- Home

- »

- Plastics, Polymers & Resins

- »

-

Silicone Derivative Market Size, Share & Growth Report 2030GVR Report cover

![Silicone Derivative Market Size, Share & Trends Report]()

Silicone Derivative Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Silicon Dioxide, Silicon Carbide, Silicate, Silicon Nitride), By End Use (Building & Construction, Automobile, Electronics, Energy), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-366-0

- Number of Report Pages: 174

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Silicone Derivative Market Size & Trends

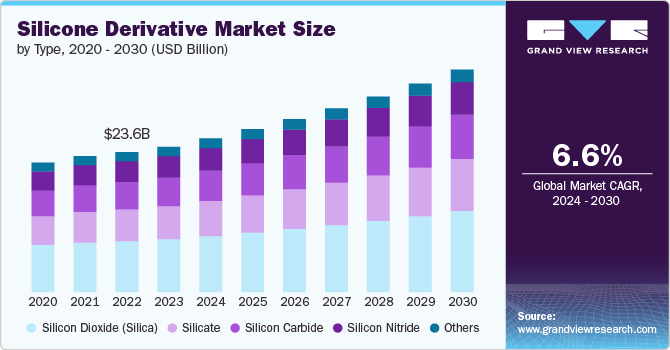

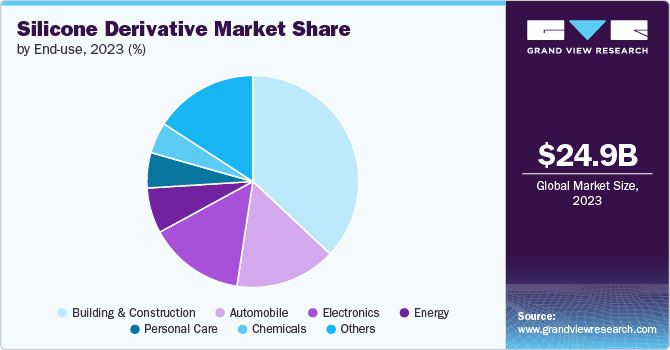

The global silicone derivative market size was estimated at USD 24.96 billion in 2023 and is expected to expand at a CAGR of 6.59% from 2024 to 2030. The growing building & construction activities in emerging economies is driving the growth of the market. With the rising population there is an increasing demand for residential as well as commercial buildings.

Another notable trend in the market is the rising demand in the medical sector. The medical and healthcare sector's reliance on silicone derivatives continues to grow, driven by their critical applications in creating medical devices, implants, prosthetics, and drug delivery systems. Silicones are essential in these applications due to their biocompatibility, flexibility, and durability, making them suitable for prolonged contact with human tissue and fluids. They are used in catheters, tubing, wound dressings, and orthotic devices, providing comfort and safety to patients. The COVID-19 pandemic has further highlighted the need for high-quality medical materials, driving innovations in silicone-based solutions for protective equipment, ventilators, and diagnostic devices.

Drivers, Opportunities & Restraints

The growing industries such as automotive, building & construction, energy, personal care, and others is propelling the research & development activities associated with silicone derivatives to expand its applicability in the respective sectors. Silicone derivatives are widely used in sealants, adhesives, and coatings, which are essential for ensuring durability and weather resistance in buildings and infrastructure projects. As urbanization increases and the construction sector continues to boom, the need for these high-performance materials rises correspondingly.

Furthermore, these materials are crucial for manufacturing various automotive components, such as gaskets, seals, and lubricants, due to their excellent heat resistance and durability. The trend towards electric vehicles (EVs) also boosts demand, as silicone derivatives play a vital role in thermal management systems and electronic components, ensuring the efficiency and safety of EVs.

The renewable energy sector, particularly solar and wind power, presents significant opportunities for silicone derivatives. Silicones are used in solar panels, wind turbines, and other renewable energy systems for their durability, weather resistance, and electrical insulation properties. As the global shift towards clean energy continues, countries are aiming to reduce the reliance on fossil fuel and achieve zero carbon emission goals, the demand for silicone-based materials in renewable energy applications is expected to rise.

Despite the positive growth outlook, the market for silicone derivative faces several challenges. One of the primary restraints is the price volatility of raw materials such as silicon, coal, natural gas, petroleum, and others, owing to the rising geopolitical tension among countries and the ongoing wars like the Russia-Ukraine war. Such volatility can affect the overall cost structure and pricing strategies of silicone derivative manufacturers, leading to uncertainties and potential profitability challenges.

Type Insights

Based on type, silicone dioxide (silica) held the market with the largest revenue share of 36.46% in 2023. The growing demand for automobiles in developing and developed countries due to the rising disposable income of individuals is fueling the need for silica in the market. Silica is commonly used in the manufacturing of rubber and tires, where it acts as a reinforcing agent to enhance durability, strength, and performance. Silica's use in tires not only enhances their strength but also contributes to lower rolling resistance, leading to better fuel economy and reduced CO2 emissions.

Silicate are another significant category within the silicone derivative market. The growing infrastructural investments in various countries is spurring the need for silicate in the silicone derivative market. Silicates are used extensively in the production of concrete, mortars, and specialty coatings. Their ability to improve the strength and longevity of building materials makes them essential for infrastructure projects, residential buildings, and commercial constructions. Silicates also provide excellent resistance to fire and chemicals, enhancing the safety and durability of construction materials.

Silicon carbide is a hard and durable compound made of silicon and carbon, valued for its strength, thermal stability, and resistance to wear and corrosion. It is essential for manufacturing semiconductors and power devices. Silicon carbide-based devices are known for their high voltage and temperature tolerance, making them suitable for applications in renewable energy systems, such as solar inverters and wind turbines. This capability supports the growing demand for efficient energy conversion and management in various electronic applications.

End Use Insights

Based on end use, building & construction segment led the market with the largest revenue share of 41.18% in 2023. This can be attributed to the growing infrastructural investments in emerging economies owing to the rapid industrialization and urbanization. Silicone derivatives are vital for producing high-performance sealants, adhesives, and coatings. These materials provide excellent waterproofing and weather resistance, making them ideal for use in buildings, bridges, and infrastructure projects. Silicone sealants are particularly valued for their flexibility and durability, which help accommodate movement and temperature fluctuations in structures. Moreover, silicones are used in architectural finishes to enhance aesthetics while ensuring long-lasting protection against the elements.

The electronics sector is expected to grow at a significant rate over the forecast period, which is attributable to the advent of technologies such as the Internet of Things (IoT), artificial intelligence, machine learning, and cloud computing. Silicone derivatives are critical in the electronics industry, where they are used for insulation, encapsulation, and thermal management of electronic components. Silicones provide excellent electrical insulation properties, making them ideal for manufacturing circuit boards, connectors, and electronic housing. They also play a vital role in protecting sensitive components from moisture, heat, and chemical exposure, which is essential for the reliability and longevity of electronic devices.

Regional Insights & Trends

North America silicone derivative market is driven by robust demand from the automotive and construction industries. The increasing adoption of electric vehicles (EVs) in the region is anticipated to spur the demand for silicone derivatives. Additionally, the construction sector's growth, particularly in residential and commercial projects, fuels the demand for silicone sealants and adhesives known for their durability and weather resistance.

U.S. Silicone Derivative Market Trends

The silicone derivative market of the U.S. benefits from technological advancements and innovation across various sectors. The strong focus on research and development in the automotive and aerospace industries promotes the adoption of advanced silicone materials. The medical industry also drives growth due to increasing healthcare needs, leading to higher demand for silicone products in medical devices and implants.

Asia Pacific Silicone Derivative Market Trends

Asia Pacific silicone derivative market dominated the global market and accounted for the largest revenue share of 44.48% in 2023. The Asia-Pacific (APAC) region, characterized by rapid industrialization and urbanization, is emerging as a major market for silicone derivatives, driven by rapid industrialization and urbanization in the region. Additionally, the low cost of labor is promoting the export of silicone derivative-based products from APAC to other regions.

The Asia-Pacific region is witnessing rapid growth in the silicone derivative market, fueled by rapid industrialization, urbanization, and increasing environmental awareness. The growing construction sector, particularly in countries including China and India, significantly increases the demand for silicone-based sealants and adhesives in infrastructure projects. The automotive industry's expansion, alongside rising disposable incomes, boosts the need for silicone components in vehicles. The rising consumer demand for personal care and cosmetics in this region propels the growth of silicone derivatives in beauty products.

Europe Silicone Derivative Market Trends

The silicone derivative market of Europe is primarily driven by stringent regulations and environmental standards that promote the use of sustainable materials. The construction industry's emphasis on energy efficiency and sustainable building practices leads to increased demand for high-performance silicone sealants and coatings. Additionally, the automotive industry's transition toward electrification and lightweight vehicles fuels the need for innovative silicone solutions that enhance vehicle performance and reduce emissions.

Key Silicone Derivative Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include Dow Corning Corporation, Shin-Etsu Chemical Co., Ltd., and Wacker Chemie AG. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Silicone Derivative Companies:

The following are the leading companies in the silicone derivative market. These companies collectively hold the largest market share and dictate industry trends.

- Dow Corning Corporation U.S.

- Shin-Etsu Chemical Co., Ltd. China

- Wacker Chemie AG Germany

- Triveni chemicals India

- Zhengzhou Yellow River Emery Co., Ltd China

- Saint-Gobain Silicon Carbide France

- Xuancheng Crystal Clear New Materials Co., Ltd China

- aromachimie Company Ltd. U.K.

- Multimin-Egypt for Mining S.A.E. Egypt

- Hisilco China

- Nanjing SiSiB Silicones Co., Ltd.

- BRB International

Recent Developments

-

In January 2024, PQ Corporation, a prominent producer of specialty chemicals, announced the acquisition of vanBaerle, a specialty silicates manufacturer. This strategic move will expand PQ's portfolio of silicate-based products and strengthen its position in the specialty chemicals market. The acquisition is expected to enhance PQ's capabilities in serving customers across various industries, including construction, personal care, and industrial applications.

-

In June 2023, Nouryon launched Kromasil 100Å diC4 spherical silica, an innovative chromatography media that enhances the purification of peptide-based pharmaceuticals for type 2 diabetes and obesity treatments. This new product achieves 99.5% purity in just two steps, improving efficiency compared to the industry standard of three or four steps. It is particularly effective for purifying complex substances such as GLP-1 agonists and expands Nouryon's Kromasil® portfolio, giving customers more flexibility to meet their specific purification needs.

Silicone Derivative Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.51 billion

Revenue forecast in 2030

USD 38.86 billion

Growth rate

CAGR of 6.59% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Dow Corning Corporation; Shin-Etsu Chemical Co., Ltd.; Wacker Chemie AG; Triveni chemicals; Zhengzhou Yellow River Emery Co., Ltd; Saint-Gobain Silicon Carbide; Xuancheng Crystal Clear New Materials Co., Ltd; aromachimie Company Ltd.; Multimin-Egypt for Mining S.A.E.; Hisilco; Nanjing SiSiB Silicones Co., Ltd.; BRB International

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silicone Derivative Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented global silicone derivative market report based on type, end use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Silicon Dioxide (Silica)

-

Silicon Carbide

-

Silicate

-

Silicon Nitride

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automobile

-

Electronics

-

Energy

-

Chemicals

-

Personal Care

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global silicone derivative market size was estimated at USD 24.96 billion in 2023 and is expected to reach USD 26.51 billion in 2024.

b. The global silicone derivative market is expected to grow at a compound annual rate of 6.59% from 2024 to 2030, reaching USD 38.86 billion by 2030.

b. The silicone dioxide segment led the global silicone derivative market, accounting for more than 36.46% of the global revenue in 2023.

b. Some of the major companies are Dow Corning Corporation, Shin-Etsu Chemical Co., Ltd., Wacker Chemie AG, Triveni chemicals, Zhengzhou Yellow River Emery Co., Ltd, Saint-Gobain Silicon Carbide, snd Xuancheng Crystal Clear New Materials Co., Ltd.

b. The growing building & construction activities in emerging economies is driving the growth of the market. With the rising population there is an increasing demand for residential as well as commercial buildings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.