Silicon Metal Market Summary

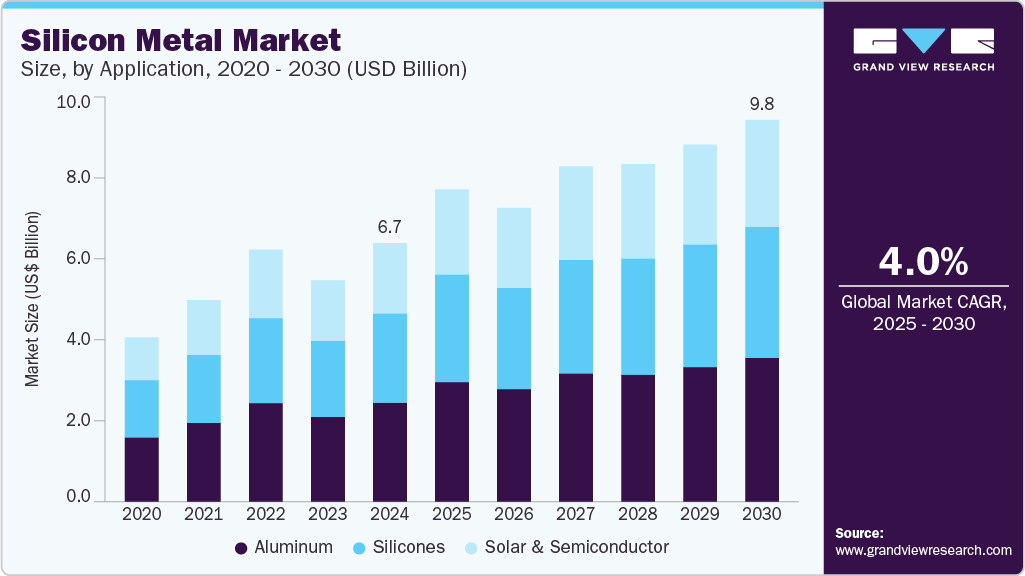

The global silicon metal market size was estimated at USD 6.66 billion in 2024 and is projected to reach USD 9.78 billion by 2030, growing at a CAGR of 4.0% from 2025 to 2030. The market is expected to be driven by the increasing production of aluminum worldwide, as a significant proportion of silicon metal output is used for this purpose.

Key Market Trends & Insights

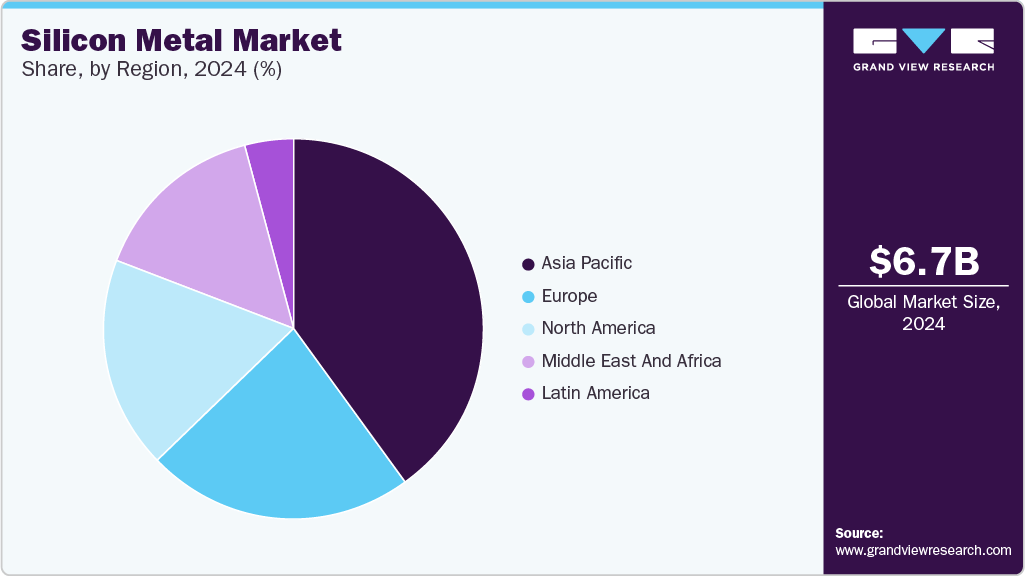

- The Asia Pacific silicon metal market held the largest revenue share of 40.5% in 2024.

- China's silicon metal dominated the Asia Pacific, with the largest revenue share in 2024.

- Based on application, the aluminum segment dominated the silicon metal market, with the largest revenue share of 38.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.66 Billion

- 2030 Projected Market Size: USD 9.78 Billion

- CAGR (2025-2030): 4.0%

- Asia Pacific: Largest market in 2024

India's aluminum production experienced a slight growth of 0.9%, reaching 38.36 lakh tonnes (LT) from April to February of the 2024-25 financial year, as per preliminary data from the Ministry of Mines. The demand for silicon metal in the electronics industry is driven by its requirement in microchips, transistors, and semiconductor manufacturing industries. Experts have predicted that the global semiconductor market will grow at 20.1% annually, surpassing USD 100.2 billion by 2032. In response, the Indian government has committed USD 10 billion to its Semiconductor Mission, aiming to boost investments and establish India as a key player in chip manufacturing.

Furthermore, the solar panel manufacturing industry plays a key role in driving the demand for the silicon metal industry, as it is a key product in the solar cells manufacturing process due to its semi-conductive properties. By October 2024, the UK’s solar generation capacity reached 17.2 GW, reflecting an increase of 6.3% or 1 GW, from October 2023. During the same period, 76 MW of new capacity was added through 20,102 new solar installations. In addition, the government of China has outlined a comprehensive plan to develop an ‘ecological civilization,’ wherein solar energy installations will play an important role in lowering pollution levels and reducing the use of fossil fuels.

Application Insights

The aluminum segment dominated the silicon metal market, with the largest revenue share of 38.9% in 2024. Silicon metal is used as a strengthener and an alloying agent in aluminum production. The stringent pollution standards set for automakers worldwide are likely to push the demand for automotive aluminum owing to its lightweight properties and ability to reduce pollution.

Japan's motor vehicle sales increased by 18.7% in February 2025, up from a growth of 12.4% in the previous month. Furthermore, silicon metal is essential for high-strength aluminum alloys in the automotive industry, with 25% of Emirates Global Aluminium (EGA)'s production used for vehicle parts. The UAE lacked a domestic silicon metal industry, relying on EGA, which imports around 60,000 tons annually. In 2022, EGA planned to launch a silicon metal production project in the UAE to secure premium aluminum supplies and support new industries under the Operation 300 bn and Make it in the Emirates initiatives.

The solar and semiconductor segment is expected to grow at the fastest CAGR of 4.5% over the forecast period. The semi-conductive nature of silicon metals drives its demand in the growing solar and semiconductor industries. In 2024, the U.S. Department of State announced that it would partner with the India Semiconductor Mission, Government of India, to explore opportunities for diversifying and expanding the global semiconductor ecosystem.

Regional Insights

The North America silicon metal industry held a substantial market share in 2024. The automotive and electronics industry in the region is a major contributor to market growth. Aluminum uses silicon metal to produce high-strength alloys, essential in manufacturing vehicles and aircraft. As per an update in 2023 by the International Trade Administration, Mexico was the seventh-largest producer of passenger vehicles globally, with an annual production of 3.5 million. Of these, 88% were exported, with 76% heading to the U.S. Major automakers operating in Mexico include Audi, General Motors, Ford, Honda, Toyota, Tesla, BMW, and Volkswagen.

U.S. Silicon Metal Market Trends

The U.S. silicon metal market led North America, with the largest revenue share in 2024. The automotive industry is a key driver of the silicon metal market, as silicon metal is a vital component in the production of metals used for manufacturing vehicles and aircraft. Boeing Commercial Airplane Co., located in Everett, Washington, operates the world’s largest aircraft manufacturing facility. Furthermore, Mississippi Silicon, a U.S.-based producer of raw silicon metal, produces about 10% of the country’s total silicon metal used.

Asia Pacific Silicon Metal Market Trends

The Asia Pacific silicon metal market held the largest revenue share of 40.5% in 2024. The automotive, semiconductor, and silicone manufacturing industries play a key role in the demand for silicon metal in the region. Japan is a global leader in motor vehicle manufacturing, home to major automakers including Toyota, Subaru, Nissan, Honda, Mazda, Suzuki, Daihatsu, and Mitsubishi. Furthermore, Shin-Etsu Chemical is a major silicone company in Japan with 5,000 products serving a diverse range of industries, including electrical/electronics and automotive manufacturing.

China's silicon metal dominated the Asia Pacific, with the largest revenue share in 2024. This significant share is attributed to China's large aluminum and silicone production base, coupled with the expanding solar and semiconductor industry.

Furthermore, strong efforts undertaken by the Chinese government to accelerate the growth of the solar industry are expected to bolster the demand for silicon metal over the coming years. The government of China has outlined a comprehensive plan to develop an ‘ecological civilization,’ wherein solar energy installations will play an important role in lowering pollution levels and reducing the use of fossil fuels.

Key Silicon Metal Company Insights

Some of the major silicon metal industry companies include Ferroglobe, Dow, Elkem ASA, and RIMA INDUSTRIAL. These companies invest in advanced technologies, improve production efficiency, and maintain high-quality standards. They also diversify their product offerings, focus on sustainability, and adapt to market trends, such as increasing demand for electric vehicles and renewable energy. Strategic partnerships and global supply chain optimization further strengthen their position.

-

Ferroglobe is engaged in the production of silicon metal, ferroalloys, and other specialized materials. It serves a range of industries, including automotive, energy, and electronics. The company manufactures and supplies materials essential for various industrial applications. It operates globally with a presence in several markets worldwide.

-

Dow manufactures a wide range of materials, including silicon-based products. The company supplies silicon metal for various industries, such as electronics, automotive, and renewable energy.

Key Silicon Metal Companies:

The following are the leading companies in the silicon metal market. These companies collectively hold the largest market share and dictate industry trends.

- Ferroglobe

- Dow

- Elkem ASA

- RIMA INDUSTRIAL

- RusAL

- LIASA

- Wacker Chemie AG

- Hoshine Silicon Industry Co., Ltd.

- Anyang Huatuo Metallurgy Co., Ltd

- Mississippi Silicon

Recent Developments

-

In April 2025, Elkem ASA's Silicones division launched two new recycled products, SILCOLEASE RE POLY 368 and SILCOLEASE RE POLY 11362, as part of its commitment to sustainability and circularity.

Silicon Metal Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 8.03 billion

|

|

Revenue forecast in 2030

|

USD 9.78 billion

|

|

Growth Rate

|

CAGR of 4.0% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Volume in Kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Country scope

|

U.S.; Canada; Mexico; Russia; Germany; Norway; France; China; India; Japan; Brazil

|

|

Key companies profiled

|

Ferroglobe; Dow; Elkem ASA; RIMA INDUSTRIAL; RusAL; LIASA; Wacker Chemie AG; Hoshine Silicon Industry Co., Ltd.; Anyang Huatuo Metallurgy Co., Ltd; and Mississippi Silicon.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Silicon Metal Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global silicon metal market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Aluminum

-

Silicones

-

Solar & Semiconductor

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)