- Home

- »

- Homecare & Decor

- »

-

Silver Tourism Market Size, Share, Industry Report, 2030GVR Report cover

![Silver Tourism Market Size, Share & Trends Report]()

Silver Tourism Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Age Group, By Category (Solo, Couple, Group), By Destination, By Booking Mode, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-465-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Silver Tourism Market Summary

The global silver tourism market size was estimated at USD 1,720.1 billion in 2024 and is projected to reach USD 2,623.4 billion by 2030, growing at a CAGR of 7.3% from 2025 to 2030. The rise of wellness and health tourism contributes to the expansion of the global market, also referred to as grey tourism.

Key Market Trends & Insights

- The Asia Pacific silver tourism industry dominated the global market, with a revenue share of 54.9% in 2024.

- The U.S. dominated the North American silver tourism market in 2024.

- By type, the wellness retreats segment dominated the global silver tourism market based on type, with a revenue share of 34.3% in 2024.

- By age group, the 50 to 60 years segment held the largest revenue share of the silver tourism market in 2024.

- By category, the couples segment held the largest revenue share of the silver tourism market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,720.1 Billion

- 2030 Projected Market Size: USD 2,623.4 Billion

- CAGR (2025-2030): 7.3%

- Asia Pacific: Largest market in 2024

Older travelers often prioritize health and well-being, seeking destinations that offer spa treatments, wellness retreats, and fitness activities. The focus on health and relaxation during travel aligns with the preferences of senior travelers who view vacations as opportunities to rejuvenate and maintain their well-being.

The rise of slow tourism is also contributing to market growth. Slow tourism emphasizes taking time to fully experience and enjoy a destination rather than rushing through a packed itinerary. Seniors often have the time to engage in extended stays, allowing them to explore destinations at their own pace, interact with locals, and participate in cultural activities. Slow tourism aligns with the many older travelers who want to experience authenticity during their travels, making it a growing trend within the market.

The influence of peer networks and social communities also plays a crucial role in driving market growth. The growth of online communities, social media platforms, and travel forums has made it easier for older adults to share their experiences, reviews, and recommendations with their peers. This word-of-mouth marketing, amplified by digital platforms, strongly impacts travel decisions, encouraging more seniors to explore new destinations or try different travel experiences. As a result, travel companies are increasingly targeting these networks and communities to reach the senior market.

Moreover, factors such as nostalgia and heritage tourism fuel market expansion. Many seniors are interested in revisiting places that hold personal significance. It involves returning to where they once lived, visiting their birthplace, or exploring historical sites that resonate with their personal or cultural history. Travel agencies and tour operators increasingly offer heritage tours and genealogical research services that cater to this interest. The emotional value of these trips is a strong motivator for older adults, driving demand in this market segment.

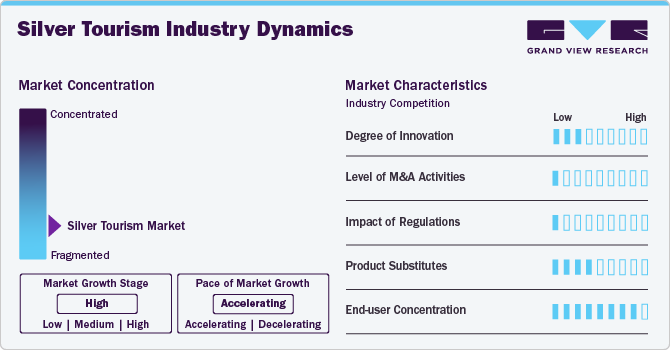

Market Concentration & Characteristics

The industry growth stage is medium, and the pace is accelerating owing to growth of heritage and genealogy tourism. This type of tourism often involves exploring historical archives and connecting with distant relatives. Travel companies have recognized this trend and offer specialized tours and services that assist older adults, including guided visits to historical sites. The personal significance of heritage travel further drives the growth of the silver tourism market.

The industry has a fragmented featuring several global and regional players. The players are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change.

The concentration of end-users in silver tourism is also evident in the rise of specific travel modes preferred by older adults. For instance, cruising has become a particularly popular option among seniors, with many cruise passengers falling into the 55+ age bracket. In the U.S., cruises were especially popular among silver-age American tourists in 2021, according to Population and Economics. Older adults adopt this mode of travel as it offers a comfortable, all-inclusive experience with minimal physical exertion, allowing travelers to visit multiple destinations without needing frequent packing or long travel days.

Type Insights

The wellness retreats segment dominated the global silver tourism market based on type, with a revenue share of 34.3% in 2024. Contemporary senior travelers exhibit a heightened emphasis on health, well-being, and rejuvenation during their leisure pursuits. This has significantly elevated the prominence of wellness retreats within the tourism sector. Tourist destinations across the globe are actively developing specialized wellness retreat infrastructures, encompassing health resorts, spa resorts, and yoga/health hotels. These establishments provide diverse activities, including yoga, meditation, spa treatments, and fitness classes. Furthermore, such facilities prioritize providing nutritious, locally sourced, and organic culinary offerings. With a primary focus on both physical and mental well-being, senior travelers consistently rank wellness retreats as their preferred travel choice.

The nature and wildlife tours segment is expected to experience the fastest CAGR from 2025 to 2030. Nature and wildlife tours allow senior travelers to escape the intense pace of urban environments and foster a deeper connection with local ecosystems and their inhabitants. Travel companies and agencies meticulously curate specialized packages tailored to offer diverse experiences, such as immersive jungle stays, night wildlife safaris, and carefully planned, accessible excursions to natural landmarks. The burgeoning popularity of slow travel and the increasing demand for immersive safari experiences across diverse terrains significantly contribute to the burgeoning growth of the nature and wildlife tourism sector.

Age Group Insights

The 50 to 60 years segment held the largest revenue share of the silver tourism market in 2024. The growing popularity of multi-destination and combination travel experiences serves as a primary driver of segment growth within the tourism industry. Travelers within this demographic frequently exhibit a strong inclination towards exploring multiple destinations within a single itinerary, seamlessly integrating diverse experiences such as cultural immersion, scenic cruises, and leisurely stays. This approach to travel enables them to optimize their travel time while engaging in a broad spectrum of enriching activities. Travel providers are actively responding to the evolving preferences of mature travelers by offering meticulously curated multi-destination itineraries that thoughtfully incorporate a harmonious blend of cultural, historical, and recreational pursuits.

The 61 to 70 years segment is expected to experience the fastest CAGR from 2025 to 2030. Travelers within this demographic exhibit a strong emphasis on maintaining optimal health and demonstrate a preference for travel experiences that align with this objective. This encompasses destinations that offer readily accessible health and wellness amenities, including fitness centers, yoga studios, and a diverse range of fitness activities. Leisure travel experiences characterized by extended durations are prevalent within this segment. The anticipated sustained growth of the aging population across various global regions is projected to serve as a significant catalyst for the continued expansion of this market segment.

Category Insights

The couples segment held the largest revenue share of the silver tourism market in 2024. Senior travelers strongly prefer to embark on vacations in the company of their partners or spouses, with the primary objective of fostering and rejuvenating their bond. This demographic has ample time and financial resources to dedicate to extended travel experiences encompassing domestic and international destinations. Furthermore, the absence of significant professional or familial responsibilities, a heightened sense of personal autonomy and control, and a strong inclination to explore diverse cultures and destinations all contribute to the substantial growth observed within the couples segment of the silver tourism industry.

The couples segment is expected to experience the fastest CAGR from 2025 to 2030. Several factors often motivate couples to opt for independent travel arrangements, including undisclosed pre-existing medical conditions, apprehension regarding independent travel, and potential difficulties in adjusting to group dynamics. Travel agencies are developing specialized travel packages specifically tailored to couples aged 50 and above. These curated packages encompass diverse experiences, including couple-oriented activities, scenic cruises, visits to historical sites, wellness retreats, and leisurely walking tours. The confluence of a diversified product offering and a significant increase in the number of elderly couples seeking shared travel experiences is a key driver of the rapid expansion observed within this travel market segment.

Destination Insights

The domestic segment held the largest revenue share of the silver tourism market in 2024. Traveling within one’s country often means shorter travel times and easier destination access. Taking shorter trips, such as weekend getaways or regional excursions, allows seniors to travel more frequently and with less stress. This convenience is a key driver for those who want to explore their own country without the demands of extended travel. According to a 2024 survey conducted by AARP, nearly 65% of Americans aged 50 and older plan to travel during the year. Of these travelers, approximately 63% intend to travel within the U.S., while around 37% are expected to take at least one international trip.

The international segment is expected to experience the fastest CAGR from 2025 to 2030. The increasing focus on luxury and comfort in international travel offerings drives the segment’s growth. As the market grows, many travel companies and destinations are tailoring their services to cater to the specific needs of affluent older adults. This includes luxury cruises, five-star accommodations, and exclusive, personalized experiences for seniors willing to spend more for comfort and high-quality service. This focus on luxury and comfort helps drive the international segment, as it meets the expectations of a demographic that provides ease in their travel experiences.

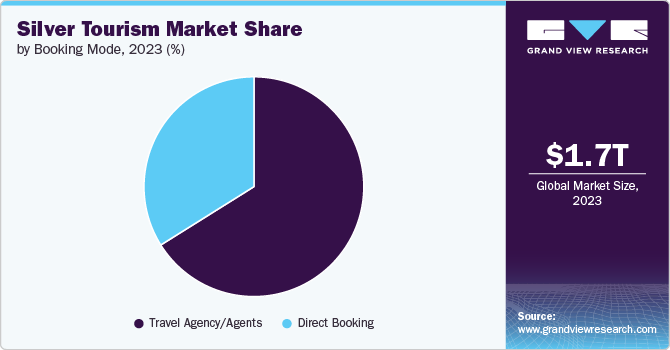

Booking Mode Insights

The travel agency/agents segment held the largest revenue share of the silver tourism industry in 2024. Travel agencies and agents often have access to exclusive deals, discounts, and group travel opportunities that drive the adoption of travel agencies/agents in the global market. Many older adults seek value in their travel experiences, and agents can offer competitive pricing through partnerships with hotels, airlines, and tour operators. Group travel options, in particular, are prevalent among seniors as they allow socializing with peers while traveling. Travel agents organize group trips specifically tailored to the interests of older adults, such as cultural tours, cruises, or heritage travel, further driving the market growth. According to the Population and Economics Journal, about 30% of respondents prefer to use the internet when selecting and purchasing travel services in 2022, while another 32% opt to use both the internet and travel agencies, depending on the situation. The remaining 38% prefer booking travel services exclusively through travel agents.

The marketplace bookings segment is expected to experience the fastest CAGR during the forecast period. Utilizing online travel marketplaces for booking tours and travel itineraries offers many advantages, including access to competitive pricing, enhanced flexibility in booking and cancellation procedures, and the convenience of easily customizing tour packages by incorporating desired upgrades. Furthermore, these platforms typically provide dedicated customer service channels to address any concerns or issues that may arise before and during the travel experience. These factors collectively contribute to the increasing appeal of online marketplaces as a preferred channel for holiday bookings among senior travelers.

Regional Insights

The North America silver tourism market is expected to experience significant growth during the forecast period. Older travelers increasingly seek customized travel experiences that cater to their interests and preferences, such as wellness retreats, culinary tours, and adventure travel. The demand for tailored travel experiences has led to the development of specialized tours and packages designed to meet the unique needs of senior travelers. The growth of personalized and niche travel experiences reflects a broader trend towards customizing travel to meet the diverse needs of the older population in North America.

U.S. Silver Tourism Market Trends

The U.S. dominated the North American silver tourism market in 2024. The rise of wellness tourism is an important driver in the U.S. silver tourism market. Many older adults prioritize their health and well-being and seek travel experiences that offer relaxation, rejuvenation, and wellness. The U.S. has many wellness destinations, including spas, health retreats, and resorts focusing on physical and mental well-being. These destinations provide activities such as yoga, meditation, and treatments that cater to the health-conscious senior traveler. The increasing interest in wellness tourism among older adults contributes to market growth.

Asia Pacific Silver Tourism Market Trends

The Asia Pacific silver tourism industry dominated the global market, with a revenue share of 54.9% in 2024. The growing aging population in the region drives market growth. Countries such as India, China, and Japan are witnessing a significant increase in older adults owing to rising life expectancy and declining birth rates. This demographic shift creates a large and growing market of senior travelers with the time, resources, and preference to explore new destinations. As more seniors in the region reach retirement age, they increasingly seek to travel domestically and internationally, fueling demand for tourism products and services tailored to their needs.

China held the largest revenue share of the regional industry in 2024. The growing emphasis on cultural and heritage tourism among older Chinese adults drives the silver tourism market. Many seniors visit historical sites and explore regions with personal or historical significance. The tourism industry has responded by offering specialized tours focusing on cultural exploration, including visits to UNESCO World Heritage Sites, traditional villages, and museums. The growing demand for cultural experiences is a key factor driving the market growth.

Europe Silver Tourism Market Trends

The European silver tourism market is expected to experience significant growth during the forecast period. The high level of disposable income among Europe’s senior population drives market growth. Their financial stability allows them to allocate more resources to leisure activities, including travel. European seniors are often willing to spend on premium travel experiences, such as luxury cruises, boutique hotels, and gourmet dining. The willingness to invest in high-quality travel experiences drives demand for upscale and customized travel options within the market.

Key Silver Tourism Company Insights

Some of the key companies operating in the global silver tourism industry are Intrepid Travel, Thomas Cook India Group, SOTC Travel Limited, Expedia, Inc., and Flight Centre Travel Group Limited. These players are engaged in continuous competition to lure older travelers. Companies are actively striving to enhance the travel experiences of their senior clientele by prioritizing factors such as pre- and in-trip convenience, ensuring a high degree of safety and security throughout the journey, guaranteeing the provision of exceptional service quality, and offering exceptional value for the investment.

-

Intrepid Travel, a global travel company, has made significant inroads into the silver tourism industry by offering tailored travel experiences that cater to older adults. These offerings include slower-paced tours that allow for a more relaxed travel experience and itineraries designed to be easily accessible to those with varying levels of mobility. Intrepid Travel’s emphasis on small group sizes ensures a more personalized and intimate travel experience, often preferred by older travelers seeking a sense of community.

-

Thomas Cook India Group offers silver tourism catering to senior citizens’ travel needs and preferences. This segment offers tailored packages that prioritize comfort, convenience, and safety. The company provides various services, including customized itineraries, special accommodations, and guided tours to ensure a safe travel experience. Their offerings include leisure trips to popular destinations, wellness retreats, and cultural excursions that allow seniors to explore new places.

-

Flight Centre Travel Group Limited is a global travel agency with a diverse portfolio that includes retail travel, corporate travel management, and wholesale travel services. The company operates under various brands, including Flight Centre, StudentUniverse, and Travel Associates, catering to different customer needs. The company provides specialized services and tailored travel packages that address older adults’ unique preferences and requirements. These offerings often include leisurely and culturally enriching tours, comfortable accommodations, and itineraries designed to accommodate varying mobility and health needs.

Key Silver Tourism Companies:

The following are the leading companies in the silver tourism market. These companies collectively hold the largest market share and dictate industry trends.

- SOTC Travel Limited

- Intrepid Travel

- Thomas Cook India Group

- China Tourism Group Duty Free Corporation Limited

- Kesari Tours Pvt Ltd.

- Flight Centre Travel Group Limited

- Trip.com Travel Singapore Pte. Ltd

- Expedia, Inc.

- MAKEMYTRIP PVT. LTD.

- Liberty Travel

- Collette Travel Service

- Tauck

- Abercrombie & Kent USA, LLC

- Travel Leaders

- Yatra Online Limited

Recent Developments

-

In January 2024, Cleartrip, a leading travel marketplace in India, partnered with a prominent e-commerce platform, Flipkart entered into a partnership to launch the Darshan Destinations program that offers 1,008 free flights for senior citizens to Ayodhya, India. The platform offered discounted hotel prices and commutation for elderly tourists for the tour.

-

In October 2022, Spain announced a focus on the development of infrastructure and facilities in line with the 55 years and above tourists in the Canary Islands. The government is emphasizing offering better conditions during the winter season and allowing more senior citizens across Europe to travel to the island during the season.

Silver Tourism Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,841.9 billion

Revenue forecast in 2030

USD 2,623.4 billion

Growth Rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, age group, category, destination, booking mode, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Australia & New Zealand, South Korea, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

SOTC Travel Limited; Intrepid Travel; Thomas Cook India Group; China Tourism Group Duty Free Corporation Limited; Kesari Tours Pvt Ltd.; Flight Centre Travel Group Limited; Trip.com; Travel Singapore Pte. Ltd; Expedia, Inc.; Makemytrip Pvt. Ltd.; Liberty Travel; Collette Travel Service; Tauck; Abercrombie & Kent USA, LLC; Travel Leaders; Yatra Online Limited.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silver Tourism Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the silver tourism market report based on type, age group, category, destination, booking mode, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Beach Tour

-

Wellness Retreats

-

Adventure Tour

-

Cruise Tour

-

Nature & Wildlife Tour

-

Historic & Cultural Tour

-

Others

-

-

Age Group (Revenue, USD Billion, 2018 - 2030)

-

50 to 60 Years

-

61 to 70 Years

-

Above 70 Years

-

-

Category (Revenue, USD Billion, 2018 - 2030)

-

Solo

-

Couple

-

Group

-

-

Destination (Revenue, USD Billion, 2018 - 2030)

-

Domestic

-

International

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Travel Agency/Agents

-

Marketplace Bookings

-

Direct Booking

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global silver tourism market size was estimated at USD 1,720.1 billion in 2024 and is expected to reach USD 1,841.9 billion in 2025

b. The global silver tourism market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 2,623.4 billion by 2030

b. Asia Pacific dominated the market with a revenue share of 54.9% in 2024 and is projected to grow over the forecast period. The growing aging population in the region drives market growth. Countries such as India, China, and Japan are witnessing a significant increase in older adults owing to rising life expectancy and declining birth rates.

b. SOTC Travel Limited; Intrepid Travel; Thomas Cook India Group; China Tourism Group Duty Free Corporation Limited; Kesari Tours Pvt Ltd.; Flight Centre Travel Group Limited; Trip.com; Travel Singapore Pte. Ltd; Expedia, Inc.; Makemytrip Pvt. Ltd.; Liberty Travel; Collette Travel Service; Tauck; Abercrombie & Kent USA, LLC; Travel Leaders; Yatra Online Limited.

b. Factors such as the rise of wellness and health tourism and the rise of slow tourism are driving the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.