- Home

- »

- Electronic & Electrical

- »

-

Sewing Machine Market Size & Share, Industry Report, 2030GVR Report cover

![Sewing Machine Market Size, Share & Trends Report]()

Sewing Machine Market Size, Share & Trends Analysis Report By Type (Electric, Computerized, Manual), By Use Case (Apparel, Shoes, Bags, Others), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-923-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Sewing Machine Market Size & Trends

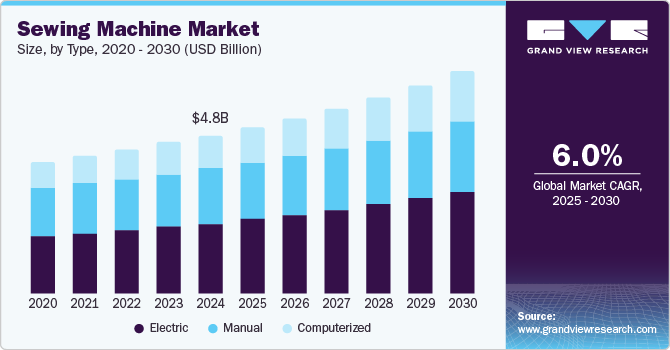

The global sewing machine market size was valued at USD 4.84 billion in 2024 and is projected to grow at a CAGR of 6.0% from 2025 to 2030. Changes in fashion and style trends, increasing demand for tailor-made apparel, availability of electric and technology-assisted sewing machines, innovations such as artificial vision, accessibility to enhanced fabrics and other essential materials, and process automation in the textile industry are key growth driving factors for this market.

Advancements in technology significantly influence this market. The emergence of electric, computer-assisted, and intelligence technology-equipped sewing machines has driven the changes in the dynamics of this market. In addition, changes in customer behavior, noteworthy penetration of e-commerce businesses, ease of doing business in the textile industry enabled by the technology, and availability of support provided by governments and other organizations to encourage production within economies, and significant changes in fashion trends have stimulated inclination towards automation in textile manufacturing. This has increased the demand for advanced sewing machines in multiple countries.

Increasing awareness regarding sustainability and environmental impact has developed influence over manufacturing processes and overall operations of textile industry. Introduction of advanced machines and automation solutions equipped with modern technology is expected to add growth opportunities for this market. For instance, in August 2024, Brother International Corporation, one of the key suppliers for home office and business solutions and products, introduced Aveneer EV1. This newly launchd sewing, quilting, and embroidery machine is equipped with StitchVision Technology, large needle to arm workspace area, voice guidance capabilities, intelligent stitch regulator, edge detection system, Artificial Intelligence thread art technology and more.

Type Insights

The electric sewing machines segment dominated the global industry with revenue share of 44.8% in 2024. This is attributed to multiple factors, including the increasing inclination towards automation among key textile manufacturers, the growing focus on capacity expansions and cost reduction among apparel industry participants, rising awareness regarding energy efficiency, and operational excellence strategy adoption among multiple end-user industries, including footwear, accessories, fashion, and others.

Computerized sewing machines segment is projected to experience the highest CAGR from 2025 to 2030. Increasing demand for customized apparel, shoes, and bags, the growing availability of artificial intelligence technology integrated solutions, changes in fashion industry trends, and enhanced productivity accomplished by the existing users are some of the key growth driving factors for this market.

Use Case Insights

The apparel segment held the largest revenue share of the global sewing machines industry in 2024. This segment is mainly driven by the increasing demand for electric and computer-assisted sewing machines from large enterprises and SMEs, the growing trend of process automation in apparel manufacturing, and the rising growth experienced by the apparel industry owing to unprecedented penetration of the e-commerce industry and overall growth in personal disposable incomes. Changes in customer preferences, demand for a wide range of collections from different users worldwide, increasing assistance by online shopping, and significant support by governments to upscale production within the country are projected to enhance demand for advanced sewing machines from the apparel industry.

The shoes segment is anticipated to experience the fastest growth during the forecast period. The growing awareness regarding sustainable manufacturing processes, increasing focus of manufacturers and marketers on reducing environmental impact while reducing costs by adopting technology solutions, rising demand for a wide variety of products, and trends in fashion and style among young consumers worldwide are primarily driving the growth of this segment.

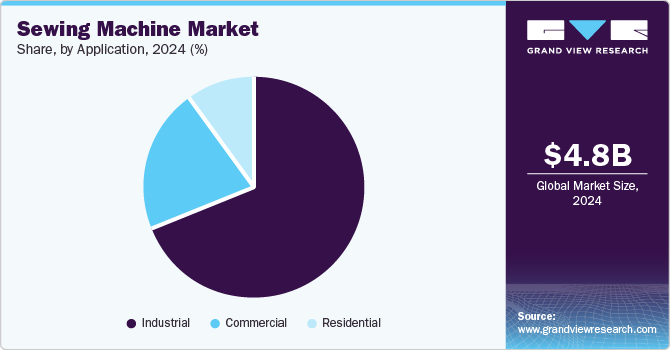

Application Insights

The industrial application segment dominated the global sewing machine market in 2024. This is attributed to factors such as the growing focus of large textile enterprises on the adoption of effective automation technology and advanced sewing machines, which are equipped with modern technologies such as intelligence vision, stitch regulation, built-in design availability, touchscreen controls, mobile app integration, and more.

Commercial application segment is projected to experience substantial growth from 2025 to 2030. Commercial buyers, not key industries or manufacturing units, often belong to small or medium-scale businesses that play a vital role in the textile industry ecosystem. This includes small vendors, product suppliers, local tailoring businesses, footwear or accessories market participants, apparel designers, and others. Enhanced assistance from advanced sewing machines in reducing costs and improving productivity is anticipated to drive growth for this segment in the coming years.

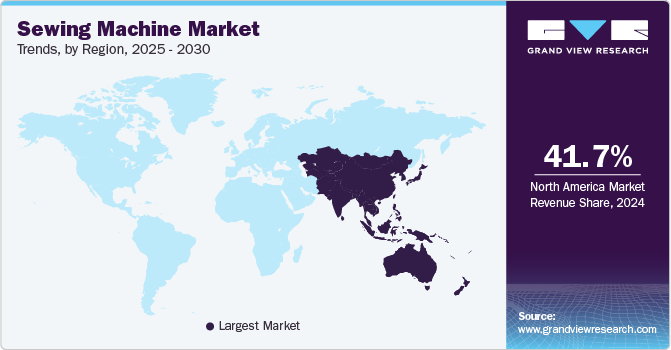

Regional Insights

North America sewing machine industry is expected to experience substantial growth during the forecast period. This is mainly influenced by the changes in fashion industry trends, increasing demand for customized and personalized clothing solutions, rising focus of manufacturers on reduction of costs, enhancement of productivity, and adoption of significant technology advancements.

U.S. Sewing Machine Market Trends

The U.S. sewing machine industry held the largest revenue share of the regional market in 2024, driven by significant changes in customer preferences within the textiles industry and growing demand due to industry automation. This growth is further attributed to the availability of cutting-edge technology-assisted sewing machines and the presence of large apparel businesses in the country.

Asia Pacific Sewing Machine Market Trends

Asia Pacific sewing machine market dominated the global industry, with a revenue share of 41.7% in 2024. This is attributed to factors such as key companies in textile and other user industries' growing adoption of process automation and enhanced sewing experience machinery, rapid growth in digitization, availability of advanced products in the region, and the presence of countries with growing apparel product demand, such as India, China, and others.

China sewing machine market dominated the regional sewing machine industry with the largest revenue share in 2024. This market is primarily driven by China's significant participation in global clothing exports, the increasing trend of automation and capacity enhancements in the textile industry, the availability of advanced sewing machines, and noteworthy technological advancements in product features.

Europe Sewing Machine Market Trends

Europe sewing machine market is projected to experience significant CAGR from 2025 to 2030. This market is primarily influenced by the rapid pace of digital transformation, the increasing focus of industry participants in textile, footwear, and fashion accessories on the adoption of process automation, the availability of technologically advanced machines, and more.

Germany held the largest revenue share of Europe's sewing machine industry in 2024 owing to the presence of a robust manufacturing industry, availability and accessibility of newly launched and advanced product portfolios equipped with smart sewing machines, increasing demand for process automation, and changes in fashion and style trends of the textile industry.

Key Sewing Machine Company Insights

Some key global sewing machine companies include Brother, AISIN CORPORATION, DÜRKOPP ADLER, BERNINA, JANOME Corporation, and others. To address the growing demand from industrial users and competition in the global market, key participants have adopted strategies such as enhanced portfolios, the addition of technology advancements in product features, post-sale service improvements, new product launches, and more.

-

Brother offers a range of products and services, including sewing machines, embroidery machines, sewing and embroidery machines, quilting and sewing machines, sergers and cover stitch machines, and more.

-

BERNINA specializes in the computerized and technology-driven sewing machine industry. It offers machines, accessories, software, and more. The machines it offers include sewing machines, quilting machines, embroidery machines, and overlockers.

Key Sewing Machine Companies:

The following are the leading companies in the sewing machine market. These companies collectively hold the largest market share and dictate industry trends.

- AISIN CORPORATION

- AMF Reece - Cars s.r.o.

- BERNINA

- Brother

- DÜRKOPP ADLER

- Elna International Corporation

- Jack Sewing Machines

- JANOME Corporation

- SEIKO SEWING MACHINE CO., LTD.

- PEGASUS CO., LTD.

View a comprehensive list of companies in the Sewing Machine Market

Recent Developments

-

In June 2024, BERNINA launched three new additions to its diverse portfolio. The BERNINA 990 is the largest and most advanced model to date, designed for both sewing and embroidery and catering to users of all skill levels. The company also introduced the BERNINA 735 Patchwork Edition and the bernette 08 Straight Stitch machine, emphasizing its commitment to innovation and Swiss craftsmanship.

Sewing Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.09 billion

Revenue forecast in 2030

USD 6.80 billion

Growth rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, use case, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Brazil, South Africa

Key companies profiled

AISIN CORPORATION; AMF Reece - Cars s.r.o.; BERNINA; Brother; DÜRKOPP ADLER; Elna International Corporation; Jack Sewing Machines; JANOME Corporation; SEIKO SEWING MACHINE CO., LTD.; PEGASUS CO.,LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sewing Machine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sewing machine market report based on type, use case, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric

-

Computerized

-

Manual

-

-

Use Case Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Shoes

-

Bags

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."