Single-use Bioprocessing Market Size, Share & Trends Analysis Report By Product (Simple & Peripheral Elements, Apparatus & Plants, Work Equipment), By Workflow (Upstream, Downstream), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-370-6

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Single-use Bioprocessing Market Trends

The global single-use bioprocessing market was valued at USD 27.94 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 16.24% from 2024 to 2030. The adoption of single-use bioprocessing technology is driven by the growing demand for biopharmaceuticals over the past few years, along with an increase in investments for the development of biologics, such as monoclonal antibodies, vaccines, recombinant proteins, and others. Furthermore, benefits pertaining to the use of single-use technology, such as significant reduction in costs and time required for operations & facility construction have supported the implementation of single-use systems in the bioprocessing sector.

The COVID-19 pandemic has generated new growth opportunities for key stakeholders in the industry. Key biopharmaceutical players can leverage the opportunity by expanding their COVID-19-related product offerings by scaling up their production facilities with the implementation of single-use bioprocessing equipment. A significant number of biopharmaceutical companies are actively involved in the development & production of COVID-19 vaccines. These programs are majorly based on single-use technologies as these systems are flexible, cost-effective, and reduce the risk of cross-contamination.

Such an ongoing and continuous increase in the adoption of these bioprocessing systems due to the COVID-19 pandemic is anticipated to drive industry growth. The commercial success of biopharmaceuticals has led single-use manufacturers to expand their production facilities globally. Capacity expansion projects have been a part of many manufacturers’ multi-year plans, to leverage a global reach and a broader customer base. For instance, in December 2020, Merck KGaA invested over USD 42 million to broaden its existing manufacturing facilities in Danvers, Massachusetts, and Jaffrey, New Hampshire, U.S.

This expansion was aimed at enhancing the company’s single-use assembly operations along with other product portfolios. Furthermore, with the rising focus on the development of regenerative medicine, such as cell and gene therapies, increased success of clinical trials, and enhanced rate of regulatory approvals, demand for commercialization of these products is expected to grow in the near future. In addition, owing to the increasing outsourcing activities in biopharmaceutical manufacturing, CMOs are adopting single-use systems for maintaining highly dynamic and frequently changing product portfolios.

Consequently, the extensive implementation of single-use systems in CMOs across the globe is likely to boost industry growth. For instance, in July 2021, Pall Corp. signed a contract with Exothera S.A., a CDMO, to establish a manufacturing space using Allegro STR single-use bioreactors and other technologies. Although innovations in single-use technology are the current trend for the bioprocessing industry, the technology has still not completely displaced stainless steel reusable systems. High-volume biopharmaceutical product manufacturers continue to fixate on the multi-use system due to their feasibility at large scales. This represents a significant challenge for the industry's growth.

Market Concentration & Characteristics

Market growth for the single-use bioprocessing market is high and market growth is accelerating. Innovation of technologically advanced products is one of the major driving factors of the market. In August 2023, Trelleborg Healthcare and Medicallaunched the BioPharmaPro family of advanced products and services for fluid path single-use equipment to bolster the development of advanced therapies.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. For instance, In March 2023, Thermo Fisher Scientific announced an update to the strategic collaboration with Arsenal Biosciences for the creation of manufacturing processes for advanced cancer treatments. This research-oriented collaboration has enabled ArsenalBio to create an efficient manufacturing process for the next-gen, autologous programmable T cells for the treatment of cancer

Companies operating in the bioprocessing space can obtain legal protection for innovative technologies and processes through patents, trademarks, etc. Licensing and collaborative agreements for increasing product distribution represent opportunities for market expansion. However, regulatory authorities are focusing on establishing stringent guidelines for biosafety, quality control, and other factors. Hence, compliance with regulatory standards represents significant challenges for market growth.

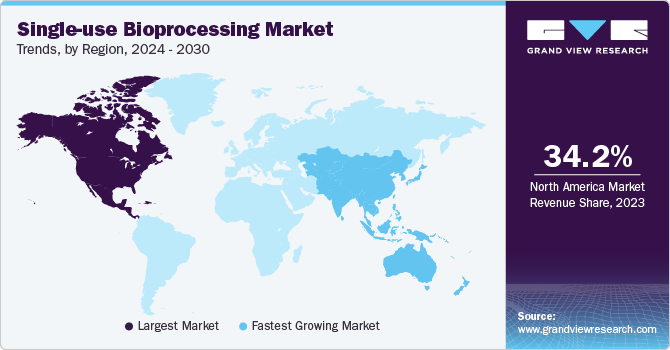

Currently, North America and Europe are the leading regions in the SU bioprocessing space. Key companies operating in the market are largely focusing on expanding into these lucrative regions to capture a greater share of the market. For instance, in May 2022, Cytiva opened a new manufacturing facility in Switzerland. The facility will focus on manufacturing single-use kits and consumables

Product Insights

The simple & peripheral elements segment recorded the largest market share of 49.31% in 2023 due to continuous innovations in these products and increasing prominence of bioprocessing operations in overall manufacturing process. Tubing, filters, connectors, and transfer systems held a majority share within simple & peripheral elements as tubing and connectors are provided by most single-use suppliers in a compatible format with single-use bags, bioreactors, or other single-use bioprocessing apparatus. For instance, Thermo Fisher Scientific, Inc. offers customization options to add tubing and connectors to its bioprocessing container bags and other bioprocessing equipment.These factors are expected to drive the segment.

The apparatus & plants segment is projected to grow at a rapid CAGR over the forecast period due to its significant penetration in the bioprocessing space majorly driven by a variety of single-use bioreactors. For instance, single-use bioreactors are available from a working volume range of 15 mL and 250 mL, such as the Ambr 15 and 250 sold by Sartorius AG, to a working volume of 6000 L, such as the CSR 7500 SUB sold by ABEC. This allows the end-users to easily scale products right from the stage of clone selection and benchtop production to harvesting high-volume yields of biologics. As a result, the availability of a broad range of options for apparatus & plants for bioprocessing is anticipated to drive the segment.

Workflow Insights

The upstream bioprocessing segment held the largest market share in 2023. This can be attributed to the continuous developments and advancements in technologies for upstream bioprocessing. For instance, advanced products, such as Ambr 15 micro-bioreactor system by Sartorius AG, are offering high-throughput upstream process development as well as efficient cell culture processing and media & feed optimization with automated experimental setup and sampling. These solutions can reduce the time taken for upstream bioprocessing operations and are anticipated to boost segment growth.

The fermentation segment is expected to register significant CAGR over the forecast period. The growth can be attributed to the launch of several innovative fermentation offerings that provide optimum conditions for bioprocessing reactions. For instance, the HyPerforma Enhanced S.U.F by Thermo Fisher Scientific, Inc. delivers optimal oxygen mass transfers and temperature control to the culture by increasing the turbine impellers and cooling jacket surface areas, respectively. Furthermore, companies like Cytiva are also involved in bringing single-use fermentation solutions for their end-users, such as the Xcellerex XDR MO, a stirred tank system with powerful mixing, efficient temperature control, and high oxygen transfer capacities for microbial cell culture. Significant innovations like these are likely to aid in revenue generation in this segment.

End-use Insights

Biopharmaceutical manufacturers dominated the market and accounted for the highest share in 2023. An increase in the commercial success of biologics in recent years and a rise in contract manufacturing/research services have led to the high growth of the segment. CROs and CMOs can offer several benefits in bioprocessing operations, such as scalability, flexibility, decreased internal infrastructure requirements, and dedicated supply channels. These advantages are fueling the adoption of contract services and are anticipated to positively affect the industry growth in the near future.

Academic & clinical research institutes are expected to grow at the fastest CAGR during 2024-2030.The availability of benchtop scale bioprocessing equipment and technological progress in single-use systems has accelerated the adoption of such technologies in academic and research institutes. For instance, institutes like the NIBRT (National Institute for Bioprocessing Research), in Ireland offer contract research services for biologics, while also conducting workshops and training for single-use technologies. Furthermore, the involvement of academic institutes and scientific communities in developing new biologics, such as cell & gene therapies and vector production, is likely to increase the implementation of single-use systems due to its cost reduction and flexibility benefits.

Regional Insights

North America held the largest revenue share of more than 34.19% in 2023, which can be attributed to the presence of an established pharmaceutical and biomanufacturing industry in the region as well as a high extent of R&D activities. Similarly, the demand for single-use bioprocessing equipment is also driven by an increasing focus on vaccine production to aid in disease prevention measures in the region. Moreover, the presence of the Bio-process System Alliance (BPSA) in North America, which aims at advancing the adoption of single-use technologies, is expected to further drive the sales of disposable systems in the region.

The Asia Pacific region is expected to grow at the fastest rate over the forecast period. The region’s growing bioprocessing market has resulted in multiple investments from several global companies. These investments assist in serving the key companies to create a regional presence and take advantage of the untapped avenues. Furthermore, the increasing interest of contract service providers to develop their base in the Asia Pacific, coupled with the trend of implementation of disposables in CMOs, acts as a catalyst for continued investments by local as well as global companies. For instance, in September 2021, Singapore witnessed the expansion of Lonza’s drug development facility. The CDMO enhanced its capacity to support the growing manufacturing needs in the region.

-

In China, the expansion of biopharmaceuticals market is driving the single-use bioprocessing market. Several international companies have expanded their manufacturing footprint in this region by forming mutually beneficial partnerships with China-based entities. Moreover, the primary focus of the country is on the development of affordable biosimilars of Western novel biotherapeutics for its domestic market, which is anticipated to positively influence market growth in the coming years.

Key Single-use Bioprocessing Company Insights

The market is witnessing several strategic initiatives such as product launches, expansions adopted by key players to increase their reach in the market and to maintain their industry presence. These developments also enhance the availability of their products in diverse geographical areas.

Key Single-use Bioprocessing Companies:

The following are the leading companies in the single-use bioprocessing market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these single-use bioprocessing companies are analyzed to map the supply network.

- Sartorius AG

- Danaher

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Avantor, Inc.

- Eppendorf SE

- Corning Incorporated

- Lonza

- PBS Biotech, Inc.

- Meissner Filtration Products, Inc.

Recent Developments

-

In January 2024, CDMO AGC Biologics announced a growth strategy to develop pharmaceutical manufacturing capabilities in the Asia region through the expansion of their mammalian cell culture, mRNA and cell therapy facility in Japan. This development is aimed to support the global demand for biologics and advanced therapy medicinal products.

-

In September 2023, Getinge launched a single-use bioreactor named the AppliFlex ST GMP. The new product is available in different sizes and provides a comprehensive cGMP manufacturing solution for mRNA production and cell and gene therapies.

-

In April 2023, Merck KGaA launched Ultimus, a single-use process container film, to provide superior strength & leak resistance for single-use assemblies.

-

In April 2023, Cytiva introduced the X-platform bioreactors that simplifies the upstream bioprocessing operations for the production of monoclonal antibodies (mAbs), protein-based drugs and cell and gene therapies.

Single-use Bioprocessing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 33.11 billion |

|

Revenue forecast in 2030 |

USD 80.13 billion |

|

Growth rate |

CAGR of 16.24% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, workflow, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Sartorius AG; Danaher Corporation; Thermo Fisher Scientific, Inc.; Merck KGaA; Avantor, Inc; Eppendorf SE; Corning Incorporated; Lonza; PBS Biotech, Inc.; Meissner Filtration Products, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Single-use Bioprocessing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the single-use bioprocessing market on the basis of product, workflow, end-use, and regions:

-

By Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Simple & Peripheral Elements

-

Tubing, Filters, Connectors, & Transfer Systems

-

Bags

-

Sampling Systems

-

Probes & Sensors

-

pH Sensor

-

Oxygen Sensor

-

Pressure Sensors

-

Temperature Sensors

-

Conductivity Sensors

-

Flow Sensors

-

Others

-

-

Others

-

-

Apparatus & Plants

-

Bioreactors

-

Upto 1000L

-

Above 1000L to 2000L

-

Above 2000L

-

-

Mixing, Storage, & Filling Systems

-

Filtration System

-

Chromatography Systems

-

Pumps

-

Others

-

-

Work Equipment

-

Cell Culture System

-

Syringes

-

Others

-

-

-

By Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Upstream Bioprocessing

-

Fermentation

-

Downstream Bioprocessing

-

-

By End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Manufacturers

-

CMOs & CROs

-

In-house Manufacturers

-

-

Academic & Clinical Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global single-use bioprocessing market size was estimated at USD 23,433.3 million in 2022 and is expected to reach USD 27,944.2 million in 2023.

b. The global single-use bioprocessing market is expected to witness a compound annual growth rate of 16.24% from 2023 to 2030 to reach USD 80,129 million by 2030.

b. The simple and peripheral elements segment, which includes filters, tubing, transfer systems, and connectors, dominated the market for single-use bioprocessing and accounted for the largest revenue share of 49.10% in 2022.

b. Some key participants in the market for single-use bioprocessing include Sartorius AG; Eppendorf AG; General Electric Company (GE Healthcare); Corning Incorporated; ThermoFisher Scientific; Rentschler Biopharma SE; Merck KGaA; and Pall Corporation.

b. Commercial advantages of single-use technology within the bioprocessing industry with respect to operating & production costs, and new product development timelines, have driven the revenue of the single-use bioprocessing market.

b. The upstream workflow segment dominated the single-use bioprocessing market and accounted for the largest revenue share of 57.86% in 2022.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.1.1. Product Segment

1.1.2. Workflow Segment

1.1.3. End Use Segment

1.2. Regional Scope

1.3. Estimates and Forecast Timeline

1.4. Research Methodology

1.5. Information Procurement

1.5.1. Purchased Database

1.5.2. GVR’s Internal Database

1.5.3. Primary Research

1.6. Information or Data Analysis:

1.6.1. Data Analysis Models

1.7. Market Formulation & Validation

1.8. Model Details

1.8.1. Commodity Flow Analysis

1.9. List of Secondary Sources

1.10. List of Abbreviations

1.11. Objective

1.11.1. Objective 1

1.11.2. Objective2

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Several advantages associated with implementation of single use technology in bio-manufacturing process

3.2.1.2. Increasing investments in expansion of cGMP manufacturing

3.2.1.3. Widespread adoption of single use technology by CMOs

3.2.2. Market Restraint Analysis

3.2.2.1. Concerns due to leachable and extractable

3.2.2.2. Limited adoption of single use technology in downstream process

3.2.3. Market Challenge Analysis

3.2.3.1. Delay in the delivery speed and supply chain of customized products

3.2.3.2. Restraints with scalability of single-use operations

3.2.3.3. Vast availability of multi-use systems

3.2.4. Market Opportunity Analysis

3.2.4.1. Developing technologies for downstream adoption

3.2.4.2. CMO-outsourcing to focus on the new product development

3.3. Industry Analysis Tools

3.3.1. Porter’s Five Forces Analysis

3.3.2. PESTEL Analysis

3.3.3. COVID-19 Impact Analysis

3.3.4. Average Pricing Analysis

Chapter 4. Product Business Analysis

4.1. Single-use Bioprocessing Market: Product Movement Analysis

4.2. Simple & Peripheral Elements

4.2.1. Simple & peripheral elements market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.2. Tubing, Filters, Connectors, & Transfer Systems

4.2.2.1. Tubing, Filters, Connectors, & Transfer Systems market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.3. Bags

4.2.3.1. Bags market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.4. Sampling Systems

4.2.4.1. Sampling systems market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.5. Probes & Sensors

4.2.5.1. Probes & sensors market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.5.2. pH Sensor

4.2.5.2.1. pH sensor market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.5.3. Oxygen Sensor

4.2.5.3.1. Oxygen sensor market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.5.4. Pressure Sensors

4.2.5.4.1. Pressure sensors market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.5.5. Temperature Sensors

4.2.5.5.1. Temperature sensors market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.5.6. Conductivity Sensor

4.2.5.6.1. Conductivity sensor market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.5.7. Flow Sensors

4.2.5.7.1. Flow sensors market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.5.8. Others

4.2.5.8.1. Others market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.6. Others

4.2.6.1. Others market estimates and forecasts, 2018 - 2030 (USD Million)

4.3. Apparatus & Plants

4.3.1. Apparatus & plants market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.2. Bioreactors

4.3.2.1. Bioreactors market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.2.2. Upto 1000L

4.3.2.2.1. Upto 1000L market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.2.3. Above 1000L to 2000L

4.3.2.3.1. Above 1000L to 2000L market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.2.4. Above 2000L

4.3.2.4.1. Above 2000L market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.3. Mixing, Storage, & Filling Systems

4.3.3.1. Mixing, storage, & filling systems market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.4. Filtration System

4.3.4.1. Filtration system market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.5. Chromatography Systems

4.3.5.1. Chromatography systems market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.6. Pumps

4.3.6.1. Pumps market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.7. Others

4.3.7.1. Others market estimates and forecasts, 2018 - 2030 (USD Million)

4.4. Work Equipment

4.4.1. Work equipment market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.2. Cell Culture System

4.4.2.1. Cell culture system market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.3. Syringes

4.4.3.1. Syringes market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.4. Others

4.4.4.1. Others market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 5. Workflow Business Analysis

5.1. Single-use Bioprocessing Market: Workflow Movement Analysis

5.2. Upstream Bioprocessing

5.2.1. Upstream bioprocessing market estimates and forecasts, 2018 - 2030 (USD Million)

5.3. Fermentation

5.3.1. Fermentation market estimates and forecasts, 2018 - 2030 (USD Million)

5.4. Downstream Bioprocessing

5.4.1. Downstream bioprocessing market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 6. End Use Business Analysis

6.1. Single-use Bioprocessing Market: End Use Movement Analysis

6.2. Biopharmaceutical Manufacturers

6.2.1. Biopharmaceutical manufacturers market estimates and forecasts, 2018 - 2030 (USD Million)

6.2.2. CMOs & CROs

6.2.2.1. CMOs & CROs market estimates and forecasts, 2018 - 2030 (USD Million)

6.2.3. In-house Manufacturers

6.2.3.1. In-house manufacturers market estimates and forecasts, 2018 - 2030 (USD Million)

6.3. Academic & Clinical Research Institutes

6.3.1. Academic & clinical research institutes market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 7. Regional Business Analysis

7.1. Single-use Bioprocessing Share By Region, 2023 & 2030

7.2. North America

7.2.1. North America Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.2.2. U.S.

7.2.2.1. Key Country Dynamics

7.2.2.2. Competitive Scenario

7.2.2.3. U.S. Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.2.3. Canada

7.2.3.1. Key Country Dynamics

7.2.3.2. Competitive Scenario

7.2.3.3. Canada Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.3. Europe

7.3.1. Europe Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.3.2. UK

7.3.2.1. Key Country Dynamics

7.3.2.2. Competitive Scenario

7.3.2.3. UK Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.3.3. Germany

7.3.3.1. Key Country Dynamics

7.3.3.2. Competitive Scenario

7.3.3.3. Germany Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.3.4. France

7.3.4.1. Key Country Dynamics

7.3.4.2. Competitive Scenario

7.3.4.3. France Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.3.5. Italy

7.3.5.1. Key Country Dynamics

7.3.5.2. Competitive Scenario

7.3.5.3. Italy Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.3.6. Spain

7.3.6.1. Key Country Dynamics

7.3.6.2. Competitive Scenario

7.3.6.3. Spain Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.3.7. Denmark

7.3.7.1. Key Country Dynamics

7.3.7.2. Competitive Scenario

7.3.7.3. Denmark Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.3.8. Sweden

7.3.8.1. Key Country Dynamics

7.3.8.2. Competitive Scenario

7.3.8.3. Sweden Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.3.9. Norway

7.3.9.1. Key Country Dynamics

7.3.9.2. Competitive Scenario

7.3.9.3. Norway Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.4.2. Japan

7.4.2.1. Key Country Dynamics

7.4.2.2. Competitive Scenario

7.4.2.3. Japan Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.4.3. China

7.4.3.1. Key Country Dynamics

7.4.3.2. Competitive Scenario

7.4.3.3. China Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.4.4. India

7.4.4.1. Key Country Dynamics

7.4.4.2. Competitive Scenario

7.4.4.3. India Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.4.5. Australia

7.4.5.1. Key Country Dynamics

7.4.5.2. Competitive Scenario

7.4.5.3. Australia Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.4.6. Thailand

7.4.6.1. Key Country Dynamics

7.4.6.2. Competitive Scenario

7.4.6.3. Thailand Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.4.7. South Korea

7.4.7.1. Key Country Dynamics

7.4.7.2. Competitive Scenario

7.4.7.3. South Korea Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.5. Latin America

7.5.1. Latin America Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.5.2. Brazil

7.5.2.1. Key Country Dynamics

7.5.2.2. Competitive Scenario

7.5.2.3. Brazil Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.5.3. Mexico

7.5.3.1. Key Country Dynamics

7.5.3.2. Competitive Scenario

7.5.3.3. Mexico Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.5.4. Argentina

7.5.4.1. Key Country Dynamics

7.5.4.2. Competitive Scenario

7.5.4.3. Argentina Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.6. MEA

7.6.1. MEA Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.6.2. South Africa

7.6.2.1. Key Country Dynamics

7.6.2.2. Competitive Scenario

7.6.2.3. South Africa Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.6.3. Saudi Arabia

7.6.3.1. Key Country Dynamics

7.6.3.2. Competitive Scenario

7.6.3.3. Saudi Arabia Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.6.4. UAE

7.6.4.1. Key Country Dynamics

7.6.4.2. Competitive Scenario

7.6.4.3. UAE Single-use Bioprocessing, 2018 - 2030 (USD Million)

7.6.5. Kuwait

7.6.5.1. Key Country Dynamics

7.6.5.2. Competitive Scenario

7.6.5.3. Kuwait Single-use Bioprocessing, 2018 - 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Company Categorization

8.2. Strategy Mapping

8.3. Company Market Position Analysis, 2023

8.4. Company Profiles/Listing

8.4.1. Sartorius AG

8.4.1.1. Overview

8.4.1.2. Financial Performance

8.4.1.3. Product Benchmarking

8.4.1.4. Strategic Initiatives

8.4.2. Thermo Fisher Scientific, Inc.

8.4.2.1. Overview

8.4.2.2. Financial Performance

8.4.2.3. Product Benchmarking

8.4.2.4. Strategic Initiatives

8.4.3. Danaher

8.4.3.1. Overview

8.4.3.2. Financial Performance

8.4.3.3. Product Benchmarking

8.4.3.4. Strategic Initiatives

8.4.4. Merck KGaA

8.4.4.1. Overview

8.4.4.2. Financial Performance

8.4.4.3. Product Benchmarking

8.4.4.4. Strategic Initiatives

8.4.5. Avantor Inc.

8.4.5.1. Overview

8.4.5.2. Financial Performance

8.4.5.3. Product Benchmarking

8.4.5.4. Strategic Initiatives

8.4.6. Eppendorf SE

8.4.6.1. Overview

8.4.6.2. Financial Performance

8.4.6.3. Product Benchmarking

8.4.6.4. Strategic Initiatives

8.4.7. Corning Incorporated

8.4.7.1. Overview

8.4.7.2. Financial Performance

8.4.7.3. Product Benchmarking

8.4.7.4. Strategic Initiatives

8.4.8. Meissner Filtration Products, Inc.

8.4.8.1. Overview

8.4.8.2. Product Benchmarking

8.4.8.3. Strategic Initiatives

8.4.9. Lonza

8.4.9.1. Overview

8.4.9.2. Financial Performance

8.4.9.3. Product Benchmarking

8.4.9.4. Strategic Initiatives

8.4.10. PBS Biotech, Inc.

8.4.10.1. Overview

8.4.10.2. Product Benchmarking

8.4.10.3. Strategic Initiatives

List of Tables

Table 1 List of secondary sources

Table 2 List of abbreviations

Table 3 Global single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 4 Global single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 5 Global single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 6 Global single-use bioprocessing market, by region, 2018 - 2030 (USD Million)

Table 7 North America single-use bioprocessing market, by country, 2018 - 2030 (USD Million)

Table 8 North America single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 9 North America single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 10 North America single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 11 U.S. single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 12 U.S. single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 13 U.S. single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 14 Canada single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 15 Canada single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 16 Canada single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 17 Europe single-use bioprocessing market, by country, 2018 - 2030 (USD Million)

Table 18 Europe single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 19 Europe single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 20 Europe single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 21 Germany single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 22 Germany single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 23 Germany single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 24 UK single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 25 UK single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 26 UK single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 27 France single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 28 France single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 29 France single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 30 Italy single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 31 Italy single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 32 Italy single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 33 Spain single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 34 Spain single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 35 Spain single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 36 Denmark single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 37 Denmark single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 38 Denmark single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 39 Sweden single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 40 Sweden single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 41 Sweden single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 42 Norway single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 43 Norway single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 44 Norway single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 45 Asia Pacific single-use bioprocessing market, by country, 2018 - 2030 (USD Million)

Table 46 Asia Pacific single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 47 Asia Pacific single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 48 Asia Pacific single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 49 China single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 50 China single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 51 China single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 52 Japan single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 53 Japan single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 54 Japan single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 55 India single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 56 India single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 57 India single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 58 South Korea single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 59 South Korea single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 60 South Korea single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 61 Australia single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 62 Australia single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 63 Australia single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 64 Thailand single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 65 Thailand single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 66 Thailand single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 67 Latin America single-use bioprocessing market, by country, 2018 - 2030 (USD Million)

Table 68 Latin America single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 69 Latin America single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 70 Latin America single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 71 Brazil single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 72 Brazil single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 73 Brazil single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 74 Mexico single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 75 Mexico single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 76 Mexico single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 77 Argentina single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 78 Argentina single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 79 Argentina single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 80 Middle East & Africa single-use bioprocessing market, by country, 2018 - 2030 (USD Million)

Table 81 Middle East & Africa single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 82 Middle East & Africa single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 83 Middle East & Africa single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 84 South Africa single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 85 South Africa single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 86 South Africa single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 87 Saudi Arabia single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 88 Saudi Arabia single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 89 Saudi Arabia single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 90 UAE single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 91 UAE single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 92 UAE single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 93 Kuwait single-use bioprocessing market, by product, 2018 - 2030 (USD Million)

Table 94 Kuwait single-use bioprocessing market, by workflow, 2018 - 2030 (USD Million)

Table 95 Kuwait single-use bioprocessing market, by end-use, 2018 - 2030 (USD Million)

Table 96 Participant’s overview

Table 97 Financial performance

Table 98 Key companies undergoing expansions

Table 99 Key companies undertaking acquisitions

Table 100 Key companies undergoing collaborations

Table 101 Key companies launching new products/services

Table 102 Key companies undergoing partnerships

Table 103 Key companies undertaking other strategies

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Market summary, 2023 (USD Million)

Fig. 9 Market segmentation & scope

Fig. 10 Types of bioprocessing systems

Fig. 11 Market trends and outlook

Fig. 12 Market driver impact

Fig. 13 Market restraint impact

Fig. 15 Porter’s analysis

Fig. 16 SWOT analysis

Fig. 17 Single-use bioprocessing market: Product outlook and key takeaways

Fig. 18 Single-use bioprocessing market: Product movement analysis

Fig. 19 Global simple and peripheral elements market, 2018 - 2030 (USD Million)

Fig. 20 Global tubing, filters, connectors and transfer systems market, 2018 - 2030 (USD Million)

Fig. 21 Global single-use bags market, 2018 - 2030 (USD Million)

Fig. 22 Global single-use sampling systems market, 2018 - 2030 (USD Million)

Fig. 23 Global single-use probes and sensors market, 2018 - 2030 (USD Million)

Fig. 24 Global single-use pH sensors market, 2018 - 2030 (USD Million)

Fig. 25 Global single-use oxygen sensors market, 2018 - 2030 (USD Million)

Fig. 26 Global single-use pressure sensors market, 2018 - 2030 (USD Million)

Fig. 27 Global single-use temperature sensors market, 2018 - 2030 (USD Million)

Fig. 28 Global single-use conductivity sensors market, 2018 - 2030 (USD Million)

Fig. 29 Global single-use flow sensors market, 2018 - 2030 (USD Million)

Fig. 30 Global single-use other sensors market, 2018 - 2030 (USD Million)

Fig. 31 Global single-use other single and peripheral elements market, 2018 - 2030 (USD Million)

Fig. 32 Global single-use apparatus and plants market, 2018 - 2030 (USD Million)

Fig. 33 Global single-use bioreactors market, 2018 - 2030 (USD Million)

Fig. 34 Global single-use bioreactors with capacity up to 1000L market, 2018 - 2030 (USD Million)

Fig. 35 Global single-use bioreactors with capacity above 1000L to 2000L market, 2018 - 2030 (USD Million)

Fig. 36 Global single-use bioreactors with capacity above 2000L market, 2018 - 2030 (USD Million)

Fig. 37 Global mixing, storage and filling systems market, 2018 - 2030 (USD Million)

Fig. 38 Global single-use filtration systems market, 2018 - 2030 (USD Million)

Fig. 39 Global single-use chromatography systems market, 2018 - 2030 (USD Million)

Fig. 40 Global single-use pumps market, 2018 - 2030 (USD Million)

Fig. 41 Global single-use other apparatus and plants market, 2018 - 2030 (USD Million)

Fig. 42 Global single-use work equipment market, 2018 - 2030 (USD Million)

Fig. 43 Global single-use cell culture system market, 2018 - 2030 (USD Million)

Fig. 44 Global single-use syringes market, 2018 - 2030 (USD Million)

Fig. 45 Global single-use other work equipment market, 2018 - 2030 (USD Million)

Fig. 46 Single-use bioprocessing market: Workflow outlook and key takeaways

Fig. 47 Single-use bioprocessing market: Workflow movement analysis

Fig. 48 Global single-use upstream bioprocessing market, 2018 - 2030 (USD Million)

Fig. 49 Global single-use fermentation bioprocessing market, 2018 - 2030 (USD Million)

Fig. 50 Global single-use downstream bioprocessing market, 2018 - 2030 (USD Million)

Fig. 51 Single-use bioprocessing market: End-use outlook and key takeaways

Fig. 52 Single-use bioprocessing market: End-use movement analysis

Fig. 53 Global single-use bioprocessing market for biopharmaceutical manufacturers, 2018 - 2030 (USD Million)

Fig. 54 Global single-use bioprocessing market for in-house biopharmaceutical manufacturers, 2018 - 2030 (USD Million)

Fig. 55 Global single-use bioprocessing market for CMOs and CROs, 2018 - 2030 (USD Million)

Fig. 56 Global single-use bioprocessing market for academic and clinical research institutes, 2018 - 2030 (USD Million)

Fig. 57 Single-use bioprocessing market: Regional outlook and key takeaways

Fig. 58 Single-use bioprocessing market: Regional movement analysis

Fig. 59 North America single-use bioprocessing market, 2018 - 2030 (USD Million)

Fig. 60 U.S. single-use bioprocessing market, 2018 - 2030 (USD Million)

Fig. 61 Canada single-use bioprocessing market, 2018 - 2030 (USD Million)

Fig. 62 Europe single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 63 Germany single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 64 France single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 65 UK single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 66 Italy single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 67 Spain single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 68 Denmark single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 69 Sweden single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 70 Norway single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 71 Rest of Europe single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 72 Asia-Pacific single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 73 China single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 74 India single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 75 South Korea single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 76 Japan single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 77 Australia single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 78 Thailand single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 79 Rest of APAC single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 80 Latin America single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 81 Brazil single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 82 Mexico single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 83 Argentina single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 84 Rest of LATAM single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 85 MEA single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 86 South Africa single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 87 Saudi Arabia single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 88 UAE single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 89 Kuwait single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 90 Rest of MEA single-use bioprocessing market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 91 Strategy framework

Fig. 92 Participant categorization

Market Segmentation

- Global Single-use Bioprocessing: Product Outlook (Revenue, USD Million, 2018 - 2030)

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Global Single-use Bioprocessing: Workflow Outlook (Revenue, USD Million, 2018 - 2030)

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Global Single-use Bioprocessing: End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Single-use Bioprocessing: Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- North America Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- North America Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- U.S.

- U.S. Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- U.S. Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- U.S. Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- U.S. Single-use Bioprocessing Market, By Product

- Canada

- Canada Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Canada Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Canada Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Canada Single-use Bioprocessing Market, By Product

- North America Single-use Bioprocessing Market, By Product

- Europe

- Europe Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Europe Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Europe Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- UK

- UK Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- UK Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- UK Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- UK Single-use Bioprocessing Market, By Product

- Germany

- Germany Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Germany Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Germany Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Germany Single-use Bioprocessing Market, By Product

- France

- France Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- France Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- France Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- France Single-use Bioprocessing Market, By Product

- Italy

- Italy Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Italy Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Italy Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Italy Single-use Bioprocessing Market, By Product

- Spain

- Spain Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Spain Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Spain Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Spain Single-use Bioprocessing Market, By Product

- Denmark

- Denmark Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Denmark Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Denmark Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Denmark Single-use Bioprocessing Market, By Product

- Sweden

- Sweden Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Sweden Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Sweden Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Sweden Single-use Bioprocessing Market, By Product

- Norway

- Norway Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Norway Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Norway Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Norway Single-use Bioprocessing Market, By Product

- Europe Single-use Bioprocessing Market, By Product

- Asia Pacific

- Asia Pacific Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Asia Pacific Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Asia Pacific Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Japan

- Japan Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Japan Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Japan Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Japan Single-use Bioprocessing Market, By Product

- China

- China Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- China Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- China Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- China Single-use Bioprocessing Market, By Product

- India

- India Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- India Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- India Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- India Single-use Bioprocessing Market, By Product

- South Korea

- Canada Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Canada Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Canada Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Canada Single-use Bioprocessing Market, By Product

- Australia

- AustraliaSingle-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Australia Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Australia Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- AustraliaSingle-use Bioprocessing Market, By Product

- Thailand

- Thailand Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Thailand Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Thailand Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Thailand Single-use Bioprocessing Market, By Product

- Asia Pacific Single-use Bioprocessing Market, By Product

- Latin America

- Latin America Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Latin America Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Latin America Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Brazil

- Brazil Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Brazil Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Brazil Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Brazil Single-use Bioprocessing Market, By Product

- Mexico

- Mexico Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Mexico Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- Mexico Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Mexico Single-use Bioprocessing Market, By Product

- Argentina

- Argentina Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

- Simple & Peripheral Elements

- Argentina Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- v Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- Argentina Single-use Bioprocessing Market, By Product

- Latin America Single-use Bioprocessing Market, By Product

- Middle East and Africa (MEA)

- MEA Single-use Bioprocessing Market, By Product

- MEA Single-use Bioprocessing Market, By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

- MEA Single-use Bioprocessing Market, By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

- Biopharmaceutical Manufacturers

- South Africa

- South Africa Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements