- Home

- »

- Communications Infrastructure

- »

-

Shared Services Center Market Size & Share Report, 2030GVR Report cover

![Shared Services Center Market Size, Share & Trends Report]()

Shared Services Center Market (2023 - 2030) Size, Share & Trends Analysis Report By End-use (Pharmaceutical & Clinical, Legal, BFSI, Manufacturing), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-703-2

- Number of Report Pages: 104

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Shared Services Center Market Summary

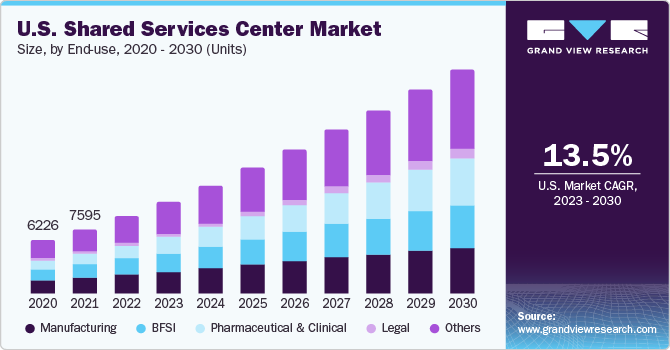

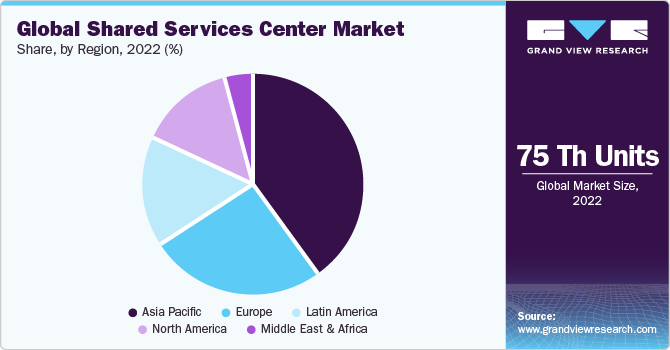

The global shared services center market demand was over 75 thousand units in 2022 and is projected to reach USD 3,36,742 units by 2030, growing at a CAGR of 19.8% from 2023 to 2030. The availability of qualified and low-cost labor in major developing countries, such as India, China, Lithuania, and the Philippines, is expected to establish SSC.

Key Market Trends & Insights

- The Asia Pacific region held the largest market share of 40.3% in 2022.

- By end-use, the pharmaceutical & clinical segment is expected to grow at the fastest CAGR of 23.9% during the forecast period.

Market Size & Forecast

- 2022 Market Size: 75 Thousand Units

- 2030 Projected Market Size: 3,36,742 Thousand Units

- CAGR (2023-2030): 19.8%

- Asia Pacific: Largest market in 2022

- Europe: Fastest growing market

Organizations globally seek innovative procedures for continuous improvement in day-to-day dealings coupled with operations performance management programs to extract the highest possible outcome from the SSC units. Efficient implementation of SSC can potentially deliver savings in operational costs, and the key outcomes generated include reduced operational complexity and improved task implementation efficiency.

The growing need for a higher degree of strategic flexibility has led to a substantial rise in establishing these centers. They are designed per organizational structure and process flow to deliver a fully optimized impact that extends operational excellence and assists the management in focusing on strategic decision-making. Implementing a shared services center brings about the complete re-engineering of primary business functions proposed to enhance operational end function optimization.

Easy availability of low-cost qualified labor and educated personnel is anticipated to drive SSC establishment in associated regions such as Latin America and Asia Pacific. Tax relaxation initiatives, such as tax-free zones and SEZs, by domestic legislation in selected territories have positively impacted SSC establishments.

The complexity linked with establishing and implementing the SSC framework is expected to challenge market growth. The assigned work is performed dynamically across numerous business units in SSC functional entities. The repetitive nature/routine procedures tasks are dealt with by leveraging best practices from multiple task sets.

Imminent tax benefits and availability of low-cost educated labor in regions such as Eastern Europe, Latin America, and Asia-Pacific are expected to boost the dynamic location shift of SSC entities to these geographies. The Latin American and Asia Pacific regions that deliver cheap labor and high tax relaxation in the present situation are presumed to eventually cut the tax reimbursements and offer cheap labor over the forecast period as they accomplish stable development and better living standards for the average population.

End-Use Insights

The other segment held the largest unit share of 35.1% in 2022. It consists of human resources, procurement, and IT & telecom. The human resource department conducts various activities such as payroll, recruitment, employee relations, training, and development. Shared services centers have HR teams that handle these functions and help organizations streamline their process without adding an extra department to the organization, ultimately saving costs for the company.

The pharmaceutical & clinical segment is expected to grow at the fastest CAGR of 23.9% during the forecast period. The increasing need for cost reduction and optimization for speed to market new drugs in the pharmaceutical industry is driving the growth of the shared services center market.

Regional Insights

The Asia Pacific region held the largest market share of 40.3% in 2022 and is expected to continue its dominance during the forecast period. This growth can be attributed to factors such as lower charges in the region since this region offers a big pool of young English-speaking professionals, relatively low wages, and infrastructure costs. Cultural homogeneity, coupled with low- labor and infrastructure costs in countries such as India, China, and Singapore, is expected to bolster the establishment of SSCs in the region.

Europe is estimated to grow at the significant CAGR of 16.9% over the forecast period. The growth is attributed to the availability of a skilled labor force, comprehensive knowledge of languages, and cultural and geographic proximity to Western Europe. Moreover, the region incorporates many well-known universities, enabling access to the qualified talent pool. There exists a rivalry between East European cities to attract investment in new or expanding SSCs, and their attractiveness is judged on key factors, such as availability of people, labor rates, and infrastructure. This rivalry has caused first-tier and capital cities, such as Bratislava, Budapest, and Warsaw, to become less attractive than the second-tier cities.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in August 2023, RHI Magnesita, a high-grade refractory products, systems, and solutions manufacturer and supplier, set up a shared service center in India. The center offers a range of services, including Procure to Pay (PTP), Attract to Grow (ATG), Record to Report (RTR), and Order to Cash (OTC).

Key Shared Services Center Companies:

- Abbott

- Ahlstrom

- Allen & Overy LLP

- Aspen Holdings

- Barclays

- Ernst & Young Global Limited

- Intermedix

- Invest Lithuania

- KPMG International Limited

- Nasdaq, Inc.

- Novartis AG

- PA Knowledge Limited

- PwC

- Tentacle Technologies

- Western Union Financial Services, Inc.

- WNS (Holdings) Ltd.

Recent Developments

-

In August 2023, Teleperformance launched a shared service center in Hyderabad, India. The center provides critical support using next-generation AI and data analytics to administer back-office services, including finance, human resources, IT administrative support, and workforce management.

-

In March 2022, Indian Oil Corporation (IOC) established a shared service center with IBM Consulting for vendor invoice management. The center was staffed with employees from IBM and Indian Oil Corporation to process over 1.5 million invoices over a year.

-

In January 2022, Chasey Partners advised ISA to expand and implement their shared services center. The aim was to improve the company's strategic thinking by moving away from transaction processes and focusing on value-added services.

Shared Services Center Market Report Scope

Report Attribute

Details

Market volume in 2023

95,100 Units

Revenue forecast in 2030

3,36,742 Units

Growth rate

CAGR of 19.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Units and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-Use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Abbott; Ahlstrom; Allen & Overy LLP; Aspen Holdings; Barclays; Ernst & Young Global Limited; Intermedix; Invest Lithuania; KPMG International Limited; Nasdaq, Inc.; Novartis AG; PA Knowledge Limited; PwC; Tentacle Technologies; Western Union Financial Services, Inc.; WNS (Holdings) Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shared Services Center Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global shared services center market report on the basis of end-use and region:

-

End-Use Outlook (Units, 2017 - 2030)

-

Pharmaceutical and clinical

-

Legal

-

BFSI

-

Manufacturing

-

Others

-

-

Regional Outlook (Units, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the shared services center market include IBM Corporation, Accenture Plc, Wipro Ltd., SAP SE, Infosys Ltd., Cognizant Technology Solutions Corp., Capgemini, and Symantec, among others.

b. Key factors that are driving the market growth include the growing need for a higher degree of strategic flexibility for businesses and the easy availability of cost-efficient, qualified labor and educated personnel across various countries worldwide.

b. The global shared services center market size was estimated at USD 75.58 billion in 2022 and is expected to reach USD 95.10 billion in 2023.

b. The global shared services center market is expected to grow at a compound annual growth rate of 19.8% from 2023 to 2030 to reach USD 336.74 billion by 2030.

b. Asia Pacific dominated the shared services center market with a share of 40% in 2022. Cultural homogeneity coupled with low- labor and infrastructure costs in countries, such as India, China, and Singapore is expected to bolster the establishment of SSCs in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.