- Home

- »

- Advanced Interior Materials

- »

-

Silicon Carbide Fibers Market Size, Industry Report, 2030GVR Report cover

![Silicon Carbide Fibers Market Size, Share & Trends Report]()

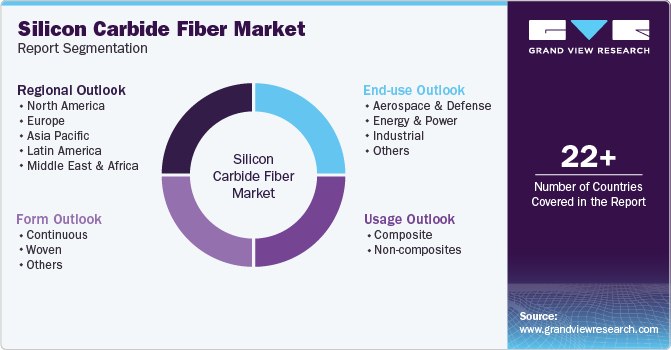

Silicon Carbide Fibers Market (2025 - 2030) Size, Share & Trends Analysis Report By Form (Continuous, Woven), By Usage (Composite, Non-composites), By End Use (Energy & Power, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-987-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Silicon Carbide Fibers Market Summary

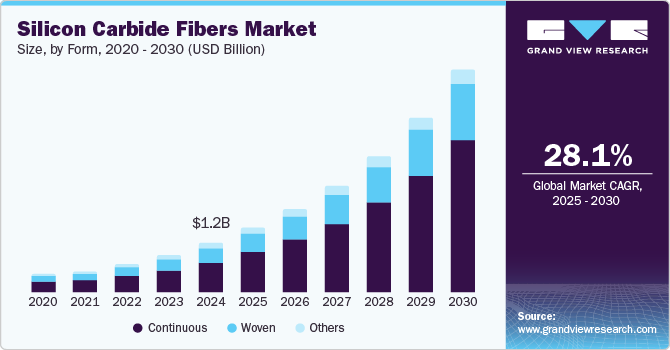

The global silicon carbide fibers market size was valued at USD 1.20 billion in 2024 and is projected to reach USD 5.49 billion by 2030, growing at a CAGR of 28.1% from 2025 to 2030. This growth is attributed to the increasing demand in the aerospace and automotive industries for lightweight, high-strength materials that enhance performance and fuel efficiency. In addition, technological advancements in manufacturing processes lead to improved fiber properties and lower production costs.

Key Market Trends & Insights

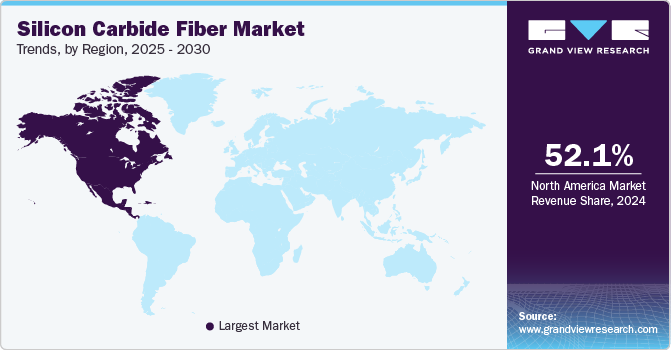

- North America silicon carbide fibers market dominated the global market and accounted for the largest revenue share of 52.1% in 2024.

- The Asia Pacific silicon carbide fibers market is expected to grow at a CAGR of 27.6% over the forecast period.

- Based on form, the continuous form dominated the market and accounted for the largest revenue share of 60.6% in 2024.

- In terms of usage, the composite segment led the market and accounted for the largest revenue share of 78.2% in 2024

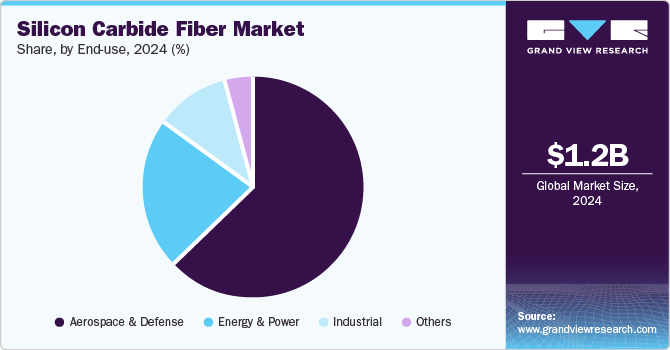

- Based on end Use, the aerospace and defense segment dominated the market and accounted for the largest revenue share of 63.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.20 Billion

- 2030 Projected Market Size: USD 5.49 Billion

- CAGR (2025-2030): 28.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, the growing emphasis on energy efficiency and sustainability encourages the adoption of silicon carbide fibers in various applications, including electronics and renewable energy systems. These factors collectively contribute to the market expansion globally.Silicon carbide fibers are advanced materials known for their exceptional strength, thermal stability, and oxidation resistance. The market for these fibers is experiencing significant growth, primarily due to the rising demand for lightweight and high-strength composites across various sectors, including aerospace, automotive, and defense. These composites leverage silicon carbide fibers to provide superior mechanical properties, making them suitable for applications where minimizing weight while maintaining structural integrity is essential.

The aerospace sector is a key market driver, as silicon carbide fiber composites can endure extreme temperatures and harsh conditions while supporting heavy loads. The increasing production of advanced aircraft, spacecraft, and satellites is expected to sustain the demand for these materials in the foreseeable future.

Furthermore, ongoing technological advancements and innovations are propelling market growth. Manufacturers are investing in research and development to enhance the performance of silicon carbide fibers, resulting in improved mechanical properties such as higher tensile strength and better fiber-to-matrix adhesion.

Moreover, government initiatives aimed at promoting environmental sustainability and fuel efficiency are influencing market dynamics. Stricter regulations worldwide to curb carbon emissions encourage industries to adopt lightweight materials such as silicon carbide fiber composites. These materials not only help manufacturers comply with regulations but also contribute to reducing their overall carbon footprint. Furthermore, government funding for research into advanced materials provides additional support for the growth of the silicon carbide fiber market, highlighting its importance in the transition toward more sustainable industrial practices.

Form Insights

The continuous form dominated the market and accounted for the largest revenue share of 60.6% in 2024 attributed to the increasing demand for high-performance materials in the aerospace, automotive, and defense industries. In addition, continuous fibers provide exceptional mechanical properties, including high tensile strength and thermal stability, making them ideal for applications that require lightweight yet durable composites. Furthermore, their ability to enhance structural integrity while reducing weight is crucial in advanced engineering applications, leading to a growing preference for continuous silicon carbide fibers in critical components and systems.

The woven form segment is expected to grow at a CAGR of 24.9% over the forecast period, owing to the versatility and enhanced performance these materials offer in various applications. In addition, woven fabrics allow for improved flexibility and adaptability in composite structures, making them suitable for complex geometries in aerospace and industrial applications. Furthermore, the growing emphasis on lightweight materials that can withstand extreme temperatures and harsh environments further drives demand for woven silicon carbide fibers. Moreover, advancements in weaving techniques enhance fiber-to-matrix adhesion, contributing to better overall performance in composite materials.

Usage Insights

The composite segment led the market and accounted for the largest revenue share of 78.2% in 2024, driven by advancements in manufacturing technologies and increasing demand from various industries. These fibers are favored for their superior strength-to-weight ratio, thermal stability, and resistance to chemical degradation, making them ideal for aerospace, automotive, and energy applications. Furthermore, the push for lightweight materials to enhance fuel efficiency in transportation sectors further propels the adoption of composite silicon carbide fibers, as they offer significant performance benefits over traditional materials.

Non-composite segment is expected to grow at a CAGR of 23.3% over the forecast period, owing to its cost-effectiveness and versatility across various applications. Non-composite silicon carbide fibers are increasingly utilized in industrial processes with high temperatures, and corrosive environments, such as semiconductor manufacturing and heating elements, are prevalent. In addition, the expanding electronics sector and the rising need for durable materials in harsh conditions contribute to the demand for non-composite fibers. Furthermore, ongoing research into new applications and improvements in fiber production techniques are expected to bolster the segment growth.

End Use Insights

The aerospace and defense segment dominated the market and accounted for the largest revenue share of 63.2% in 2024, driven by the increasing demand for lightweight, high-strength materials that can withstand extreme conditions. In addition, silicon carbide fibers offer exceptional thermal stability and mechanical properties, making them ideal for critical applications in aircraft and military equipment. Furthermore, the rising production of advanced aircraft and the need for improved performance in defense systems further fuel this demand as manufacturers seek materials that enhance efficiency and reduce overall weight.

The energy and power segment is expected to grow at a CAGR of 28.5% from 2025 to 2030, owing to the transition towards more efficient and sustainable energy solutions. These fibers are utilized in applications such as turbine blades and heat exchangers, where their high-temperature resistance and strength are essential. In addition, the increasing focus on renewable energy technologies, including wind and solar power, also drives the adoption of silicon carbide fibers, as they contribute to improved performance and reliability in energy generation systems. Moreover, this trend is further supported by government initiatives to promote energy efficiency and reduce carbon emissions.

Regional Insights

North America silicon carbide fibers market dominated the global market and accounted for the largest revenue share of 52.1% in 2024 attributed to the strong presence of aerospace and defense industries that demand high-performance materials. In addition, the region's focus on developing lightweight, durable composites that can withstand extreme conditions drives the adoption of silicon carbide fibers. Furthermore, substantial research and development investments and government initiatives supporting advanced manufacturing technologies further enhance market growth. Moreover, the established supply chain and presence of key manufacturers also contribute to the market's expansion in North America.

U.S. Silicon Carbide Fibers Market Trends

The silicon carbide fibers market in the U.S. dominated the North American market and accounted for the largest revenue share in 2024, driven by advancements in aerospace technology and defense applications. Furthermore, the growing production of military aircraft and satellites necessitates materials that offer superior strength and thermal resistance, making silicon carbide fibers highly desirable. Moreover, government regulations promoting energy efficiency and sustainability encourage industries to adopt lightweight materials.

Asia Pacific Silicon Carbide Fibers Market Trends

The Asia Pacific silicon carbide fibers market is expected to grow at a CAGR of 27.6% over the forecast period, owing to rapid industrialization and increasing investments in the aerospace, automotive, and energy sectors. In addition, countries such as China and India are focusing on developing advanced materials to meet the demands of their expanding industries. Furthermore, the push for lightweight composites that enhance performance and efficiency drives the adoption of silicon carbide fibers. Moreover, government initiatives aimed at promoting sustainable practices further support market growth as industries seek to comply with environmental regulations.

The silicon carbide fibers market in Japan led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its expansion due to its emphasis on technology and innovation within the aerospace and electronics industries. The country's commitment to developing high-performance materials aligns with global energy efficiency and sustainability trends. Japanese manufacturers are investing in advanced production techniques to create high-quality silicon carbide fibers that meet strict industry standards. This focus on innovation and a strong manufacturing base position Japan as a key player in the global silicon carbide fibers market.

Europe Silicon Carbide Fibers Market Trends

Europe silicon carbide fibers market is expected to witness substantial growth over the forecast period, owing to growing demand from aerospace and automotive sectors focused on lightweight materials. Furthermore, Europe’s commitment to sustainability fosters research and development activities aimed at enhancing fiber properties. Moreover, collaborations between industry leaders and academic institutions further promote advancements in silicon carbide fiber technologies throughout the region.

The growth of the silicon carbide fibers market in Germany is driven by its robust automotive and aerospace industries. The country's emphasis on engineering excellence leads to a growing demand for high-performance materials that improve efficiency and reduce weight in vehicles and aircraft. Government initiatives promoting sustainable manufacturing practices encourage the adoption of silicon carbide fibers. Furthermore, Germany's strong research environment supports advancements in fiber technology, contributing significantly to the overall growth of the silicon carbide fibers market within the country.

Key Silicon Carbide Fibers Company Insights

Some of the key players in the global silicon carbide fibers industry include SGL Carbon, Toyobo Co., Ltd., CeramTec, 3M, and others. These companies adopt various strategies to enhance their market presence and gain a competitive edge. These strategies include investing in research and development to innovate and improve fiber performance, forming strategic partnerships to expand market reach, and focusing on sustainable manufacturing practices to meet environmental regulations. Furthermore, companies often engage in mergers and acquisitions to consolidate resources and capabilities while diversifying their product offerings to cater to different end-use industries and customer needs.

-

CeramTec manufactures advanced ceramics, including silicon carbide fibers. The company operates within the high-performance materials segment, focusing on applications that require exceptional strength, thermal stability, and corrosion resistance. The company’s silicon carbide fibers are utilized in various industries, including aerospace, automotive, and energy, where they enhance the performance of composite materials and contribute to innovative solutions for demanding environments.

-

3M produces a wide range of products, including silicon carbide fibers. Operating in the industrial materials segment, the company develops advanced materials that improve performance across multiple applications. Their silicon carbide fibers are known for their high strength and thermal resistance, making them suitable for use in aerospace, electronics, and energy sectors. The company’s commitment to innovation drives the continuous improvement of its fiber products to meet evolving industry needs.

Key Silicon Carbide Fibers Companies:

The following are the leading companies in the silicon carbide fibers market. These companies collectively hold the largest market share and dictate industry trends.

- SGL Carbon

- Toyobo Co., Ltd.

- U.S. Specialty Materials (USSM)

- CeramTec

- 3M

- H.C. Starck

- Nippon Carbon Co., Ltd.

- GE Aviation

- Dow Chemical (Dow Inc.)

- Applied Materials

- NextEra Energy Inc.

Silicon Carbide Fibers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.59 billion

Revenue forecast in 2030

USD 5.49 billion

Growth Rate

CAGR of 28.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Volume in Tons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, usage, end use, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, China, Japan, Germany, UK, France, Brazil

Key companies profiled

SGL Carbon; Toyobo Co., Ltd.; U.S. Specialty Materials (USSM); CeramTec; 3M; H.C. Starck; Nippon Carbon Co., Ltd.; GE Aviation; Dow Chemical (Dow Inc.); Applied Materials.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silicon Carbide Fibers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global silicon carbide fibers market report based on form, usage, end use, and region.

-

Form Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Continuous

-

Woven

-

Others

-

-

Usage Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Composite

-

Non-composites

-

-

End Use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Energy & Power

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global silicon carbide fibers market size was estimated at USD 1.20 billion in 2024 and is expected to reach USD 1.59 billion in 2025.

b. The global silicon carbide fibers market is expected to grow at a compounded annual growth rate of 28.1% from 2025 to 2030 to reach USD 5.49 billion in 2030.

b. North America dominated the silicon carbide fibers market with a share of 52.1% in 2023. Increasing product consumption in the production of energy and power components is also expected to drive the SiC market over the forecast period.

b. Some key players operating in the silicon carbide fibers market include Ube Industries, NGS Advanced Fibers, and Suzhou Saifei Group.

b. Key factors driving the silicon carbide fibers market growth include increasing use of lightweight silicon carbide fibers for component manufacturing in aerospace industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.