- Home

- »

- Organic Chemicals

- »

-

Shielding Gas For Welding Market Size & Share Report 2030GVR Report cover

![Shielding Gas For Welding Market Size, Share & Trends Report]()

Shielding Gas For Welding Market Size, Share & Trends Analysis Report By Product (Argon, Carbon Dioxide), By End-use (Construction, Energy), By Distribution, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-397-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Shielding Gas For Welding Market Trends

The global shielding gas for welding market size was estimated at USD 3.03 billion in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. The market is expected to grow due to the increasing demand for construction and manufacturing work in smart cities. Government initiatives aimed at improving infrastructure will also contribute to this growth.

The growing need for welding processes like shielded arc welding, metal arc welding, and tungsten metal arc welding is a significant factor driving the gas and shielding gas market. This demand is primarily fueled by the construction industry, particularly the increasing need for larger buildings in major cities, which will further boost the welding gas market. In addition to the construction and manufacturing sectors, the demand for welding gas/shielding gas will further drive the market.

Drivers, Opportunities & Restraints

The construction sector is experiencing a surge in welding processes, primarily driven by the increasing complexity of architectural designs and the need for durable structural integrity. Welding is essential for creating strong, lasting joints in metal structures, which is crucial in modern construction projects that often involve innovative materials and design concepts. Moreover, the growth in infrastructure development projects, including high-rise buildings, bridges, and public facilities, necessitates advanced welding techniques to meet safety standards and architectural demands. This has led to a heightened demand for skilled welders and specialized welding materials and equipment, directly influencing the market expansion within the construction industry.

Welding or shielding gases, such as acetylene or argon, are integral to many welding processes, providing the necessary environments for the weld to form correctly. However, these gases can be highly explosive under certain conditions. The explosive nature necessitates stringent safety measures, including proper storage, handling, and usage protocols to prevent leaks and ignition sources from coming into contact with the gases. Adequate ventilation and compliance with safety regulations are also vital to avoid the accumulation of gases and reduce the risk of explosion. Always follow the guidelines relevant authorities and manufacturers set when dealing with these gases.

The rise in automotive industry, coupled with many nations focusing on ramping up automotive production, presents a significant opportunity for businesses and economies. This surge not only boosts the demand for vehicles but also opens vast prospects in the supply chain, including parts manufacturing, technology integration, and innovation. Furthermore, it paves the way for advancements in sustainable and electric vehicles, offering a green alternative and contributing to global environmental goals. As countries invest in this sector, there's potential for job creation, technological development, and enhanced global competitiveness in the automotive market.

Product Insights

“Argon emerged as the fastest-growing product with a CAGR of 5.8%.”

Argon dominated the market and accounted for a revenue share of 39.67% in 2023. The integration of argon as a shielding gas in the welding market represents a significant opportunity for growth and innovation. As a key component in welding processes, particularly in applications requiring high precision and cleanliness, argon gas provides an inert atmosphere that prevents oxidation during welding. This not only enhances the quality of the welds but also opens new possibilities in industries requiring advanced manufacturing techniques, such as aerospace, automotive, and electronics. The increasing demand for high-quality manufacturing in these sectors underscores the potential for argon as a product segment, making it a lucrative area for businesses to explore and expand their offerings.

Carbon dioxide (CO2) as a shielding gas presents unique opportunities. It is cost-effective and widely available, making it an attractive option for companies aiming to reduce operational costs. CO2 can be used pure or mixed with other gases to optimize welding attributes, such as penetration and bead shape, which is particularly beneficial in construction and manufacturing. Its application in industries that require robust, high-volume welding operations highlights its potential to drive efficiency and productivity. Given these advantages, exploring CO2 as a product segment offers significant growth prospects for businesses in the welding industry.

End-use Insights

“Metal Manufacturing & Fabrication emerged as the fastest-growing end use with a CAGR of 6.4%.”

Metal manufacturing & fabrication dominated the market with a market and accounted for a revenue share of 39.72% in 2023. The demand for shielding gases like argon and CO2 is paramount in metal manufacturing and fabrication due to their critical role in ensuring quality welding. The merchant liquid/bulk distribution model represents a lucrative opportunity in this context, promising the efficient and economical supply of these gases in large volumes. This approach satisfies the substantial gas requirements of heavy industries and guarantees economies of scale, significantly lowering costs and improving supply reliability. Adopting this model can fuel growth and innovation within the metal manufacturing and fabrication sector by catering to its extensive gas needs.

In the construction sector, using shielding gases such as argon and CO2 for welding is crucial to achieving high-quality joints and structures. The burgeoning demand for these gases presents a significant business opportunity, primarily through the merchant liquid/bulk distribution model. This model promises an efficient, cost-effective way to supply large volumes of necessary gases, meeting the extensive needs of industry. Adopting such a distribution approach can reduce costs, enhance supply reliability, and support the growth and technological advancements in construction-related metal manufacturing and fabrication.

Distribution Insights

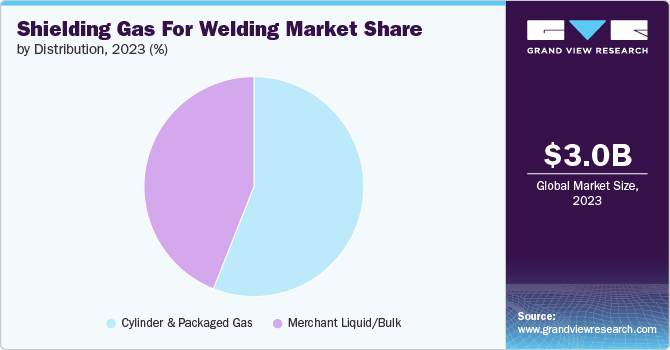

“Cylinder & Packaged Gas emerged as the fastest-growing distribution with a CAGR of 5.7%.”

Cylinder & packaged gas dominated the market with a revenue share of 55.99% in 2023.The cylinder and packaged gas distribution segment holds considerable promise. Its convenience and scalability make it ideal for various operations, from small workshops to large industrial projects. This segment enables easy access and simplified logistics, allowing companies to maintain a steady supply of gases like CO2, essential for cost-effective and high-quality welding. By focusing on this distribution channel, businesses can tap into the growing demand for efficient and reliable welding solutions, opening significant growth opportunities in the sector.

The merchant liquid/bulk distribution segment presents a significant opportunity for welding within the shielding gas market. This approach facilitates the efficient delivery of large volumes of gases, catering to the high-demand needs of large-scale industrial operations. By leveraging bulk distribution, businesses can achieve economies of scale, reducing overall costs and enhancing the reliability of gas supply. Furthermore, this model supports the continuous and extensive usage of gases like argon and CO2, essential for quality welding, thereby meeting the needs of heavy industries and promoting growth in this sector.

Regional Insights

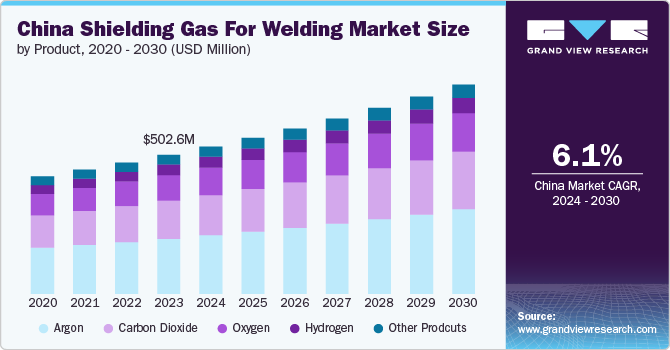

“China emerged as the fastest-growing region in Asia Pacific, with a CAGR of 6.1% in 2030.”

Asia Pacific dominated the market and accounted for a 40.52% share in 2023. The increasing demand for product markets in the construction industry in developing countries such as China and India are expected to propel the demand for shielding gas for welding in this region.

China Shielding Gas for Welding Market Trends

The shielding gas for welding market in China dominated and accounted for a revenue share of 40.95% in 2023. This growth is attributed to increasing demand for the country's metal manufacturing & fabrication industry. China is one of the highest metal manufacturing & fabrication of steel product manufacturers, leading to a rise in demand for the product market in the region.

North America Shielding Gas for Welding Market Trends

The shielding gas for welding market in North American is expected to grow due to the growing energy and power segment in the region. This growth will lead to a rise in demand for the product, which is used in the energy and power sector, leading to a rise in demand for the product market in the region.

Europe Shielding Gas for Welding Market Trends

The shielding gas for welding market in Europe plays a significant role with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the rise in demand for electronics, which leads to increased demand for products.

Key Shielding Gas For Welding Company Insights

Some of the key players operating in the global market include:

-

Air Products & Chemicals is an international corporation that primarily produces and distributes industrial gases and chemicals and supplies atmospheric gases like oxygen, nitrogen, argon, hydrogen, carbon dioxide, and process and specialty gases. Air Products' key offering is shielding gases for welding applications. These gases protect the welding pool and surrounding metal from atmospheric contamination during the welding process. The company has a global presence.

-

Linde plc is an industrial gas and engineering company primarily operating in the industrial gas industry. The company's main product lines include atmospheric gases such as nitrogen, oxygen, rare gases, and argon and process gases like carbon dioxide, hydrogen, helium, specialty gases, electronic gases, and acetylene. Linde's products and services serve various industries, including chemicals and energy, healthcare, metals and mining, manufacturing, electronics, and food and beverage. In addition, the company provides gas production and processing services, including natural gas plants, olefin plants, hydrogen and synthesis gas plants, and air separation plants. The company has a global presence.

Air Liquide SA and Huntsman advanced materials are some of the emerging market participants globally.

-

Air Liquide SA manufactures industrial gases, including nitrogen, oxygen, argon, hydrogen, and other rare gases. These products are used in various industries, including food, steel, chemicals, pharmaceuticals, automotive, electronics, and manufacturing. Air Liquide also provides antiseptics, skin disinfectants, and medical instrument disinfection products. The company has a global presence.

-

Nippon Sanso Holdings Corp, a Mitsubishi Chemical Group Corp subsidiary, is an industrial gas manufacturing company. It provides nitrogen, oxygen, hydrogen, argon, carbon dioxide, acetylene, and other specialty gases. The company also manufactures semiconductors, electronics, welding, and medical-related equipment. It offers household and consumer-related products. The company provides manufacturing, designing, maintenance services, and installation for air separation units. The company has a global presence.

Key Shielding Gas For Welding Companies:

The following are the leading companies in the shielding gas for welding market. These companies collectively hold the largest market share and dictate industry trends.

- Air Products & Chemicals

- Linde plc

- Praxair Inc.

- Taiyo Nippon Sanso Corporation

- Air Liquide SA

- Gulf Cyro

- Iwatani Corporation

- Messer Group GmbH

- SIG Gases Berhad

- Matheson Tri-Gas, Inc.

Recent Developments

-

In July 2024, Air Liquide India opened a new air separation unit (ASU) in Mathura, Uttar Pradesh, for USD 4.18 million. The plant is intended to support industrial and healthcare activities in the region and serve clients in northern India, including Rajasthan, Madhya Pradesh, and Delhi. The ASU aims to help Air Liquide meet the growing demand from automotive, metal fabrication, heat treatment, photovoltaic, electronics, and local hospitals. The plant is also intended to operate on renewable energy by 2030.

-

In January 2024, Linde announced a USD 60 million investment to construct a new air separation unit (ASU) at the Rourkela steel plant of SAILs in Odisha, India. The new facility will be operational by 2026 and supply oxygen, nitrogen, and argon to bolster SAIL's expansion and modernization program. The ASU will also provide industrial gases to Linde's other local and regional customers.

Shielding Gas For Welding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.19 billion

Revenue forecast in 2030

USD 4.40 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

Air Products & Chemicals; Linde plc; Praxair Inc.; Taiyo Nippon Sanso Corporation; Air Liquide SA; Gulf Cyro; Iwatani Corporation; Messer Group GmbH; SIG Gases Berhad; Matheson Tri-Gas, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shielding Gas for Welding Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global shielding gas for welding market report based on resin, distribution, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Argon

-

Carbon Dioxide

-

Oxygen

-

Hydrogen

-

Other Products

-

-

Distribution Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cylinder & Packaged Gas

-

Merchant Liquid/Bulk

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Metal Manufacturing & Fabrication

-

Construction

-

Energy

-

Aerospace

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global shielding gas for welding market size was estimated at USD 3.03 billion in 2023 and is expected to reach USD 3.19 billion in 2024.

b. The global shielding gas for welding market is expected to grow at a compound annual rate of 5.5% from 2024 to 2030 to reach USD 4.40 billion by 2030.

b. Asia Pacific dominated the shielding gas for welding market with a share of 40.52% in 2023. This growth is attributable to the increasing demand for product markets in the construction industry in developing countries such as China and India are expected to propel the demand for shielding gas for welding in this region.

b. Some key players operating in the shielding gas for welding market include Air Products & Chemicals; Linde plc; Praxair Inc.; Taiyo Nippon Sanso Corporation; Air Liquide SA; Gulf Cyro; Iwatani Corporation; Messer Group GmbH; SIG Gases Berhad; and Matheson Tri-Gas, Inc.

b. Key factors that are driving the market growth include increasing demand for construction and manufacturing work in smart cities. Government initiatives aimed at improving infrastructure will also contribute to this growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."