Service Virtualization Market Size, Share & Trends Analysis Report By Component (Software, Service), By Deployment (Cloud, On-premise), By Enterprise Size, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-364-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Service Virtualization Market Size & Trends

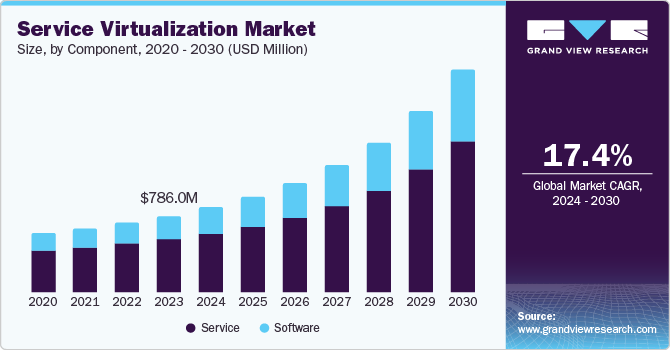

The global service virtualization market size was valued at USD 786.0 million in 2023 and is projected to grow at a CAGR of 17.4% from 2024 to 2030. The growing complexity of IT environments, particularly in large organizations, drives market demand. With the rise of microservices, distributed systems, and cloud-based architectures, it has become increasingly challenging for development teams to access and test all necessary components of their applications in real time. Service virtualization allows teams to simulate the behavior of components that are otherwise unavailable or difficult to access, enabling continuous testing and faster development cycles. This capability is valuable in ensuring that development processes remain agile and efficient, even when faced with complex dependencies.

Another significant driver is the push towards digital transformation across industries. As businesses seek to modernize their IT infrastructure and deliver digital services faster, the ability to develop, test, and deploy applications quickly becomes critical. Service virtualization supports this need by allowing for early and continuous testing in the development lifecycle, which can significantly reduce time-to-market for new applications and services. This efficiency is particularly important in competitive markets where speed and innovation are crucial to staying ahead.

The increased adoption of Agile and DevOps methodologies has also fueled the demand for service virtualization. These practices emphasize continuous integration and continuous delivery (CI/CD), where testing must occur frequently and at every stage of development. Service virtualization enables teams to maintain the pace of CI/CD pipelines by removing dependencies on external systems or services that may not be readily available. This allows for faster feedback loops, improving the overall quality of the software while reducing development costs.

Furthermore, service virtualization is gaining traction as organizations increasingly move towards hybrid and multi-cloud environments. In such setups, applications often rely on services across different cloud providers and on-premises systems, making it challenging to test these services in a cohesive environment. Service virtualization provides a solution by simulating these services, enabling seamless integration and testing across diverse environments. This capability is becoming essential as companies adopt cloud-based solutions to scale their operations globally.

Component Insights

The service segment held the largest market revenue share of 69.2% in 2023. The growing need for efficient testing environments in software development drives segment growth. As businesses increasingly adopt agile and DevOps methodologies, the requirement for faster and more reliable testing has surged. Service virtualization allows teams to simulate complex environments and dependencies without requiring the actual services to be available, reducing downtime and enabling continuous integration and testing. Additionally, with the rise of microservices and cloud-native architectures, the complexity of software systems has grown, making service virtualization essential for ensuring seamless integration and functionality across various components, further driving demand in the service segment.

The software segment is expected to grow at the fastest CAGR over the forecast period. The growing need for efficient and cost-effective testing and development environments drives the increasing demand for the software market. As businesses adopt more complex software systems and applications, they face challenges in testing these systems due to dependencies on external services, which may be unavailable or costly. Service virtualization software allows developers to simulate these external services, enabling continuous testing and faster development cycles without needing the actual service to be available.

Deployment Insights

The cloud segment held the largest market revenue share in 2023. The growing need for flexible and scalable infrastructure solutions that cloud-based deployments offer fuels the demand for cloud deployment. As businesses increasingly adopt agile and DevOps methodologies, the cloud provides a suitable platform for rapidly provisioning and deploying virtual services, supporting continuous integration and testing processes. Moreover, the cloud reduces the need for costly on-premises infrastructure, enabling organizations to scale resources on demand and manage costs more effectively. Additionally, the rise of remote work and distributed teams has further fueled the demand for cloud-based service virtualization, as it allows teams to collaborate and access services from any location seamlessly.

The on-premise segment is expected to grow significantly over the forecast period. Organizations handling sensitive data, particularly in finance, healthcare, and government sectors, prefer on-premise solutions to mitigate risks associated with cloud deployments. On-premise deployments allow organizations to maintain full control over data, comply with stringent regulatory requirements, and protect against potential data breaches.

Enterprise Size Insight

The large enterprises segment held the largest market revenue share in 2023. Large enterprises often manage extensive and diverse IT infrastructures that require continuous testing, development, and integration of software applications. Service virtualization allows these organizations to simulate complex service behaviors and test software in a virtualized environment, reducing the need for physical resources and minimizing downtime. Additionally, the need to accelerate time-to-market, improve operational efficiency, and reduce costs in large-scale projects is pushing large enterprises to adopt service virtualization solutions at a higher rate.

The SMEs segment is expected to grow at the fastest CAGR over the forecast period. The growing need for cost-effective and efficient software testing solutions drives segment growth. Small and medium-sized enterprises (SMEs) are increasingly adopting service virtualization to reduce development costs, accelerate time-to-market, and improve the quality of their software products. Service virtualization allows SMEs to simulate complex environments without requiring extensive infrastructure, making it a preferred option for businesses with limited resources. Additionally, the rise of cloud-based solutions and the need for continuous integration and delivery practices further drive SMEs to invest in service virtualization to remain competitive in the market.

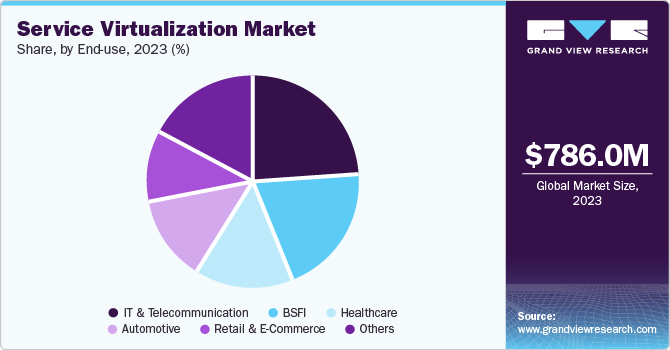

End Use Insights

IT & telecommunication segment held the largest market revenue share in 2023. The IT and telecommunication industries increasingly emphasize quick development and frequent releases through the growing acceptance of agile and DevOps practices. Service virtualization aids these methodologies by allowing simultaneous development and testing, promoting continuous integration and testing. The rising use of IoT and connected devices in IT and telecommunication industries is fueling the need for service virtualization, which can mimic the actions of IoT devices and allow comprehensive testing of IoT apps.

The retail & e-commerce segment is expected to grow at the fastest CAGR over the forecast period. Service virtualization enables retailers and e-commerce platforms to test and develop applications and services without disrupting their live environments, allowing for faster release cycles and improved performance. As customer expectations rise, especially for personalized and real-time interactions, retail and e-commerce companies leverage service virtualization to simulate complex environments, optimize their operations, and ensure their systems can handle high traffic volumes, all while reducing costs and development time.

Regional Insights

North America service virtualization market held the largest market revenue share of 40.5% in 2023. North America's regulatory landscape, especially in sectors such as healthcare and finance, necessitates rigorous testing and compliance checks, which are managed through virtualized services. The region's strong emphasis on cybersecurity also plays a role, as service virtualization allows for safe and controlled testing of security measures without exposing live systems to vulnerabilities. Lastly, the push towards remote work and distributed teams has heightened the need for virtualized testing environments that can be accessed and utilized by developers and testers from anywhere, further boosting demand in North America.

U.S. Service Virtualization Market Insights

The U.S. service virtualization market held the largest revenue share regionally in 2023. The increasing demand for service virtualization is driven by the nation's strong focus on innovation and its fast-paced technology sector. American companies, especially in technology hubs like Silicon Valley, heavily invest in software development, where rapid prototyping and testing are critical. Service virtualization allows these companies to simulate real-world environments and test new applications without relying on fully built systems, essential for maintaining competitiveness.

Europe Service Virtualization Market Insights

Europe service virtualization market is projected to witness lucrative market growth in upcoming years. The region's emphasis on digital transformation and adopting cloud-based solutions fuel the demand for service virtualization. European companies are focusing on enhancing their software development processes, particularly in industries such as finance, telecommunications, and manufacturing. Additionally, Europe's stringent data protection regulations, like GDPR, have driven organizations to adopt service virtualization to ensure compliance while maintaining efficiency. The rise of remote work and distributed teams across Europe has also fueled the need for service virtualization, allowing seamless collaboration and reducing the costs and risks associated with traditional testing environments.

Germany service virtualization market is projected to grow prominently in the coming years. As German companies aim to enhance their software development processes and accelerate time-to-market, service virtualization is becoming essential. Additionally, the rising adoption of cloud-based solutions and the need for continuous integration and delivery (CI/CD) pipelines are driving businesses in Germany to invest in service virtualization to improve agility and reduce costs. The emphasis on maintaining high software quality and reducing system downtime further strengthens the adoption of service virtualization in the region.

Asia Pacific Service Virtualization Market Insights

Asia Pacific service virtualization market is expected to grow at the fastest CAGR over the forecast period. The increasing demand is due to enterprises' rapid adoption of digital transformation initiatives, particularly in the finance, telecommunications, and healthcare sectors. Companies in these industries increasingly rely on service virtualization to enhance their software development processes, improve testing efficiency, and reduce costs. Additionally, the growing presence of cloud-based infrastructure in countries such as China, India, and Japan is driving the need for service virtualization as it supports developing and deploying complex applications. The region's expanding IT outsourcing market also contributes to this demand, as service providers seek to deliver faster and more reliable services to their clients.

China service virtualization market is projected to grow rapidly in the coming years. China's robust 5G network and the rapid expansion of its Internet of Things (IoT) ecosystem require efficient testing environments, which service virtualization provides. Furthermore, the Chinese government's support for homegrown technology companies has increased R&D investments, driving the need for service virtualization to reduce time-to-market for innovative solutions.

Key Service Virtualization Company Insights

Some of the key companies in the service virtualization market include Capgemini Group; Microsoft; Wipro; Cavisson Systems Inc.; Prolifics; and others.

-

Cavisson Systems Inc. offers a service virtualization tool, NetOcean. This strong backend application simulator was created to eliminate dependencies on backend applications and third-party systems. This helps enable quicker quality and performance testing, increasing the time to market for software applications.

-

Capgemini Group offers a range of service virtualization solutions to enhance IT agility and efficiency. Their Virtualization to Business (V2B) suite combines business-centric approaches with VMware technologies to transform IT environments into flexible, automated cloud infrastructures. They also leverage service virtualization in DevOps to simulate dependent systems, enabling parallel development and testing, which speeds up delivery and reduces costs.

Key Service Virtualization Companies:

The following are the leading companies in the service virtualization market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom

- IBM

- Open Text Corporation

- SmartBear Software

- Parasoft

- Capgemini Group

- Microsoft

- Wipro

- Cavisson Systems Inc.

- Prolifics

Recent Developments

-

In June 2024, Broadcom announced the launch of the latest updates to its flagship private cloud platform, VMware Cloud Foundation (VCF). This improvement is expected to support customers’ digital innovation with quick infrastructure modernization and help improve developer productivity and cyber resiliency.

-

In April 2024, Microsoft announced a strategic partnership with Cloud Software Group that will last for eight years, aimed at improving their joint efforts in cloud solutions and generative AI. As part of this agreement, Cloud Software Group is expected to invest $1.65 billion in Microsoft's cloud and AI services. The focus will be on developing integrated products and marketing strategies to benefit over 100 million users. This collaboration is intended to enhance productivity and foster innovation in AI.

Service Virtualization Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 870.4 million |

|

Revenue forecast in 2030 |

USD 2,278.5 million |

|

Growth Rate |

CAGR of 17.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Broadcom; IBM; Open Text Corporation; SmartBear Software; Parasoft; Capgemini Group; Microsoft; Wipro; Cavisson Systems Inc.; Prolifics |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Service Virtualization Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the service virtualization market report based on component, deployment, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Service

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

SMEs

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Healthcare

-

IT & Telecommunication

-

Automotive

-

Retail & E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."