Shingles Vaccine Market Size, Share & Trends Analysis Report By Product (Shingrix, Zostavax, SkyZoster), By Vaccine Type (Recombinant Vaccine, Live Attenuated Vaccine), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-638-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Shingles Vaccine Market Size & Trends

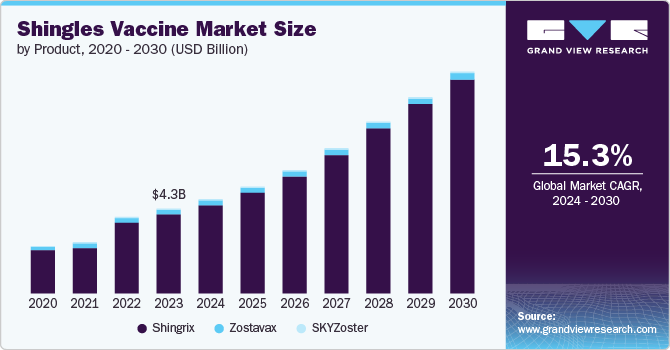

The global shingles vaccine market size was valued at USD 4.25 billion in 2023 and is projected to grow at a CAGR of 15.3% from 2024 to 2030. Market growth is expected to be driven by factors such as the heightened risk of shingles in individuals aged 60 and above and advancements in healthcare policies in developed countries. According to the Centers for Disease Control and Prevention (CDC), one out of three people in the U.S. are likely to develop shingles during their lifetime. In March 2021, the CDC also released guidelines regarding shingles vaccination amidst the COVID-19 pandemic, recognizing it as an essential preventive care service.

The rising incidence of shingles, particularly among older adults, is a significant driver of the shingles vaccine market. The global population is expected to experience significant aging, as the World Health Organization (WHO) forecasts that the worldwide population aged 60 and above will nearly double by 2050, reaching 2.1 billion.

Including shingles vaccines in national immunization programs is another key driver of market growth. Many countries have included shingles vaccines in their national immunization programs, such as the UK government's reported 31.2% coverage rate for patients aged 70 and 74.9% coverage rate for patients aged 76 in 2021-2022. Recombinant vaccines such as Shingrix have gained significant market share due to their high efficacy.

New product approvals are also expected to boost market growth by expanding availability. For instance, in January 2023, SK Bioscience announced the receipt of biologics license application approval for its shingles vaccine, SKYZoster, from the National Pharmaceutical Regulatory Agency (NPRA) in Malaysia. This marks the second overseas approval for the vaccine after Thailand in May 2020. Increasing shingles risk, aging populations, national vaccination programs, superior recombinant vaccine efficacy, and new product launches are further driving market growth.

Product Insights

Shingrix dominated the market share with a revenue share of 93.7% in 2023 due to its exceptional effectiveness and lack of serious adverse events. Furthermore, Shingrix is also anticipated to exhibit the most significant growth rate in the coming years, credited to increasing awareness of the disease and approving Shingrix vaccines across different regions.

The SkyZoster segment is projected to grow at a lucrative rate over the forecast period due to its recent approval for use in adults aged 50 and older in South Korea. This approval has made it a more cost-effective option compared to other shingles vaccines such as Shingrix. The vaccine's inclusion in South Korea's immunization programs has also boosted its adoption. Furthermore, clinical trials are underway to obtain international approval and commercialize the vaccine, which is expected to expand its global reach.

Vaccine Type Insights

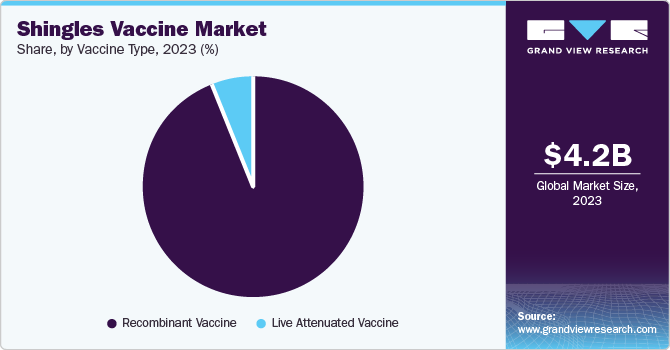

In 2023, the recombinant vaccine segment accounted for the largest share, with a share of 93.7% of the total revenue attributed to the superior disease prevention efficacy of recombinant vaccines, particularly in the adult demographic. Recombinant vaccines are produced using recombinant DNA technology, allowing the insertion of desired antigen-containing genes into viral vectors. This process triggers a robust antigen-specific immune response, mimicking natural infection. The high efficacy of recombinant vaccines and their growing adoption in adult vaccination programs has been a key driver of the segment's significant market share and growth.

The live attenuated vaccine segment is projected to expand steadily over the forecast period, driven by the growing concern about transmissible diseases and the increasing acceptance of vaccination programs, particularly in developing countries. The vaccines' ability to provide long-lasting immunity has made them a crucial component of global preventive healthcare strategies. As developing nations invest in expanding vaccination coverage, the demand for live attenuated vaccines is expected to rise steadily.

Regional Insights

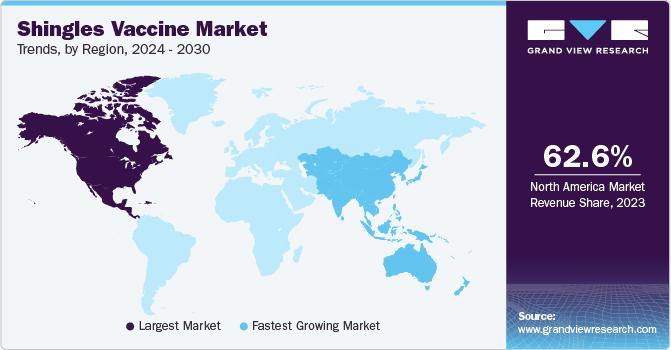

The North America shingles vaccine market led the global shingles vaccine market with a revenue share of 62.5% in 2023 attributed to several key factors, including major industry players, favorable reimbursement policies, and a significant uptake of vaccines. Additionally, the region's high awareness among the population and the strong recommendation for vaccination contribute to the market's growth throughout the forecast period. Notably, the U.S. and Canada prioritize using Shingrix over Zostavax to prevent shingles in the elderly population due to its proven effectiveness.

U.S. Shingles Vaccine Market Trends

The U.S. shingles vaccine market dominated the North America shingles vaccine market with a share of 95.7% in 2023 due to the high prevalence of shingles, with approximately 1 million cases reported annually, according to the CDC. The inclusion of shingles vaccines in the National Immunization Program and the presence of sophisticated healthcare infrastructure are driving the market growth in the U.S.

Europe Shingles Vaccine Market Trends

Europe shingles vaccine market was identified as a lucrative region in this industry due to favorable government policies, improved vaccine accessibility, and increased awareness about the disease. The availability of recombinant vaccines such as Shingrix and the rising incidence of shingles are further propelling the market expansion in Europe.

The Germany shingles vaccine market held a substantial market share in 2023 owing to a well-established healthcare system and a high level of population awareness regarding the importance of vaccination. The availability of recombinant vaccines such as Shingrix and the inclusion of shingles vaccination in the national immunization program have boosted the market growth in Germany. The country's aging population and the associated increase in shingles risk are also driving the demand for shingles vaccines.

Asia Pacific Shingles Vaccine Market Trends

The Asia Pacific shingles vaccine market is projected to experience the most rapid growth rate of 16.3% from 2024 to 2030, attributed to factors such as rising disposable income, improved healthcare policies, and a large population base vulnerable to disease. The market is expected to be driven by unmet medical needs in low- and middle-income countries in Asia Pacific. Moreover, the impending approval of Shingrix in various Asian countries is likely to further propel regional market growth.

Japan shingles vaccine market is expected to grow rapidly in the coming years. The country has a rapidly aging population, with a high proportion of individuals aged 60 and above at a higher risk of developing shingles. The Japanese government's efforts to promote vaccination and the availability of recombinant vaccines such as Shingrix are expected to drive market growth in the country. The presence of local manufacturers such as Biken and the increasing awareness about the disease among healthcare professionals and the general population are further contributing to the market expansion in Japan.

Key Shingles Vaccine Company Insights

Prominent players in the global shingles vaccine market are leveraging various strategies to bolster their market position. These initiatives aim to increase market share, improve customer satisfaction, and stay competitive in the rapidly evolving vaccine market.

-

GlaxoSmithKline's (GSK) recombinant zoster vaccine, Shingrix, has demonstrated superior efficacy globally. GSK has leveraged its expertise in adult vaccination to drive awareness and adoption of Shingrix in several countries. The company's strong research and development capabilities, global reach, and focus on expanding access to Shingrix have solidified its position as a dominant force in the shingles vaccine landscape.

-

Merck & Co., Inc. has maintained a significant presence in the industry through its extensive experience in vaccine development and established distribution channels. To stay relevant in the evolving market landscape, Merck is also exploring the development of next-generation shingles vaccines. The company’s commitment to innovation and brand recognition make it a formidable player in the global shingles vaccine industry.

Key Shingles Vaccine Companies:

The following are the leading companies in the shingles vaccine market. These companies collectively hold the largest market share and dictate industry trends.

- GlaxoSmithKline plc.

- Pfizer Inc.

- Merck & Co., Inc.

- CanSinoBIO

- Vaccitech

- Green Cross Corp

- Geneone Life Science

- SK Bioscience

Recent Developments

-

In April 2024, GSK revealed results from the ZOSTER-049 trial, which showed that Shingrix effectively protected adults aged 50 and over against shingles for a period of over 10 years.

-

In February 2023, Pfizer and BioNTech initiated a Phase 1/2 trial for an mRNA-based shingles vaccine. The trial aims to explore the safety, tolerability, and immunogenicity of their vaccine candidates against shingles.

Shingles Vaccine Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.71 billion |

|

Revenue forecast in 2030 |

USD 11.09 billion |

|

Growth Rate |

CAGR of 15.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, vaccine type, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

GlaxoSmithKline plc.; Pfizer Inc.; Merck & Co., Inc.; CanSinoBIO; Vaccitech; Green Cross Corp; Geneone Life Science; SK Bioscience |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Shingles Vaccine Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global shingles vaccine market report based on product, vaccine type, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Shingrix

-

Zostavax

-

SKYZoster

-

-

Vaccine Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Recombinant Vaccine

-

Live Attenuated Vaccine

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global shingles vaccine market size was estimated at USD 4.31 billion in 2023 and is expected to reach USD 4.71 billion in 2024

b. The global shingles vaccine market is expected to grow at a compound annual growth rate of 15.3% from 2024 to 2030 to reach USD 11.09 billion by 2030.

b. Shingrix vaccine dominated the shingles vaccine market with a share of 93.7% in 2023. This is attributable to high efficacy and inclusion of the vaccine in national immunization programs of various countries.

b. Some key players operating in the shingles vaccine market include GlaxoSmithKline plc.; Merck & Co., Inc.; and SK chemicals, Green Cross Corp, Geneone Life Science, and Vaccitech.

b. Key factors that are driving the shingles vaccine market growth include increased risk of developing shingles especially in adults aged 60 & above and high adoption of vaccines in developed and developing countries.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."