Shoe Deodorizer Market Summary

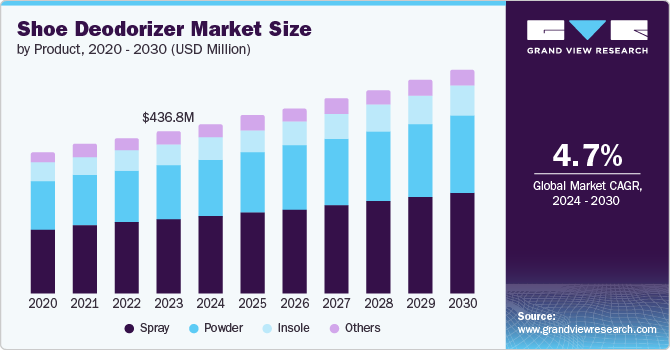

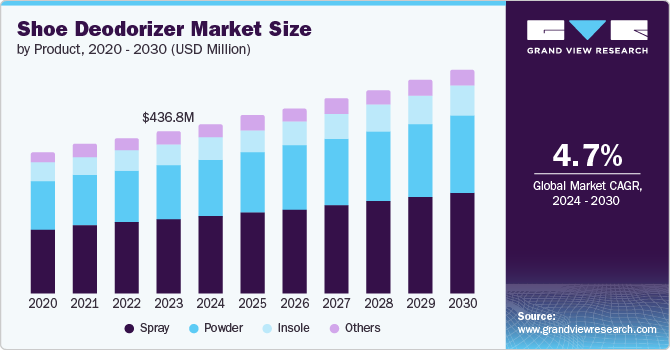

The global shoe deodorizer market size was valued at USD 436.8 million in 2023 and is projected to reach USD 601.1 billion by 2030, growing at a CAGR of 4.7% from 2024 to 2030. The robust expansion of the footwear sector owing to product innovation, product line extension, and premiumization has primarily fueled the demand for shoe deodorizers.

Key Market Trends & Insights

- The North America shoe deodorizer market accounted for 34.5% of the market share in 2023.

- Asia Pacific shoe deodorizer market is expected to witness a CAGR of 5.5% over the forecast period.

- By product, the Spray shoe deodorizers have dominated the market with a lucrative share of 45.6% in 2023.

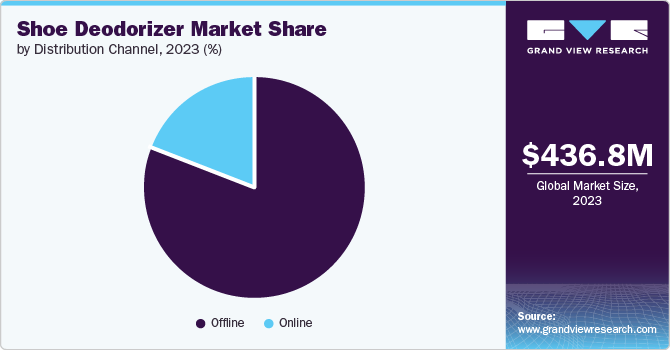

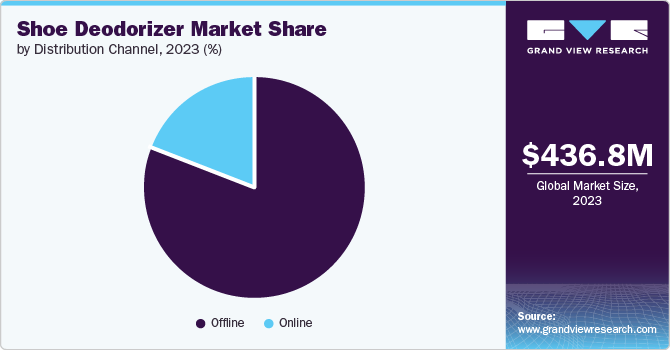

- By distribution channel, the Offline distribution channels have secured the dominant market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 436.8 Billion

- 2030 Projected Market Size: USD 601.1 Billion

- CAGR (2024-2030): 4.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Brands have actively introduced advanced footwear solutions that cater to diverse consumer needs with the rising consumer consciousness of foot health and hygiene. The rising popularity of sports and fitness activities has fueled the demand for high-performance footwear solutions. Athletes and sports enthusiasts have progressively become aware of their foot health, which has led to taking preventive measures, contributing to the growth of the shoe deodorizer market. Foot odor, caused by sweat and bacteria, can lead to health issues. Consumers have increasingly recognized the benefits of shoe deodorizers to prioritize chronic disease prevention.

Furthermore, retail stores, shopping complexes, and online markets have become major shoe deodorizer sales channels, leading to easy product accessibility. In addition to commercial products, consumers use natural methods like baking soda powder to eliminate foot odor. Shoe deodorizers provide a convenient solution that avoids lengthy drying and washing processes.

Product Insights

Spray shoe deodorizers have dominated the market with a lucrative share of 45.6% in 2023 owing to the growing awareness of foot hygiene. Spray products offer a convenient solution to combat foot odor caused by sweat and bacteria accumulation. They provide a quick and efficient way to refresh shoes and maintain hygiene for individuals who are prone to sweaty feet. In addition, the growing incidence of diabetes globally has driven the need for proper foot hygiene. Diabetic individuals, who are susceptible to foot issues due to neuropathy and poor circulation, benefit from using shoe deodorizers to prevent infections and complications.

Powder shoe deodorizers have registered the fastest CAGR during the forecast period. The rising popularity of formal shoes in corporate offices and workplaces has contributed to the demand for powder shoe deodorizers. Professionals who wear formal footwear for extended hours have increasingly sought odor control solutions to maintain hygiene. Moreover, the rising disposable incomes have encouraged consumers to willingly invest in personal care products, including shoe deodorizers.

Distribution Channel Insights

Offline distribution channels have secured the dominant market share in 2023. Offline retail outlets have a broad customer base that allows them to cater to diverse consumer needs, driving market growth. These stores cater to various shoes for professionals, sports and fitness enthusiasts along with shoe care segment which includes shoe deodorizers. Brands such as Sketchers, Mochi, Vans, and Puma contribute to the wider availability of shoe care solutions. Additionally, consumers find it convenient to purchase shoe deodorizers from physical stores as they are able to learn from retail store agents and compare products laid out in aisles before making a purchase.

The online distribution channels are projected to emerge at the fastest-growing CAGR of 5.1% during the forecast period owing to the increased internet penetration. The rising number of internet users, especially in developing economies including China, India, and Brazil, has considerably propelled the online market for shoe deodorizers. Furthermore, popular online retailers such as Amazon, Walmart, Flipkart, and Myntra offer a wide range of shoe care solutions. Their extensive platforms provide easy access to various brands, formulations, and price points, driving product demand through online channels.

Regional Insights

The North America shoe deodorizer market accounted for 34.5% of the market share in 2023. This growth can be attributed to the rising incidence of foot wounds, infections, and other foot-related problems, leading to a high demand for shoe care products, including deodorizers. Hyperthyroidism and diabetic patients have particularly sought solutions to prevent odors and maintain foot health. They have increasingly preferred innovative deodorizers that utilize advanced technologies including activated carbon and nanoparticles to effectively eliminate odors.

U.S. Shoe Deodorizer Market Trends

The shoe deodorizer market in the U.S. was driven by the rising number of fitness enthusiasts and athletes. They have increasingly demanded effective shoe deodorizers to maintain odor control and foot hygiene due to prolonged use. Moreover, manufacturers have increasingly focused on research and development activities to introduce advanced formulations with enhanced odor-fighting technologies.

Europe Shoe Deodorizer Market Trends

The growth of the Europe shoe deodorizer market is attributable to the increased awareness about the impact of foot odor caused by sweat and bacteria. European consumers have increasingly prioritized eco-friendly and natural shoe deodorizers formulated with sustainable ingredients and zero harsh chemicals. Furthermore, the presence of offline retail stores across Europe has played a significant role in catering to diverse consumer needs.

Asia Pacific Shoe Deodorizer Market Trends

The Asia Pacific shoe deodorizer market is expected to witness a CAGR of 5.5% over the forecast period owing to rapid urbanization and increased per capita disposable income. Consumers have alarmingly prioritized health and well-being along with their interest in sports and fitness, leading to a surge in demand for effective shoe deodorizers.

Key Shoe Deodorizer Company Insights

Key players including S.C. Johnson & Son, Reckitt Benckiser Group PLC, and others have increasingly focused on product innovation and product line extension with extensive R&D activities. They have prioritized strategic collaborations to formulate sustainable solutions to continue their dominant footprint in the market.

-

Reckitt Benckiser Group PLC specializes in health, hygiene, and nutrition products. Their diverse portfolio includes brands such as Dettol, Mucinex, Nurofen, Clerasil, and Scholl. With operations in over 68 countries across six continents, the company focuses on improving global hygiene, health, and nutrition.

-

Sanofi S.A. is a French multinational pharmaceutical and healthcare company. The company has extensively engaged in the research, production, and distribution of its pharmaceutical products. Their portfolio includes medicines for cancer treatment, rare diseases, multiple sclerosis, and human vaccines for protection against various bacterial and viral diseases.

Kay Shoe Deodorizer Companies:

The following are the leading companies in the shoe deodorizer market. These companies collectively hold the largest market share and dictate industry trends.

- Reckitt Benckiser Group PLC

- Sanofi S.A.

- S.C. Johnson & Son Inc.

- Guangzhou Bubujie Household Products Co., Ltd.

- Lumi Outdoors

- PUMA

- Addidas

Recent Development

-

In May 2022, Arm & Hammer launched Sport Collection Body Powder and the Gear/Shoe Refresher Spray. These products utilize Fresh Guard Technology, combining the odor-absorbing effects of baking soda with other odor-neutralizing ingredients. The Sport Collection aims to provide heavy-duty odor defense for active individuals ensuring a refreshing and comfortable experience while combating shoe and gear odor.

Shoe Deodorizer Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 456.5 million

|

|

Revenue forecast in 2030

|

USD 601.1 million

|

|

Growth rate

|

CAGR of 4.7% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

September 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, distribution channel, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia & New Zealand, Brazil, Argentina, South Africa

|

|

Key companies profiled

|

Reckitt Benckiser Group PLC; Sanofi S.A.; S.C. Johnson & Son Inc.; Guangzhou Bubujie Household Products Co., Ltd.; Lumi Outdoors; PUMA; Addidas

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

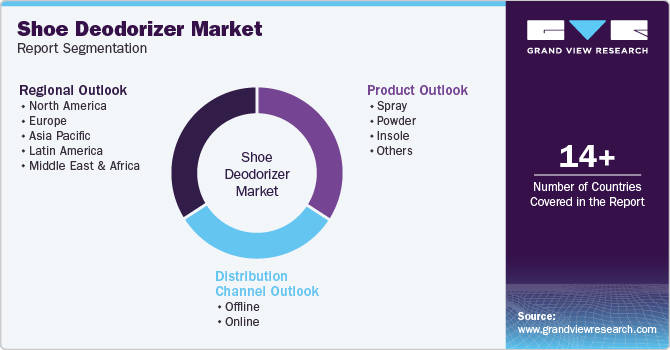

Global Shoe Deodorizer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global shoe deodorizer market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Spray

-

Powder

-

Insole

-

Others

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)