Serviced Apartment Market Size, Share & Trends Analysis Report By Type (Long-Term, Short-Term), By End-use (Corporate/Business Traveler, Leisure Traveler), By Booking Mode, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-424-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Serviced Apartment Market Size & Trends

The global serviced apartment market was estimated at USD 112.42 billion in 2023 and is projected to grow at a CAGR of 12.7% from 2024 to 2030. The market is driven by a growing demand for flexible, cost-effective accommodations that cater to both business and leisure travelers. Factors such as increased corporate travel, employee relocation, and the rise of digital nomads contribute significantly to market growth. Serviced apartments offer a "home away from home" experience, with amenities like kitchens and living spaces, making them ideal for extended stays. In addition, the rise of online booking platforms, urbanization, and the appeal of privacy and safety in a post-pandemic world has further boosted demand, particularly in emerging markets and urban centers.

Growth in corporate travel significantly drives market expansion by increasing the demand for long-term, flexible, and cost-effective accommodations for business travelers. According to the Global Business Travel Association (GBTA), business travel accounted for about 20% of global travel expenditures in 2021 and increased by 47%, reaching $1.03 trillion in 2022. Projections indicate an additional 32% growth in 2023, with spending expected to reach $1.4 trillion by 2024, surpassing pre-pandemic levels.

Companies often require housing solutions for employees on extended assignments, relocations, or project-based work, where serviced apartments provide a more comfortable and economical alternative to hotels. With features like fully equipped kitchens, living spaces, and home-like amenities, these apartments offer a balance between convenience and privacy, making them ideal for corporate travelers seeking a productive and comfortable environment for longer stays. This trend has expanded the market, especially in business hubs and major cities worldwide.

Moreover, an increase in tourism drives market growth by increasing demand for more spacious, affordable, and flexible accommodations, especially for families and long-term travelers. As more tourists seek personalized and home-like stays, serviced apartments offer an attractive alternative to traditional hotels, with amenities such as kitchens, living areas, and multiple bedrooms. These apartments cater to groups, providing cost savings through self-catering options and extended stays. In addition, as tourists increasingly prefer unique, localized experiences, serviced apartments often provide the flexibility and convenience needed for longer or more immersive travel experiences.

Key players in the market are driving innovation by introducing tech-driven solutions and personalized services to enhance guest experiences. Many companies are adopting smart home technology, offering app-based control of in-room features such as lighting, climate, and entertainment. Contactless check-ins, mobile concierge services, and virtual tours have also become standard in response to increased demand for convenience and safety. In addition, some operators are customizing apartment designs to cater to niche markets like eco-conscious travelers or long-stay professionals by incorporating sustainable practices, flexible workspaces, and wellness amenities. These innovations are helping serviced apartments stay competitive and attract a broader audience.

Type Insights

Serviced apartments for short-term stays accounted for a share of about 65% in 2023. Serviced apartments are primarily used for short-term stays due to their flexibility, convenience, and cost-effectiveness compared to hotels. They offer the comfort of home-like amenities making them ideal for travelers, business professionals, or temporary relocations. In addition, serviced apartments often come with housekeeping services and utilities included, providing a hassle-free, ready-to-live option for short-term visitors. This makes them particularly attractive for those who need a comfortable yet temporary living arrangement without the long-term commitment of traditional rentals.

The demand for long-term serviced apartments is expected to grow at a CAGR of 13.9% from 2024 to 2030. There is a growing preference for serviced apartments for long-term stays due to their combination of home-like comfort and hotel-like amenities. Serviced apartments offer more space, privacy, and flexibility compared to traditional hotels, with features like fully equipped kitchens and separate living areas, making them ideal for extended stays. In addition, they often provide cost savings for longer durations, as rates are typically more competitive than hotels, likely favoring the segment growth.

End-use Insights

Serviced apartment for corporate/business traveler held a market share of about 52% in 2023. The market is benefiting from the rise of "bleisure travel”, where professionals combine business trips with leisure time, necessitating more spacious and well-equipped lodgings. Moreover, market expansion includes the growing preference for privacy and self-contained living spaces post-pandemic, increased adoption of remote work policies allowing for extended stays, and the rising popularity of serviced apartments among employees and digital nomads seeking turnkey living solutions in new cities, driving the segment growth.

The demand for serviced apartment for expats and relocators is anticipated to grow at a CAGR of 14.2% from 2024 to 2030. These accommodations offer a seamless transition to a new location, providing a home-like environment with the convenience of hotel services. This balance is particularly appealing for those facing the challenges of settling into a foreign country. In addition, these apartments usually come fully furnished with equipped kitchens, reducing the initial setup costs and logistical challenges for newcomers. The provision of utilities, housekeeping, and sometimes local cultural orientation services further enhances their appeal, offering a turnkey solution that simplifies the relocation process for both individuals and corporations managing employee transfers.

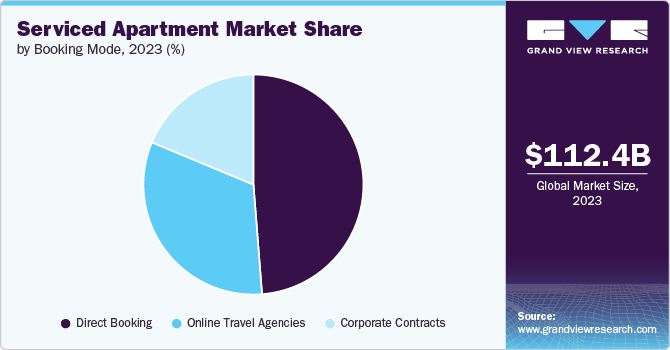

Booking Mode Insights

Direct booking accounted for a market share of around 48% in 2023. This direct approach allows for more competitive pricing by eliminating intermediary commissions, thereby increasing profit margins and potentially offering more attractive rates to customers. In addition, direct bookings facilitate enhanced customer data acquisition, enabling personalized marketing strategies and tailored service offerings that boost customer loyalty and repeat business. The COVID-19 pandemic has further accelerated this trend as travelers seek direct communication with property managers for up-to-date information on safety protocols and flexible cancellation policies.

The sales through corporate contracts are expected to grow at a CAGR of 14.2% from 2024 to 2030. The utilization of corporate contractors for booking serviced apartments is driven by several key business imperatives. It allows companies to leverage economies of scale, negotiating preferential rates and terms through volume bookings, thus optimizing cost efficiency in corporate travel and relocation budgets. These contractors often provide streamlined booking processes and centralized billing systems, enhancing operational efficiency and reducing administrative overhead for HR and travel management departments.

Regional Insights

The serviced apartment market in North America held a market share of around 37% in 2023. The North American market is primarily driven by robust corporate demand, increasingly mobile workforce trends, and the growing preference for flexible, home-like accommodations.Major players in this market include Oakwood Worldwide, which offers a range of serviced apartment solutions across premium and mid-tier segments; BridgeStreet Global Hospitality, known for its extensive network of corporate housing options; and AKA, which specializes in luxury extended-stay accommodations in prime urban locations. These providers are continually innovating their offerings to meet evolving consumer demands, incorporating smart home technologies, enhanced wellness amenities, and flexible booking options to maintain a competitive edge in this growing market segment.

U.S. Serviced Apartment Market Trends

The serviced apartment market in the U.S. held a market share of around 80% in 2023 in the North American market. The rise of the gig economy and remote work trends has also increased demand as professionals seek comfortable, well-equipped spaces for longer stays in various locations. In addition, the growing millennial workforce, with its preference for experience-based living and work-life balance, finds serviced apartments an attractive option. The U.S. market also benefits from a robust tourism sector, with both domestic and international travelers seeking more spacious, home-like alternatives to traditional hotels, especially for extended vacations or family travel.

Asia Pacific Serviced Apartment Market Trends

The serviced apartment market in Asia Pacific accounted for a revenue share of around 21% of global revenue in 2023. The growth of the market in the Asia Pacific region will be driven by increasing business travel, rising numbers of expatriates, and the expanding tourism sector in major countries such as China, India, Japan, and Australia. Economic growth in these countries is attracting multinational corporations, which fuels the demand for long-term accommodation solutions for business professionals. In addition, the preference for flexible, home-like stays among both business and leisure travelers, coupled with the cost-effectiveness of serviced apartments compared to hotels, is further boosting demand. Urbanization and infrastructure development in cities such as Shanghai, Mumbai, Tokyo, and Sydney also contribute to the sector's expansion in the region.

Europe Serviced Apartment Market Trends

The Europe serviced apartment market is expected to grow at a CAGR of 12.3% from 2024 to 2030. In Europe, the demand for serviced apartments is driven by factors such as increased business travel, a growing expatriate population, and the rising trend of extended stays. Major countries such as Spain, the UK, Germany, France, and the Netherlands are key markets due to their economic significance and business hubs. In these regions, companies such as The Ascott Limited, Frasers Hospitality, and Oakwood are expanding their portfolios to cater to the demand.

Key Serviced Apartment Company Insights

The competitive landscape of the serviced apartment industry is characterized by a diverse range of players, including global chains, regional operators, and independent providers. Major international brands such as The Ascott Limited, Frasers Hospitality, and Marriott International, Inc. lead with extensive portfolios and a strong presence in key markets worldwide. Regional operators like Adina Apartment Hotels in Europe also play a significant role, offering localized expertise and tailored services. Competition is driven by factors such as location, quality of amenities, pricing, and the ability to provide flexible, long-term accommodation solutions. In addition, the rise of new entrants and the growing trend of property management companies expanding into the serviced apartment sector further intensify the competitive dynamics.

Key Serviced Apartment Companies:

The following are the leading companies in the serviced apartment market. These companies collectively hold the largest market share and dictate industry trends.

- The Ascott Limited

- Frasers Hospitality

- The Serviced Apartment Company

- Staycity Ltd

- Habicus Group

- THE SQUA.RE SERVICED APARTMENTS

- adiahotels.com

- Viridian Apartments

- Adagio

- Marriott International, Inc.

Recent Developments

-

In August 2024, Ascott Limited announced its expansion in India, underscoring its commitment to enhancing its footprint in the region. The company plans to increase its presence by adding several new properties across key cities, leveraging the growing demand for serviced apartments driven by business travel and long-term stays. This strategic move aligns with Ascott's broader growth strategy, aiming to capitalize on India's burgeoning market and establish a stronger foothold in one of the world's fastest-growing economies.

-

In July 2024, Ascott Limited announced a global partnership with Chelsea FC, enhancing its brand visibility and engagement through the exclusive Chelsea FC Global Hotels Partnership. This collaboration aims to leverage Chelsea FC's global appeal to promote Ascott's serviced apartments and extend its market reach. The strategic alliance will include co-branded marketing initiatives and exclusive benefits for Chelsea FC fans, reinforcing Ascott's position as a leading player in the global serviced apartment market while tapping into the extensive fanbase of one of football's most recognized clubs.

-

In August 2024, Frasers Hospitality announced its ambitious plan to open 20 new properties over the next four years, reflecting its commitment to expanding its global footprint. This strategic initiative is designed to capitalize on the post-pandemic recovery and growing demand for serviced apartments. The expansion will target key markets across Asia, Europe, and the Americas, aiming to strengthen Frasers Hospitality's position in the competitive serviced apartment sector and cater to the increasing need for flexible, high-quality accommodation solutions.

Serviced Apartment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 121.30 billion |

|

Revenue forecast in 2030 |

USD 248.92 billion |

|

Growth Rate |

CAGR of 12.7% from 2024 to 2030 |

|

Actuals |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end-use, booking mode, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

The Ascott Limited; Frasers Hospitality; The Serviced Apartment Company; Staycity Ltd.; Habicus Group; THE SQUA.RE SERVICED APARTMENTS; adiahotels.com; Viridian Apartments; Adagio; and Marriott International, Inc. |

|

Customization |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

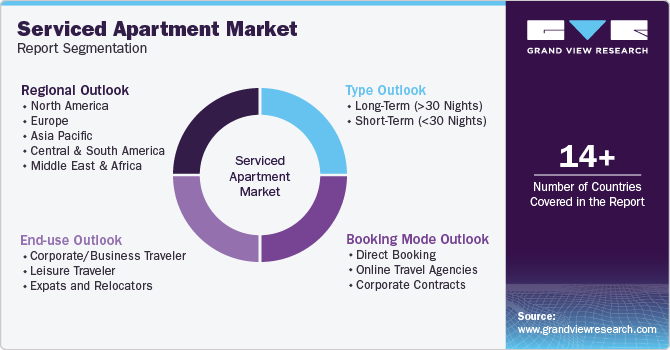

Global Serviced Apartment Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global serviced apartment market report based on type, end-use, booking mode, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Long-Term (>30 Nights)

-

Short-Term (<30 Nights)

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Corporate/Business Traveler

-

Leisure Traveler

-

Expats and Relocators

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Booking

-

Online Travel Agencies

-

Corporate Contracts

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global serviced apartment market was estimated at USD 112.42 billion in 2023 and is expected to reach USD 121.30 billion in 2024.

b. The global serviced apartment market is expected to grow at a compound annual growth rate of 12.7% from 2023 to 2030 to reach USD 248.92 billion by 2030.

b. North America dominated the serviced apartment market with a share of around 37% in 2023. The serviced apartment market in North America is driven by high demand for flexible, spacious, and home-like accommodations from business travelers, expatriates, and relocating professionals, coupled with the growth of urban centers and remote work trends.

b. Key players in the serviced apartment market are The Ascott Limited; Frasers Hospitality; The Serviced Apartment Company; Staycity Ltd.; Habicus Group; THE SQUA.RE SERVICED APARTMENTS; adiahotels.com; Viridian Apartments; Adagio; and Marriott International, Inc.

b. Key factors that are driving the serviced apartment market growth include increased demand for flexible, long-term accommodations, rising urbanization, growth in global business travel, advancements in smart technology, and a preference for home-like amenities combined with professional services.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."