Siding Market Size, Share & Trends Analysis Report By Product (Vinyl, Fiber Cement, Wood), By End-use (Residential, Non-residential), By Region (North America, Asia Pacific, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-329-0

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Siding Market Size & Trends

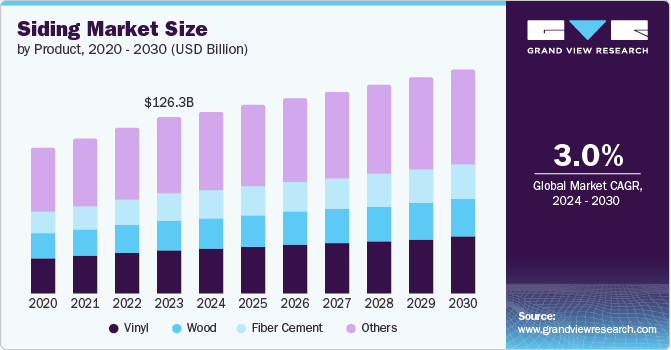

The global siding market size was estimated at USD 126.25 billion in 2023 and is projected to grow at a CAGR of 3.0% from 2024 to 2030. The growth of the market can be attributed to the growing construction industry, population growth, rising investments in residential buildings, and ongoing remodeling projects. Furthermore, it helps prevent water from coming inside the house, therefore protecting it from mold and mildew and keeping the house insulated. These factors are anticipated to fuel the market demand for sidings over the forecast period.

Installation of sidings not only enhances the aesthetics of a house but also significantly boosts its value. It provides an additional layer of protection to the house, withstanding extreme weather conditions such as hail, storms, and high winds. The use of materials in siding, such as vinyl, aluminum, brick, and fiber cement, also plays a crucial role in protecting the house from fire-related damages, thereby creating a sense of security and safety for homeowners and potential investors.

Manufacturers of sidings are increasingly investing in technological innovation in manufacturing processes and materials to make products more durable, energy-efficient, and environmentally friendly. Innovation includes the development of composite sidings that combine the aesthetics of natural materials such as wood with durability and low maintenance. Additionally, new treatments and coatings development help improve resistance to weather, UV radiation, and pests, thereby increasing the lifespan of siding materials.

The market players in the industry are opting for various strategies, such as research and development, to innovate durable and eco-friendly materials to target customers with sustainable options. They are also enhancing their product portfolios to offer comprehensive solutions and improving distribution channels to ensure wider market reach. In addition, they are also forming alliances with construction companies and architects to expand their market reach.

Product Insights

The vinyl segment dominated the market with the largest share of 24% in 2023 due to its ease of maintenance and cost-effectiveness. This material is available in a wide variety of styles and colors which makes it suitable for various construction projects. Furthermore, it is resistant to decay and moisture, is lightweight, and offers insulation properties which makes it an energy efficient option.

The fiber cement segment is expected to grow at a significant CAGR over the forecast period. Fiber cement is considered the most durable and affordable, along with aesthetical appeal it offers making it an ideal option for all residential and non-residential buildings. It helps in preventing cracks from appearing on building surface and the material can last for around 50 years. Additionally, fiber cement is replacing asbestos cement in construction which is further providing new growth opportunities for the material.

End-use Insights

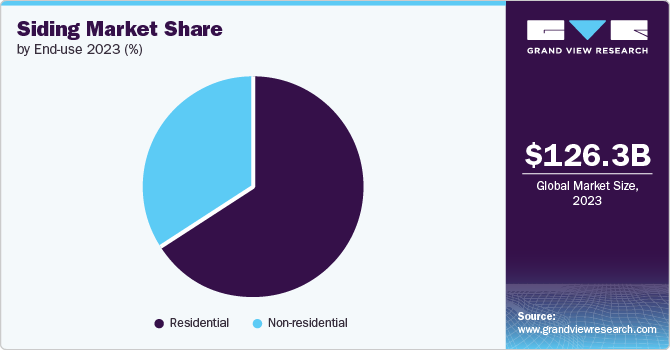

Based on end use, the residential segment dominated the market with the largest revenue share in 2023 and is further expected to grow at a significant rate over the forecast period. Various factors such as ongoing urbanization and growing number of immigrants across the globe in search of job opportunities are driving the need for more residential buildings, thereby fueling product growth. In addition to this, siding helps in protecting a building from harsh external weather along with offering an aesthetical appeal. The most commonly used siding materials for residential sector include wood, bricks, vinyl, and fiber cement.

The non-residential segment includes various commercial and institutional buildings such as offices, convenience stores, shopping malls, schools, colleges, and retail stores. These buildings utilize siding materials on account of various advantages it provides such as protection from leakage, mildew, molds, and bad weather. Moreover, as sidings offer superior insulation it further helps in saving energy cost of a building. Additionally, commercial and institutional buildings around the world are giving more emphasis on décor and aesthetics which is expected to increase the use of siding materials over years.

Regional Insights

North America siding market dominated the global market with a revenue share of 15.0% in 2023. The region has been witnessing increased demand for residential and commercial spaces owing to its growing population and rising purchasing power in countries such as Canada and Mexico. This is driving the consumption of siding materials as it helps in increasing the durability and aesthetics of a building.

U.S. Siding Market Trends

The siding market in the U.S. is growing at a CAGR of 2.5% over the forecast period owing to growth of construction sector. Construction industry is growing due to a rise in public and private investments in infrastructure development activities. Furthermore, initiatives undertaken by companies to establish their manufacturing facilities in the U.S. also fuel construction activities, driving the demand for siding materials used in residential and commercial buildings.

Europe Siding Market Trends

The siding market in Europe has been witnessing continuous growth in recent years. This can be attributed to a rise in construction activities, infrastructure development, and renovation projects in the region. Additionally, trend of luxuries and aesthetical buildings in various countries of Europe, especially France further drives the consumption of sidings in the region.

Asia Pacific Siding Market Trends

Construction is the dominant industry in Asia Pacific owing to the rising needs of a growing population. Furthermore, governments of various countries present in Asia Pacific significantly invest in construction activities and infrastructural development due to increasing population in countries and to attract more foreign investments. This is driving the demand for siding material in region over years.

Key Siding Company Insights

Some of the key players operating in the market include CertainTeed, Cornerstone Building Brands, Inc., and Georgia-Pacific:

-

CertainTeed was established in 1904, and is headquartered in Malvern, Pennsylvania. CertainTeed is a subsidiary of Saint-Gobain SA. The company is involved in the production of building materials such as railing, decking, insulation, ceilings, gypsum, and pipe products for residential and commercial constructions. CertainTeed exports its building products and materials in about 50 countries around the world.

-

Cornerstone Building Brands, Inc. is a U.S.-based exterior building solution producer for residential and commercial applications. The company has a vast product portfolio, which includes sidings, fencing & railing, windows, doors, trims, and metal buildings. Cornerstone Building Brands, Inc. has about 100 manufacturing plants and about 78 warehouses, distribution & retail outlets.

Westlake Royal Building Products, Gentek Canada, and Allura are some of the emerging participants in siding market.

-

Westlake Royal Building Products is involved in the manufacturing and distribution of various building products. The company offers a wide range of products, including sidings, soffits, exterior trim and moldings, interior trims & moldings, decking, and roofing. The company has manufacturing facilities across the U.S. and Canada.

-

Allura was founded in 2013 and headquartered at Texas, U.S. The company has been involved in the manufacturing and distribution of fiber cement exterior building products. This includes exterior trims, sidings, shakes, soffits, and panels.

Key Siding Companies:

The following are the leading companies in the siding market. These companies collectively hold the largest market share and dictate industry trends.

- CertainTeed

- Cornerstone Building Brands, Inc.

- Georgia-Pacific

- Westlake Royal Building Products

- James Hardie Building Products Inc.

- Gentek Canada

- Norandex

- Alside

- Boral Limited

- Nichiha USA Inc.

Recent Developments

-

In September 2023, Saint Gobain’s subsidiary, CertainTeed Siding, announced the expansion of its facility in Williamsport, Maryland, costing USD 28 million. This expansion will allow the company to improve its shipping and production capacity and significantly help increase warehouse space. In addition, this initiative is also expected to add training and office areas, which will allow the company to improve its customer experience by making it a centralized distribution site for all its products.

Siding Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 130.67 billion |

|

Revenue forecast in 2030 |

USD 160.63 billion |

|

Growth Rate |

CAGR of 3.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina |

|

Key companies profiled |

CertainTeed; Cornerstone Building Brands Inc.; Georgia-Pacific; Westlake Royal Building Products; James Hardie Building Products Inc.;Gentek Canada; Norandex; Alside; Boral Limited; Nichiha USA Inc |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Siding Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global siding market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vinyl

-

Fiber Cement

-

Wood

-

Other Products

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Some key players operating in the siding market include CertainTeed, Cornerstone Building Brands, Inc., Georgia-Pacific, Westlake Royal Building Products, James Hardie Building Products Inc.,Gentek Canada, Norandex, Alside, Boral Limited, and Nichiha USA Inc.

b. The key factors driving the siding market growth are the increasing construction activities around the world coupled with the rising emphasis on building appearance.

b. The global siding market size was estimated at USD 126.25 billion in 2023 and is expected to reach USD 130.67 billion in 2024.

b. The global siding market is expected to grow at a compound annual growth rate (CAGR) of 3.0% from 2024 to 2030 to reach USD 160.63 billion by 2030.

b. Fiber cement accounted for the largest revenue share, over 15.1%, in 2023 due to its durability and affordability, along with its aesthetic appeal, making it an ideal option for all residential and non-residential buildings.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."