- Home

- »

- Plastics, Polymers & Resins

- »

-

Silicone In Personal Care Market Size & Share Report, 2030GVR Report cover

![Silicone In Personal Care Market Size, Share & Trends Report]()

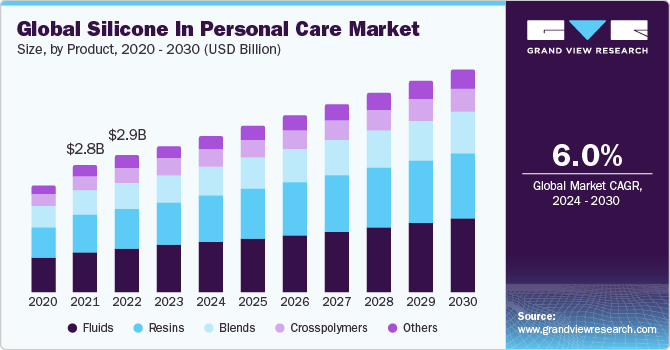

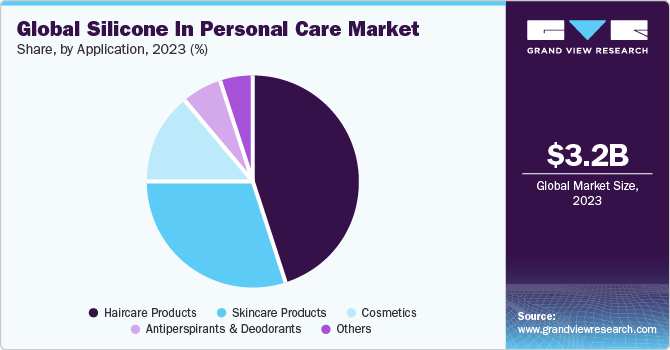

Silicone In Personal Care Market Size, Share & Trends Analysis Report By Product (Fluids, Resins, Blends, Cross polymers), By Application (Skincare Products, Haircare Products, Cosmetics, Antiperspirants & Deodorants), By Regions, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-259-9

- Number of Report Pages: 162

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Silicone In Personal Care Market Trends

The global silicone in personal care market size was estimated at USD 3.17 billion in 2023 and is projected to grow at a CAGR of 6.0% from 2024 to 2030. Rising awareness in regards to personal hygiene, rising disposable income across various regions, and increasing influence of social media are anticipated to boost the demand for silicone for manufacturing multiple personal care products such as shampoos, conditioners, serums, sunscreens, body lotions, and various cosmetics such as lipsticks, eyeliners, and others.

Increasing market share for products for diverse skin tones and hair types, along with an increasing demand for new color pallets, has benefited the cosmetics industry across globe in the past few years.

According to the India Brand Equity Federation (IBEF), in 2023, the Indian beauty industry was one of the highest-blooming markets across the country, owing to changing consumer behavior, rising disposable incomes, and increasing interests of consumers in aesthetic looks & personal grooming. These factors have fueled the demand for silicone-based personal care products in the past decades. In recent years, various personal care and cosmetic manufacturers have invested in the market growth, because of its high potential customer base. Major investments are made in the research & development of products that are suitable and can be used for longer duration among the consumers.

In the past decade, the economic growth of China, an increase in the purchasing power of consumers, and a shift in consumer trends toward high-quality skincare products have propelled the demand for silicone for manufacturing skincare and other personal care products. The personal care market across China has propulsive accelerated during the COVID-19 pandemic, since people became more cautious about products being utilized.

Market Concentration & Characteristics

The market growth stage is high, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in the production and adoption of silicones in personal care, the availability of raw materials, and increasing silicone consumptions.

Market growth stage is high, and pace of market growth is accelerating owing to the consolidated market. Silicone in personal care manufacturers are actively implementing challenging strategic initiatives such as mergers & acquisitions, new product launches, and production expansion, among others.

For instance, in December 2022, Kenya-based Uncover SkinCare Ltd, a skincare product manufacturer, invested USD 1.0 million to expand its reach to Nigeria with its recently launched product line. Such initiatives, in line with the rising demand for cosmetics, skincare, and haircare products, are anticipated to propel the demand for market growth across Africa over the forecast period.

The market is also subject to increasing regulatory scrutiny. The market is subject to numerous regulations, guidelines, and restrictions regarding silicon usage in personal care applications. For instance, in June 2023, a draft amendment to the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation was published, amending Annex XVII. The change aims to introduce restrictions on the use of D4, D5 and D6 silicones in cosmetics items.

There are a limited number of direct product substitutes for silicones available in the region. However, there are a number of technologies that can be used to achieve sustainable outcomes for silicones, such as nutrient-rich plant oils, bamboo extract, C13-15 Alkane, Hydrogenated Ethylhexyl Olivate, and Marula Tetradecane. These substitutes can be used in several personal care applications.

Product Insight

The fluid segment led the market with the largest revenue share of above 32.0% in 2023. Silicone in fluid form is highly resistant to thermal changes and is highly stable in terms of viscosity. Since silicone fluids show minute changes under distinctive thermal conditions, these are recommended for the manufacturing of personal care products, especially haircare products such as shampoos and conditioners.

The resins segment accounted for a revenue share of above 29.0% in 2023. Silicone in resin form provides heat resistance, weather ability, and hardness hence is useful for manufacturing of thickeners and conditioners in hair and skincare products. Furthermore, the blends segment accounted for a market revenue share of above 18.0% in 2023. Silicone blends act as emollients and lubricants, gliding effortlessly onto the dermis and providing a silky smooth finish.

Application Insights

Based on application, the haircare segment led the market with the largest revenue share of above 45.0% in 2023. Silicone acts as a smooth, protective shield, and coating for each hair strand, creating a sleek and unified surface finish for a more polished looks. Furthermore, silicone’s light reflecting attributes provide hair with a luminous and healthy shine, providing a more aesthetic and glossy finish.

The skincare segment accounted for a revenue share of above 29.0% in 2023. Silicone helps retain moisture by forming a breathable barrier on the skin applied, preventing water from evaporating, hence keeping the skin hydrated. Furthermore, silicone creates smooth and even canvas for makeup application by filling up tiny imperfections, providing a flawless base for foundation and other cosmetics.

Regional Insights

North America dominated the silicone in personal care market with a revenue share of above 18.0%, in 2023. The region is considered a mature market for personal care products owing to the increasing sales of cosmetics, hair care products, skincare products, and others. In the past decade, North American countries, including the U.S., Canada, and Mexico, have witnessed propulsive growth in the consumption of personal care products owing to the increasing disposable income of consumers and rising preference for aesthetic appearance. Furthermore, hair loss, dry skin & scalp, dark spots, and other conditions related to the dermis (skin) are a few of the major factors propelling the demand for skin care & hair care products and cosmetics.

U.S. Silicone In Personal Care Market Trends

The silicone in personal care market in U.S. is expected to grow at a substantial CAGR over the forecast period. Rising desire for an aesthetic appearance across the teenage and adult population in the U.S. has immensely augmented the demand for cosmetics such as lipsticks, eyeliners, nail polish, and foundations, among other products. Furthermore, the era of social media and increasing followers of social media influencers, especially across social media platforms like YouTube and Instagram, has come to the aid of cosmetics manufacturers seeking to reach a wide range of audiences across the country as well as across the globe.

Asia Pacific Silicone In Personal Care Market Trends

The silicone in personal care market in Asia Pacificaccounted with the revenue share of 59.66% in 2023. The region has witnessed a rise in demand for silicone-based personal care products on account of the rising number of working women professionals across emerging economies such as China and India, along with their growing interests in and increasing spending on beauty and personal care products. Furthermore, the rising demand from the young population across these countries and their easy internet access is anticipated to offer immense opportunities for the market growth over the forecast period.

The China silicone in personal care market accounted with the largest revenue share in 2023. In the past decade, the economic growth of China, an increase in the purchasing power of consumers, and a shift in consumer trends toward high-quality skincare products have propelled the demand for silicone for manufacturing skincare and other personal care products.

The silicone in personal care market in India is expected to grow at a significant CAGR over the forecast period. According to the India Brand Equity Federation (IBEF), in 2023, the Indian beauty industry was one of the highest blooming markets across the country, owing to changing consumer behavior, rising disposable incomes, and increasing interests of consumers in aesthetic looks & personal grooming. These factors have fueled the demand for silicone-based personal care products in India in the past decades.

Europe Silicone In Personal Care Market Trends

The silicone in personal care market in Europe registered a substantial market share in 2023. The European population from the past decades have been seeking products and services that are personal to them, and are additionally conscious of the environment and the social and ethical ramifications of consumption and production of personal care products. Hence, the manufacturers of personal care products across Europe manufacture products that tailor to diverse individual factors such as gender, age, religious beliefs, ethnicity, geography, climate, lifestyle, health, and well-being. Since silicone-based hair care products and skin care products are non-allergic to the dermis, this has propelled the demand for silicone in personal care products in recent years in the European region.

Middle East & Africa Silicone In Personal Care Market Trends

The silicone in personal care market in Middle East & Africa has witnessed rise in demand for personal care products and cosmetics in recent years, owing to the increasing disposable income and the preference of majority of population for luxurious accessories, such as aesthetic looking expensive clothing, make-ups, personal care, and grooming. Furthermore, rising interests of women across Saudi Arabia for employment has propelled the disposable income and has therefore increased the consumption of haircare and skin care products among the female population.

Key Silicone In Personal Care Company Insights

Most of key players operating in market have integrated their raw material and distribution operations to maintain additive quality and expand their regional presence. This provides companies a competitive advantage in form of cost benefits, thus increasing profit margins. Companies are undertaking research and development activities to develop new industrial plastics to sustain market competition and changing end-user requirements. Research activities focused on development of new materials, which combine several properties, are projected to gain wide acceptance in this industry in coming years. Furthermore, active players implement strategic initiatives for maintaining competitive environmental.

Key Silicone In Personal Care Companies:

The following are the leading companies in the silicone in personal care market. These companies collectively hold the largest market share and dictate industry trends.

- Wacker Chemie AG

- Elkem ASA

- CHT Germany GmbH

- Shin-Etsu Chemical, Co., Ltd.

- Momentive Performance Materials Inc.

- Dow, Inc.

- BRB International B.V.

- DyStar Singapore Pte Ltd

- Mitsubishi Shoji Chemical Corporation

- Chemsil Silicones, Inc.

- PHOENIX CHEMICAL, INC.

- Jiangxi New Jiayi New Materials Co., Ltd.

- Thor Personal Care

- AB Specialty Silicones

- Siltech Corporation

Recent Developments

- In November 2023, Shin-Etsu Chemical Co., Ltd., a silicone manufacturer introduced KSP-1000W hydrophilized hybrid silicone powder for cosmetic applications since it provides soft texture and natural looks

Silicone In Personal Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.38 billion

Revenue forecast in 2030

USD 4.81 billion

Growth rate

CAGR of 6.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; France; Spain; Netherlands; China; India; Japan; South Korea; Singapore; Malaysia; Indonesia; Thailand; Vietnam; Australia; Brazil; Argentina; Saudi Arabia; United Arab Emirates (UAE); and South Africa

Key companies profiled

Wacker Chemie AG; Elkem ASA; CHT Germany GmbH; Shin-Etsu Chemical, Co., Ltd.; Momentive Performance Materials Inc.; Dow, Inc.; BRB International B.V.; DyStar Singapore Pte Ltd.; Mitsubishi Shoji Chemical Corporation; Chemsil Silicones, Inc.; PHOENIX CHEMICAL, INC.; Jiangxi New Jiayi New Materials Co., Ltd.; Thor Personal Care; AB Specialty Silicones; Siltech Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silicone In Personal Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented silicone in personal care market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fluids

-

Resins

-

Blends

-

Cross polymers

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Skincare products

-

Haircare products

-

Cosmetics

-

Antiperspirants & deodorants

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Malaysia

-

Indonesia

-

Thailand

-

Vietnam

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global silicone in personal care market size was estimated at USD 3.17 billion in 2023 and is expected to reach USD 3.38 billion in 2024.

b. The global silicone in personal care market is expected to grow at a compound annual growth rate of 6.0% from 2024 to 2030 to reach USD 4.81 billion in 2030.

b. The fluid product dominated silicone in personal care market and accounted for the largest revenue share of 32.5% in 2023, silicone fluids show minute changes under distinctive thermal conditions. These are recommended for the manufacturing of personal care products, especially haircare products such as shampoos and conditioners.

b. Some key players operating in the silicone in personal care market include Wacker Chemie AG; Elkem ASA; CHT Germany GmbH; Shin-Etsu Chemical, Co., Ltd.; Momentive Performance Materials Inc.; Dow, Inc.; BRB International B.V.; DyStar Singapore Pte Ltd.; and Mitsubishi Shoji Chemical Corporation.

b. Key factors driving the silicone in personal care market growth include rising awareness in regards to personal hygiene, rising disposable income across various regions, and increasing influence of social media

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."