- Home

- »

- Pharmaceuticals

- »

-

SGLT2 Inhibitors Market Size, Share & Growth Report, 2030GVR Report cover

![SGLT2 Inhibitors Market Size, Share & Trends Report]()

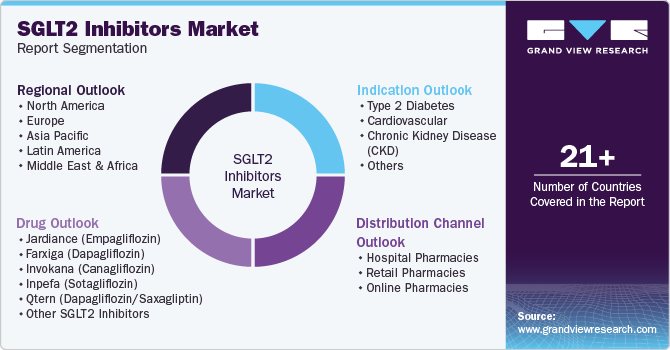

SGLT2 Inhibitors Market Size, Share & Trends Analysis Report By Drug (Jardiance, Farxiga, Inpefa, Invokana), By Indication (Diabetes, Cardiovascular), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-322-4

- Number of Report Pages: 159

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

SGLT2 Inhibitors Market Size & Trends

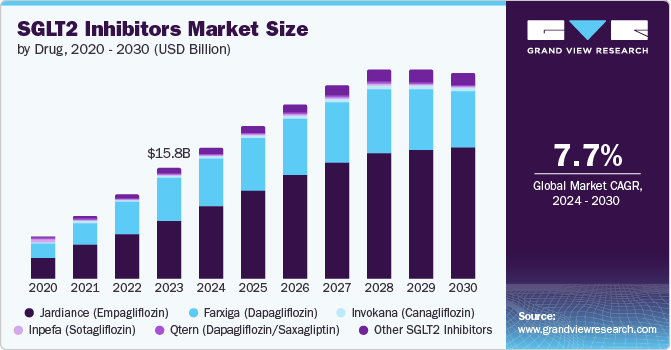

The global SGLT2 inhibitors market size was estimated at USD 15.85 billion in 2023 and is projected to grow at a CAGR of 7.71% from 2024 to 2030. The demand for the market is primarily driven by increasing incidence of type 2 diabetes worldwide. In addition, constant R&D endeavors leading to the development of new and improved formulations of sodium-glucose cotransporter-2 (SGLT2) inhibitors that boost market growth.

According to the International Diabetes Federation (IDF), around 537 million people suffered from diabetes worldwide in 2021. More than 3 in 4 adults with diabetes belong from low- and middle-income countries. In addition, the number of new cases of diabetes is expected to be 643 million by 2030 and 783 by 2045. Type 2 diabetes, comprising approximately 90% of all diabetes cases, is the most prevalent form of the disease. The rapid development and urbanization have resulted in significant dietary and lifestyle changes, leading to a sharp rise in type 2 diabetes incidence. The increasing rates of obesity, sedentary lifestyles, and poor dietary habits have contributed to a growing number of cases among children, adolescents, and younger adults.

Furthermore, rising research in the field of diabetic treatment opens new opportunities in the market for new players. Several clinical studies have shown that SGLT2 inhibitors can significantly reduce the risk of hospitalization for heart failure in patients with and without diabetes. According to study published by the New England Journal of Medicine in 2022, SGLT2 inhibitor Dapagliflozin has been shown to reduce the combined risk of cardiovascular death among patients with heart failure who have a mildly reduced or preserved ejection fraction or worsening heart failure. This finding underscores the therapeutic potential of dapagliflozin in a broader heart failure population, extending its benefits beyond those with reduced ejection fraction to include those with less severe forms of heart failure.

In addition, supportive government policies and insurance coverage for diabetes treatments facilitate the uptake of SGLT2 inhibitors. In February 2024, TheracosBio has expanded its partnership with the Mark Cuban Cost Plus Drug Company to offer SGLT2 inhibitor drug BRENZAVVY (bexagliflozin) directly to healthcare providers through the “Cost-Plus Drugs Marketplace” program. With a list price 90% lower than comparable medications, BRENZAVVY enhances accessibility for the uninsured and streamlines care for insured patients by removing insurance-related obstacles and cost-sharing issues. Pharmacies, hospitals, and other healthcare entities can now purchase BRENZAVVY through the business portal, business.costplusdrugs.com, at USD 47.85 per 30-tablet bottle. This partnership is expected to boost SGLT2 inhibitor market growth over the forecast period.

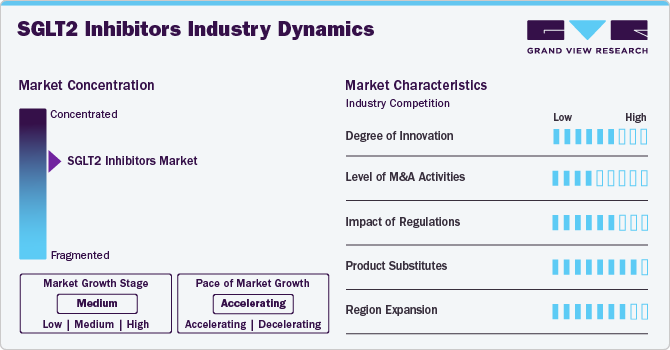

Industry Dynamics

The degree of innovation is high in the market characterized by a development of fixed-dose combination therapies, pairing SGLT2 inhibitors with other antidiabetic agents, improves patient adherence and therapeutic outcomes. In addition, new formulations and delivery methods, such as extended-release versions, are being developed to improve patient convenience and adherence. Some of the most common approved SGLT2 inhibitors include Jardiance (empagliflozin), Farxiga (dapagliflozin), Invokana (canagliflozin), Inpefa (sotagliflozin), and Qtern (dapagliflozin/saxagliptin).

The level of merger and acquisition is moderate in market due increase interest of pharmaceutical companies to acquire smaller biotech firms with promising SGLT2 inhibitor portfolios to consolidate their market position and expand their product offerings. For instance, in February 2023, AstraZeneca completed acquisition of CinCor Pharma Inc., a U.S. based clinical stage biopharmaceutical organization, engaged in development and commercialization of novel treatments resistant and uncontrollable hypertension and CKD. This acquisition is anticipated to drive SGLT2 inhibitors market.

Regulatory agencies such as the FDA and EMA have approved SGLT2 inhibitors for additional indications beyond Type 2 diabetes, including heart failure and chronic kidney disease. This trend reflects the growing recognition of the cardiovascular and renal benefits of these drugs.

This market has many products substitute including DPP-4 Inhibitors (Saxagliptin, Sitagliptin, Linagliptin), GLP-1 Receptor Agonists (Liraglutide, Dulaglutide, Exenatide), Metformin, insulin, Sulfonylureas, ACE Inhibitors, and others. These substitutes offer alternative or complementary options to SGLT2 inhibitors, providing various aspects of diabetes management, cardiovascular health, and kidney protection.

North America, particularly the United States, remains a dominant market due to high diabetes prevalence, advanced healthcare infrastructure, and strong regulatory support. In addition, countries such as Germany, the UK, and France exhibit strong adoption rates due to well-established healthcare systems and favorable guidelines promoting SGLT2 inhibitors.

Drug Insights

The Jardiance segment dominated the market and accounted for 52.60% of the global revenue in 2023 and is anticipated to grow significantly over the forecast period. Jardiance is used for treatment of patients with type 2 diabetes and risk of heart failure. According to Boehringer Ingelheim International GmbH, in 2023, Jardiance, the leading SGLT2 inhibitor, has achieved 59 million prescriptions worldwide since approval. In addition, it has contributed to extending patient lives by over 461,000 patient-life years. Furthermore, the Centers for Medicare and Medicaid Services (CMS) has included Jardiance (empagliflozin) in the “Drug Price Negotiation Program” as part of the Inflation Reduction Act (IRA). Such initiatives of government organizations are expected to drive segment growth during the forecast period.

The Farxiga segment is the second largest segment in the market. This can be attributed to approval of drug for new indications. For instance, in May 2023, AstraZeneca has received FDA approval in the US for FARXIGA to reduce the risk of cardiovascular death, hospitalization for heart failure, and urgent heart failure visits in adults with heart failure. This approval was based on positive outcomes from the DELIVER Phase III trial. Previously, FARXIGA was approved for treating adults with heart failure with reduced ejection fraction (HFrEF). This approval is anticipated to boost segment growth.

Indication Insights

Type 2 Diabetes segment dominated the market with a market share of 71.99% in 2023. This can be attributed to rising awareness of diabetes in developed and developing countries and increase in treatment population. According to the Center for Disease Control and Prevention (CDC), in 2024, around 38.2 million people with type 2 diabetes visit physician’s office for primary diagnosis. In addition, around 579,000 people with type 2 diabetes visit emergency departments for diagnosis and treatment. Thus, rising visits of type 2 diabetes patients is expected to boost segment growth over the forecast period.

The cardiovascular segment is anticipated to grow at fastest growth over the forecast period. SGLT2 inhibitors significantly reduce the risk of hospitalization for heart failure, providing a substantial benefit to patients with both reduced and preserved ejection fraction. Thus, increasing prevalence of cardiovascular disease is anticipated to positively impact market growth. According to the National Center for Biotechnology Information (NCBI), in 2023, over 64 million people suffered from heart failure worldwide. Thus, rising government efforts to reduce its social and economic burden is expected to boost demand for SGLT2 Inhibitors worldwide and driving segment growth.

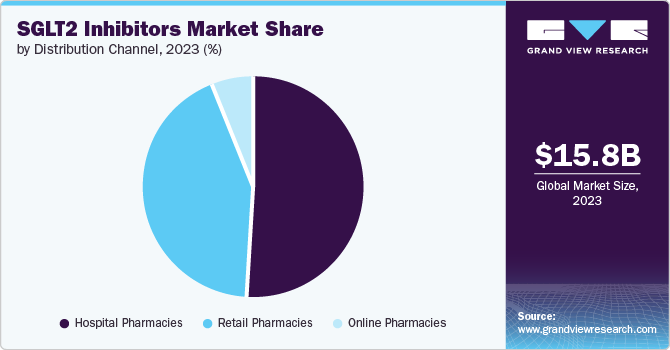

Distribution Channel Insights

The hospital pharmacies segment held a considerable market share of 50.52% in 2023. This dominance is attributed due to the high advantages associated with it over other pharmacies such as retail and online. Hospital pharmacies operate 24 hours a day, 7 days a week, providing continuous access to medications and pharmacy services for inpatient and emergency care, whereas many retail pharmacies have limited operating hours and may not be accessible during evenings, weekends, or holidays.

The online pharmacies segment is projected to witness a significant growth rate over the forecast period. Online pharmacies provide patients with convenient access to SGLT2 inhibitors, allowing them to order medications from the comfort of their homes and have them delivered directly to their doorstep, especially beneficial for patients with mobility limitations or those residing in remote areas. In addition, it offers a discreet and confidential option for patients to purchase SGLT2 inhibitors, reducing the stigma associated with certain medical conditions, such as diabetes or erectile dysfunction, and providing patients with greater privacy in managing their healthcare needs.

Regional Insights

The North America SGLT2 inhibitors market accounted for 40.92% share in 2023. Obesity rates in North America have been steadily increasing, leading to a higher incidence of obesity-related conditions such as Type 2 diabetes, cardiovascular disease, and chronic kidney disease. SGLT2 inhibitors offer benefits beyond glycemic control, including weight loss and cardiovascular protection, making them attractive treatment options for patients with multiple comorbidities. Thus, rising incidence of these conditions is expected to drive market growth.

U.S. SGLT2 Inhibitors Market Trends

The SGLT2 inhibitors market in the U.S. held the largest regional share in 2023. The Food and Drug Administration (FDA) in the U.S. has approved multiple SGLT2 inhibitors for various indications, including Type 2 diabetes, heart failure, and chronic kidney disease. Expanded indications and label updates have expanded the market potential for SGLT2 inhibitors, leading to higher demand among healthcare providers and patients.

Europe SGLT2 Inhibitors Market Trends

Europe SGLT2 inhibitors market was identified as a lucrative region in this industry. The growth of the market in the region can be attributed to a steady increase in the prevalence of diabetes, particularly Type 2 diabetes, driven by factors such as aging populations, sedentary lifestyles, and obesity. SGLT2 inhibitors are effective in managing glycemic control in diabetes, making them a sought-after treatment option.

The SGLT2 inhibitors market in UK is expected to grow over the forecast period due to the presence has a well-developed healthcare infrastructure and the availability of a wide range of medical services associated with treatment. This facilitates the distribution and availability of SGLT2 Inhibitors effectively across the UK and supports market expansion.

The Germany SGLT2 inhibitors market held largest share in Europe in 2023. This can be attributed to rising incidence of diabetes and associated diseases. CKD is anticipated to continuously rise along with interconnected conditions such as hypertension, diabetes, and obesity. According to the NCBI study published in 2021, approximately 10% of population aged 40 years and over suffered from renal insufficiency or CKD.

The SGLT2 inhibitors market in France is anticipated to grow during the forecast period due to increasing prescription rate of SGLT2 inhibitors for management of diabetes and its associated conditions. According to the French Health Insurance Database, SGLT2 inhibitors became the second largest prescribed diabetic drug after metformin at the end of 2021.

Asia Pacific SGLT2 Inhibitors Market Trends

Asia Pacific SGLT2 inhibitors market is anticipated to witness the fastest growth from 2024 to 2030. The adoption of drugs in the Asia Pacific is driven by increasing prevalence of diabetes, proven efficacy and additional benefits of these medications, increasing awareness, increase patient preference, and high economic growth.

The China SGLT2 inhibitors market is expected to witness significant growth over the forecast period. This can be attributed to increasing prevalence of diabetes and high demand for drugs to manage condition. According to the International Diabetes Federation (IDF), around 1,079,960,800 people suffered from diabetes in China in 2021. Among them, approximately 13% of the population were adults.

The SGLT2 inhibitors market in Japan held a considerable revenue share in 2023, due to rising geriatric population and increasing prevalence of diabetes. Geriatric people are at high risk of developing diabetes, CKD, and cardiovascular disease conditions owing to high comorbidity and weak immune system.

Latin America SGLT2 Inhibitors Market Trends

Latin America SGLT2 inhibitors market was identified as a lucrative region in this industry. This can be attributed to rising incidence of chronic kidney disease (CKD). According to Kidney International Reports published in 2023, the mean prevalence of CKD was 9.9% in Latin America in 2021. Thus, rising prevalence of CKD is expected to boost adoption of SGLT2 inhibitors in the region.

The SGLT2 inhibitors market in Brazil dominated SGLT2 inhibitors market in Latin America in 2023. This can be attributed to rising awareness about diabetes, cardiovascular, and CKD benefits among physicians and patients. This factor is anticipated to drive market growth during forecast period.

Middle East & Africa SGLT2 Inhibitors Market Trends

MEA SGLT2 inhibitors market was identified as a lucrative region in this industry. The prevalence of diabetes is increasing in the MEA region, driven by various factors such as lifestyle changes, stress, and genetic predisposition.

The SGLT2 inhibitors market in Saudi Arabia is projected to grow fastest in the coming years largely due to high prevalence rates of diabetes globally, driven by rapid urbanization, lifestyle changes, and increasing rates of obesity. This has made a significant demand for effective diabetes management therapies, including SGLT2 inhibitors.

Key SGLT2 Inhibitors Company Insights

Leading players in the market include Boehringer Ingelheim International GmbH, AstraZeneca, Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.), and Lexicon Pharmaceuticals, Inc. These key players are leveraging their existing customer bases in the region to prioritize maintaining high-quality standards and expanding their market presence. This strategy is particularly effective for brands that have already established a strong position in the market. Additionally, these companies are heavily investing in the advanced development of new SGLT2 inhibitor drugs for diabetes treatment.

Glenmark Pharmaceuticals Ltd, Lexicon Pharmaceuticals, Inc., and TheracosBio, LLC are some of the emerging market players in the market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key SGLT2 Inhibitors Companies:

The following are the leading companies in the SGLT2 inhibitors market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer Ingelheim International GmbH

- AstraZeneca

- Merck & Co., Inc.

- Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.)

- TheracosBio, LLC

- Lexicon Pharmaceuticals, Inc.

- Eli Lilly and Company

- Bristol-Myers Squibb Company

- Glenmark Pharmaceuticals Ltd.

Recent Developments

-

In June 2024, the U.S. FDA approved Farxiga (dapagliflozin) developed by AstraZeneca for treatment of type-2 diabetes in patients aged 10 years and older. This additional approval is expected to boost market growth.

-

In April 2024, Boehringer Ingelheim International GmbH announced that its EMPACT-MI phase 3 clinical trial showed a 10% risk reduction in hospitalized heart failure patient after use of Jardiance (empagliflozin). The positive result of study is anticipated to boost demand for drugs over the forecast period.

-

In September 2023, Eli Lilly and Company and Boehringer Ingelheim International GmbH jointly announced that the U.S. FDA approved its Jardiance (empagliflozin) owing to its ability to reduce risk of cardiovascular mortality and CKD in hospitalization.

SGLT2 Inhibitors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.85 billion

Revenue forecast in 2030

USD 29.43 billion

Growth rate

CAGR of 7.71% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug, indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; and Kuwait

Key companies profiled

Boehringer Ingelheim International GmbH; AstraZeneca

Merck & Co., Inc.; Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.); TheracosBio, LLC;

Lexicon Pharmaceuticals, Inc.; Eli Lilly and Company; Bristol-Myers Squibb Company; Glenmark Pharmaceuticals Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global SGLT2 Inhibitors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global SGLT2 Inhibitors market report based on drug, indication, distribution channel, and region:

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Jardiance (Empagliflozin)

-

Farxiga (Dapagliflozin)

-

Invokana (Canagliflozin)

-

Inpefa (Sotagliflozin)

-

Qtern (Dapagliflozin/Saxagliptin)

-

Other SGLT2 Inhibitors

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Type 2 Diabetes

-

Cardiovascular

-

Chronic Kidney Disease (CKD)

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global SGLT2 inhibitors market size was estimated at USD 15.85 billion in 2023 and is expected to reach USD 18.85 billion in 2024.

b. The global SGLT2 inhibitors market is expected to grow at a compound annual growth rate of 7.71% from 2024 to 2030 to reach USD 29.43 billion by 2030.

b. North America dominated the SGLT2 inhibitors market with a share of 40.92% in 2023. Factors such as high prevalence of type 2 diabetes, obesity, cardiovascular diseases, and a well-established healthcare infrastructure are responsible for market growth.

b. Some key players operating in the SGLT2 inhibitors market include Boehringer Ingelheim International GmbH, AstraZeneca, Merck & Co., Inc., Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.), TheracosBio, LLC, Lexicon Pharmaceuticals, Inc., Eli Lilly and Company, Bristol-Myers Squibb Company, and Glenmark Pharmaceuticals Ltd.

b. Key factors that are driving the SGLT2 inhibitors market growth include a growing prevalence of diabetes and cardiovascular diseases, technological advancements in drug development, increasing awareness and diagnosis rate and rising geriatric population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."