Signals Intelligence Market Size, Share & Trends Analysis Report By Solutions (Airborne, Ground, Naval, Space, Cyber), By Type (ELINT, COMINT), By Mobility (Fixed, Portable), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-256-4

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Signals Intelligence Market Size & Trends

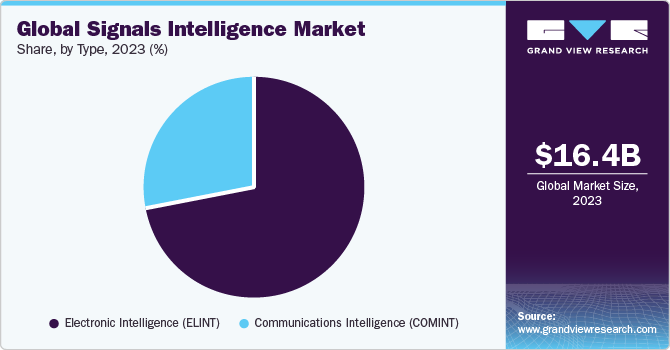

The global signals intelligence market size was estimated at USD 16.41 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. The emergence of geopolitical uncertainties and the increase in criminal activities are driving the market growth. SIGINT is an intelligence-gathering technique of intercepting and analyzing signals transmitted over electronic devices such as radios, telephones, and computers. It can provide valuable information about individuals, groups, or nations' intentions, capabilities, and activities.

The demand for effective communication interception methods is growing owing to the rising geopolitical strains such as Russia-NATO tensions, U.S.-China competition, and the Israel-Palestine war. With cyberattacks on the rise and the potential for exchanging critical information, governments and organizations increasingly rely on interception technologies to monitor conversations and gather intelligence. In November 2023, the Ukrainian company Falcons developed a SIGINT system called Eter, comprising three direction finding (DF) systems for detecting communication signals, electronic warfare systems, and unmanned aerial vehicles (UAVs). The complex can operate for up to 24 hours and identify equipment by employing frequency-hopping spread-spectrum (FHSS) techniques. Eter is deployed with several separate Armed Forces units, helping soldiers perform launch drones, combat missions, and engage enemy positions. The system is portable and modular, enabling damaged components to be replaceable.

With advancements in artificial intelligence (AI), many companies are increasingly integrating AI in SIGINT, aiming to enhance efficiency and speed of interception. For instance, in August 2023, Vectra AI, an AI-based cyber risk detection and response solutions developer, announced the patented Attack Signal Intelligence-powered Vectra AI Platform. The Vectra AI Platform allows enterprises to combine signals from cloud, identity, SaaS, and network sources with existing endpoint detection and response (EDR) signals to identify suspicious behavior that other tools cannot. The platform uses the power of AI to analyze attacker behavior and automatically categorizes, correlates, and prioritizes security incidents. This integrated signal drives the XDR and helps to prevent sophisticated adversaries, streamline security operations, and enhance cyber resilience.

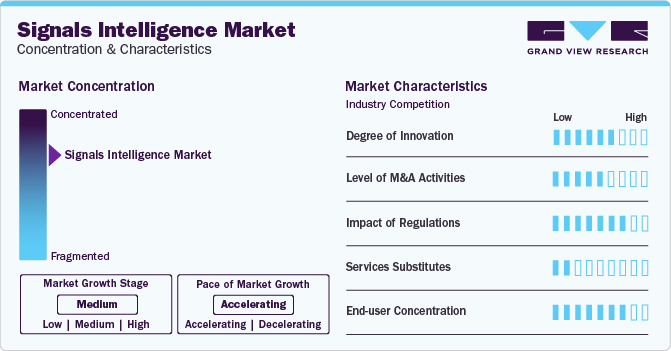

Market Concentration & Characteristics

The market is concentrated in nature and it is accelerating at a medium pace. The signals intelligence (SIGINT) industry is characterized by an active and rapidly evolving landscape driven by technological advancements. One prominent feature is the increasing SIGINT adoption as a commercial solution to law enforcement agencies and private companies including Maritime Domain Awareness (MDA), spectrum monitoring and management by telecommunication companies, and fraud detection & financial risk management by various financial institutions.

Government regulations for SIGINT are stringent in many countries due to its potential risk of privacy invasion. For instance, in October in October 2022, the U.S. government revised its norms for signals intelligence activities to establish robust protection for SIGINT activities to ensure they comply with the law, privacy, and civil liberties. It is achieved by creating a multi-layered oversight framework involving the Attorney General, Director of National Intelligence, and Privacy and Civil Liberties Oversight Board. Overall, this executive order represents a significant step towards addressing privacy concerns surrounding U.S. SIGINT activities while still prioritizing national security needs.

Signals intelligence companies are incorporating mergers and acquisitions to gain substantial market advantage. For instance, in March 2023, Altamira Technologies Corp. announced the acquisition of Virginia Systems & Technology (VaST). The acquisition aimed to bring VaST’s crucial customers and SIGINT capabilities to its business portfolio.

Solutions Insights

Based on solutions, the market is further segmented into airborne, ground, naval, space and cyber. The airborne segment led the market with the largest revenue share of 40.3% in 2023 and is expected to continue to dominate the industry over the forecast period. The growth of the airborne segment can be attributed to factors such as the rising need for border security and surveillance. The airborne SIGINT offer extended coverage, high mobility, and interception at higher altitudes for improved data collection and interpretation. These feature makes airborne SIGINT vital for any interception activities and thus to cater this demand, companies are developing innovative solutions. For instance, in November 2023, PEGASUS SIGINT received approval from the Critical Design Review conducted by the Federal Office of Bundeswehr Equipment, Information Technology, and In-Service Support (BAAINBw), allowing the commencement of the manufacturing process.

The cyber segment is expected to experience a significant CAGR over the forecast period. With the increase in cybercrime and the emergence of cyber weapons, the demand for cyber SIGINT is on the rise, owing to its capability of identifying and holding cyber attackers accountable. In addition, the growing integration of AI and machine learning (ML) is increasing their effectiveness against cyber threats.

Type Insights

Based on type, the market is bifurcated as electronic intelligence (ELINT) and communications intelligence (COMINT). The ELINT segment held the market with the largest revenue share of 72.3% in 2023. One of the key drivers of this segment is the increasing usage of electronic equipment across different domains such as military and civilian. The modern battlefield relies heavily on electronic equipment for communication, surveillance, and reconnaissance purposes. ELINT systems play a crucial role in detecting and analyzing enemy radar systems, electronic warfare threats, and other electronic emissions to gain a tactical advantage on the battlefield. Beyond the military, ELINT technologies find applications in various civilian domains, including aerospace, maritime, and telecommunications.

The COMINT segment is expected to grow at the fastest CAGR over the forecast period, owing to the technological advancements in natural language processing (NLP). NLP allows COMINT systems to understand and analyze the meaning of intercepted communications, extracting sentiment, emotions, and intent beyond just the literal content. This provides deeper insights into adversary plans and motivations, finding increasing applications in counterterrorism and counter-espionage.

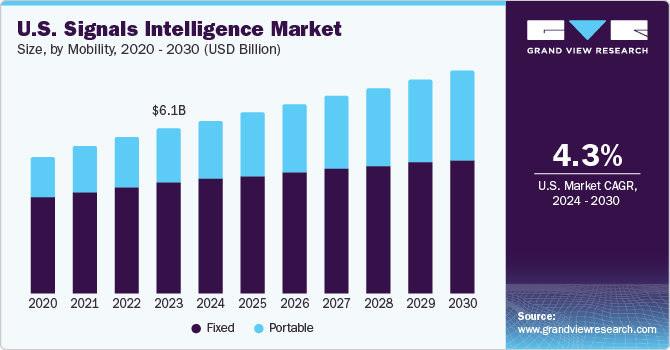

Mobility Insights

Based on mobility, the market is bifurcated as fixed and portable. The fixed segment led the market with the largest revenue share of 73.9% in 2023. This can be attributed to the rising need for long-range monitoring and passive collection of data. Many portable SIGINT actively emit signals for interception activities and fixed SIGINT passively collect intelligence, making it difficult for adversaries to detect and reducing the risk of compromising intelligence sources.

The portable segment is expected to witness at the fastest CAGR during the forecast period. This growth can be attributed to the increasing need for flexibility in covert operations and Special Forces tasks. Modern conflicts often involve dynamic situations and mobile targets, requiring intelligence-gathering capabilities that can adapt and deploy quickly. Portable SIGINT systems offer the flexibility and speed needed to respond to these evolving threats. Research and developments are being conducted to produce smaller portable SIGINT. For instance, in June2022, Mercury Systems, Inc., a technology developer for military and aerospace, announced the launch of power-efficient, compact tuner modules for applications including direction finding (DF), SIGINT, and test and measurement. It features rapid broadband radio-frequency processing AM9030 and AM9018 modules.

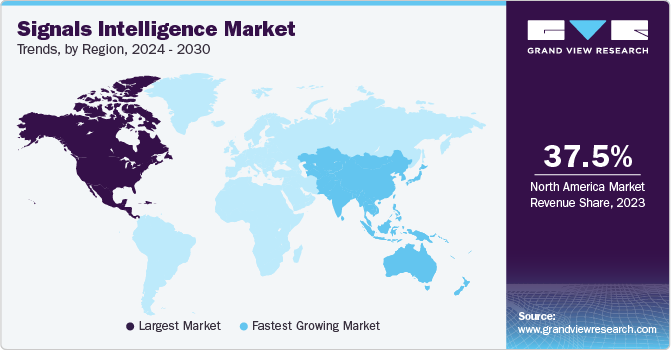

Regional Insights

North America dominated the signals intelligence market with the revenue share of 37.5% in 2023. This is attributable to the increasing defense budget and the rising innovations in artificial intelligence (AI). With ongoing geopolitical tensions and evolving security threats, governments in North America have been bolstering their defense expenditures to enhance their intelligence capabilities, including SIGINT. AI is enabling more advanced signal processing, data analytics, and decision-making capabilities. North American companies and research institutions have been at the forefront of leveraging AI to enhance SIGINT systems, thereby strengthening the region's competitive position in the global market.

U.S. Signals Intelligence Market Trends

The signals intelligence market in U.S. is expected to witness at a significant CAGR of 4.3% over the forecast period, due to the rising competition with China and Russia. With China and Russia actively enhancing their own SIGINT capabilities, the U.S. is compelled to invest in advanced technologies and intelligence-gathering systems to maintain strategic superiority and safeguard national security interests. This competitive landscape is driving increased funding allocations towards SIGINT programs and initiatives, fostering innovation and the development of cutting-edge solutions tailored to meet the evolving challenges posed by adversarial actors. In addition, the U.S. market accounted for over 35% in 2023 and is expected to grow at a significant CAGR over the forecast period.

The Canada signals intelligence market is expected to grow at a significant CAGR over the forecast period, influenced by commercial and industrial factors, including the presence of domestic companies specializing in defense and security technologies. Government contracts, partnerships with international firms, and investments in research and development contribute to the market growth and competitiveness of Canada's SIGINT industry, driving innovation and technological advancement in the market.

Europe Signals Intelligence Market Trends

The signals intelligence market in Europe has been identified as a lucrative region in this industry. European countries often collaborate on intelligence-sharing initiatives and defense procurement programs to pool resources, expertise, and capabilities. Multinational SIGINT projects and joint ventures facilitate information exchange, interoperability, and cost-sharing among European allies, driving cooperation and integration within the SIGINT market.

The UK signals intelligence market is expected to grow at the fastest CAGR over the forecast period. As a member of the Five Eyes intelligence alliance alongside Canada, Australia, the U.S., and New Zealand, the UK collaborates closely with its partners to gather, analyze, and share intelligence from global sources. This collaboration enhances the UK's SIGINT capabilities and fosters interoperability with allied nations, driving investments in advanced technologies and intelligence-gathering systems.

The signals intelligence market in Germany is anticipated to grow at a substantial CAGR over the forecast period. Germany is renowned for its technological prowess and innovation capabilities, which extend to the field of SIGINT. German companies and research institutions are at the forefront of developing advanced SIGINT technologies, including signal processing algorithms, communication interception systems, and cybersecurity solutions. This technological expertise drives innovation and competitiveness in the German SIGINT market, enabling the country to maintain a technological edge in intelligence gathering.

Asia Pacific Signals Intelligence Market Trends

The signals intelligence market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. Diverse geopolitical dynamics, including territorial disputes, regional rivalries, and military tensions, characterize the Asia Pacific region. These factors drive the demand for advanced SIGINT capabilities among Asia Pacific countries to monitor and counter emerging threats, safeguard national sovereignty, and maintain regional stability.

The China signals intelligence market held a significant share in terms of revenue in 2023. The Chinese government employs SIGINT capabilities for domestic surveillance and social control purposes, monitoring communications, internet activity, and electronic transactions to identify and suppress dissent, political activism, and perceived threats to the ruling Communist Party's authority. This extensive surveillance apparatus contributes to the market growth and development of China's SIGINT infrastructure and capabilities.

The signals intelligence market in India is expected to grow at a significant CAGR during the forecast period, owing to India's ongoing efforts to combat terrorism, drive investment in SIGINT capabilities to monitor and disrupt terrorist networks, prevent attacks, and protect critical infrastructure. SIGINT plays a crucial role in providing intelligence support to counterterrorism operations, including tracking terrorist communications, identifying safe havens, and targeting high-value individuals involved in terrorist activities.

Middle East & Africa Signals Intelligence Market Trends

The signals intelligence market in Middle East and Africa is expected to witness at the substantial CAGR during the forecast period. The region has a growing defense and technology industry comprising a mix of domestic companies, multinational corporations, and research institutions. Government investments in research and development, public-private partnerships, and defense procurement programs stimulate technological innovation and market growth, driving the development of advanced SIGINT solutions tailored to regional security needs.

The Saudi Arabia signals intelligence market held a noteworthy share in the market in 2023, owing to its growing investments in developing its defense and technology industry as part of its Vision 2030 initiative. The country aims to reduce its dependence on oil and diversify its economy by investing in sectors such as defense and technology. Government investments in research and development, public-private partnerships, and defense procurement programs stimulate technological innovation and market growth in the Saudi Arabia, driving the development of advanced SIGINT solutions tailored to the country's security needs

Key Signals Intelligence Company Insights

Some of the key players operating in the market includeLockheed Martin, BAE Systems, Northrop Gruman, L3Harris Technologies, Thales, and Indra.

-

Lockheed Martin offers a wide range of intelligence and surveillance systems including ground and airborne radar technologies, electronic warfare systems, satellite and sensor systems for remote intelligence gathering, and command, control, communications, computers, intelligence, surveillance and reconnaissance (ISR) solutions for data fusion and analysis. Some of its products include Terrestrial Layer System-Echelons above Brigade (TLS-EAB), and Terrestrial Layer System-Brigade Combat Team (TLS-BCT)

-

BAE Systems is a company that provides intelligence and security solutions. Their services include cyber intelligence, counterintelligence, signal intelligence, electronic warfare systems, advanced communication and data networks, and intelligence-gathering sensors on ground vehicles and aircraft. Their products include Unmanned SIGINT/Electronic Warfare, Airborne SIGINT and Electronic Support, Maritime SIGINT, and Eclipse RF Products

Northrop Grumman, Indra are some of the other market participants in the quantum cryptography market.

-

Northrop Grumman deals in intelligence, surveillance, and reconnaissance technologies, including unmanned aerial vehicles (UAVs), ground and airborne radar systems, satellite-based communication and intelligence systems, and advanced sensors and processing technologies for image and signal analysis

-

Indra is a Spanish technology company with a focus on defense and security. Their capabilities include command and control systems for intelligence operations, radar and sensor technologies for air traffic management and surveillance, cybersecurity and critical infrastructure protection solutions, and communication systems for military and government use. It offers 3D Lanza-MRR and Lanza-LRR, 3D PSR, 2D PSR, MSSR-S, MLAT/WAM

Key Signals Intelligence Companies:

The following are the leading companies in the signals intelligence market. These companies collectively hold the largest market share and dictate industry trends.

- Lockheed Martin Corporation

- BAE Systems

- Thales

- Northrop Grumman

- L3Harris Technologies

- Raytheon Technologies

- General Dynamics

- HENSOLDT AG

- Elbit Systems

- Saab

- Mercury Systems

Recent Developments

-

In November 2023, Finland-based VTT Technical Research Center and Lockheed Martin Corporation announced an agreement to work on a research consortium. The collaborative project aims to enhance the methods and technologies for detecting and classifying radar and communication signals in a modern battlefield, where emitters are equipped with a low probability of interception and detection signals. Developing such techniques is essential to ensure optimal performance in detecting and classifying signals amidst the challenging environment of a modern battlefield. The project seeks to leverage the latest technological advancements to achieve the desired objectives

-

In October 2021, Northrop Grumman Corporation signed a contract to design an innovative signals intelligence (SIGINT) sensor for high-altitude surveillance platforms under the GHOST program for the U.S. Air Force. Leveraging their SAGE technology and SIGINT expertise, Northrop Grumman was expected to develop a flexible, platform-agnostic sensor capable of meeting current ISR needs while adapting to future changes in the battlespace. This agile system is to be scalable and configurable for use on various Air Force aircraft, supporting rapid enhancements and integration

Signals Intelligence Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 17.44 billion |

|

Revenue forecast in 2030 |

USD 24.42 billion |

|

Growth rate |

CAGR of 5.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Solutions, type, mobility, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Lockheed Martin Corporation; BAE Systems; Thales; Northrop Grumman; L3Harris Technologies; Raytheon Technologies; General Dynamics; HENSOLDT AG; Elbit Systems; Saab; Mercury Systems |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Signals Intelligence Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the signals intelligence (SIGINT) marketreport based on, solutions, type, mobility, and region:

-

Solutions Outlook (Revenue, USD Million, 2017 - 2030)

-

Airborne

-

Ground

-

Naval

-

Space

-

Cyber

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Electronic Intelligence (ELINT)

-

Communications Intelligence (COMINT)

-

-

Mobility Outlook (Revenue, USD Million, 2017 - 2030)

-

Fixed

-

Portable

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global signals intelligence market size was estimated at USD 16.41 billion in 2023 and is expected to reach USD 17.44 billion in 2024

b. The global signals intelligence market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 24.42 billion by 2030

b. North America dominated the SIGINT market, with a share of 37.5% in 2023. Factors such as the increasing defense budget and the rising innovations in artificial intelligence (AI) are propelling market growth in the region.

b. Some key players operating in the signals intelligence market include Lockheed Martin Corporation; BAE Systems; Thales; Northrop Grumman; L3Harris Technologies; Raytheon Technologies; General Dynamics; HENSOLDT AG; Elbit Systems; Saab; Mercury Systems

b. Factors such as the emergence of geopolitical uncertainties and the increase in criminal activities are fueling the market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."