Silver Wound Dressing Market Size, Share & Trends Analysis Report By Product (Traditional, Advanced), By End-use (Hospitals, Clinics, Home Healthcare), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-874-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Silver Wound Dressing Market Size & Trends

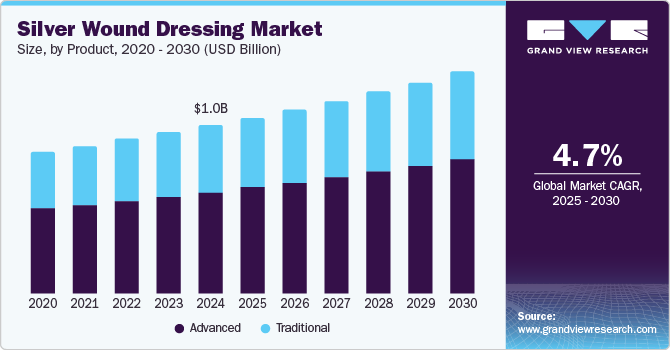

The global silver wound dressing market size was estimated at USD 1.03 billion in 2024 and is projected to grow at a CAGR of 4.7% from 2025 to 2030. According to the Health Innovation Program, approximately 2 million citizens in the U.S. develop diabetic foot ulcers annually, a statistic that underscores the urgent demand for effective wound care solutions. This rising prevalence is not limited to the U.S.; countries such as Mexico, with about 126 million people and 10% of its population aged 60 and older, are witnessing a similar surge in chronic wounds as this demographic expands. Moreover, Brazil, with a population of around 213 million and 9% aged 65 and above, reflects a broader trend in emerging markets, further intensifying the demand for advanced wound management products.

The aging population is a critical driver influencing the market for silver-based dressings. In Norway, a nation with a median age of 39.8 years and a growing proportion of individuals aged 65 and above, there is an increasing need for advanced healthcare services, particularly in wound care. This trend is echoed in South Africa, where approximately 60 million people are about 9% of their population aged 65 and older, highlighting the urgent need for specialized wound management solutions to address chronic conditions associated with aging. These demographic shifts are prompting healthcare providers to increasingly turn to silver dressings for their proven antibacterial properties and effectiveness in promoting healing.

In addition to demographic trends, the rise in surgical procedures worldwide is driving market expansion further. As the volume of surgical interventions continues to rise, the need for effective wound dressings to prevent infections and manage post-operative wounds becomes paramount. Surgical wounds constitute a substantial segment of the silver dressing market, anticipated to maintain its upward trajectory alongside the increasing number of surgeries performed globally.

Moreover, silver dressings are acknowledged for reducing infection rates and enhancing healing times compared to traditional methods. Technological advancements in wound care products, including innovative silver-infused dressings, also promote a transition from conventional wound care solutions to better patient outcomes.

Product Insights

Advanced silver wound dressing led the market with a revenue share of 60.3% in 2024, attributed to its superior antibacterial efficacy that significantly reduces infection risks and promotes healing. The category includes silver foam dressings, silver plated nylon fiber dressings, silver hydrogel/hydrofiber, silver alginates, and nano crystalline silver dressings, among others, as healthcare providers increasingly recognize their benefits for acute and chronic wound management amid rising chronic conditions and an aging population.

Traditional silver wound dressing is expected to grow rapidly over the forecast period. These dressings, typically made from cotton gauze treated with silver, offer a cost-effective solution for clean, dry wounds with minimal exudate. Their broad-spectrum antibacterial properties enhance their reliability, and their established reputation ensures continued use, especially in budget-constrained environments, despite the availability of advanced alternatives.

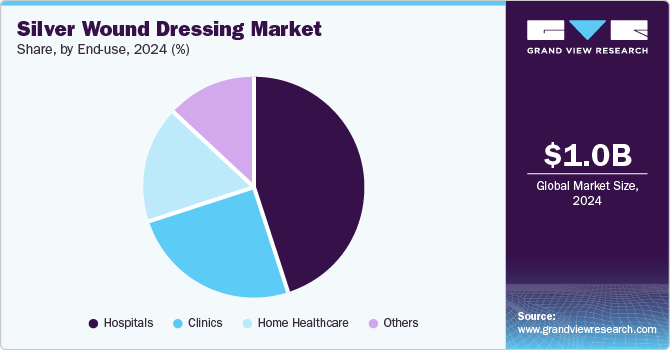

End-use Insights

Hospitals dominated the market and accounted for a share of 45.4% in 2024. Hospitals serve as primary care environments where advanced wound management is crucial for infection prevention and healing, particularly for surgical wounds and chronic conditions such as diabetic foot ulcers. The increase in surgical procedures and chronic disease prevalence underscores the demand for effective wound care solutions.

Home healthcare is projected to grow at the fastest CAGR of 5.6% over the forecast period, driven by an increasing preference for at-home treatment among patients, particularly the elderly and those with chronic wounds. As individuals seek to manage their health outside hospital settings, the need for effective, user-friendly wound care solutions has escalated. Advanced silver wound dressings are preferred for their antimicrobial properties, reducing infection risks and promoting healing, especially among the growing geriatric population requiring frequent dressing changes.

Regional Insights

North America silver wound dressing market dominated the global market with a revenue share of 48.4% in 2024. The region’s robust medical technology and substantial healthcare investment promote the adoption of innovative wound care products. Furthermore, the rising incidence of diabetes and an aging population enhances the demand for effective wound management solutions, supported by favorable reimbursement policies and increased awareness of advanced options in North America.

U.S. Silver Wound Dressing Market Trends

The silver wound dressing market in the U.S. dominated the North America silver wound dressing market with a revenue share of 82.4% in 2024. The country is facing a high prevalence of chronic conditions, especially diabetes, resulting in numerous diabetic foot ulcers and chronic wounds. A strong healthcare system fosters extensive R&D, leading to innovative wound care products. Moreover, a growing elderly population and favorable reimbursement policies enhance the accessibility and adoption of silver wound dressings.

Europe Silver Wound Dressing Market Trends

Europe silver wound dressing market held a substantial market share in 2024, driven by high disposable income and a robust healthcare infrastructure that supports advanced wound care product usage. The growing prevalence of chronic wounds, chiefly due to an aging population and rising diabetes cases, further elevates demand, with approximately 448.8 million people in the EU and a median age of 44.5 years. Favorable reimbursement policies also encourage healthcare providers to adopt silver-based dressings for their antimicrobial benefits, while heightened awareness of effective wound management among patients and professionals contributes to overall market expansion in the region.

The silver wound dressing market in the UK is expected to grow rapidly in the forecast period. The increasing prevalence of chronic conditions, particularly diabetes and obesity, has resulted in a greater need for specialized wound care. The UK’s commitment to evidence-based medicine promotes the adoption of effective silver dressings, while favorable government policies and reimbursement frameworks facilitate their widespread utilization in hospitals and clinics.

Asia Pacific Silver Wound Dressing Market Trends

Asia Pacific silver wound dressing market is expected to register the fastest CAGR of 5.6% in the forecast period. The median age in countries such as Japan is rising, underscoring the need for effective wound management solutions. This demographic shift boosts demand for silver-infused dressings while increased awareness and investments in healthcare infrastructure enhance access to innovative wound care products.

The silver wound dressing market in India is anticipated to witness the fastest growth of 7.5% in the Asia Pacific market over the forecast period. Increased awareness of advanced wound care solutions among healthcare providers and patients fuels demand for silver-based dressings. India’s estimated population of 1.4 billion, with approximately 8% over 60 years old and prone to chronic wounds, highlights significant growth opportunities. Enhanced healthcare infrastructure and government initiatives further facilitate access to effective treatments in urban and rural areas.

Key Silver Wound Dressing Company Insights

Some key companies operating in the market include B. Braun Medical Inc., 3M, Convatec Group PLC, Coloplast Group, and Smith+Nephew. Strategic initiatives involve mergers, acquisitions, and collaborations to broaden product offerings and market presence, alongside focused research and development to improve product efficacy and utilize innovative technologies.

-

Convatec Group PLC designs and markets an extensive array of advanced wound care products, including silver-based dressings such as AQUACEL Ag. These dressings utilize ionic silver and innovative Hydrofiber Technology to enhance healing and minimize infection risks in acute and chronic wounds.

-

Mölnlycke Health Care AB specializes in advanced wound care solutions, including silver wound dressings that enhance healing through antibacterial properties. The company prioritizes innovation and research collaborations to improve chronic wound management and enhance patient outcomes.

Key Silver Wound Dressing Companies:

The following are the leading companies in the silver wound dressing market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun Medical Inc.

- 3M

- Convatec Group PLC

- Coloplast Group

- Smith+Nephew

- Mölnlycke Health Care AB

- Ferris Mfg. Corp.

- Cardinal Health

Recent Developments

-

In October 2024, Mölnlycke Health Care and Transdiagen announced a research collaboration to leverage TDG’s novel wound gene signatures, enhancing understanding and innovation in chronic wound care and management solutions.

-

In May 2024, Convatec announced results from a multinational RCT, revealing that AQUACEL Ag+ Extra dressing significantly outperformed standard care in healing venous leg ulcers, achieving a 74.8% complete healing rate at 12 weeks.

Silver Wound Dressing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.08 billion |

|

Revenue forecast in 2030 |

USD 1.36 billion |

|

Growth rate |

CAGR of 4.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

B. Braun Medical Inc.; 3M; Convatec Group PLC; Coloplast Group; Smith+Nephew; Mölnlycke Health Care AB; Ferris Mfg. Corp.; Cardinal Health |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Silver Wound Dressing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global silver wound dressing market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional

-

Silver Bandages

-

Others

-

-

Advanced

-

Silver Foam Dressing

-

Silver Plated Nylon Fiber Dressing

-

Silver Hydrogel/Hydrofiber

-

Silver Alginates

-

Nano Crystalline Silver Dressings

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global silver wound dressing market size was estimated at USD 1.03 billion in 2024 and is expected to reach USD 1.08 billion in 2025.

b. The global silver wound dressing market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2030 to reach USD 1.36 billion by 2030.

b. The advanced silver wound dressing segment held the largest market share of over 59.86% in 2024 and is expected to witness the fastest growth rate over the forecast period.

b. Some key players operating in the silver wound dressing market include Mölnlycke Health Care AB, 3M, Coloplast, Medline, and Smith & Nephew PLC.

b. Key factors that are driving the market growth include the increasing prevalence of chronic diseases, technological advancement, rising cases of accidents & trauma, and rising geriatric population.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."