- Home

- »

- Plastics, Polymers & Resins

- »

-

Silicone Sealants Market Size, Share, Industry Report, 2030GVR Report cover

![Silicone Sealants Market Size, Share & Trends Report]()

Silicone Sealants Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology, By Application (Construction, Insulating Glass, Automotive, Others), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-1-68038-029-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Silicone Sealants Market Size & Trends

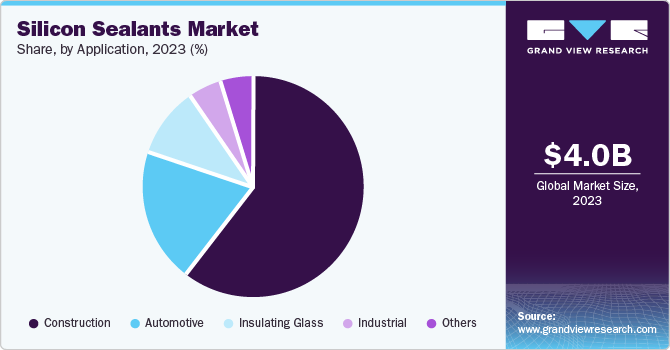

The global silicone sealants market size was valued at USD 4,265.7 million in 2024 and is expected to grow at a CAGR of 6.1% from 2025 to 2030. This growth is attributed to the expanding construction industry, significantly boosting demand for durable, weather-resistant sealants in various applications, including windows and doors. The versatility of silicone sealants in the automotive and electronics sectors contributes to market expansion. Moreover, technological advancements have led to high-performance formulations that meet evolving industry needs while increasing awareness of sustainable practices, further enhancing their appeal.

Silicone sealants are widely used in construction for applications such as expanding joints, panel sealing, and protection against environmental factors. These materials, which are adhesive and typically found in a liquid or gel-like form, require curing to achieve optimal bonding strength. Unlike conventional adhesives, silicone maintains flexibility and integrity across extreme temperatures and offers strong resistance to moisture, corrosion, and various chemicals.

Moreover, the increasing environmental concerns associated with synthetic sealants and adhesives are significantly influencing the growth of the silicone sealant market. This has led to a shift towards more sustainable options, with manufacturers focusing on creating bio-based silicone sealant alternatives. These eco-friendly sealants possess excellent mechanical and chemical properties and serve many applications while being environmentally safe.

Silicone rubber sealants are particularly favored in HVAC systems due to their strength, ability to absorb shrinkage and cracks in vehicles, and effectiveness in maintaining interior cleanliness and thermal insulation. Advanced HVAC systems are implemented in residential and commercial buildings to ensure optimal indoor air quality. Consequently, growth in construction activities is expected to drive demand for HVAC systems, further boosting the industry’s expansion.

Technology Insights

Room temperature vulcanizing (RTV) dominated the market and accounted for the largest revenue share of 65.0% in 2023 driven by the expanding construction industry's demand for resilient, weather-resistant sealants for applications such as sealing joints and weatherproofing buildings. In addition, RTV sealants are favored for their flexibility and ability to accommodate significant joint movement. The automotive sector's increasing need for lightweight and efficient materials also propels RTV sealant adoption. Further, environmental concerns also encourage the shift towards sustainable sealant solutions, boosting market demand for eco-friendly RTV products.

Thermoset or heat-cured silicone sealants are expected to grow at a CAGR of 6.6% over the forecast period attributed to the increasing demand for durable and high-performance materials in construction and automotive applications, as these sealants offer superior adhesion and resistance to extreme circumstances. In addition, advancements in formulation technology enhance their properties, making them suitable for a wider range of uses. Furthermore, the shift towards sustainable building practices and the need for environmentally friendly solutions further boost the adoption of thermoset silicone sealants across numerous industries.

Application Insights

The construction applications led the market and accounted for the largest revenue share of 60.4% in 2023 attributed to the growing construction and real estate sectors increasing the demand for effective sealing solutions to prevent water leakage and air infiltration in buildings. In addition, the push for energy efficiency in buildings necessitates using silicone sealants to minimize air leaks, while their durability and weather resistance make them ideal for various environmental conditions.

Insulating glass is expected to grow significantly over the forecast period driven by the increasing demand for energy-efficient buildings, which has led to a rise in the use of insulating glass. This requires effective sealing solutions to enhance thermal performance and reduce energy loss. In addition, the construction industry's focus on sustainability and regulatory requirements for energy efficiency further propel this demand. The superior properties of silicone sealants, such as weather resistance and durability, make them ideal for insulating glass applications in both residential and commercial projects.

Regional Insights

Asia Pacific silicone sealants market dominated the global market and accounted for the largest revenue share of 50.7% in 2023 driven by rapid urbanization and significant investments in infrastructure development. In addition, countries such as China and India are experiencing a construction boom, which increases the demand for silicone sealants used in building applications. Furthermore, the region's expanding industrial base and rising disposable incomes lead to greater adoption of advanced materials. The need for durable and efficient sealing solutions further fuels market growth, positioning Asia Pacific as a key player in the global silicone sealants industry.

China Silicone Sealants Market Trends

The silicone sealants market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2023 attributed to the country's robust construction sector and increasing industrial activities. In addition, the government's focus on sustainable development and infrastructure projects has increased the demand for high-performance sealants that meet stringent environmental regulations. Furthermore, technological advancements enable manufacturers to produce innovative products catering to diverse applications, including automotive and electronics. This combination of regulatory support and technological progress is propelling the growth of silicone sealants in China.

Latin America Silicone Sealants Market Trends

The silicone sealants market in Latin America is expected to grow at a CAGR of 6.4% over the forecast period driven by the booming construction industry, fueled by urbanization and substantial infrastructure development projects in countries such as Brazil and Mexico. As these nations invest heavily in residential and commercial buildings, the demand for durable sealing solutions rises. In addition, increasing awareness of energy-efficient building practices enhances the adoption of silicone sealants. Furthermore, the region's industrialization and automotive production are also pivotal, as manufacturers seek advanced materials to meet global standards, thereby propelling market expansion across various sectors in Latin America.

North America Silicone Sealants Market Trends

The North America silicone sealants market is expected to grow significantly over the forecast period attributed to rising consumer awareness about safety and energy efficiency in construction. In addition, the increasing use of silicone sealants in insulating glass applications and their role in enhancing fire safety measures significantly contribute to market expansion. Furthermore, the growth of the electronics and consumer goods sectors drives demand for specialized silicone products, thus reinforcing North America's position as a prominent market for silicone sealants.

The silicone sealants market in the U.S. is expected to grow substantially due to the increasing demand for silicone sealants in the construction sector. The country's commitment to sustainable building practices and the growing awareness of fire safety measures drive the adoption of silicone sealants. The expanding electronics and consumer goods industries further contribute to the market's expansion as the demand for specialized silicone products rises.

Europe Silicone Sealants Market Trends

The Europe silicone sealants market is expected to experience significant growth driven by the automotive and medical equipment industries. The region's stringent emissions regulations push manufacturers to innovate and develop eco-friendly products. Furthermore, the rising demand for lightweight materials in automotive applications is further boosting the adoption of silicone sealants. As European countries continue to invest in advanced manufacturing technologies, the market for silicone sealants is expected to expand significantly over the coming years.

Key Silicone Sealants Company Insights

Some key silicone sealants market companies include Dow, Shin-Etsu Chemical Company, Wacker Chemie AG, and others. Companies in the global silicone sealants market adopt several strategies to gain a competitive advantage. Key approaches include product innovation and customization to meet industry needs and enhance performance characteristics such as adhesion and flexibility. Vertical integration is also a prominent strategy, allowing manufacturers to control raw material supply and mitigate price fluctuations.

-

Dow offers diverse silicone adhesives and sealants. The company manufactures over 7,000 products, including high-performance sealants in construction, automotive, electronics, and general industries. Dow's silicone solutions are renowned for their durability, weather resistance, and thermal stability, catering to various applications that require reliable sealing and bonding.

-

Shin-Etsu Chemical Company specializes in producing high-quality silicone products for various industries. The company manufactures various silicone sealants, adhesives, and coatings for construction, automotive, electronics, and healthcare applications. Shin-Etsu is recognized for its advanced silicone formulations that offer exceptional performance characteristics such as flexibility, durability, and resistance to environmental factors.

Key Silicone Sealants Companies:

The following are the leading companies in the silicone sealants market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- Shin-Etsu Chemical Company

- Wacker Chemie AG

- 3M

- Tremco Incorporated

- Bostik

- Sika AG

- Henkel Corporation

- Huntsman International LLC

- H.B. Fuller

- Mapei

Recent Developments

-

In March 2023, Dow announced the launch of its DOWSIL PV Product Line, expanding its silicone-based sealants and adhesives specifically for photovoltaic (PV) module assembly. This new line includes six products designed for applications such as frame sealing and junction box bonding, supporting the growing demand for renewable energy solutions. Dow's innovations aim to enhance sustainability and performance in solar energy applications, aligning with the company's commitment to climate goals and local sourcing capabilities to meet evolving market needs.

-

In March 2023, Huntsman Corporation successfully launched three innovative products at the European Coatings Show (ECS), held in Nuremberg, Germany, from March 28 to 30, 2023. Among the highlights was the POLYRESYST IC6005, an intumescent polyurethane coating designed for the construction industry. It offers passive fire protection with enhanced durability and low VOC levels. Furthermore, Huntsman introduced a new high molecular weight mono-polyether amine, JEFFAMINE M-3085. The event gave attendees valuable insights into these advancements and their applications across various sectors.

Silicone Sealants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,516.0 million

Revenue forecast in 2030

USD 6,069.2 million

Growth Rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million/Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, South Africa

Key companies profiled

Dow; Shin-Etsu Chemical Company; Wacker Chemie AG; 3M; Tremco Incorporated; Bostik; Sika AG; Henkel Corporation; Huntsman International LLC; H.B. Fuller; Mapei

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silicone Sealants Market Report Segmentation

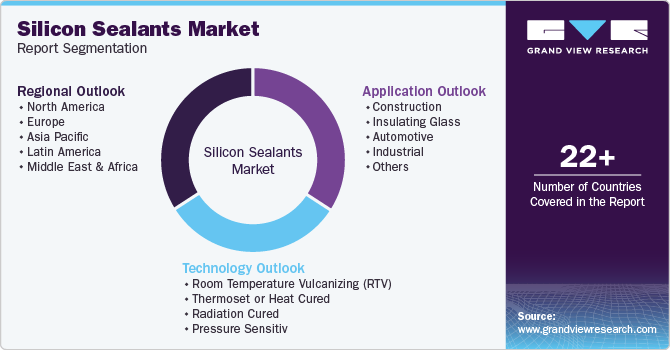

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global silicone sealants market report based on technology, application, and region.

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Room Temperature Vulcanizing (RTV)

-

Thermoset or Heat Cured

-

Radiation Cured

-

Pressure Sensitive

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Insulating Glass

-

Automotive

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.