- Home

- »

- Plastics, Polymers & Resins

- »

-

Sheet Molding & Bulk Molding Compound Market Report, 2030GVR Report cover

![Sheet Molding And Bulk Molding Compound Market Size, Share & Trends Report]()

Sheet Molding And Bulk Molding Compound Market (2024 - 2030) Size, Share & Trends Analysis Report By Resin Type (Epoxy, Polyester), By Fiber Type (Glass Fiber, Carbon Fiber), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-360-5

- Number of Report Pages: 176

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

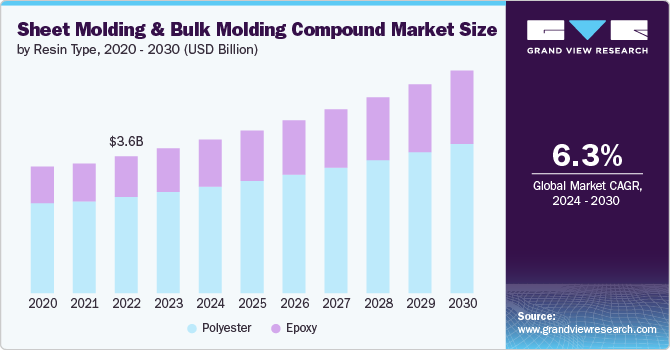

The global sheet molding and bulk molding compound market size was valued at USD 3.83 billion in 2023 and is expected to grow at a CAGR of 6.39% from 2024 to 2030. Sheet Molding compound (SMC) and bulk molding compound (BMC) are composite materials made from thermosetting resins, typically polyester, combined with fillers, fiber reinforcements, and other additives. These materials offer exceptional strength-to-weight ratios, corrosion resistance, and design flexibility, making them ideal for automotive, electrical, construction, and aerospace applications.

The growth of SMC and BMC is largely attributed to the automotive industry's increasing focus on reducing vehicle weight to improve fuel efficiency and meet stringent emission regulations. Additionally, the construction sector's demand for durable and lightweight materials is expected to drive further market expansion. The development of advanced SMC and BMC formulations with enhanced properties, such as improved fire resistance and electrical conductivity, is also anticipated to open new avenues for market growth.

Drivers, Opportunities & Restraints

One of the key factor driving the sheet molding and bulk molding compound market is the automotive industry's shift towards lightweight materials to enhance fuel efficiency and reduce carbon emissions. SMC and BMC offer significant weight savings compared to traditional materials like steel and aluminum, making them highly attractive for manufacturing various automotive components, including body panels, hoods, and structural parts. Additionally, the increasing adoption of electric vehicles (EVs) has further fueled the demand for these composites, as they contribute to overall vehicle weight reduction, thereby extending the driving range of EVs.

The market presents substantial opportunities for innovation and growth, particularly in the development of sustainable and eco-friendly composites. With the global focus on sustainability and reducing environmental impact, there is a growing demand for materials that can be recycled or produced from renewable sources. Manufacturers are investing in research and development to create bio-based resins and recyclable composites that maintain the performance characteristics of traditional SMC and BMC. Furthermore, the expanding applications of these materials in emerging industries, such as renewable energy and infrastructure development, offer new growth prospects for market players.

The market faces certain challenges that could hinder its expansion during the forecast period. One of the primary restraints is the high cost of raw materials, particularly resins and fiber reinforcements, which can increase the overall production cost of SMC and BMC components. This cost factor may limit the adoption of these composites, especially in price-sensitive markets. Additionally, the complex manufacturing processes required for producing high-quality SMC and BMC parts can pose technical challenges and require significant capital investment in advanced production equipment and skilled labor. Addressing these cost and technical challenges will be crucial for the continued growth of the market.

Resin Type Insights & Trends

Based on resin type, polyester held the market with the largest revenue share of 69.88% in 2023. Polyester resins are widely used due to their cost-effectiveness and versatility. Polyester-based SMC and BMC offer good mechanical properties, electrical insulation, and resistance to corrosion, making them suitable for a broad range of applications, including electrical and electronics, construction, and consumer goods. The flexibility in formulation and the ability to incorporate various fillers and reinforcements further enhance the appeal of polyester resins in the market.

Epoxy resins are well-regarded for their superior mechanical properties, including high strength, excellent adhesion, and resistance to chemicals and heat. These characteristics make epoxy resins highly suitable for demanding applications in industries such as aerospace and automotive, where durability and performance are critical. The growing emphasis on lightweight and high-strength materials in these sectors is expected to drive the demand for epoxy-based SMC and BMC.

Fiber Type Insights & Trends

Based on fiber type, glass fiber held the market with the largest revenue share of 63.07% in 2023. Glass fiber is the most commonly used reinforcement material in SMC and BMC due to its excellent mechanical properties, cost-effectiveness, and versatility. It provides high tensile strength, good chemical resistance, and electrical insulating properties, making it suitable for a wide range of applications, including automotive parts, electrical components, and construction materials. The widespread availability and lower cost of glass fiber contribute to its dominant position in the market.

Carbon fiber, although more expensive than glass fiber, offers superior strength-to-weight ratios, stiffness, and thermal stability. These properties make carbon fiber-reinforced SMC and BMC highly desirable for high-performance applications in aerospace, automotive, and sports equipment industries. The increasing demand for lightweight and high-strength materials in these sectors is driving the adoption of carbon fiber, despite its higher cost. The trend towards electric vehicles and the need for weight reduction to improve fuel efficiency further bolsters the demand for carbon fiber reinforcements.

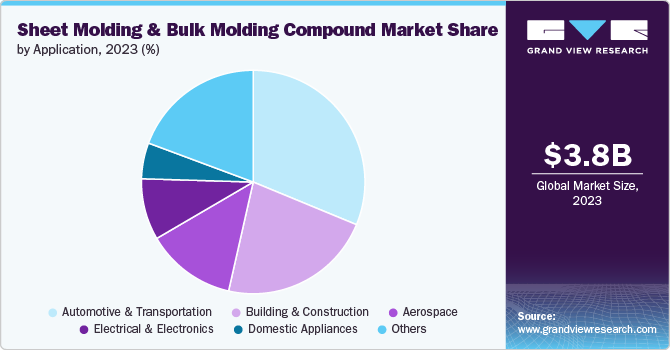

Application Insights & Trends

Based on application, automotive & transportation held the market with the largest revenue share of 31.23% in 2023. The automotive & transportation sector is a major driver of market growth, as SMC and BMC materials are increasingly used for manufacturing lightweight and high-strength components, such as body panels, bumpers, and structural parts. The push for fuel efficiency and emission reduction in vehicles, along with the rise of electric vehicles, is fueling the demand for these composites in the automotive industry.

In the aerospace industry, the need for materials that offer a high strength-to-weight ratio, durability, and resistance to extreme conditions makes SMC and BMC ideal choices for various aircraft components. The electrical & electronics sector benefits from the excellent electrical insulating properties and flame resistance of these composites, making them suitable for applications such as electrical enclosures, connectors, and circuit breakers. The construction industry utilizes SMC and BMC for their corrosion resistance, lightweight, and ease of installation in products like panels, roofing, and structural elements.

Regional Insights

North America holds a substantial share of the market, driven by robust demand from the automotive and aerospace industries. The United States, in particular, is a major contributor, with its strong manufacturing base and technological innovation. The region's focus on reducing vehicle weight to enhance fuel efficiency and meet stringent emission standards boosts the demand for lightweight composite materials. Additionally, the presence of leading automotive manufacturers and aerospace companies in North America further propels market growth.

U.S. Sheet Molding And Bulk Molding Compound Market Trends

The United States is a key player in the global market, benefiting from a well-established manufacturing sector and significant investments in research and development. The country's automotive industry is a major consumer of SMC and BMC materials, driven by the need for lightweight and durable components. Additionally, the aerospace sector's demand for high-performance materials contributes to market growth.

Europe Sheet Molding And Bulk Molding Compound Market Trends

The automotive industry in countries like Germany, France, and Italy is a major consumer of SMC and BMC composites, utilizing them to produce fuel-efficient and eco-friendly vehicles. The region's aerospace and construction sectors also contribute to the market, with a focus on using advanced materials to enhance performance and reduce environmental impact.

Asia Pacific Sheet Molding And Bulk Molding Compound Market Trends

The Asia-Pacific region is witnessing rapid growth in the market, driven by the expanding automotive and construction industries in countries like China, India, Japan, and South Korea. The region's economic development and urbanization are increasing the demand for durable, lightweight, and cost-effective materials. China, in particular, is a major market player, with its booming automotive sector and significant investments in infrastructure projects.

Key Sheet Molding And Bulk Molding Compound Company Insights

The market is highly competitive, with key players including IDI Composites International, Continental Structural Plastics Inc., Core Molding Technologies, Polynt-Reichhold Group, and Menzolit GmbH holding significant market shares. These companies are focused on expanding their product portfolios, investing in research and development, and adopting strategic mergers and acquisitions to enhance their market positions. Innovations in composite formulations, such as the development of bio-based resins and high-performance fibers, are critical areas of focus.

Key Sheet Molding And Bulk Molding Compound Companies:

The following are the leading companies in the sheet molding and bulk molding compound market. These companies collectively hold the largest market share and dictate industry trends.

- IDI Composites International

- National Composites

- MENZOLIT

- Polynt (Polynt-Reichhold)

- Continental Structural Plastics Inc. (TEIJIN)

- ZOLTEK (Toray Group)

- Mitsui Chemicals

- TORAY INTERNATIONAL

- Core Molding Technologies

- Devi Polymers Private Limited

- Zhejiang Yueqing SMC & BMC Manufacture Factory

- Huayuan Advanced Materials Co., Ltd.

- Resonac Holdings Corporation

Recent Developments

-

In March 2024, National Composites acquired Northern Plastics, a thermoforming company, to expand its capabilities in composite material production and processing. The combined expertise will offer a comprehensive suite of composite solutions to customers. This acquisition supports National Composites' growth strategy to deliver high-quality, sustainable, and cost-effective composite solutions.

-

In December 2023, National Composites announced a strategic partnership with Laval, a global leader in composite materials. The partnership aims to expand the production and distribution of SMC and BMC products to meet the growing demand in the transportation and electrical & electronics industries.

-

In October 2023, Toray, a leading manufacturer of carbon fiber materials, developed TORAYC T1200, an ultra-high-strength carbon fiber. The new fiber offers exceptional tensile strength and modulus, making it ideal for applications requiring high performance and lightweight materials.

Sheet Molding And Bulk Molding Compound Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.07 billion

Revenue forecast in 2030

USD 5.90 billion

Growth rate

CAGR of 6.39% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Resin type, fiber type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

IDI Composites International; MENZOLIT; Polynt (Polynt-Reichhold); Continental Structural Plastics Inc. (TEIJIN); ZOLTEK (Toray Group); Mitsui Chemicals; TORAY INTERNATIONAL; Core Molding Technologies; Devi Polymers Private Limited; Zhejiang Yueqing SMC & BMC Manufacture Factory; Huayuan Advanced Materials Co., Ltd.; National Composites; Resonac Holdings.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sheet Molding And Bulk Molding Compound Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented sheet molding and bulk molding compound market report based on resin type, fiber type, application, and region:

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Polyester

-

-

Fiber Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Glass Fiber

-

Carbon Fiber

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Aerospace

-

Electrical & Electronics

-

Building & Construction

-

Domestic Appliances

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sheet molding and bulk molding compound market size was estimated at USD 3.83 billion in 2023 and is expected to reach USD 4.07 billion in 2024.

b. The global sheet molding and bulk molding compound market is expected to grow at a compound annual rate of 6.39% from 2024 to 2030, reaching USD 5.90 billion by 2030.

b. The polyester segment led the global graphic film market, accounting for more than 69.88% of the global revenue in 2023.

b. Some of the major companies in the global sheet molding and bulk molding compound market include IDI Composites International, MENZOLIT, Polynt (Polynt-Reichhold), Continental Structural Plastics Inc. (TEIJIN), ZOLTEK (Toray Group), Mitsui Chemicals, TORAY INTERNATIONAL, and Core Molding Technologies.

b. The growth of SMC and BMC is largely attributed to the automotive industry's increasing focus on reducing vehicle weight to improve fuel efficiency and meet stringent emission regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.