- Home

- »

- Distribution & Utilities

- »

-

Shunt Capacitor Market Size & Share, Industry Report, 2030GVR Report cover

![Shunt Capacitor Market Size, Share & Trends Report]()

Shunt Capacitor Market (2025 - 2030) Size, Share & Trends Analysis Report By Voltage Rating (Low & Medium, High), By Application (Industrial, Utility, Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-531-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Shunt Capacitor Market Summary

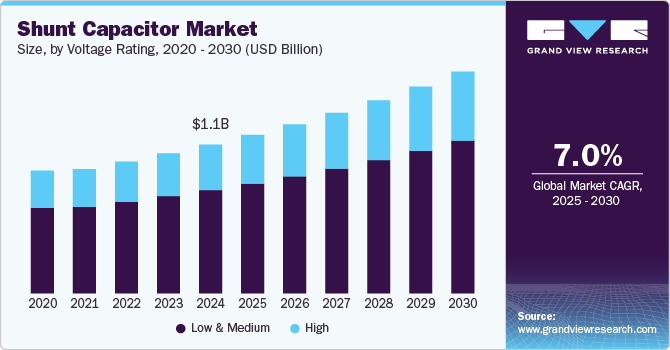

The global shunt capacitor market size was estimated at USD 1.08 billion in 2024 and is anticipated to reach USD 1.61 billion by 2030, growing at a CAGR of 7.0% from 2025 to 2030. Growing global demand for electricity, coupled with increasing grid complexity, is driving the adoption of shunt capacitors.

Key Market Trends & Insights

- The Asia Pacific shunt capacitors market held the largest revenue share of 45.04% in 2024.

- By voltage rating, low & medium segment held a revenue share of around 70% of the global market in 2024.

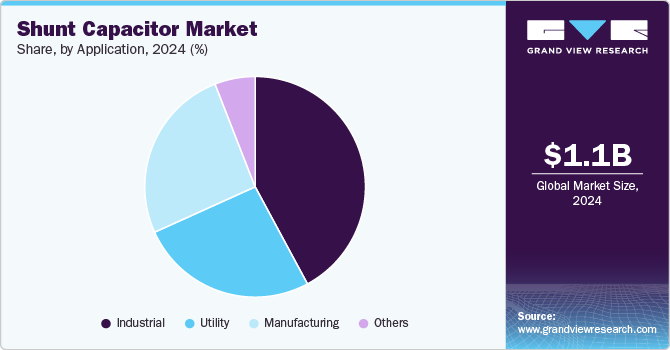

- By application, the industrial segment accounted for a revenue share of 42% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.08 Billion

- 2030 Projected Market Size: USD 1.61 Billion

- CAGR (2025-2030): 7.0%

- Asia Pacific: Largest market in 2024

These capacitors help improve power factor, reduce line losses, and stabilize voltage levels in transmission and distribution networks. Utilities and industrial facilities are investing in power quality enhancement solutions, further fueling market growth. In addition, governments and regulatory bodies are mandating grid modernization projects, integrating renewable energy sources, and promoting energy efficiency measures, all of which boost the demand for shunt capacitors.

Drivers, Opportunities & Restraints

The increasing demand for energy efficiency and power quality improvement across industrial and commercial sectors drives the market. Rapid urbanization and industrialization, particularly in emerging economies, are fueling the need for stable and reliable power distribution, boosting capacitor installations. In addition, integrating renewable energy sources into the grid requires voltage regulation solutions, further driving demand. Regulatory policies promoting power factor correction and reducing transmission losses also contribute to market growth.

Furthermore, the growing adoption of smart grids and advancements in energy storage solutions create lucrative opportunities for shunt capacitors. Expanding electrification in developing regions and government initiatives for modernizing aging power infrastructure provide strong market potential. Moreover, technological innovations in capacitor materials, such as self-healing and high-durability capacitors, enhance product longevity and efficiency, opening new avenues for market expansion.

Despite its growth potential, the market faces challenges such as high initial investment costs and maintenance complexities, which may deter small-scale consumers. Furthermore, fluctuations in raw material prices, particularly for dielectric materials and metals like aluminum, impact production costs and pricing. Concerns related to capacitor failures, leading to system disruptions or safety hazards, also pose limitations, requiring advanced monitoring and protection mechanisms to ensure reliable operation.

Voltage Rating Insights

The increasing demand for energy efficiency, power factor correction, and grid stability across industrial, commercial, and utility sectors drive the low and medium voltage shunt capacitor segment. Growing electricity consumption, aging grid infrastructure, and government initiatives promoting energy conservation and smart grids further fuel market growth. In addition, the expansion of renewable energy integration, which requires power quality management solutions, and rising industrial automation contribute to the increasing adoption of shunt capacitors. Regulatory mandates on power factor correction and incentives for reducing reactive power losses also support market expansion.

Key market trends include the shift toward smart shunt capacitors with advanced monitoring and control features, enabling real-time power quality management. The adoption of eco-friendly dielectric materials to enhance capacitor lifespan and reduce environmental impact is gaining traction. Increased investments in smart grids and industrial automation are driving demand for more compact and efficient capacitor solutions. Moreover, digitalization and IoT-based capacitor management systems are emerging to enhance operational efficiency and predictive maintenance, ensuring grid reliability and reducing downtime.

Application Insights

The industrial segment holds the largest revenue share in the market, with a revenue share of about 42% in 2024. The increasing need for power factor correction, voltage stabilization, and energy efficiency in industrial applications drives the demand for industrial shunt capacitors. Rapid industrialization, particularly in emerging economies, has led to higher electricity consumption, necessitating improved grid efficiency and reduced transmission losses. Government regulations and incentives promoting energy-efficient solutions further boost market growth. Furthermore, expanding renewable energy sources, such as wind and solar power, increases the demand for shunt capacitors to manage reactive power and maintain grid stability.

In the utility segment, rising investments in smart grids and regulatory mandates for energy efficiency and power quality improvements further boost market demand. In addition, aging power infrastructure and the need to accommodate fluctuating loads due to renewables are driving the adoption of shunt capacitors to enhance grid reliability and operational performance.

Regional Insights

The Asia Pacific shunt capacitors market held the largest revenue share of 45.04% in 2024, driven by the region’s rapid industrialization, expanding power transmission and distribution infrastructure, and growing investments in renewable energy projects. Increasing electricity demand, particularly in emerging economies like India and China, pushes utilities to enhance power factor correction and grid stability, boosting the demand for shunt capacitors.

China Shunt Capacitor Market Trends

The shunt capacitors market in China includes adopting smart grid technologies, integrating IoT-based monitoring systems, and advancements in capacitor design to enhance efficiency and durability as their key trends. The shift towards ultra-high-voltage (UHV) transmission projects and increasing investments in renewable energy are pushing demand for high-performance capacitors. Moreover, domestic manufacturers are strengthening their R&D capabilities and expanding production capacity to cater to both domestic and export markets, responding to the global rise in power infrastructure development.

North America Shunt Capacitor Market Trends

The shunt capacitors market in North America is primarily driven by the increasing demand for efficient power management solutions and the modernization of aging power infrastructure. The region's focus on renewable energy integration, such as solar and wind power, necessitates using shunt capacitors to stabilize grid voltage and improve power quality. In addition, stringent government regulations and policies aimed at reducing energy losses and enhancing grid reliability are pushing utilities and industries to adopt advanced capacitor technologies. The growing adoption of electric vehicles (EVs) and the need for robust charging infrastructure further contribute to the demand for shunt capacitors in the region.

The U.S. shunt capacitors market is driven by the growing demand for grid reliability, energy efficiency, and power factor correction amid rising electricity consumption. Aging power infrastructure and the need for modernization, including smart grids and high-voltage transmission systems, are accelerating capacitor deployment. Moreover, the increasing integration of renewable energy sources, such as wind and solar, necessitates voltage regulation and reactive power compensation, further boosting demand. Supportive government policies, investments in grid resilience, and the push for industrial energy optimization also contribute to market growth.

Europe Shunt Capacitor Market Trends

The shunt capacitors market in Europe is driven by the increasing focus on energy efficiency, grid stability, and the integration of renewable energy sources such as wind and solar power. The European Union’s stringent regulations on power quality and carbon emissions encourage utilities and industries to adopt power factor correction solutions. Furthermore, the modernization of aging electrical infrastructure, rising electrification of transportation, and investments in smart grid projects further boost demand for shunt capacitors across the region.

Key Shunt Capacitor Company Insights

Some key players operating in the market include ABB Ltd., Schneider Electric, General Electric Company, Siemens AG, and Larsen & Toubro Ltd. Leading manufacturers are investing in R&D to develop high-performance capacitors with improved lifespan, reliability, and smart monitoring capabilities, leveraging IoT and AI-driven predictive maintenance. Market competition is also influenced by economies of scale, with major players expanding their production capacities to cater to global demand while maintaining cost competitiveness.

-

ABB has invested in smart grid technologies, integrating shunt capacitors with advanced monitoring and control systems to enhance grid stability and efficiency. Also, the company is developing eco-friendly shunt capacitors with reduced environmental impact, aligning with global sustainability goals.

-

Siemens has incorporated IoT-enabled shunt capacitors for real-time monitoring and predictive maintenance, improving operational efficiency. The company is investing heavily in R&D to develop next-generation shunt capacitors with higher efficiency and longer lifespans

Key Shunt Capacitor Companies:

The following are the leading companies in the shunt capacitor market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Schneider Electric

- General Electric Company

- Siemens AG

- Larsen & Toubro Ltd

- Eaton Corporation Plc

- Aerovox Corp.

- Magnewin Energy Private Limited

- CIRCUTOR, SA

- Energe Capacitors Pvt Ltd.

Shunt Capacitor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.15 billion

Revenue forecast in 2030

USD 1.61 billion

Growth rate

CAGR of 7.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Voltage rating, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East, Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; China; India; Japan; Australia; South Korea; Brazil; Argentina

Key companies profiled

ABB Ltd.; Schneider Electric; General Electric Company; Siemens AG; Larsen & Toubro Ltd.; Eaton Corporation Plc; Aerovox Corp.; Magnewin Energy Private Limited; CIRCUTOR, SA; Energe Capacitors Pvt Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shunt Capacitor Market Report Segmentation

This report forecasts revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global shunt capacitor market report based on voltage rating, application, and region:

-

Voltage Rating Outlook (Revenue, USD Million, 2018 - 2030)

-

Low & Medium

-

High

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Utility

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global shunt capacitor market size was estimated at USD 1.08 billion in 2024 and is expected to reach USD 1.15 billion in 2025.

b. The global shunt capacitor market is expected to grow at a compound annual growth rate of 7.00% from 2025 to 2030 to reach USD 1.61 billion by 2030.

b. By Application, industrial dominated the market with a revenue share of over 42.14% in 2024. The segment is primarily driven by the need for power factor correction, energy cost reduction, and improved electrical efficiency in manufacturing facilities.

b. Some of the key vendors of the global shunt capacitormarket are ABB Ltd., Schneider Electric, General Electric Company, Siemens AG, among others.

b. The shunt capacitor market is primarily driven by the rising demand for energy efficiency, grid stability, and power factor correction across industrial, commercial, and utility sectors. Rapid urbanization, industrialization, and the increasing penetration of renewable energy sources, such as wind and solar, necessitate reactive power compensation, further boosting market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.