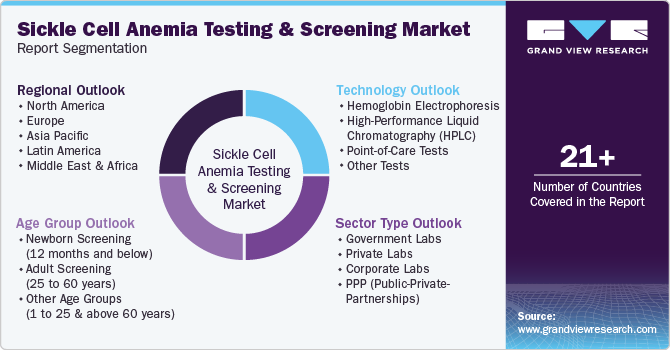

Sickle Cell Anemia Testing And Screening Market Size, Share & Trends Analysis Report By Technology (Hemoglobin Electrophoresis, Point-of-Care Tests), By Age Group, By Sector Type, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-761-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

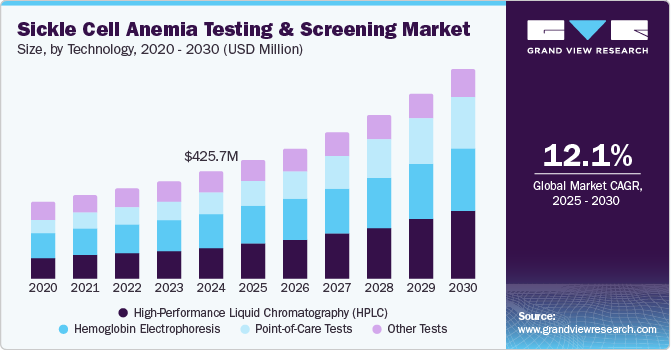

The global sickle cell anemia testing and screening market size was estimated at USD 425.7 million in 2024 and is projected to grow at a CAGR of 12.1% from 2025 to 2030, driven by the increasing global prevalence of sickle cell anemia, especially in high-risk regions, there is a growing demand for early diagnosis and testing. This is attributed to increasing awareness about the importance of early detection for better disease management and outcomes. In addition, advancements in diagnostic technologies, such as genetic testing and PCR, have made screenings more accurate, faster, and cost-effective. Moreover, government initiatives, including newborn screening programs and public health campaigns, are significantly driving the adoption of testing services.

Advancements in diagnostic technologies, such as genetic testing, PCR, and point-of-care devices, have made diagnosing the disease faster, more accessible, and cost-effective. Moreover, noninvasive diagnostic techniques and portable screening tools have enabled early detection, even in remote and resource-limited settings. Furthermore, this progress has expanded market opportunities by allowing screenings in various healthcare settings, including rural areas and home environments.

According to the press information bureau, the National Sickle Cell Anemia Elimination Mission (NSCAEM), launched by the Government of India on July 1, 2023, aims to eliminate Sickle Cell Disease (SCD) by 2047, attributing its success to a nationwide screening effort targeting high-prevalence areas, especially among tribal populations. In addition to screening, the mission focuses on raising awareness and providing education to ensure early detection and effective treatment. Moreover, it seeks to improve access to care, which is essential in reducing sickle cell anemia's impact on affected communities. Therefore, the mission represents a crucial step toward comprehensive management and prevention of SCD in India.

Technology Insights

The hemoglobin electrophoresis segment dominated the market, with a revenue share of 32.5% in 2024, driven by its high accuracy in identifying hemoglobin variants. This technique attributes its effectiveness to its ability to separate different hemoglobin types based on their charge and mobility, allowing precise identification of sickle hemoglobin (HbS) and other hemoglobinopathies. Moreover, electrophoresis provides essential information for genetic counseling and disease management, further boosting its clinical importance. Furthermore, the method's widespread acceptance and long-established role in healthcare contribute to its market dominance. Therefore, hemoglobin electrophoresis remains the preferred choice for routine screening and advanced diagnostics in sickle cell anemia.

The point-of-care tests segment is projected to witness the fastest CAGR of 16.7% over the forecast period, attributed to its ability to deliver quick and accurate results at the patient's location. In addition, these tests provide immediate diagnosis, reducing the need for expensive and time-consuming lab procedures. Moreover, their portability and ease of use make them ideal for low-resource and clinical environments. Furthermore, POC tests are cost-effective and improve patient outcomes by enabling early detection and intervention. Therefore, as healthcare shifts toward more accessible and efficient solutions, POC tests are increasingly preferred, driving market growth.

Age Group Insights

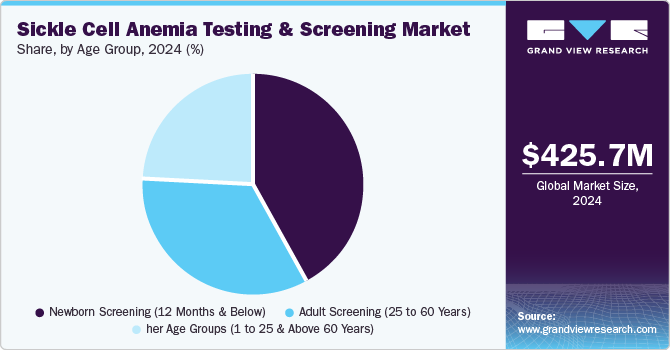

The newborn screening (12 months and below) segment dominated the market with the largest revenue share of 42.1% in 2024, fueled by its early identification of sickle cell disease. Screening infants at birth allows immediate intervention, reducing the risk of severe complications and improving long-term health outcomes. In addition, early diagnosis facilitates genetic counseling, enabling parents to make informed decisions for future pregnancies. Moreover, newborn screening helps initiate early treatment, including pain management and preventative care, significantly improving quality of life. Therefore, the emphasis on early detection and intervention continues to drive the dominance of newborn screening in the market.

The other age groups (1 to 25 & above 60 years) segment is projected to grow at a CAGR of 11.5% over the forecast period due to their distinct health needs related to sickle cell disease. In addition, for the 1 to 25 age group, individuals are typically diagnosed early and require ongoing monitoring and care to manage symptoms and prevent complications like pain crises and organ damage. Moreover, those above 60 years face an increased risk of severe complications such as stroke, renal failure, and heart problems due to long-term disease progression. Furthermore, as the elderly population grows, there is an increasing need for specialized care and screening to address age-related complications of sickle cell anemia. Therefore, the younger and older age groups contribute significantly to the demand for testing and management solutions.

Sector Type Insights

The government labs segment dominated the market with the largest revenue share of 38.6% in 2024, driven by a crucial role in public health infrastructure. Government-funded labs are typically more accessible and cost-effective, allowing for widespread screening, especially in underserved and low-income populations. Moreover, these labs are central to national public health programs, such as mandatory newborn screening for sickle cell disease, ensuring early diagnosis and intervention. Furthermore, they help maintain centralized disease monitoring, surveillance, and research databases. Therefore, government labs ensure that all individuals, regardless of socioeconomic status, access critical screening and diagnostic services.

The private labs segment is projected to grow at a CAGR of 13.5% over the forecast period, fueled by their ability to offer faster and more flexible services than government-run labs. Private labs often provide quicker turnaround times, which is increasingly important as patients seek faster diagnoses for timely treatment. In addition, they are equipped with advanced technologies that allow for specialized testing and more accurate results, catering to a wider range of diagnostic needs. Furthermore, private labs are more adaptable and can expand their testing capacity quickly to meet rising demand, especially in urban areas. Therefore, many private labs offer personalized services such as home testing and genetic counseling, which appeal to patients seeking a more tailored healthcare experience.

Regional Insights

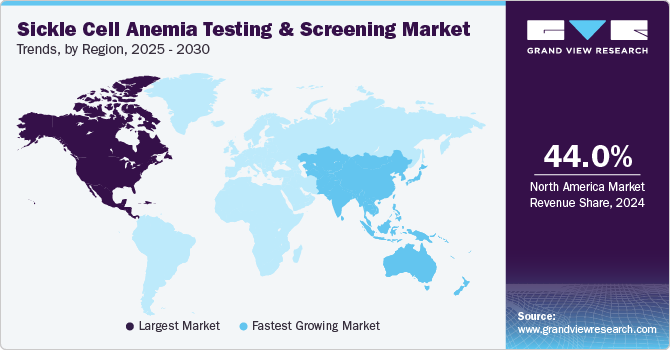

North America sickle cell anemia testing & screening market dominated the global market with a revenue share of 44.0% in 2024, driven by its advanced healthcare infrastructure, state-of-the-art diagnostic tools, and widespread access to genetic testing. In addition, government-mandated newborn screening programs in the U.S. ensure early detection and intervention for all infants, driving consistent demand. Moreover, strong awareness campaigns and funding from organizations like the CDC and the private sector promote early diagnosis and improved treatment options. Therefore, these factors collectively contribute to the region’s leadership in the market.

U.S. Sickle Cell Anemia Testing And Screening Market Trends

The U.S. sickle cell anemia testing and screening market dominates North America, with a significant revenue share in 2024, attributed to the mandatory newborn screening for sickle cell anemia, which has greatly contributed to the early detection and management of the disease. In addition, the National Institutes of Health (NIH) announced over USD 50 million in funding for gene therapy research targeting sickle cell disease (SCD) in September 2023. Moreover, this initiative includes clinical trials to evaluate the safety and efficacy of gene-editing methods, particularly CRISPR technology. Therefore, combining early screening programs and cutting-edge research ensures continued advancements in treating and managing sickle cell anemia in the U.S.

Europe Sickle Cell Anemia Testing And Screening Market Trends

Europe sickle cell anemia testing and screening market held a substantial market share in 2024, driven by several key factors, including advancements in diagnostic technologies, increasing awareness, and government-supported healthcare initiatives. In addition, several countries, including the UK, France, and Italy, have introduced and are expanding newborn screening programs for sickle cell disease. Moreover, in the UK, the National Health Service (NHS) has integrated newborn screening for sickle cell disease into routine neonatal care, ensuring early diagnosis and better management. Therefore, these initiatives significantly contribute to the region's market growth.

The sickle cell anemia testing & screening market in France is expected to grow in the forecast period, attributable to the increasing focus on sickle cell disease (SCD), particularly in communities with higher prevalence, such as African, Caribbean, and Mediterranean populations. In addition, public health campaigns supported by organizations like the French Sickle Cell Disease Association aim to reduce stigma and promote early diagnosis. Moreover, in June 2021, the Fondation Pierre Fabre launched the "E-Drépanocytose" training program for healthcare professionals, designed to improve the recognition and management of SCD. Therefore, this initiative provides free access to essential training, equipping healthcare workers with the necessary knowledge to enhance early diagnosis and patient care, particularly in high-risk communities.

Asia Pacific Sickle Cell Anemia Testing And Screening Market Trends

Asia Pacific sickle cell anemia testing & screening market is expected to register the fastest CAGR of 12.6% over the forecast period, attributed to the growing prevalence of sickle cell disease (SCD) in regions with large populations of African, Mediterranean, Middle Eastern, and Indian descent, countries like India, Pakistan, Bangladesh, and Sri Lanka are witnessing rising cases, particularly in tribal and rural communities. In addition, the increasing recognition of SCD as a public health issue is driving demand for enhanced testing and screening services in these regions. Therefore, these factors contribute to the growing focus on early diagnosis and disease management strategies.

Indian tribal populations are driving the sickle cell anemia testing and screening market, particularly in states such as Madhya Pradesh, Gujarat, Maharashtra, Odisha, and Chhattisgarh. Due to the genetic nature of the disease, these regions have a higher incidence, with many tribal communities carrying the sickle cell trait.

For instance, the national sickle cell anemia elimination program, introduced in the Union Budget 2023, targets addressing the health challenges of sickle cell disease, especially among tribal populations. The program, implemented in 17 high-focus states, aims to reduce the prevalence of sickle cell disease and improve patient care. It is part of the National Health Mission (NHM) and seeks to eliminate the genetic transmission of sickle cell by 2047. Over 2026, the program plans to screen seven crore people, promoting early diagnosis and intervention. This long-term initiative is the commitment to tackling sickle cell disease.

Key Sickle Cell Anemia Testing And Screening Company Insights

Some key companies operating in the market include STRECK, INC, Daktari Diagnostics, BIOMEDOMICS INC, Laboratory Corporation of America Holdings, and HEMOTYPE. Companies are implementing strategic initiatives, including mergers, acquisitions, and technology launches, to expand their market presence and address evolving healthcare demands through sickle cell anemia testing & screening.

-

STRECK, INC. offers specialized quality control materials and diagnostic products for sickle cell anemia testing and screening. Its product line includes hematology controls, calibration standards, and reference materials that ensure the accuracy and reliability of tests for sickle cell disease and other hemoglobinopathies.

-

HEMEX HEALTH offers innovative diagnostic solutions for sickle cell anemia testing and screening through its Sickle SCAN platform. Its product lineup includes point-of-care diagnostic tests for detecting sickle cell disease and hemoglobinopathies designed for use in low-resource settings.

Key Sickle Cell Anemia Testing And Screening Companies:

The following are the leading companies in the sickle cell anemia testing and screening market. These companies collectively hold the largest market share and dictate industry trends.

- STRECK, INC

- Daktari Diagnostics

- BIOMEDOMICS INC.

- Laboratory Corporation of America Holdings

- Request A Test, Ltd

- HALCYON BIOMEDICAL INCORPORATED

- Silver Lake Research Corporation

- HEMOTYPE

- HEMEX HEALTH

- Bio-Rad Laboratories, Inc

Recent Developments

-

In October 2024, Bio-Rad Laboratories launched the Vericheck ddPCR Empty-Full Capsid Kit, which uses Droplet Digital PCR technology to analyze AAV samples for capsid and genome titer, and the percentage of full capsids. This cost-effective kit provides accurate, reproducible results, optimizing gene therapy development while ensuring regulatory compliance.

-

In April 2024, Streck launched Protein Plus BCT, a blood collection tube to stabilize blood protein concentrations during storage. This tube preserves sample integrity for mass spectrometry and immunoassay analysis. It allows laboratories logistical flexibility without compromising accuracy.

Sickle Cell Anemia Testing And Screening Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 468.7 million |

|

Revenue forecast in 2030 |

USD 829.5 million |

|

Growth rate |

CAGR of 12.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Technology,Age Group, Sector Type, Region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

STRECK, INC; Daktari Diagnostics; BIOMEDOMICS INC; Laboratory Corporation of America Holdings; Request A Test, Ltd; HALCYON BIOMEDICAL INCORPORATED; Silver Lake Research Corporation; HEMOTYPE; HEMEX HEALTH; Bio-Rad Laboratories, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Sickle Cell Anemia Testing And Screening Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global sickle cell anemia testing and screening market report based on technology, age group, sector type, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemoglobin Electrophoresis

-

Isoelectric Focusing

-

Others

-

-

High-Performance Liquid Chromatography (HPLC)

-

Point-of-Care Tests

-

Lateral Flow Immunoassay

-

Paper-Based Rapid Diagnostics

-

Others

-

-

Other Tests

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Newborn Screening (12 months and below)

-

Adult Screening (25 to 60 years)

-

Other Age Groups (1 to 25 & above 60 years)

-

-

Sector Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Government Labs

-

Private Labs

-

Corporate Labs

-

PPP (Public-Private-Partnerships)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."