- Home

- »

- Beauty & Personal Care

- »

-

Shampoo Bar Market Size And Share, Industry Report, 2030GVR Report cover

![Shampoo Bar Market Size, Share & Trends Report]()

Shampoo Bar Market (2024 - 2030) Size, Share & Trends Analysis Report By Hair (Normal, Dry, Oily, Others), By Distribution Channel (Online, Offline), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-2-68038-950-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Shampoo Bar Market Summary

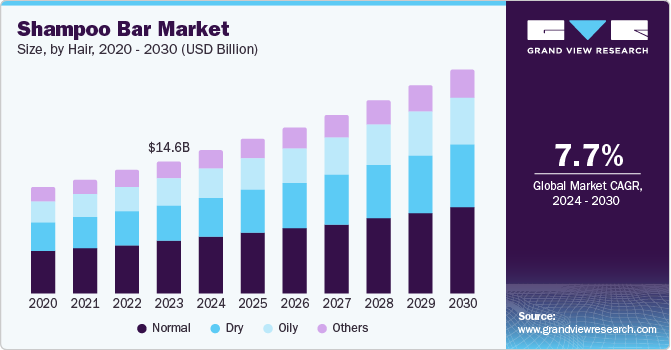

The global shampoo bar market size was estimated at USD 14.57 billion in 2023 and is projected to reach USD 24.59 billion by 2030, growing at a CAGR of 7.7% from 2024 to 2030. Rising demand for parabens- and sulfate-free hair products, growing emphasis on environment-friendly packaging, and increased demand for solid personal care solutions have contributed to market expansion.

Key Market Trends & Insights

- North America dominated the global market with a revenue share of 65.4% in 2023.

- The U.S. held the largest share of the regional market in 2023.

- By hair, shampoo bars for normal hair segment accounted for the largest revenue share of 40.1% in 2023.

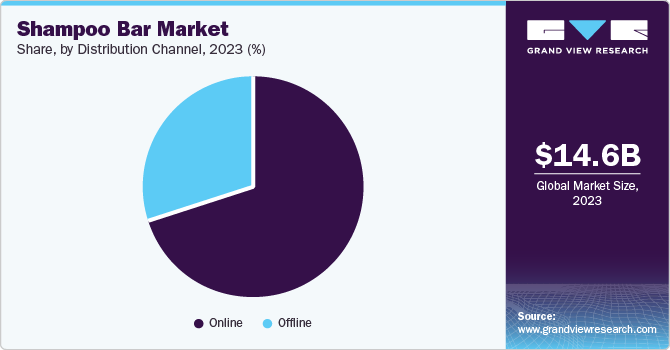

- By distribution channel, online distribution channels segment held the highest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 14.57 Billion

- 2030 Projected Market Size: USD 24.59 Billion

- CAGR (2024-2030): 7.7%

- North America: Largest market in 2023

Consumers are increasingly seeking environmentally responsible and sustainable personal care items, thus driving demand for shampoo bars, as they are thought to be an eco-friendly alternative to traditional liquid shampoos. Addressing these concerns, several brands are actively promoting their sustainable packaging solutions for shampoo bars. For instance, Garnier, a brand under L’Oréal S.A., produces 94% plant-based Ultra Doux shampoo bars that come in zero-plastic packaging. As awareness regarding the benefits of shampoo bars over traditional liquid and gel-based shampoo grows, a steady demand from untapped regions such as Asia Pacific and Africa is expected over the forecast period.

Consumers are becoming more informed and aware of the importance of hair care and scalp health, leading to increased demand for shampoo bars that offer nourishing and moisturizing benefits. In addition, the zero-waste movement has gained significant momentum among the global population, driving strong demand for shampoo bars that generate lesser amounts of packaging waste compared to traditional shampoos. For instance, HiBAR, Ethique, and grüum are among some notable manufacturers that are extensively promoting sustainable and zero-waste packaging for their personal care products and advertising their contribution to the plastic-free circular economy.

An important factor behind the popularity of shampoo bars is the growth of e-commerce and social media platforms due to increasing internet penetration and rising smartphone usage. These trends have enabled shampoo bar manufacturers to reach a wider audience, thus increasing brand visibility and driving sales. The introduction of innovative shampoo bar products, such as those with natural ingredients, colorants, essential oils, and customized formulations, is attracting consumers seeking unique and personalized hair care solutions. Moreover, shampoo bars, being leak and spill-free, offer a convenient and travel-friendly alternative to traditional shampoos, appealing to consumers with active lifestyles.

Hair Insights

Shampoo bars for normal hair accounted for the largest revenue share of 40.1% in 2023. This is attributed to the fact that normal hair is the most common hair among consumers. Consequently, shampoo bars catering to normal hair have witnessed widespread adoption, as they effectively clean and nourish hair without stripping it of its natural oils. Additionally, the versatility of normal hair allows for a broad range of shampoo bar formulations, enabling manufacturers to offer a variety of products that appeal to a large customer base. As a result, this segment has emerged as the dominant contributor to the global market, driven by its universal appeal and adaptability.

The oily segment is expected to register the fastest CAGR during the forecast period. Shampoo bars specifically formulated for oily hair have gained substantial popularity due to their ability to balance oil production, reduce frizz, and provide a longer-lasting clean. Furthermore, rising awareness about the benefits of sulfate-free and natural ingredients has driven the adoption of shampoo bars among consumers with oily hair seeking alternatives to traditional liquid shampoos. Notable manufacturers in this industry have increased their efforts to ensure that people with oily scalp can look after their hair care routines by using their products. For instance, Ethique has a range of offerings in this space, including the ‘Clarifying Shampoo Bar for Oily Scalp and Hair: St Clements’ and the ‘Volumising Shampoo Bar for Fine, Flat Hair: Sweet & Spicy,’ among others.

Distribution Channel Insights

Online distribution channels held the highest market share in 2023. The rise of e-commerce platforms such as Amazon, Alibaba, Flipkart, and many other global players has enabled manufacturers to reach a wider audience, increasing the visibility and availability of shampoo bars globally. Online channels also enable consumers to research, compare, and purchase products at their convenience, thus offering higher customer satisfaction. Moreover, the influence of social media marketing and online reviews significantly impacts purchasing decisions and drives sales. As a result, online platforms have emerged as a leading contributor to the global market for shampoo bars.

Offline distribution channels are expected to register the fastest CAGR from 2024 to 2030. The introduction of shampoo bars in supermarkets, specialty retail shops, and salons has improved product visibility and accessibility for consumers. These stores allow customers to experience products physically, ensuring a sense of trust and loyalty. Moreover, strategic partnerships between manufacturers and offline retailers have led to targeted promotions, demos, and workshops, enhancing product awareness and driving sales. As consumers increasingly seek authentic experiences and personalized interactions, the offline distribution channel is expected to generate a steady demand for shampoo bars over the forecast period.

Regional Insights

North America dominated the global market with a revenue share of 65.4% in 2023. This is attributed to the region's robust consumer demand for sustainable and eco-friendly personal care products. The U.S. and Canada, in particular, have witnessed a significant shift towards natural and organic products, creating opportunities for shampoo bars to gain traction. Moreover, the presence of several key market players, such as Procter & Gamble and HiBAR, has contributed to the region's leading market share. These companies have successfully addressed consumer preferences by offering a wide range of shampoo bar products that cater to diverse hairs and needs.

U.S. Shampoo Bar Market Trends

The U.S. held the largest share of the regional market in 2023. Rising consumer awareness regarding plastic-free packaging of personal care products and user convenience offered by shampoo bars over gel-based or liquid-based shampoos have contributed to an increased demand for plant-based and organically produced shampoo bars. Additionally, manufacturers are extensively promoting their products on social media platforms, which has led to a steady demand growth from untapped and new customers in the economy.

Europe Shampoo Bar Market Trends

Europe accounted for a notable share of the global market in 2023. A growing awareness regarding environmental concerns, veganism, and health & wellness has led to higher demand for plant-based and ethically sourced ingredients in the personal care product space in the European market. Furthermore, the presence of a well-established cosmetics industry and a high concentration of prominent market players such as L'Oréal, Lush Retail, and L’Occitane Groupe S.A. has facilitated the widespread availability and promotion of shampoo bars across the region.

The UK accounted for a significant share of the regional market in 2023. The younger population in the country is increasingly shifting its preferences towards sustainability in products across various segments, including personal care. Parabens- and sulfate-free shampoo bars have perfectly catered to the requirements of these consumers. In addition, local brands such as Lush Retail have expanded their operations in the UK and Ireland. These factors have collectively contributed to increased awareness and high demand for shampoo bars.

Asia Pacific Shampoo Bar Market Trends

Asia Pacific is expected to register the fastest CAGR over the forecast period. This is attributed to the region's rapidly expanding middle-class population, increasing awareness regarding environmental issues, and growing demand for natural and organic personal care products. A large and diverse consumer base, particularly in countries such as China, India, and Japan, has created a high-potential market for shampoo bars. Moreover, the region's e-commerce boom and social media penetration have enabled manufacturers to effectively reach out and engage with consumers, driving sales and adoption of these products.

In India, urbanization and income levels among the middle-income population group are experiencing a rapid growth trajectory. Anticipating the market potential, international brands such as Procter & Gamble, L'Oréal, and others have expanded their operations in the economy, offering a diverse range of products addressing the requirements of consumers. Furthermore, the growing focus on sustainability and eco-friendliness has led to increased demand for products that align with these values, further fueling the growth of this market.

Key Shampoo Bar Company Insights

Some key companies involved in the shampoo bar market include Lush Retail Ltd., Ethique Limited, and L’OCCITANE INTERNATIONAL SA, among others.

-

Lush Retail Ltd. is a UK-based cosmetics retailer offering personal care products in hair care, body care, skincare, and fragrance categories. In the hair care category, Lush offers a variety of products such as shampoos, conditioners, hair treatments, henna-based hair colors, and a dedicated product range for the Afro and Vegan hair care segment. The products offered by Lush are made from ethically sourced ingredients, are 100% vegetarian, and are handcrafted. The company has opened the Lush HairLab salon in Brighton and offers various hair care-related services.

-

Ethique Limited is a New Zealand-based cosmetics company that specializes in the development and manufacturing of sustainable, eco-friendly, and cruelty-free personal care products. The company aims to provide effective, gentle, and environmentally responsible alternatives to traditional cosmetic products. Its hair care products range includes shampoo bars and conditioner bars catering to the needs of normal, dry, and oily scalp types. Ethique focuses on natural ingredients, zero-waste packaging, and vegan-friendly formulations for its products.

Key Shampoo Bar Companies:

The following are the leading companies in the shampoo bar market. These companies collectively hold the largest market share and dictate industry trends.

- Lush Retail Ltd.

- L'Oréal S.A.

- Procter & Gamble

- Ethique Limited

- Shiseido Co.,Ltd.

- L’OCCITANE INTERNATIONAL SA

- grüum

- HiBAR

- Davines S.p.A.

- J.R.LIGGETT LTD.

Recent Developments

-

In July 2024, L'Oréal S.A. and Debut Biotech entered into an agreement to develop bio-identical ingredients to be used in the production of global beauty and personal care brands of L'Oréal across skin, hair, color cosmetics, and fragrance segments. This partnership is an effort from both companies towards sustainable development of beauty products. The bio-based ingredients would be prepared through Debut Biotech’s proprietary biomanufacturing processes that combine fermentation and cell-free technology.

-

In January 2024, HiBAR, Inc. announced that it had received ‘Vegan Certification’ from the Vegan Society. The company’s conditioner bars and shampoo bars have already received the Leaping Bunny Certification from the Coalition for Consumer Information on Cosmetics (CCIC). This recent recognition is expected to strengthen the efforts of HiBAR towards vegan sourcing of ingredients and educate its customer base about plant-based products and their benefits.

Shampoo Bar Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.71 billion

Revenue Forecast in 2030

USD 24.59 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Hair, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, Australia, South Korea, India, Brazil, Argentina, South Africa, UAE

Key companies profiled

Lush Retail Ltd.; L'Oréal S.A.; Procter & Gamble; Ethique Limited; Shiseido Co.,Ltd.; L’OCCITANE INTERNATIONAL SA; grüum; HiBAR; Davines S.p.A.; J.R.LIGGETT LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shampoo Bar Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global shampoo bar market report based on hair, distribution channel, and region.

-

Hair Outlook (Revenue, USD Million, 2018 - 2030)

-

Normal

-

Dry

-

Oily

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.