Singapore Customer Experience Business Process Outsourcing Market Size, Share & Trends Analysis Report By Service (Inbound, Outbound), By Outsourcing, By Support Channel (Voice, Non-voice), By End-use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-532-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

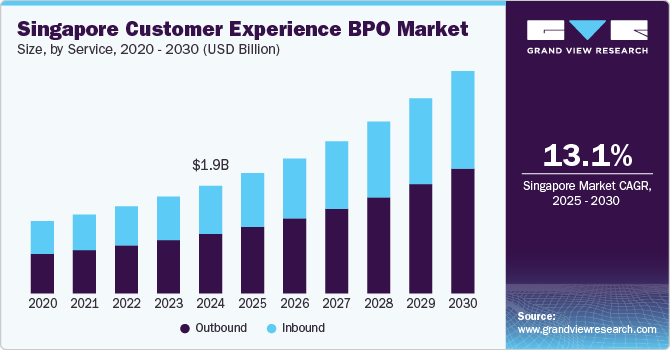

The Singapore customer experience business process outsourcing market size was estimated at USD 1.98 billion in 2024 and is anticipated to grow at a CAGR of 13.1% from 2025 to 2030. The market is driven by the country's strong digital infrastructure, skilled multilingual workforce, and strategic location as a regional business hub. The rising demand for AI-powered customer support, automation, and omnichannel engagement solutions accelerates business process outsourcing (BPO) adoption, especially in the banking, e-commerce, and telecommunications industries.

The rapid advancement of digital transformation is significantly reshaping the customer experience (CX) business process outsourcing (BPO) market in Singapore. As businesses increasingly adopt digital-first strategies to enhance customer engagement, the demand for outsourced CX solutions is rising. Companies leverage automation, artificial intelligence (AI), and cloud-based contact center solutions to optimize service delivery while maintaining operational efficiency. This shift drives growth in the CX BPO market, as organizations seek specialized providers to implement and manage digital customer interactions effectively.

One of the key drivers of this transformation is the increasing adoption of AI-powered chatbots, virtual assistants, and predictive analytics. These technologies enhance customer service efficiency by reducing response times and personalizing interactions. As a result, CX BPO providers are expanding their capabilities beyond traditional call center services to include AI-driven customer support, omnichannel communication, and advanced data analytics. Businesses in Singapore and Malaysia are turning to BPO providers to integrate these technologies, ensuring seamless and proactive customer engagement. For instance, according to DataReportal's Global Digital Insights 2024, in Singapore, implementing AI chatbots in banking customer service resulted in a 40% decrease in response times and enhanced customer satisfaction.

The increasing digital adoption among enterprises in Singapore has played a pivotal role in driving the growth of the customer experience (CX) business process outsourcing (BPO) market. According to the Infocomm Media Development Authority Singapore, the digital adoption rate, which measures the average number of digital solutions implemented per firm across six key areas-Cybersecurity, Cloud, E-payment, E-commerce, Data Analytics, and AI among enterprises reached 94.6%, reflecting a 0.5 percentage point increase from the previous year. This steady progress in digitalization has significantly influenced the demand for advanced CX BPO services.

Rising security concerns and data privacy issues present significant challenges to the growth of the Singapore customer experience business process outsourcing industry. As businesses increasingly rely on outsourced CX services to handle sensitive customer data, ensuring robust security measures and regulatory compliance has become a critical concern for organizations and service providers. Singapore has stringent data privacy laws, such as Singapore's Personal Data Protection Act (PDPA) and Malaysia's Personal Data Protection Act (PDPA), which require organizations to implement strict measures for collecting, processing, and storing customer information. Non-compliance with these regulations can result in substantial fines and reputational damage, making companies cautious about outsourcing CX functions to third-party providers.

Service Insights

The outbound segment dominated the market and accounted for a revenue share of over 55.0% in 2024 due to the increasing demand for high-quality sales, lead generation, and customer retention services, particularly in the banking, insurance, and technology sectors. Businesses leverage Singapore's multilingual talent pool and advanced analytics-driven strategies to enhance customer outreach and engagement. The use of AI-driven predictive dialing, automation, and data-driven insights further improves efficiency and personalization.

The inbound segment is expected to grow at a significant CAGR of 12.7% over the forecast period. The growth of e-commerce, fintech, and digital services industries is fueling the demand for inbound in Singapore Customer Experience Business Process Outsourcing Industry. As more consumers engage with online platforms for shopping, banking, and entertainment, businesses ensure seamless customer service through multiple communication channels, including voice calls, live chat, social media, and email.

Outsourcing Type Insights

The offshore segment accounted for the largest revenue share of nearly 44.0% in 2024 due to the country's reputation as a global business hub, strong data security regulations, and high service quality standards. Multinational companies choose Singapore for offshore outsourcing due to its advanced digital infrastructure, political stability, and skilled multilingual workforce capable of handling complex customer interactions across various industries, including finance, technology, and healthcare

The nearshore segment is expected to grow at a significant CAGR over the forecast period. The increasing adoption of hybrid work models and remote customer service solutions has accelerated the demand for nearshore outsourcing. Many businesses in Singapore have shifted towards digital and cloud-based platforms, making it easier to collaborate with service providers in neighboring countries.

Support Channel Insights

The voice segment accounted for the largest revenue share of over 75.0% in 2024. With the rise of digital transactions, fintech firms and e-commerce platforms increasingly rely on voice support for payment verification, fraud prevention, and customer assistance. Moreover, combining AI-driven voice bots for routine inquiries and human agents for complex issues enhances operational efficiency and customer satisfaction. Businesses are increasingly outsourcing voice support to Singapore to provide round-the-clock assistance for global customers, ensuring enhanced service availability.

The non-voice segment is expected to grow at a significant CAGR over the forecast period. The increasing importance of omnichannel customer engagement is driving the expansion of the non-voice in Singapore customer experience business process outsourcing industry. Modern consumers interact with brands across multiple touchpoints, expecting a seamless and integrated experience whether they contact a business via email, chat, social media, or mobile apps. Businesses are investing in omnichannel customer experience strategies to ensure consistent and personalized interactions, regardless of the communication channel used.

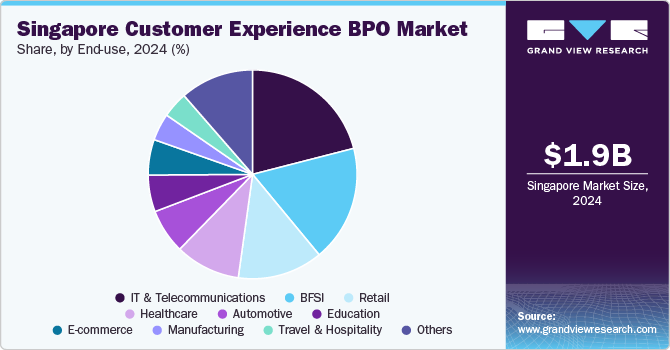

End-use Insights

The IT & telecommunications segment accounted for the largest revenue share of over 21.0% in 2024. The increasing adoption of digital technologies like 5G, IoT, and cloud services in the IT and telecommunications industries drives the demand for outsourcing customer support to handle complex queries and technical troubleshooting. Telecom and IT firms increasingly leverage AI and automation to enhance their customer service capabilities, driving the demand for AI-powered customer support solutions like chatbots, voice bots, and predictive analytics for quicker resolution time.

The e-commerce segment is expected to grow at a significant CAGR over the forecast period. Expansion of cross-border e-commerce and international customer support drives the segment growth. As Singaporean retailers expand into global markets, they face the challenge of managing international customer inquiries, returns, and logistics issues. Cross-border e-commerce growth requires retailers to provide multilingual support, address diverse customer preferences, and comply with different regulatory requirements across regions.

Key Singapore Customer Experience BPO Company Insights

Key players operating in the Singapore customer experience business process outsourcing industry are Teleperformance, Accenture, Concentrix Corporation, and TDCX. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In January 2025, Accenture acquired a digital twin technology platform from Singapore-based fintech company Percipient, enhancing its banking modernization capabilities in Asia Pacific. This acquisition aims to help financial institutions accelerate the transformation of their core systems, drive innovation, and promote growth by adopting advanced technology.

-

In July 2024, Digital Business People Pte Ltd (DBP) announced a strategic partnership with Salesforce, a U.S.-based company in customer relationship management (CRM), to enhance digital transformation efforts across multiple industries. As a consulting partner, DBP aims to integrate its expertise in customer communications management (CCM) with Salesforce’s advanced technology to help organizations improve customer engagement, optimize operations, and drive business growth. This collaboration aims to deliver tailored solutions that align with clients' specific needs, reinforcing DBP’s commitment to innovation and efficiency in the evolving digital landscape.

Key Singapore Customer Experience Business Process Outsourcing Companies:

- Accenture

- Antasis Pte Ltd

- Asian Technology Solutions

- Concentrix Corporation

- Connect Centre Pte Ltd

- Foundever

- SMCBPO

- Star CRM

- TDCX

- Teleperformance

Singapore Customer Experience BPO Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.22 billion |

|

Revenue forecast in 2030 |

USD 4.10 billion |

|

Growth rate |

CAGR of 13.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report services |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, outsourcing,support channel, end-use |

|

Key companies profiled |

Accenture; Antasis Pte Ltd; Asian Technology Solutions; Concentrix Corporation; Connect Centre Pte Ltd; Foundever; SMCBPO; Star CRM; TDCX Teleperformance |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Singapore Customer Experience BPO Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Singapore customer experience business process outsourcing market report based on service, outsourcing, support channel, and end-use.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Inbound

-

Outbound

-

-

Outsourcing Outlook (Revenue, USD Billion, 2018 - 2030)

-

Onshore

-

Offshore

-

Nearshore

-

-

Support Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Voice

-

Non-voice

-

Chats

-

Email

-

Others

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

BFSI

-

Healthcare

-

Manufacturing

-

Media & Entertainment

-

IT & Telecommunications

-

Education

-

Retail

-

Travel & Hospitality

-

E-commerce

-

Others

-

Frequently Asked Questions About This Report

b. The Singapore customer experience business process outsourcing market size was estimated at USD 1.98 billion in 2024 and is expected to reach USD 2.22 billion in 2025.

b. The global Singapore customer experience business process outsourcing market is expected to grow at a compound annual growth rate of 13.1% from 2025 to 2030 to reach USD 4.10 billion by 2030

b. The outbound segment dominated the market and accounted for a revenue share of over 55.0% in 2024 due to the increasing demand for high-quality sales, lead generation, and customer retention services, particularly in the banking, insurance, and technology sectors.

b. Some key players operating in the Singapore customer experience business process outsourcing market include Accenture, Antasis Pte Ltd, Asian Technology Solutions, Concentrix Corporation, Connect Centre Pte Ltd, Foundever, SMCBPO, Star CRM, TDCX Teleperformance

b. The market is driven by the country's strong digital infrastructure, skilled multilingual workforce, and strategic location as a regional business hub.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."