Shunt Reactor Market Size, Share & Trend Analysis Report By Type (Oil-immersed, Air-core), By Application (Fixed, Variable), By Phase (Three Phase, Single Phase), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-393-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Shunt Reactor Market Size & Trends

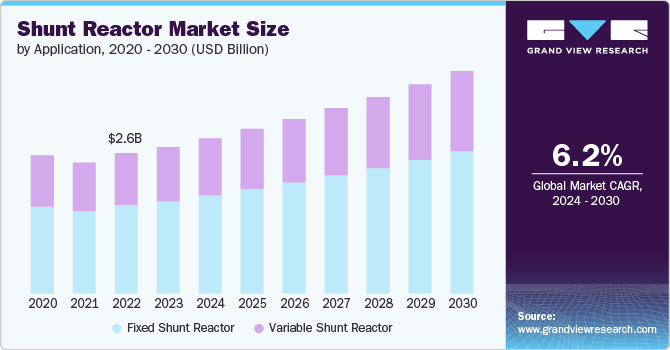

The global shunt reactor market size was estimated at USD 2.66 billion in 2023 and is estimated to grow at a CAGR of 6.2% from 2024 to 2030. This growth is driven by increasing demand across various applications, particularly in power transmission and distribution systems. The surge is fueled by expanding electricity consumption globally, driven by industrialization, urbanization, and infrastructural development.

As the adoption of renewable energy sources, including solar and wind power, expands, their inherently variable nature introduces volatility into the system. Shunt reactors are critical in ensuring grid stability and delivering a reliable power supply by managing voltage fluctuations. Within high-voltage transmission networks, shunt reactors play a pivotal role in voltage regulation amidst varying load conditions. These reactors are strategically engaged and disengaged to provide the necessary reactive power compensation, aligning with the prevailing voltage demands.

Drivers, Opportunities & Restraints

Environmental considerations and tight government regulations that promote energy efficiency are driving the uptake of shunt reactors in power networks. There's a growing emphasis on cutting carbon emissions and boosting grid reliability, leading utilities to adopt supportive technologies. In 2023, the Australian government highlighted the need to blend renewable energy sources into the grid without compromising environmental integrity, as mandated by the Environment Protection and Biodiversity Conservation Act. This legislation ensures that new energy initiatives, including those involving shunt reactors, meet strict environmental criteria, supporting technology adoption for improved grid stability and efficiency.

Advancements in grid infrastructure and integration of renewable energy sources are expected to bolster market expansion for shunt reactors. As renewable energy generation continues to grow, reactive power compensation becomes critical to maintaining voltage levels and ensuring the stability of the power system. The U.S. EPA has also highlighted the role of advanced technologies in enhancing grid resilience and reliability, which is essential as more intermittent renewable energy sources, such as wind and solar, are integrated into the energy mix.

Despite these advantages, shunt reactors face challenges related to their size and installation complexity, particularly in urban areas with limited space. In 2024, a report from the International Energy Agency (IEA) noted that while shunt reactors effectively enhance power system stability, their deployment in densely populated areas requires careful planning and innovative solutions to mitigate space constraints. This factor may limit widespread adoption despite their effectiveness in enhancing power system stability and voltage regulation.

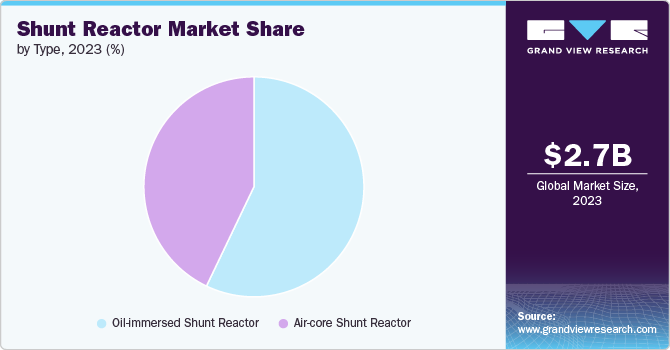

Type Insights

“The air-core shunt reactor segment is anticipated to grow at the fastest CAGR over the forecast period from 2024 - 2030.”

Oil-immersed shunt reactors dominated the market and held the largest revenue share in 2023. They use mineral oil as a coolant and insulating medium. They offer excellent heat dissipation and insulation properties essential for continuous and reliable operation under varying load conditions. Their robust design ensures long-term performance and minimal maintenance requirements, making them preferred for applications in large-scale power grids.

Air-core shunt reactor is expected to grow at the fastest CAGR during the forecast period, driven by advancements in high-voltage direct current transmission and renewable energy projects that demand superior performance in voltage control and stability. Unlike oil-immersed reactors, air-core reactors use air as the core material, reducing energy losses and environmental impact. Their lightweight construction and reduced footprint make them suitable for installation in compact spaces, such as urban substations and offshore wind farms.

Application Insights

“Variable shunt reactor segment held the largest revenue share of shunt reactor market in 2023.”

Variable shunt reactors hold dominance in the market due to their flexibility in adjusting reactive power compensation according to dynamic grid conditions and varying loads. These reactors feature adjustable tapping points or electronically controlled switching mechanisms that regulate voltage levels precisely in response to fluctuating demand or grid disturbances. Their capability to dynamically manage reactive power ensures optimal grid stability and efficiency, particularly in networks experiencing varying operational conditions or integrating renewable energy sources.

The fast-growing fixed shunt reactor segment is driven by expanding applications in traditional power transmission networks and industrial installations where steady-state voltage control is paramount. These reactors have a fixed number of tapping points or fixed impedance values designed to provide consistent reactive power compensation under normal operating conditions. They are essential for maintaining grid stability and power quality in large-scale transmission lines and substations.

Phase Insights

“Three-phase shunt reactor held the largest revenue market share in 2023.”

The segment is dominant due to its widespread application in high-voltage transmission systems, where it effectively manages reactive power and enhances voltage stability. Its ability to handle large amounts of reactive power compensation makes it essential for maintaining grid reliability, especially as the integration of renewable energy sources increases. In addition, major players like Siemens and ABB have developed advanced three-phase shunt reactors that cater to the growing demand for efficient power transmission, further solidifying their market dominance.

One-phase shunt reactors are the fastest-growing segment in the market, primarily due to their suitability for lower voltage applications and their ease of installation in urban environments where space is limited. The increasing demand for localized reactive power compensation in distribution networks has led to a surge in adopting one-phase shunt reactors. For instance, in 2023, Hitachi Energy announced the introduction of compact one-phase shunt reactors designed specifically for urban areas, addressing the challenges of space constraints while providing effective voltage regulation.

Regional Insights

“China dominated the revenue share of the Asia Pacific shunt reactor market.”

Asia Pacific holds a significant portion of the global shunt reactor market, driven by rapid industrialization and urbanization in countries like China and India. The region's expanding power generation capacities and investments in smart grid technologies are key factors contributing to market growth. Furthermore, government initiatives promoting sustainable energy infrastructure and grid modernization are accelerating the adoption of shunt reactors in the region.

North America Shunt Reactor Market Trends

The shunt reactor market in North America is prominent, driven by robust investments in upgrading aging grid infrastructure and integrating renewable energy sources. The U.S. leads the market, supported by stringent regulatory frameworks and the need for reliable electricity supply. In addition, government initiatives such as the U.S. Department of Energy's "Building a Better Grid" program are catalyzing investments in high-voltage transmission facilities, further propelling the demand for shunt reactors.

U.S. Shunt Reactor Market Trends

The shunt reactor market in the U.S. is experiencing significant growth, driven by increasing demand for energy efficiency and the modernization of aging power infrastructure. Key trends include a heightened focus on environmentally sustainable solutions, with manufacturers like Hitachi Energy introducing variable shunt reactors that enhance voltage stability while minimizing environmental impact.

Europe Shunt Reactor Market Trends

The shunt reactor market in Europe is expected to grow significantly over the forecast period. Europe's emphasis on enhancing grid reliability and reducing transmission losses supports the demand for shunt reactors. The region's ambitious renewable energy targets and investments in smart grid technologies create favorable market conditions for shunt reactor deployment.

Key Shunt Reactor Company Insights

Some of the key players operating in the market include ABB and Siemens.

-

ABB, headquartered in Switzerland, is a global leader in power and automation technologies, offering advanced shunt reactor solutions tailored for voltage regulation and stability in transmission networks. With a strong commitment to sustainability and innovation, ABB continues to expand its market presence through strategic partnerships and technological advancements.

-

Siemens, based in Germany, is a key player in the energy sector. It provides comprehensive shunt reactor solutions designed for optimal grid performance and efficiency. Leveraging its extensive expertise in power transmission and distribution, Siemens delivers reliable and scalable shunt reactor systems that meet the evolving needs of utilities worldwide.

Key Shunt Reactor Companies:

The following are the leading companies in the shunt reactor market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- General Electric

- Siemens

- Crompton Greaves

- Toshiba

- Fuji Electric

- Mitsubishi Electric

- Nissin Electric

- Trench Group

- Hilkar

- TBEA

- Hitachi Energy

Recent Developments

-

In April 2024, Hitachi Energy plans to invest over USD 100 million to upgrade its Quebec, Canada power transformer factory. This investment aims to enhance manufacturing capabilities to meet the increasing demand for advanced power transmission technologies, like shunt reactors. This initiative aligns with the company's commitment to leading the shift towards a sustainable energy future and establishing a strong position in the shunt reactor market.

-

In September 2023, Hitachi Energy announced its strategic partnership with TenneT to supply transformers and shunt reactors as part of TenneT's transmission grid development program in Germany. By providing advanced shunt reactors, Hitachi Energy aims to improve reactive power compensation and voltage regulation within TenneT's infrastructure, facilitating the transition to a more sustainable energy system. This collaboration reinforces Hitachi Energy's position in the shunt reactor market and highlights its role in advancing critical energy infrastructure in Europe.

Shunt Reactor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.82 billion |

|

Revenue forecast in 2030 |

USD 4.05 billion |

|

Growth rate |

CAGR of 6.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative Units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, phase, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Spain; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

ABB; Nissin Electric; Siemens; Toshiba; Fuji Electric; Crompton Greaves; Mitsubishi Electric; Hilkar; Trench Group; General Electric; Hitachi Energy; TBEA |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Shunt Reactor Market Report Segmentation

This report forecasts revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global shunt reactor market report based on type, phase, application, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oil-Immersed Insulator

-

Air-Core Insulator

-

-

Phase Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single Phase

-

Three Phase

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Variable Shunt Reactor

-

Fixed Shunt Reactor

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global shunt reactor market size was estimated at USD 2.66 billion in 2023 and is expected to reach USD 2.82 billion in 2024.

b. The global shunt reactor market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 4.05 billion by 2030.

b. By phase, oil-immersed dominated the market with a revenue share of over 57.0% in 2023.

b. Some of the key vendors in the global shunt reactor market are ABB, Nissin Electric, Siemens, Toshiba, Fuji Electric, Crompton Greaves, Mitsubishi Electric, Hilkar, Trench Group, General Electric, TBEA, and Hitachi Energy.

b. The key factor driving the growth of the global shunt reactor market is attributed to the significant growth driven by increasing demand across various applications, particularly in power transmission and distribution systems.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."