- Home

- »

- Plastics, Polymers & Resins

- »

-

Shrink & Stretch Sleeve Labels Market Size Report, 2030GVR Report cover

![Shrink & Stretch Sleeve Labels Market Size, Share & Trends Report]()

Shrink & Stretch Sleeve Labels Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (PVC, PET-G, PE, OPS), By Type (Shrink Sleeves & Stretch Sleeves), By Embellishing Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-341-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

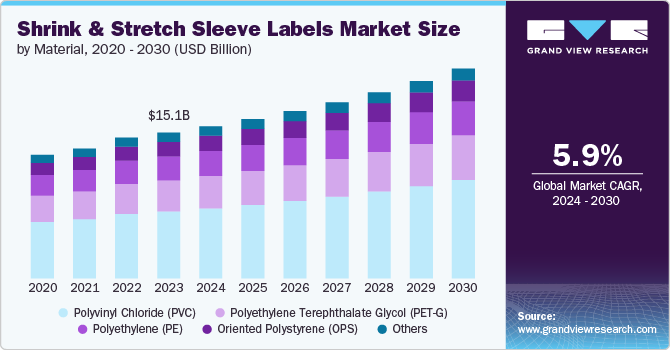

The global shrink sleeve & stretch sleeve labels market size was estimated at USD 15.12 billion in 2023 and is expected to grow at a CAGR of 5.5% from 2024 to 2030. The global market for stretch and shrink sleeves labels is poised for growth, driven by advancements in material technology, a strong demand for aesthetically pleasing packaging, and a shift towards sustainability and smart packaging solutions.

The global stretch and shrink sleeve labels market is experiencing robust growth, driven by several key factors and emerging opportunities. One of the primary market drivers is the increasing demand for visually appealing and functional packaging. Consumers are drawn to products that stand out on the shelves and stretch and shrink sleeves provide an ideal solution with their 360-degree graphics and ability to conform to complex shapes. This has led to a surge in demand across industries such as food and beverage, personal care, and pharmaceuticals.

In terms of materials, the market is witnessing a shift towards sustainable options. Regulatory pressures and consumer preference for environmentally friendly products are prompting manufacturers to explore bio-based and recyclable materials. For instance, there has been a rise in the adoption of Polyethylene Terephthalate Glycol (PET-G), which not only provides excellent clarity and shrinkage but is also more recyclable compared to traditional materials like PVC. This shift towards sustainable materials opens up new opportunities for innovation and market differentiation.

Several recent product launches highlight the trend towards sustainability and advanced functionality in this market. For example, Avery Dennison introduced a new range of shrink sleeve labels made from recycled PET, aiming to reduce the environmental footprint of packaging solutions. Similarly, CCL Industries launched EcoShrink, a new series of shrink sleeves made from bio-based polymers that offer comparable performance to conventional materials but with a lower environmental impact.

Another significant opportunity lies in the expanding use of smart labels. Integrating QR codes, RFID tags, and other interactive elements into stretch and shrink sleeves enhances the consumer experience and provides valuable data for brands. This trend is particularly relevant in the context of increasing e-commerce and the demand for product authenticity and traceability.

Material Insights

The PVC segment dominated the market with a share of over 45% in 2023, due to the versatility, cost-effectiveness, and excellent shrinkage properties of the material. It is widely used for a variety of applications, from food and beverage to personal care products. However, its environmental impact is a growing concern, leading to a gradual shift towards more sustainable alternatives.

Polyethylene Terephthalate Glycol (PET-G) is gaining traction due to its superior clarity, excellent shrinkage characteristics, and recyclability. Its growth is fueled by the increasing demand for sustainable packaging solutions. PET-G is particularly favored in the beverage industry for its crystal-clear appearance and compatibility with recycling processes.

Oriented Polystyrene (OPS) offers excellent shrinkage and printability, making it a popular choice for high-quality graphics. However, it faces challenges in terms of recycling and environmental impact, which may limit its growth compared to more eco-friendly alternatives.

Type Insights

The shrink sleeves labels segment dominated the market and accounted for the largest revenue share of over 76% in 2023 and is expected to grow at the fastest CAGR during the forecast period. Shrink sleeve labels are preferred for their full-body coverage and ability to fit complex shapes, providing a large surface area for branding and information. Their versatility and the growing demand for visually impactful packaging solutions are driving their dominant market position and rapid growth.

Stretch sleeve labels offer cost advantages and ease of application since they do not require heat for shrinking. They are primarily used for labeling cylindrical containers in the beverage and household product sectors. Their market share is smaller compared to shrink sleeves, but they are valued for their cost-effectiveness and environmental benefits due to reduced material usage.

Embellishing Type Insights

The hot foil segment dominated and accounted for the largest revenue share of over 49% in 2023 and is expected to grow at the fastest CAGR of 5.8% during the forecast period. Hot foil stamping is favored for its ability to create high-quality, eye-catching metallic finishes that enhance the perceived value of products. Its popularity is growing across luxury goods, cosmetics, and premium food and beverage sectors, where packaging aesthetics play a crucial role in consumer choice.

Cold foil application is a more cost-effective alternative to hot foil, offering good metallic effects without the need for heat and pressure. It is suitable for applications where a quick and efficient embellishing process is needed, though it generally offers less durability and aesthetic quality compared to hot foil.

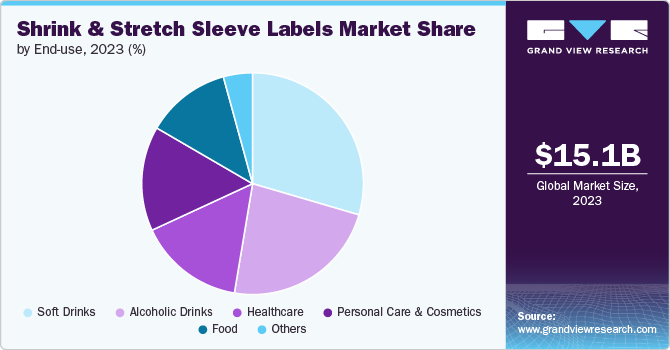

End-use Insights

The soft drinks application segment dominated the market and accounted for the largest revenue share of over 29.5% in 2023 and is expected to grow at the fastest CAGR during the forecast period. Soft drinks represent the largest market share due to the need for durable, vibrant labels that can withstand various storage conditions and handling. The rise in flavored water, energy drinks, and other non-alcoholic beverages is fueling demand for stretch and shrink sleeves that offer excellent branding opportunities and product differentiation.

In the alcoholic beverage sector, stretch and shrink sleeves are used for premiumization and brand differentiation, particularly in wine, spirits, and craft beer. The ability to provide high-quality graphics and tamper-evident features makes them a popular choice for this segment.

The personal care and cosmetics segment is experiencing rapid growth in the adoption of stretch and shrink sleeves due to the increasing focus on aesthetic packaging and the need for products that stand out on retail shelves. The trend towards premium and eco-friendly packaging is further driving growth in this sector.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 44% in 2023. Asia Pacific is the leading and fastest-growing market for stretch and shrink sleeves labels. Rapid industrialization, urbanization, and the rising middle-class population are driving demand for packaged goods in the region. Countries like China, India, and Japan are major contributors to market growth, with significant investments in the food and beverage, personal care, and pharmaceutical industries.

India Shrink & Stretch Sleeve Labels Market Trends

The increasing popularity of e-commerce and the demand for visually appealing and durable packaging are also propelling the market forward. The country’s focus on cost-effective and high-quality packaging solutions is attracting global manufacturers to expand their presence in India.

North America Shrink & Stretch Sleeve Labels Market Trends

The North America market for stretch and shrink sleeves labels is characterized by high demand from the food and beverage, healthcare, and personal care sectors. The region's focus on innovative packaging solutions and sustainability is driving the adoption of recyclable and eco-friendly materials. Additionally, stringent regulatory standards for packaging and labeling in the pharmaceutical and food industries are boosting the market. Major players in the region are investing in advanced technologies and new product launches to cater to the diverse needs of end users.

The shrink & stretch sleeve labels market in the U.S. is robust and continually evolving, driven by technological advancements, regulatory standards, and changing consumer preferences. The demand for these labels is particularly high in industries such as food and beverage, personal care, and pharmaceuticals.

Europe Shrink & Stretch Sleeve Labels Market Trends

Europe is a significant market for stretch and shrink sleeves labels, driven by the region's strong emphasis on sustainability and recycling. The European Union's regulations on packaging waste and sustainability goals are encouraging manufacturers to adopt eco-friendly materials such as PET-G. The food and beverage industry is the largest end user segment, with high demand for attractive and informative packaging. Innovations in packaging technology and a growing focus on reducing carbon footprints are key trends influencing the market in Europe.

The shrink & stretch sleeve labels market in Germany is rising on account of the growth of the e-commerce sector, requiring robust and attractive packaging that can endure the rigors of shipping.

Middle East & Africa Shrink & Stretch Sleeve Labels Market Trends

The market for stretch and shrink sleeves labels in the Middle East & Africa is growing steadily, driven by the expanding food and beverage industry and the increasing demand for packaged consumer goods. The region's economic development and rising consumer spending are boosting the adoption of advanced packaging solutions. While the market is smaller compared to other regions, the demand for high-quality and durable labels is increasing, particularly in the Gulf Cooperation Council (GCC) countries. The focus on improving packaging standards and increasing investments in manufacturing infrastructure are expected to drive market growth in the coming years.

Key Shrink & Stretch Sleeve Labels Company Insights

The market is fragmented with the presence of a significant number of companies. shrink sleeve & stretch sleeve labels industry has been witnessing a significant number of new product launches, merger & acquisitions, and expansions over the past few years.

-

In April 2024, Nestlé USA announced that it is replacing the existing labels in its Nesquick ready-to-drink portfolio with recyclable shrink sleeve labels that are manufactured by light-blocking print technology. These shrink sleeve labels are compatible with the U.S. recycling stream, allowing the bottle to be recycled easily.

-

In February 2024, CCL Industries officially announced the opening of its new sustainable sleeve label manufacturing facility in Dornbirn, Austria. The investment made for this facility is USD 52.7 million (EUR 50.0 million) and has a capacity that is double the size of its previous site in Hohenems.

-

In February 2023, CCL Industries announced to develop an innovative thinnest stretch sleeve label having a thickness of 30 microns. This new stretch sleeve label is developed in-house and designed for returnable 1-liter polyethylene terephthalate (PET) bottles.

Key Shrink & Stretch Sleeve Labels Companies:

The following are the leading companies in the shrink & stretch sleeve labels market. These companies collectively hold the largest market share and dictate industry trends.

- Bemis Company

- Berry Global Group

- Klockner Pentaplast

- Amcor plc

- Clondalkin Group Holdings BV

- Huhtamaki

- Schur Flexibles

- Cenveo Group

- Taghleef Industries

- WestRock Company

- CCL Industries

- Fuji Seal International

- Fort Dearborn Company

- Coveris

- Avery Dennison Corporation

Shrink & Stretch Sleeve Labels Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.78 billion

Revenue forecast in 2030

USD 21.76 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in million-meter square, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Material, type, embellishing type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France, Italy; Spain; China; India; Japan; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Bemis Company; Berry Global Group; Klockner Pentaplast; Amcor plc; Clondalkin Group Holdings BV; Huhtamaki; Schur Flexibles; Cenveo Group; Taghleef Industries; WestRock Company; CCL Industries; Fuji Seal International; Fort Dearborn Company; Coveris; Avery Dennison Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shrink & Stretch Sleeve Labels Market Report Segmentation

This report forecasts revenue & volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the shrink & stretch sleeve labels market report based on material, type, embellishing type, end-use, and region:

-

Material Outlook (Volume, Million Meter Square; Revenue, USD Million, 2018 - 2030)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate Glycol (PET-G)

-

Polyethylene (PE)

-

Oriented Polystyrene (OPS)

-

Others

-

-

Type Outlook (Volume, Million Meter Square; Revenue, USD Million, 2018 - 2030)

-

Shrink Sleeve Labels

-

Stretch Sleeve Labels

-

-

Embellishing Type Outlook (Volume, Million Meter Square; Revenue, USD Million, 2018 - 2030)

-

Hot Foil

-

Cold Foil

-

Others

-

-

End-use Outlook (Volume, Million Meter Square; Revenue, USD Million, 2018 - 2030)

-

Food

-

Soft Drinks

-

Alcoholic Drinks

-

Personal Care & Cosmetics

-

Healthcare

-

Others

-

-

Regional Outlook (Volume, Million Meter Square; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global shrink sleeve & stretch sleeve labels market size was estimated at USD 15.12 billion in 2023 and is expected to reach USD 15.78 billion in 2024.

b. The global shrink sleeve & stretch sleeve labels market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030, reaching USD 21.76 billion by 2030.

b. The hot foil segment accounted for the largest revenue share, over 49%, in 2023 and is expected to grow at the fastest rate of 5.8% during the forecast period. Hot foil stamping is favored for its ability to create high-quality, eye-catching metallic finishes that enhance the perceived value of products.

b. Key players in the market include Bemis Company, Berry Global Group, Klockner Pentaplast, Amcor plc, Clondalkin Group Holdings BV, Huhtamaki, Schur Flexibles, Cenveo Group, Taghleef Industries, WestRock Company, CCL Industries, Fuji Seal International, Fort Dearborn Company, Coveris Holdings, and Avery Dennison Corporation.

b. Global stretch and shrink sleeves labels market is poised for growth, driven by advancements in material technology, strong demand for aesthetically pleasing packaging, and a shift towards sustainability and smart packaging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.