- Home

- »

- Plastics, Polymers & Resins

- »

-

Single-serve Packaging Market Size, Industry Report, 2030GVR Report cover

![Single-serve Packaging Market Size, Share & Trends Report]()

Single-serve Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Flexible Plastics, Paper & Paperboard), By Application (Food & Beverages, Personal Care), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-534-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Single-serve Packaging Market Trends

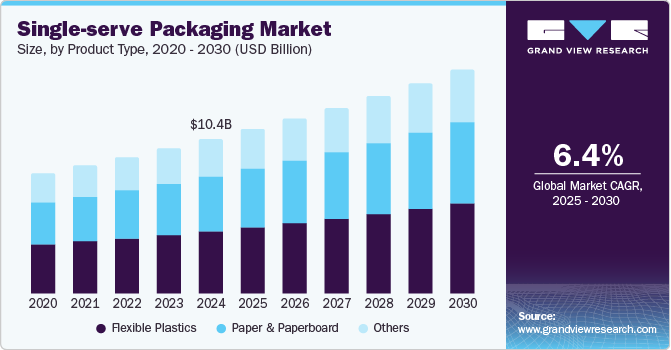

The global single-serve packaging market size was estimated at USD 10.41 billion in 2024 and is expected to grow at a CAGR of 6.38% from 2025 to 2030. The rise of online food delivery and e-commerce is boosting the demand for single-serve packaging, as businesses need durable, lightweight, and tamper-proof solutions for efficient logistics.

The single-serve packaging market is experiencing a significant shift towards sustainability as businesses and consumers prioritize environmental responsibility. Major food and beverage brands are increasingly adopting recyclable, compostable, and bio-based materials to comply with stringent regulations and reduce their carbon footprint. This trend is further accelerated by rising consumer awareness and preferences for eco-friendly alternatives, particularly in regions like North America and Europe.

Companies are innovating with plant-based plastics, paper-based flexible packaging, and lightweight packaging designs to minimize waste while maintaining product integrity. Additionally, circular economy initiatives and extended producer responsibility (EPR) programs are driving investments in sustainable single-serve packaging solutions.

Drivers, Opportunities & Restraints

The rapid urbanization and fast-paced lifestyles of consumers worldwide are key factors propelling the single-serve packaging market. With more individuals living in cities, the demand for on-the-go, portion-controlled, and ready-to-consume food and beverages has surged. This shift is particularly evident in the growing consumption of packaged snacks, ready-to-drink beverages, and meal kits. Single-serve packaging caters to the needs of busy professionals, students, and commuters who prioritize convenience without compromising on freshness and quality. Furthermore, the expanding food delivery and e-commerce sectors have intensified the need for compact, lightweight, and tamper-proof packaging, further driving market growth.

The integration of smart and functional packaging technologies presents a lucrative opportunity for players in the single-serve packaging market. Developments in active and intelligent packaging, such as freshness indicators, self-heating and self-cooling features, and QR code-enabled traceability, enhance consumer engagement and product safety. Brands are leveraging smart packaging solutions to offer personalized experiences, enable real-time tracking, and ensure food safety compliance. The increasing adoption of nanotechnology and barrier coatings to extend shelf life and maintain product quality is also opening new avenues for market expansion. These innovations not only enhance consumer trust but also provide a competitive edge in the highly fragmented single-serve packaging industry.

Despite the growing shift towards sustainable and technologically advanced packaging, cost remains a major restraint in the single-serve packaging market. The development and adoption of biodegradable materials, high-barrier recyclable films, and smart packaging technologies require substantial investments in research, development, and manufacturing infrastructure. Small and medium-sized enterprises (SMEs) often struggle to balance affordability with sustainability, leading to slower adoption rates. Moreover, regulatory compliance with evolving packaging waste laws adds complexity and cost to production. Price-sensitive consumers in developing regions may also be reluctant to pay a premium for sustainable single-serve packaging, further limiting widespread adoption.

Product Type Insights

Flexible plastics dominated the single-serve packaging market across the product segmentation in terms of revenue, accounting for a revenue share of 44.28% in 2024. The flexible plastics segment in single-serve packaging is advancing due to the demand for high-barrier, lightweight, and cost-effective solutions that enhance product shelf life.

Food and beverage brands are increasingly adopting multilayer flexible films with superior oxygen and moisture resistance to maintain freshness and prevent spoilage. In response to regulatory pressures and sustainability goals, companies are developing recyclable mono-material films and bio-based flexible plastics that offer the same protective properties as conventional materials. Additionally, the shift toward high-speed packaging lines in food processing industries has fueled innovations in flexible plastic pouches and sachets, ensuring efficiency in automated filling and sealing operations.

The increasing consumer and regulatory push for plastic-free packaging solutions has positioned paper and paperboard as a leading alternative in the single-serve packaging market. Businesses across food, beverage, and personal care sectors are switching to coated paperboard, molded fiber, and biodegradable paper pouches to align with sustainability commitments.

Technological advancements in water- and grease-resistant coatings have expanded the application of paper-based single-serve packaging for liquid and semi-solid products, including soups, sauces, and dairy alternatives. Moreover, major retailers and fast-food chains are phasing out single-use plastic in favor of recyclable and compostable paper-based options, further strengthening demand in this segment.

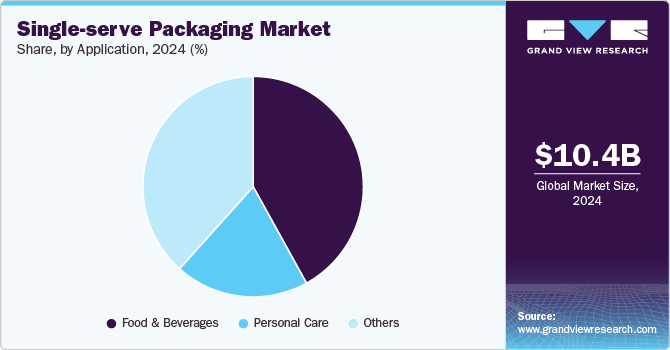

Application Insights

Food and beverage dominated the single-serve packaging market across the technology segmentation in terms of revenue, accounting for a revenue share of 41.96% in 2024. The food and beverage industry is witnessing rapid expansion in single-serve packaging due to the increasing demand for functional, health-focused, and premium on-the-go products. Consumers, particularly in urban areas, are seeking convenient yet nutritious options such as protein shakes, fortified snacks, and cold-pressed juices in portion-controlled packaging. This trend is further supported by the rising influence of fitness-conscious and diet-aware lifestyles, where single-serve packaging helps in portion management and calorie tracking. Additionally, brands are investing in resealable and extended-shelf-life packaging formats, catering to both retail and direct-to-consumer delivery models in an increasingly digital marketplace.

In the personal care industry, single-serve packaging is gaining traction due to the growing preference for travel-sized, disposable, and hygienic product formats. Skincare, cosmetics, and hygiene brands are responding to consumer needs by introducing single-use sachets, ampoules, and biodegradable pods that offer controlled dosing and portability. The post-pandemic emphasis on hygiene has also driven demand for individually packaged wet wipes, sanitizers, and facial masks, ensuring safety and minimizing contamination risks. Furthermore, luxury and premium beauty brands are leveraging single-serve packaging for sampling and trial-size products, boosting consumer engagement and increasing brand accessibility in a competitive market.

Regional Insights & Trends

North America single-serve packaging market dominated the global market and accounted for the largest revenue share of 40.62% in 2024. The rapid expansion of direct-to-consumer (DTC) brands and subscription-based services is significantly driving demand for single-serve packaging in North America. Consumers increasingly prefer home-delivered meal kits, functional beverages, and personalized nutrition products, all of which rely on portion-controlled and tamper-proof packaging to maintain freshness and convenience.

Companies in the food, beverage, and personal care sectors are investing in innovative single-serve formats, such as pre-measured coffee pods, skincare sachets, and plant-based snack packs, to cater to evolving consumer preferences. The rise of e-commerce and quick-commerce platforms has further strengthened this demand, with brands optimizing packaging for efficient logistics and sustainability compliance.

As hybrid and remote work models reshape consumer behavior, there is a growing demand for convenient, ready-to-use, single-serve packaging solutions in North America. While remote workers seek pre-portioned snacks and beverages for home consumption, office-goers require portable, mess-free packaging options for workplace snacking and hydration. The resurgence of travel and outdoor activities has also increased the need for compact, resealable, and durable single-serve packaging, particularly for protein bars, bottled functional drinks, and energy supplements. Brands are responding with sustainable and innovative packaging formats, aligning with consumer expectations for both convenience and environmental responsibility.

U.S. Single-serve Packaging Market Trends

The single-serve packaging market in the U.S. is driven by the evolving federal and state-level packaging regulations that are accelerating the adoption of sustainable single-serve packaging solutions. States like California, New York, and Washington have implemented stringent laws restricting single-use plastics and promoting extended producer responsibility (EPR) programs, compelling brands to rethink their packaging strategies. Large food and beverage companies are increasingly shifting toward recyclable, compostable, and biodegradable materials to comply with these regulations while maintaining product appeal. The introduction of advanced material innovations, such as fiber-based flexible packaging and water-soluble films, is further transforming the single-serve packaging landscape, ensuring compliance without compromising functionality.

Europe Single-serve Packaging Market Trends

The European single-serve packaging market is being driven by a high consumer preference for eco-friendly and premium packaging solutions. With stringent sustainability regulations under the EU Green Deal and Circular Economy Action Plan, companies are accelerating the shift towards recyclable and bio-based materials. Consumers are willing to pay a premium for single-serve products packaged in environmentally friendly formats, such as paper-based coffee pods, biodegradable food trays, and refillable personal care sachets. The trend is particularly strong in Western Europe, where regulatory bodies and major retailers are imposing stricter packaging waste reduction targets, making sustainable single-serve packaging an industry priority.

Asia Pacific Single-serve Packaging Market Trends

The single-serve packaging market in the Asia Pacific region is experiencing significant demand for single-serve packaging due to rapid urbanization and the expansion of modern retail formats, including supermarkets, convenience stores, and online grocery platforms. As more consumers shift to fast-paced urban lifestyles, there is a growing need for convenient, portioned food and beverage options, particularly in countries like China, India, and Southeast Asian nations. The rise of online food delivery and digital grocery shopping is further driving innovation in single-serve packaging, with brands adopting lightweight, tamper-evident, and cost-effective solutions that cater to affordability-focused and convenience-driven consumers.

Key Single-serve Packaging Company Insights

The single-serve packaging market is highly competitive, with several key players dominating the landscape. Major companies include Berry Global, Amcor plc, Sonoco Products Company, Sealed Air, Huhtamaki, Constantia Flexibles, Winpak, Tetra Pak, Plastipak Packaging, and Reynolds Consumer Products. The single-serve packaging market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Single-serve Packaging Companies:

The following are the leading companies in the single-serve packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Berry Global

- Amcor plc

- Sonoco Products Company

- Sealed Air

- Huhtamaki

- Constantia Flexibles

- Winpak

- Tetra Pak

- Plastipak Packaging

- Reynolds Consumer Products

Recent Developments

-

In November 2024, Lactips and Walki Group entered a joint development agreement to create fully biodegradable, plastic-free food packaging using natural polymers that can be recycled in the paper stream. This partnership combined Lactips' expertise in natural polymer formulation with Walki's production capabilities.

-

In July 2024, the U.S. government announced a government-wide strategy to combat plastic pollution by addressing its entire lifecycle. A key component is phasing out single-use plastics in federal procurement, with goals set for 2027 and 2035. The government aims to encourage reusable, compostable, and recyclable alternatives.

Single-serve Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.02 billion

Revenue forecast in 2030

USD 15.01 billion

Growth rate

CAGR of 6.38% from 2024 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Berry Global; Amcor plc; Sonoco Products Company; Sealed Air; Huhtamaki; Constantia Flexibles; Winpak; Tetra Pak; Plastipak Packaging; Reynolds Consumer Products

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Single-serve Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the single-serve packaging market report based on the product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Flexible Plastics

-

Paper & Paperboard

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Personal Care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global single-serve packaging market size was estimated at USD 10.41 billion in 2024 and is expected to reach USD 11.02 billion in 2025.

b. The global single-serve packaging market is expected to grow at a compound annual growth rate of 6.38% from 2025 to 2030 to reach USD 15.01 billion by 2030.

b. Food and beverage dominated the single-serve packaging market across the technology segmentation in terms of revenue, accounting to a market share of 41.96% in 2024. The food and beverage industry is witnessing rapid expansion in single-serve packaging due to the increasing demand for functional, health-focused, and premium on-the-go products.

b. Some key players operating in the single-serve packaging market include Berry Global, Amcor plc, Sonoco Products Company, Sealed Air, Huhtamaki, Constantia Flexibles, Winpak, Tetra Pak, Plastipak Packaging, and Reynolds Consumer Products.

b. The rise of online food delivery and e-commerce is boosting the demand for single-serve packaging, as businesses need durable, lightweight, and tamper-proof solutions for efficient logistics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.