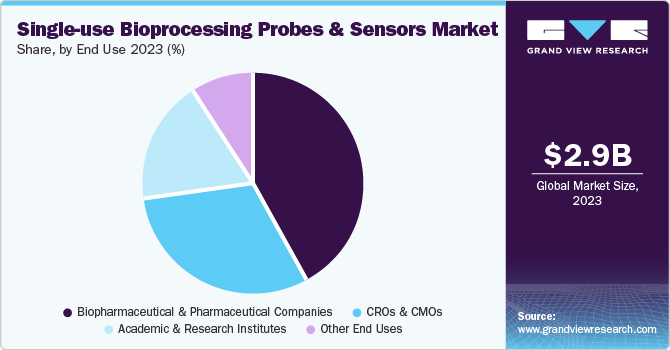

End Use Insights

The biopharmaceutical & pharmaceutical companies segment held the largest market share of 41.66% in 2023. Pharmaceutical & biopharmaceutical companies are witnessing an increasing shift toward biologics and personalized medicine. For instance, demand for biologics, such as vaccines, has risen to an all-time high after the COVID-19 pandemic, which led to increased production activities and a high demand for single-use technologies. Moreover, the commercial advantages of single-use sensors, such as cost-effectiveness, reduced labor charges, and others, are also expected to increase their application in the biopharmaceuticals market in the near future.

The CROs & CMOs segment is expected to witness the fastest CAGR over the forecast period due to several reasons. One of the primary drivers is increased outsourcing in drug development and manufacturing. Biopharmaceutical companies often collaborate with CMOs & CROs to leverage specialized expertise and reduce in-house costs. Furthermore, various CMOs are adding single-use system bioreactors to scale up commercial manufacturing capacity, which has led to an increasing number of CMOs becoming commercial product manufacturers. This increasing number is also expected to increase the application of single-use sensors by CMOs and CROs.

Regional Insights

North America dominated the market and accounted for a 42.81% share in 2023. This can be attributed to the increasing adoption of new technologies, such as single-use technology, coupled with the presence of major biopharmaceutical and biotechnology companies. In addition, the expanding applications of disposables in biomanufacturing plants by various companies, including in-house and CMOs, in the region are significantly contributing to the market growth

U.S. Single-use Bioprocessing Probes & Sensors Market Trends

The single-use bioprocessing probes & sensors market in the U.S. is expected to grow significantly over the forecast period. The expansion of biopharmaceutical manufacturing facilities in the U.S. is propelling the adoption of single-use/disposable products in the production workflow. The increasing demand for single-use products in the bioprocessing industry has led many companies to undertake various strategic initiatives. Moreover, the presence of key market players, such as Thermo Fisher Scientific; PendoTECH LLC; Hamilton Company; Polestar Technologies, Inc.; Mettler Toledo LLC; and Broadley-James Corporation, is anticipated to drive the market in the country.

Europe Single-use Bioprocessing Probes & Sensors Market Trends

Europe single-use bioprocessing probes & sensors market was identified as a lucrative region in this industry. Robust strategic initiatives by government and private organizations to promote the uptake of upstream bioprocessing equipment have contributed to revenue generated by this region over the forecast period

The Germany single-use bioprocessing probes & sensors market is expected to grow over the forecast period. Germany is home to several established bioprocessing industry participants who have ensured easy access to novel upstream bioprocessing equipment for researchers and healthcare professionals in the country. This is expected to significantly contribute to the dominance of Germany in Europe’s single-use bioprocessing probes & sensors market over the forecast period.

The single-use bioprocessing probes & sensors market in the UK is expected to grow over the forecast period. To meet the changing market demands, the biopharmaceutical industry in the UK is embracing single-use technologies for the manufacturing of biopharmaceutical products.

The France single-use bioprocessing probes & sensors market is anticipated to grow over the forecast period due to the increasing number of biopharmaceutical companies operating in France, coupled with supportive government initiatives. In addition, increasing investments by global biopharmaceutical companies in France’s biopharmaceutical industry and growing collaborations with local CROs & CMOs are expected to drive the market for single-use probes and sensors in France.

Asia Pacific Single-use Bioprocessing Probes & Sensors Market Trends

Asia Pacific single-use bioprocessing probes & sensors market is anticipated to witness the fastest CAGR of 12.38% from 2024 to 2030. This can be attributed to biotechnology's broad reach and the region's rapid technological innovation. Furthermore, the growing biopharmaceutical and biotechnology sector in the region is anticipated to accelerate the adoption of single-use technologies, leading to an increase in the demand for single-use bioprocessing probes and sensors in the region.

The Japan single-use bioprocessing probes & sensors market is anticipated to grow at a significant CAGR over the forecast period. Japan’s biopharmaceutical industry has witnessed transformation due to an increase in the demand for biosimilars and biologics, which is anticipated to positively impact the bioprocessing market in the country. This is expected to contribute to the increasing adoption of single-use sensors in the country in the coming years.

The single-use bioprocessing probes & sensors market in China is expected to grow at the fastest CAGR over the forecast period. Expansion of the biopharmaceuticals market is driving the single-use bioprocessing probes and sensors in China. Several international companies have expanded their manufacturing footprint in this region by forming mutually beneficial partnerships with China-based entities. For instance, in April 2022, Merck entered into a partnership with the Administrative Management Committee of Wuxi National. This partnership can result in the development of the first single-use manufacturing center by Merck in Asia Pacific.

The India single-use bioprocessing probes & sensors market is anticipated to grow at a rapid rate over the forecast. Currently, biopharmaceuticals are the fastest-growing segment in the Indian pharmaceutical industry. The expanding biopharmaceutical industry in the country is anticipated to increase the adoption of single-use sensors in the production workflow.

Middle East And Africa Single-use Bioprocessing Probes & Sensors Market Trends

The single-use bioprocessing probes & sensors market in the Middle East and Africa is projected to grow in the near future due to the increasingly broad range of complementary and direct investments in the biopharmaceutical industry. Furthermore, expanding businesses by global companies in the region is expected to positively impact the adoption of single-use technologies in the region.

The single-use bioprocessing probes & sensors market in Saudi Arabia is expected to grow over the forecast period. Currently, Saudi Arabia lacks expertise and awareness in upstream & downstream bioprocessing to support biomanufacturing. However, considering the effective role of biotherapeutics in chronic disease management, several initiatives are being undertaken to address the technology gap. For instance, in November 2020, Cytiva announced that it would supply its FlexFactory platform to SaudiVax to help meet vaccine and biologics demand in the MEA.

UAE single-use bioprocessing probes & sensors market is anticipated to witness growth over the forecast period. The UAE's strategic focus on developing a robust biotechnology and pharmaceutical sector, as part of its economic diversification efforts, is significantly boosting the demand for advanced bioprocessing technologies.

Key Single-use Bioprocessing Probes & Sensors Company Insights

Key players operating in the single-use bioprocessing probes & sensors market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Single-use Bioprocessing Probes & Sensors Companies:

The following are the leading companies in the single-use bioprocessing probes & sensors market. These companies collectively hold the largest market share and dictate industry trends.

- Hamilton Company

- Thermo Fisher Scientific Inc.

- Parker-Hannifin Corporation

- Danaher Corporation

- Mettler-Toledo International Inc. (PendoTECH)

- PreSens Precision Sensing GmbH

- Sartorius AG

- Broadley-James Corporation

- Saint-Gobain (Equflow)

- Dover Corporation

Recent Developments

-

In February 2024, Thermo Fisher Scientific Inc. has significantly grown its biologics manufacturing plant in St. Louis, Missouri. The expansion doubled the company's biologics manufacturing capacity in St. Louis, increasing production from 2,000l to 5,000l to produce complicated biologic medicines for various diseases, such as cancer, autoimmune problems, and rare disorders.

-

In October 2023, Hamilton Company introduced VisiFerm SU, a single-use redesign of trusted dissolved oxygen sensors.

-

In February 2022, Thermo Fisher Scientific Inc.spent USD 40 million to expand its SUT manufacturing site in Millersburg, Pennsylvania. The expansion was part of the company's USD 650 million multi-year investment announced in 2021 to ensure flexible, scalable, & dependable bioprocessing production capacity for crucial materials required in developing new & existing biologics and vaccines, including COVID-19.

-

In December 2020, PALL Corporation partnered with Single-Use Support GmbH to advance in the biopharmaceutical sector. The latter distributes the RoSS platform, expanding Pall’s portfolio of integrated solutions.

Single-use Bioprocessing Probes & Sensors Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.32 billion |

|

Revenue forecast in 2030 |

USD 6.31 billion |

|

Growth Rate |

CAGR of 11.32% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Type, workflow, end use, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Hamilton Company; Thermo Fisher Scientific Inc.; Parker-Hannifin Corporation; Danaher Corporation; Mettler-Toledo International Inc. (PendoTECH); PreSens Precision Sensing GmbH; Sartorius AG; Broadley-James Corporation; Saint-Gobain (Equflow); Dover Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Single-use Bioprocessing Probes & Sensors Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global single-use bioprocessing probes & sensors market report based on type, workflow, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

pH Sensor

-

Oxygen Sensors

-

Pressure Sensors

-

Temperature Sensors

-

Conductivity Sensors

-

Flow Meter & Sensors

-

Other Sensors

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Upstream

-

pH Sensor

-

Oxygen Sensors

-

Pressure Sensors

-

Temperature Sensors

-

Conductivity Sensors

-

Flow Meter & Sensors

-

Other Sensors

-

-

Downstream

-

pH Sensor

-

Pressure Sensors

-

Temperature Sensors

-

Conductivity Sensors

-

Flow Meter & Sensors

-

Other Sensors

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical & Pharmaceutical Companies

-

CROs & CMOs

-

Academic & Research Institutes

-

Other End uses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global single-use bioprocessing probes & sensors market size was estimated at USD 2.99 billion in 2023 and is expected to reach USD 3.32 billion in 2024.

b. The global single-use bioprocessing probes and sensors market is expected to witness a compound annual growth rate of 11.32% from 2024 to 2030 to reach USD 6.31 billion by 2030.

b. pH sensors dominated the single-use bioprocessing probes & sensors market with a revenue share of 20.10% in 2023. The large share is attributable to high penetration in terms of product availability coupled with the increasing importance of pH monitoring during product development.

b. Some key players in the single-use bioprocessing probes and sensors market are Hamilton Company, Thermo Fisher Scientific Inc., Parker-Hannifin Corporation, Danaher Corporation, Mettler-Toledo International Inc. (PendoTECH), PreSens Precision Sensing GmbH, Sartorius AG, Broadley-James Corporation, Saint-Gobain (Equflow), Dover Corporation.

b. Key factors driving the single-use bioprocessing probes and sensors market growth include increasing implementation of single-use technology; increasing investment in biotherapeutics R&D. In addition, the commercial benefits of the products are fueling the market for single-use bioprocessing probes and sensors. market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."