- Home

- »

- Clothing, Footwear & Accessories

- »

-

Singapore Baby Apparel Market Size, Industry Report, 2030GVR Report cover

![Singapore Baby Apparel Market Size, Share & Trends Report]()

Singapore Baby Apparel Market Size, Share & Trends Analysis Report By Product (Outerwear, Underwear), By Distribution Channel (Online, Offline), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-487-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Singapore Baby Apparel Market Trends

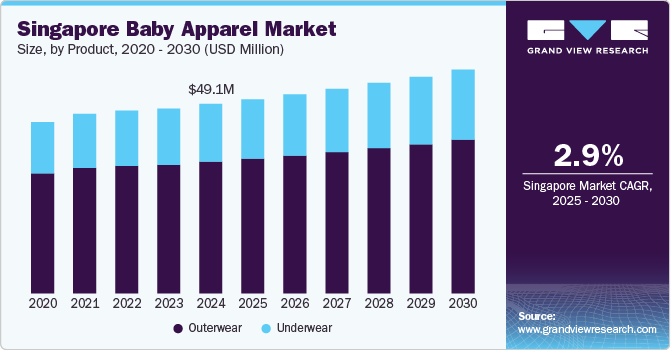

The Singapore baby apparel market size was estimated at USD 49.1 million in 2024 and is projected to grow at a CAGR of 2.9% from 2025 to 2030. The market demand for baby apparel in Singapore is growing due to several factors and trends that align with changing demographics, consumer preferences, and economic conditions. Singapore's rising birth rate and increase in household disposable income have boosted parents' spending power, allowing them to prioritize quality and branded baby apparel. In addition, Singaporean parents increasingly prioritize fashion and comfort for their children, driving demand for a diverse range of stylish and high-quality baby clothing options.

Major market participants in the e-commerce industry have fueled market growth. Online platforms by brands and e-retailers have played a crucial role in the growing demand for baby apparel. These platforms offer numerous baby apparel products through the website, such as shirts, tops, dresses, shorts, t-shirts, skirts, briefs, dungaree sets, joggers, jeans, gift sets, pajamas, rompers, shawls, sleepsuits, vests, and others.

Demand for baby apparel made with sustainably sourced material has also contributed to the growth of this industry. For instance, Greendigo is one of the prominent brands that offers sustainable products that are designed with excellence, made to last long, and easy to maintain. The brand eliminates the use of harmful chemicals and impractical designs and adds fresh colors, comforts, attractive prints, and high quality to the product. Its diverse product portfolio entails baby apparel, bedtime and bath essentials, and sustainably developed products with applauded aesthetics.

Product Insights

The outerwear segment led the market with the largest revenue share of 69.50% in 2024. A growing number of parents with enhanced purchasing power and disposable income, large collections of dedicated baby apparel offered by numerous well-liked brands, the emergence of organic products made with sustainably sourced materials, ease of availability, and rising penetration of several e-commerce platforms are driving the growth for this segment. To attract a greater number of customers, major brands in this market are offering newly developed products at regular intervals. The availability of consumer data collected through various means has helped these brands to design and deliver the exact type of products, which have a higher possibility of generating demand in less time after introduction to the market.

The underwear segment is expected to grow at the fastest CAGR of 3.3% from 2025 to 2030. This market is primarily driven by the growing awareness among parents about the quality of materials used in baby underwear as it directly comes in contact with the baby’s skin. In recent years, owing to enhanced availability and accessibility of information, parents have become more conscious about underwear and baby apparel that they buy for their infants and even older children. The availability of specially tailored organic apparel, growing inclusion of natural materials in clothing, and ease of accessibility through online platforms are expected to generate greater demand for this segment in the approaching years.

Distribution Channel Insights

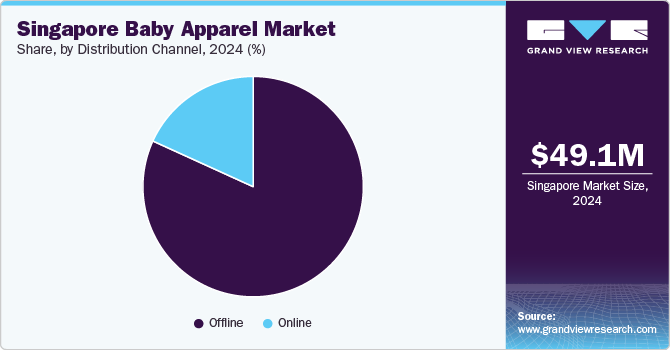

Based on distribution channel, the offline segment led the market with the largest revenue share of 81.8% in 2024. Major retailers are increasing the penetration of retail stores to cater to the increasing demand for baby apparel. These outlets often provide a convenient location for people who prefer offline shopping experiences while buying baby apparel. Furthermore, the presence of baby boutiques and distinctive shops that provide a specially selected range of baby clothes emphasizing uniqueness and luxury have contributed to the growth of this segment. The inclusion of baby apparel products on their shelves by multiple retail store chains and hypermarkets offers enhanced brand visibility to the key players, which encourages them to focus more on effective offline distribution.

The online segment is expected to grow at the fastest CAGR of 4.9% from 2025 to 2030. The increasing penetration of the e-commerce industry, growing dependence on smartphones and other smart devices, increasing accessibility of the internet, entry of multiple applauded brands in the online shopping market, and additional services provided for online shoppers such as doorstep deliveries, return and refund policy, customer review, and multiple payment alternatives are projected to assist this segment in terms of growth.

Key Singapore Baby Apparel Company Insights

The market is characterized by numerous well-established and emerging players. Manufacturers in the Singapore market are engaging in a variety of strategic initiatives to keep pace with evolving consumer demands and market trends.

Key Singapore Baby Apparel Companies:

- Carter’s, Inc.

- H&M Hennes & Mauritz AB

- Nike, Inc.

- Adidas AG

- Burberry Limited

- The Gap, Inc.

- Ralph Lauren Corporation

- Gerber Childrenswear LLC

- PatPat

- LVMH Group

Recent Developments

-

In August 2021, In Singapore, two mothers launched ReLoved Collective, an online platform for buying and selling high-quality preloved kids' clothes, toys, and books. The initiative encourages sustainability by reducing waste, and offering items like preloved designer clothes at affordable prices. The platform also aims to help families find value in secondhand goods without compromising on quality.

Singapore Baby Apparel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 50.4 million

Revenue forecast in 2030

USD 58.0 million

Growth rate

CAGR of 2.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Distribution Channel

Country scope

Singapore

Key companies profiled

Carter’s, Inc.; H&M Hennes & Mauritz AB; Nike, Inc.; Adidas AG; Burberry Limited; The Gap, Inc.; Ralph Lauren Corporation; Gerber Childrenswear LLC; PatPat; LVMH Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Singapore Baby Apparel Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Singapore baby apparel market report based on the product, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Outerwear

-

Underwear

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The Singapore baby apparel market size was estimated at USD 49.1 million in 2024 and is expected to reach USD 50.4 million in 2025.

b. The Singapore baby apparel market is expected to grow at a compounded growth rate of 2.9% from 2025 to 2030 to reach USD 58.0 million by 2030.

b. Underwear is expected to growth with a CAGR of 3.3% from 2025 to 2030. A growing interest in sustainable, organic cotton options aligns with eco-conscious values, which parents increasingly prioritize. Additionally, with rising disposable incomes, families are more willing to invest in durable, comfortable products for infants. Lastly, the influence of online shopping and targeted marketing for premium babywear contributes to increased demand in this segment.

b. Some key players operating in Singapore baby apparel market include Unilever PLC, Nestlé S.A., General Mills, Inc., Nomad Foods Ltd., Tyson Foods Inc., and others.

b. Key factors that are driving the market growth include rising fashion trends for baby clothing and increasing disposable income of consumers

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."